Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Diamond Sector Overview

Cargado por

roshan.gawde1991Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Diamond Sector Overview

Cargado por

roshan.gawde1991Copyright:

Formatos disponibles

The gems and jewellery sector has been one of the fastest-growing sectors in India in the past few

years. The sector has gained global popularity because of its talented craftsmen, its superior practices in cutting and polishing fine diamonds and precious stones, and its cost-efficiencies. The sector has been vital to the Indian economy as well; during 2008-09, the sector accounted for around 13% of the countrys total exports. The gems and jewellery sector in India is engaged in sourcing, manufacturing, and processing, which involves cutting, polishing and selling precious gemstones and metals such as diamonds, other precious stones, gold, silver and platinum. Gold jewellery is the most preferred form of jewellery in demand in India as it is considered auspicious to purchase gold on major occasions like festivals, marriage, birth etc. Also, gold occupies the second position among all investment instruments and is considered as the safest investment option. According to the data released by the World Gold Council (WGC), India is the largest consumer of gold. In 2008, India consumed approximately 660 tonnes of gold and accounted for 22.71% of the total gold consumed all over the world, most of which was used in jewellery. Even though the gold demand remained weak, India continued to maintain its second position in the third quarter-ended 2009 as well and accounted for 20.87% of the total gold consumed all over the world. India is also one of the largest diamond processor in the world and its artisans have specialised skills in processing small diamonds (below one carat); in fact, the Indian craftsmen have achieved excellence in cutting and polishing small diamonds. However, the real uniqueness of the Indian craftsmen lies in the fact that they do most of the cutting and polishing manually which sets India apart from its other peers. India (especially, Surat and Mumbai) ranks among the big four diamond cutting centres of the world the other three being, Belgium (Antwerp), the US (New York) and Israel (Ramat Gan). Currently, diamonds processed in India account for 85% in volume, 92% in pieces and 60% in value of the total world diamond market. The gems and jewellery sector in India is highly export-oriented, labour-intensive and a major contributor to the foreign exchange earnings; therefore, the Indian government has declared the sector as a thrust area for export promotion. Market Size and Structure The sector is highly-fragmented and unorganised, and is characterised by family-owned operations. Around 96% of the gems and jewellery players have family-owned businesses, but, over the last few years, more organised players have been entering the sector. The products in the sector can be categorised as gemstones, jewellery and pearls, which can be further segmented into diamonds, coloured stones (precious, semi-precious and synthetic), studded jewellery, costume jewellery, gold and silver.

However, diamond and gold are the two most important segments of the Indian gems and jewellery sector. Diamond processing in the form of cutting and polishing is a major industry in India. However, a majority of these processed diamonds are exported either in polished form or as diamond jewellery globally. On the other hand, the gold jewellery is mostly meant for domestic consumption as India is the largest consumer of gold. The Gems & Jewellery sector occupies a prominent place in the Indian economy in terms of its export earnings, employment generation, and growth. According to the estimates of Assocham, in CY 2008, the total market size of the sector was US$ 23.44 bn, out of which exports garnered the largest share of 90.45% at US$ 21.20 bn and the domestic market accounted for 9.55% at US$ 2.24 bn. According to the Economic Survey 2006-07, India had a market share of just around 3% in the global gems and jewellery sector, which was worth around US$ 80 bn annually.

Gross Bank Credit to the Sector The sector is well-supported by government policies and the banking sector. According to the report by the RBI on Gross Bank Credit (GBC), credit to the gems and jewellery sector has registered a CAGR of 11.55% (2006-09) and increased from Rs 205.59 bn as on March 31, 2006 to Rs 285.37 bn as on March 31, 2009. The gems and jewellery sector accounted for 2.71% of the total GBC disbursed during the period. However, it is observed that the sectors share as on March 31, 2009, in the total GBC deployed to the industry has declined to 2.71% from 3.73% as on March 31, 2006.

Market Characteristics Unorganised Sector The gems and jewellery sector in India has been known for its highly-fragmented and unorganised nature and for the plurality of family-owned operations. However, the organised sector is also growing. Even though it has been growing slowly, in future, it is likely to garner a substantial share of the market due to the changing lifestyle and preferences of consumers. Labour-Intensive As the sector is highly labour-intensive, its dependency on craftsmanship is very high. For instance, the cutting and polishing of diamonds and coloured gems, which are soft stones, requires immense care on the part of the labourer. Although some activities in the cutting and polishing of gems are mechanised, the sector still requires skilled craftsmen to achieve precision in diamond cutting. Working Capital-Intensive The labour-intensive nature of the sector makes it more working capital-intensive as well (working capital amounts to a substantial part of capital employed). This is due to the higher turnaround time in manufacturing and the regular payment of wage bills. There is a considerable time gap between the import of raw materials and sale of finished products, especially in diamond processing, as cutting and polishing are time-consuming tasks. Raw Material-Intensive Gemstones (both rough and finished) and precious metals such as gold, silver, and platinum are the raw materials used in the sector. The prices of these raw materials directly affect the profitability of companies. In recent years, the prices of low-quality rough diamonds and higher quality stones, such as solitaires, have gone up, but as the polished diamond prices have not been increasing at the same rate, the margins of exporters have been under pressure. Import Dependency for Raw Materials The gems and jewellery sector is highly-dependent on imports for its raw materials and among these raw materials, rough diamonds account for more than 50% of imports. These rough diamonds are cut, polished, and re-exported. According to the World Gold Council, the consumer demand in India for gold in 2008 was 660.20 tonnes. Besides, India is also one of the largest importers and biggest consumers of silver in the world, according to the Bombay Bullion Association.

Export-Oriented The Indian gems and jewellery sector is one of the foremost examples of export-led growth. Gems & Jewellery exports have been accounting for over 15% of total exports from India consistently since FY91. However, being export-dependent makes the sector susceptible to foreign currency volatility. Value Chain of the Sector Value Chain - Diamonds Diamonds pass through a series of processes before they are finally sold in the retail market. The value chain of diamonds begins with exploration of diamonds from mines and is followed by processing, manufacturing, whole selling and retailing. Mining There are very few commercially-viable diamond mines operating in the world currently. Diamonds are sourced through three ways, open pit mining, underground mining and extraction from alluvial deposits. The rough diamonds that are sought from mining are then sorted in different categories according to the quality, shape, colour, and size. The diamonds that are not good in quality are used for industrial purposes and the good quality diamonds are sent for further processing. Processing Processing is the next and the most important step as the greatest value addition takes place at this stage. Diamonds are sorted, graded, and valued at this step and then sent for further processing. Not all countries that produce diamonds also process it. The sorted and graded diamonds are sent to the cutting and polishing centres such as Antwerp (particularly high-value diamonds), Tel Aviv, Israel (for medium-value diamonds), India (for low value diamonds), China, Johannesburg, New York and Thailand. These processed diamonds are then exported or sold in domestic markets as finished diamonds or as diamond-studded jewellery. Manufacturing and Retailing Once the diamonds are processed, they are then sold to manufacturers directly or through registered diamond exchanges. Much of the value addition is done at this stage, as the diamonds are converted into jewellery. Jewellery making has high margins and therefore, many cutting and polishing centres across the globe are aiming to move up the value chain to gain maximum revenue. The jewellery that is manufactured from the diamonds is sold either through a wholesaler or directly in the retail

market, domestically or internationally. India is not a major miner of precious metals and stones such as diamonds but it is the largest processor of diamonds in the world owing to its skilled labour and low cost of processing.

Value Chain Gold South Africa is the largest producer of gold in the world. Gold mining, the process of mining gold out of the earth, is done through the following methods: hard rock mining, gold ore processing, placer mining and by-product gold mining. The gold that is extracted from mines is in impure form, and it is obtained in its purest form through a series of chemical processes called refining. The gold that is refined is converted into cast bars/gold bars through fabrication. The fabricated gold is then used for either making jewellery or for making coins, industrial products and dental products jewellery fabrication garners the highest share among the value chain activities. The gold jewellery is then sold in the retail outlets in domestic as well as international markets. Global Sources of Gold and Diamonds Traditional Diamond-Producing Regions Diamond reserves are mostly located in Western Australia and Southern Africa. According to the Kimberley Process Certification Scheme data, the leading diamond-producing countries in 2007 were Russia (23%), Botswana (20%), the Congo (17%), Australia (11%), Canada (10%), South Africa (9%) and others (10%), which include countries such as Namibia, Brazil, Sierra Leone, Tanzania and Ghana. However, other non-traditional regions such as former Soviet Union and China, which are believed to have diamond deposits, remain underexplored.

De Beers De Beers is one of the largest diamond miners in the world and controls majority of the diamond supply and production (almost 40 to 43% ) of the world. De Beers has mines in South Africa, Botswana, Tanzania, and Namibia. It buys diamonds from members across the globe through the central selling organisation (CSO) and sells them through its marketing arm - the Diamond Trading Corporation (DTC) - located in London. Rio Tinto and BHP Biliton are the other major diamond producers. Indias Diamond and Gold Sources Production of raw material including gold and diamond is negligible in India; thus, the Indian gems and jewellery sector is heavily dependent on imports for its raw material supply. Until the eighteenth century, India was the only known source of diamonds to the world; diamonds were discovered in India around 8,000 B.C. The country was home to many well-known diamonds such as the famous Koh-i-Noor, the Pitt or Regent, the Orloff (Orlov) and the Hope; however, as new sources of diamonds were discovered in Latin America and South Africa, India gradually lost its importance as a diamond producer. Ironically, India has only one primary source of diamond deposit today, the Majhgawan diamond mine in Panna district in Madhya Pradesh. India gets most of its diamonds from De Beers/CSO diamonds, the Rio Tinto-controlled Argyle mine in Western Australia and through a small but growing illicit trade in diamonds smuggled out of Russia. Though India is not a major producer of precious metals and gemstones, it does have noteworthy reserves of gold, ruby, diamond, emerald, sapphire and other precious stones. States such as Andhra Pradesh, Chhattisgarh, Jammu and Kashmir, Karnataka, Kerala, Madhya Pradesh, Orissa, Rajasthan and Tamil Nadu are the centres of various varieties of gemstones in India. Andalusite, apatite, beryl, brown sunstone (feldspar), chrysoberyl (including alexandrite), diamond, diopside, emerald, fluorite, garnet, hessonite, idocrase, iolite, kornerupine, kyanite, quartz (amethyst, rose quartz), ruby, rhodolite, sapphire, sillimanite, sphene, spinel, tourmaline and zircon are the varieties of gemstones found in India.

Even though Indias geological environment is similar to that of Africa and Australia, two of the top gold-producing countries of the world, its gold production is insufficient. The gold exploration in India is still in its early stages, even though amazingly it is one of the largest consumers of gold and its Archean greenstone belts and the other favourable geological horizons are comparable to Africa and Australia. Currently India imports majority of its gold from countries like Australia, Switzerland, South Africa, UAE etc. According to the Geological Survey of India (GSI), the Deccan region in the southern India has one of the richest deposits of gold. Further, India has around 9% of the global gold reserves; however, it hardly produces around 0.4% of its total gold consumption. Karnataka, Andhra Pradesh and Gujarat are the gold-producing centres in India and there exists tremendous potential for further gold exploration. Realising this anomaly, the Indian government is taking the help of the GSI to explore the potential in gold and diamond reserves in India.

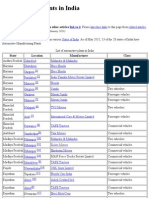

Gems and Jewellery Cluster The Indian gems and jewellery sector employs around 1 million people directly and indirectly. The sector is primarily concentrated in Maharashtra and Gujarat, and Mumbai and Surat are the most important diamond-cutting-and-polishing centres in both states, respectively. Mumbai is an important export-import centre for gems and jewellery and Surat is an important centre for processing diamonds. Furthermore, Gujarat accounts for 80% of the total diamonds processed in India and 72% of the diamonds processed in the world almost 8 out of the 10 diamonds

processed in the world are processed in Gujarat. Popularly known as the silky city sparkling with diamonds, Surat is the largest diamond processing centre, with around 10,000 diamond units located in and around the city. Surat accounts for more than 50% of Gujarats total exports of processed diamonds from India. Apart from Surat, Ahmedabad and Rajkot are the other major gems and jewellery clusters in Gujarat of which, Rajkot is also famous for its exclusive hand made gold and silver jewellery. The Indian government has set up gems and jewellery parks in special economic zones (SEZ) in Mumbai and Surat to promote the diamond industry. Mumbai has an SEZ called SEEPZ SEZ, which has a gems and jewellery complex that houses more than 150 gems and jewellery units. Similarly, Surat also has a SEZ that houses a diamond park. However, the sector is gradually spreading its wings to other parts in India such as cities in the south (Coimbatore, Bangalore, Hyderabad, Nellore, Thrissur), West Bengal (Kolkata) and the north (Delhi and Jaipur).

Demand Drivers In the past few years, but before the global slowdown, the gems and jewellery sector has been on a growth trajectory and its growth has been driven by several interplaying factors. Some of these demand drivers are discussed below: Low Cost of Labour The low cost of labour for cutting and polishing of diamonds has made India an attractive destination for diamond processing. Further, the diamond jewellery that is produced at a cost of US$ 60 to US$ 90 fetches around US$ 180 in the international markets, which leaves a huge margin for the retailer. Availability of Skilled Craftsmen

Jewellery manufacturing is an ancient industry in India therefore it has a huge population of skilled artisans/craftsmen. The true strengths of the jewellery industry are its beautiful handcrafted articles that are intricate and comparable to world-class designs and the Indian craftsmen who have achieved excellence in this art. Furthermore, India is famous for processing very small diamonds that requires immense skill, which the Indian artisans seem to have developed over the years. These advantages help India score over its peers. Rising Disposable Income The rising disposable income has been a major demand driver for the sector over the years, both domestically as well as internationally. Jewellery, particularly diamond jewellery, is considered as a lifestyle product, and the demand for lifestyle products has also gone up with the increase in disposable incomes; as a result, the gems and jewellery sector has recorded tremendous growth in the past few years. Gold demand has been rising in India in the last few years because of increased purchasing parity of the middle class and the increasing income levels. Gold demand grew by 7% to 769 tonnes in 2007 as compared with 722 tonnes in 2006. Rise in Number of Working Women Over the last few years, there has been a spurt in the number of working women. This trend has not only empowered women financially but also has changed their general attitude; as a result, there has been a growth in purchase of gems and jewellery by this segment, mostly for jewellery that can be worn at work and for social occasions. The increase in purchasing power of working women and their changing fashion needs has pushed up the growth in the gems and jewellery sector. Favourable Government Policies The abolition of the Gold Control Act in 1992, opening up the gold and diamond mining to private foreign investors, concessional / low import duties have all been instrumental in increasing the demand for Indian gems and jewellery sector. Nurturing New Talent The government has set up various training institutes to attract quality personnel, to cater to the international market and to focus on constant innovation of globally-acceptable designs. These institutes were set up to provide the gems and jewellery sector with a well-trained professional workforce that is proficient in all aspects of jewellery design, refining, model making, jewellery manufacturing, CAD / CAM, gemmology and diamond grading. Adoption of Kimberly Process Certification System India is a member of the Kimberley Process Certification Scheme (KPCS) that promotes conflictfree diamonds and thrives to prevent smuggling and non-standard trade in diamonds. Under the KPCS, import or export of all rough diamonds in India is permitted only if the shipment is accompanied by the Kimberley Process Certificate, which has not only increased the credibility of diamonds processed in India in the global market but also has boosted its exports. Increased Awareness and Changing Preferences There is a rise in awareness about diamonds in the Indian market. Various initiatives are being undertaken by major diamond producers, retailers and industry bodies about portraying diamonds as exotic as well as affordable. Increased promotion by retailers has made consumers aware of the diamond jewellery and have created demand from various segments, which include people from all age groups. The trend of buying jewellery only during special occasions such as weddings and festivals has gradually changed. Development of SEZs The government has set up various SEZs to provide special incentives to the highly export-oriented sector. The SEZs have units catering to designing, cutting and polishing of jewellery. The

development of SEZs for gems and jewellery has facilitated the growth and has enhanced the trade potential for the sector. The exports from SEZs grew by 43.18% from FY07 to FY08.

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elizabethan Literature: From Wikipedia, The Free EncyclopediaDocumento3 páginasElizabethan Literature: From Wikipedia, The Free EncyclopediaRay Rafael RamosAún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- American History XDocumento110 páginasAmerican History XNick LaurAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- You Want A Confederate Monument My Body Is A Confederate MonumentDocumento4 páginasYou Want A Confederate Monument My Body Is A Confederate MonumentmusabAún no hay calificaciones

- Painting Faces Redux PDFDocumento4 páginasPainting Faces Redux PDFhardy100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- TravelCLICK Premium Consortia Directory PDFDocumento31 páginasTravelCLICK Premium Consortia Directory PDFquentinejamAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- BackgroundDocumento12 páginasBackgroundpuspo agungAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- EENADU No 1 NewspaperDocumento25 páginasEENADU No 1 NewspaperPradip PandaAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- We Wish You A Merry Christmas Harp PDFDocumento4 páginasWe Wish You A Merry Christmas Harp PDFCleiton XavierAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Thomas Kirk Portfolio PDFDocumento20 páginasThomas Kirk Portfolio PDFAnonymous j04dx15mnAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Weeping WomenDocumento5 páginasThe Weeping Womenapi-341946993Aún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- There Will Come Soft RainDocumento11 páginasThere Will Come Soft RaindittydootiesAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Philippine Possession and PoltergeistDocumento12 páginasPhilippine Possession and PoltergeistYan Quiachon BeanAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- SGG Cool-Lite - SKN 176 - 176 II Inc SGG StadipDocumento2 páginasSGG Cool-Lite - SKN 176 - 176 II Inc SGG StadipMaria IacobAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Dystopian Project PDFDocumento3 páginasDystopian Project PDFTejas RegeAún no hay calificaciones

- Semi ColonDocumento21 páginasSemi ColonJopax CanedaAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Experimentation of Composite Repair Techniques For PipelinesDocumento13 páginasExperimentation of Composite Repair Techniques For Pipelinesusto2014Aún no hay calificaciones

- Paradise Lost and Paradise Regained by John Milton: Toggle NavigationDocumento14 páginasParadise Lost and Paradise Regained by John Milton: Toggle NavigationLALIT SAINIAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Ceating Abundance Ram SutrasDocumento1 páginaCeating Abundance Ram SutrasAbhijeet DeshmukkhAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Kylie MinogueDocumento2 páginasKylie MinogueJhon Ray Ganton RabaraAún no hay calificaciones

- Waterina BrochureDocumento14 páginasWaterina BrochureThuận Văn ThuậnAún no hay calificaciones

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- How To Play Single Notes On The HarmonicaDocumento19 páginasHow To Play Single Notes On The HarmonicaxiaoboshiAún no hay calificaciones

- Chaadaev's Continuity of ThoughtDocumento6 páginasChaadaev's Continuity of ThoughtthebusstopworldAún no hay calificaciones

- Afsnit 03 SpainDocumento186 páginasAfsnit 03 SpainElson100Aún no hay calificaciones

- A Heartbreaking Work of Staggering Genius LessonplanDocumento229 páginasA Heartbreaking Work of Staggering Genius LessonplanMahmoud El SheikhAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- 1998 Art of AccidentDocumento230 páginas1998 Art of AccidentRiccardo Mantelli100% (1)

- An Elusive Eagle SoarsDocumento215 páginasAn Elusive Eagle SoarsXenophonGounaropoulosAún no hay calificaciones

- List of Vehicle Plants in India - Wikipedia, The Free EncyclopediaDocumento3 páginasList of Vehicle Plants in India - Wikipedia, The Free EncyclopediaAjay Marya50% (2)

- Zodiac Dragon Baby - Crochet Amigurumi Doll Pattern PDFDocumento14 páginasZodiac Dragon Baby - Crochet Amigurumi Doll Pattern PDFMaika Pardo100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- 21 Prayer Points For PromotionDocumento1 página21 Prayer Points For PromotionVincent Kalule92% (13)

- EXTRACT - The Truth About The Harry Quebert AffairDocumento23 páginasEXTRACT - The Truth About The Harry Quebert AffairKristy at Books in Print, Malvern0% (1)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)