Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Good and Services Tax

Good and Services Tax

Cargado por

Ishita BansalTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Good and Services Tax

Good and Services Tax

Cargado por

Ishita BansalCopyright:

Formatos disponibles

Good and Services Tax

Goods and Services Tax (GST) is a comprehensive tax levy on manufacture, sale and consumption of goods and services at a national level. Through a tax credit mechanism, this tax is collected on value-added goods and services at each stage of sale or purchase in the supply chain. The system allows the set-off of GST paid on the procurement of goods and services against the GST which is payable on the supply of goods or services. However, the end consumer bears this tax as he is the last person in the supply chain. Almost 140 countries have already implemented the GST. Brazil and Canada follow a dual system where GST is levied by both the Union and the State governments. France was the first country to introduce GST system in 1954. India is planning to implement a dual GST system. Under dual GST, a Central Goods and Services Tax (CGST) and a State Goods and Services Tax (SGST) will be levied on the taxable value of a transaction. It has been suggested to implement consumption type GST, that is, there should be no distinction between raw materials and capital goods in allowing input tax credit. The tax base should comprehensively extend over all goods and services upto final consumption point. GST will be structured on the destination principle. According to Task Force this will result in the shift from production to consumption whereby imports will be liable to both CGST and SGST and exports should be relieved of the burden of goods and services tax by zero rating. Consequently, revenues will accrue to the state in which the consumption takes place or is deemed to take place. Under GST, the taxation burden will be divided equitably between manufacturing and services, through a lower tax rate by increasing the tax base and minimizing exemptions. The Task Force on GST said the computation of CGST and SGST liability should be based on the Invoice credit method. i.e., allow credit for tax paid on all intermediate goods and services on the basis of invoices issued by the supplier. As a result, all different stages of production and distribution can be interpreted as a mere tax passthrough and the tax will effectively stick on final consumption within the taxing jurisdiction. This will facilitate elimination of the cascading effect at various stages of production and distribution.

The EC has decided to adopt a two rate structure- a lower rate for necessary items and goods of basic importance and a standard rate for goods in general. There will be also a special rate for precious metals and list of exempted items. The Task Force has provided a clear rate structure for GST. According to it the rate of CGST and SGST on all non-SIN goods and services should be fixed at a single positive rate of 5% and 7% respectively. The combined GST rate is being discussed by government. The rate is expected around 14-16 per cent. After the total GST rate is arrived at, the States and the Centre will decide on the CGST and SGST rates. According to EC alcoholic beverages should be kept out of GST. Also crude oil, diesel, petrol and ATF will not attract GST but the states will be free to levy taxes on them. Currently, services are taxed at 10 per cent and the combined charge indirect taxes on most goods is around 20 percent. Benefits to State & India: It is estimated that India will gain $15 billion a year by implementing the Goods and Services Tax as it would promote exports, raise employment and boost growth. It will divide the tax burden equitably between manufacturing and services. Why are some States against GST; will they lose money? The governments of Madhya Pradesh, Chhattisgarh and Tamil Nadu say that the information technology systems and the administrative infrastructure are not ready to implement GST. Some States fear that if the uniform tax rate

www.commercehansraj.in

info@commercehansraj.in

is lower than their existing rates, it will hit their tax kitty. States are also worried that they will lose their fiscal autonomy if they cannot impose taxes on their own. The EC favoured the imposition of GST to be based on negative list. It is considered necessary to provide exemption, the centre and states should draw a common exemption which should be restricted to the following: a) All public services of Government (Central, state and municipal/ panchayati raj) including civil-administration, health services and formal education services provided by Govt. schools and colleges, Defence, Para-military, Police, Intelligence and Government Departments except Railways, Post and Telegraph, Other commercial departments, Public sector Enterprises, Banks and Insurance, Health and Education services. b) Any service transactions between an employer and employee either as a service provider, recipient or vice versa. c) Any unprocessed food article which is covered under the public distribution system should be exempt regardless of the outlet through which it is sold; d) Education services provided by non-Governmental schools and colleges; and e) Health services provided by non-Governmental agencies. Taxes to be subsumed under GST The following central taxes should be subsumed in the CGST: a) Central Excise Duty (including Additional Excise Duty) b) Service tax c) Additional Customs Duty (commonly referred as CVD) d) Surcharges and all cesses. The following state taxes should be subsumed in the SGST. a) VAT / Sales tax (including CST) b) Entertainment tax (other than levied by local bodies) c) Entry tax no in lieu of Octroi d) Other Taxes and Duties (includes Luxury tax, Taxes on lottery, betting and gambling, and all cesses and surcharges by states). The Task Force has recommended for the subsumation of following other taxes levied by the states on goods and services: a) Stamp duty b) Taxes on vehicles c) Taxes on Goods and Passengers d) Taxes on duties on electricity. It has also suggested that all entry and Octroi duties levied by the third-tier government should be abolished. The GST bill to be enacted needs the support of two-third of parliament and the approval of half of India's states.

www.commercehansraj.in

info@commercehansraj.in

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (844)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (540)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (347)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (822)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Lehman Brothers Case StudyDocumento13 páginasLehman Brothers Case StudyIshita BansalAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Advertising Agency Agreement ModelDocumento7 páginasAdvertising Agency Agreement ModelIleana MarkuAún no hay calificaciones

- Women Sample ProjectDocumento105 páginasWomen Sample ProjectIshita BansalAún no hay calificaciones

- Applicant Entrance Exam Registration Form: First Name Middle Name Last Name Date of BirthDocumento1 páginaApplicant Entrance Exam Registration Form: First Name Middle Name Last Name Date of BirthIshita BansalAún no hay calificaciones

- Project 2 Nse BseDocumento12 páginasProject 2 Nse BseIshita BansalAún no hay calificaciones

- DQM AdvanceDocumento418 páginasDQM AdvanceSubendu RakshitAún no hay calificaciones

- One Temenggong EbrochureDocumento35 páginasOne Temenggong EbrochureLester SimAún no hay calificaciones

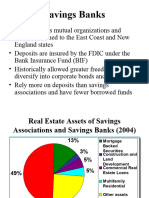

- Savings BanksDocumento7 páginasSavings BanksLara KhanAún no hay calificaciones

- Role of NABARD in Rural BankingDocumento11 páginasRole of NABARD in Rural BankingRamesh MaluAún no hay calificaciones

- Pollock An Essay On Possession in The Common Law 1888Documento268 páginasPollock An Essay On Possession in The Common Law 1888Sh0wtim3Aún no hay calificaciones

- 2013fin MS176Documento3 páginas2013fin MS176nmsusarla999Aún no hay calificaciones

- Chi Ming Tsoi Vs Court of Appeals and Gina LaoDocumento4 páginasChi Ming Tsoi Vs Court of Appeals and Gina Laocarmzy_ela24Aún no hay calificaciones

- Simple Past Tense Jack and The Beanstalk 2Documento1 páginaSimple Past Tense Jack and The Beanstalk 2pepac414100% (6)

- DOLE Citizens CharterDocumento95 páginasDOLE Citizens CharterGemmie Gabriel Punzalan-CaranayAún no hay calificaciones

- EquadorDocumento1 páginaEquadorfroggerrabbitAún no hay calificaciones

- G R - No - 190590 - July-12-2017Documento2 páginasG R - No - 190590 - July-12-2017Francis Coronel Jr.Aún no hay calificaciones

- Vdocuments - MX - Case Digests Atty CabochanDocumento38 páginasVdocuments - MX - Case Digests Atty CabochanRhuejane Gay MaquilingAún no hay calificaciones

- Interstate and Intrastate Transactions Under GSTDocumento11 páginasInterstate and Intrastate Transactions Under GSTD.Naga RajuAún no hay calificaciones

- Non-Ecumenical Caliphates: Ibn Al-Zubayr's Caliphate (684-692)Documento3 páginasNon-Ecumenical Caliphates: Ibn Al-Zubayr's Caliphate (684-692)Najah DaliAún no hay calificaciones

- Project TortsDocumento12 páginasProject Tortsharsh sahuAún no hay calificaciones

- Conan Quickstart - Changes For v3.5Documento6 páginasConan Quickstart - Changes For v3.5Antonio EleuteriAún no hay calificaciones

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDocumento2 páginasSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarAún no hay calificaciones

- Lesson 4 Types of IdeologiesDocumento11 páginasLesson 4 Types of IdeologiesSir BenchAún no hay calificaciones

- GoFirst BDY6FKDocumento2 páginasGoFirst BDY6FKDhiraj PalAún no hay calificaciones

- Small BusinessDocumento16 páginasSmall Businessshivamlamba1100% (1)

- Lecture Notes Engineering Society Week 2,3Documento53 páginasLecture Notes Engineering Society Week 2,3Yousab Creator0% (1)

- PromotionsDocumento6 páginasPromotionshydexcust1Aún no hay calificaciones

- Caste or Income Based ReservationDocumento10 páginasCaste or Income Based ReservationSuvasish DasguptaAún no hay calificaciones

- Policy of InsuranceDocumento12 páginasPolicy of InsuranceClarisseAccadAún no hay calificaciones

- Acknowledgement Receipt - 20190331 - 205351Documento1 páginaAcknowledgement Receipt - 20190331 - 205351jay-ar barangay100% (1)

- Compilation in Crim Juris 09Documento206 páginasCompilation in Crim Juris 09Josephine Carbunera Dacayana-Matos100% (3)

- Magnetic Fields: What You Should Know!!!!Documento10 páginasMagnetic Fields: What You Should Know!!!!angelAún no hay calificaciones

- Psychology of GraffitiDocumento8 páginasPsychology of GraffitiMiles Kilometer CentimeterAún no hay calificaciones

- Physics II ProblemsDocumento1 páginaPhysics II ProblemsBOSS BOSSAún no hay calificaciones