Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Commodities Weekly Tracker 6th May 2013

Cargado por

Angel BrokingDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Commodities Weekly Tracker 6th May 2013

Cargado por

Angel BrokingCopyright:

Formatos disponibles

Commodities & Currencies

Weekly Tracker

Commodities Weekly Tracker

Monday | May 6, 2013

Contents

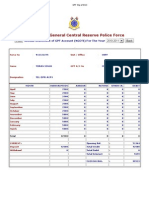

Returns Non Agri Commodities Currencies Agri Commodities

Non-Agri Commodities Gold Silver Copper Crude Oil

Currencies DX, Euro, INR Agri Commodities Chana Black Pepper Turmeric Jeera Soybean Refine Soy Oil & CPO Sugar Kapas

Commodities Weekly Tracker

Monday | May 6, 2013

Currencies Weekly Performance

1.0 0.9 0.7

0.6

0.4 (0.1) (0.6) (1.1)

(1.6) (2.1) (2.0) (0.5) (0.5) (0.5) (1.1)

Commodities Weekly Tracker

Monday | May 6, 2013

Non-Agri Commodities Weekly Performance

3.5 2.5 1.5 0.5 (0.5) (1.5) (2.5) (2.4) 0.8 0.8

3.6

2.8

0.5

0.4

0.2

(0.2)

Commodities Weekly Tracker

Monday | May 6, 2013

*Weekly Performance for May contract, Chilli June Contract

Commodities Weekly Tracker

Monday | May 6, 2013

Gold Weekly Price Performance

Spot gold prices increased around 0.5 percent in the last week. The yellow metal touched a weekly high of $1487.8/oz and closed at $1470.20/oz in last trading session of the week. In the Indian markets, prices declined by 0.9 percent on account of appreciation in the Indian Rupee and closed at Rs.26825/10 gms on Friday after touching a weekly low of Rs. 26365/10 gms. Holdings in the SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, declined by 1.6 percent to 1,065.61 tonnes as on 3rd May 2013 from previous level of 1,083.05 tonnes as on 26th April 2013. Rise in risk appetite in the global market sentiments Weakness in the DX. Favorable economic data from US and Euro Zone. Further, European central bank (ECB) slashed interest rates to 0.5 percent supported prices.

Spot Gold Vs US Dollar Index

1,700

1,650 1,600 1,550 1,500 1,450 1,400 1,350

MCX and Comex Gold Price Performance

31,500 30,500 29,500 28,500 27,500 26,500 25,500 1,800 1,750 1,700 1,650 1,600 1,550 1,500 1,450 1,400 1,350

ETF Performance

Factors that influenced upside in gold prices

MCX- Near Month Gold Futures - Rs/10 gms

Comex Gold Futures - $/oz

Outlook

In the coming week, we expect gold prices to trade on a positive note as a result of upbeat global market sentiments coupled with weakness in the DX. Further, expectations of favorable economic data from major global economies will support an upside in the prices. Additionally, decline in US unemployment rate in last week will act as a positive factor for the prices. Appreciation in the Indian Rupee will cap gains in the prices on the MCX. Spot Gold : Support 1,465/1,440 Resistance 1,492/1514. (CMP: $1477.20) Buy MCX Gold June between 26,820-26,780, SL-26,600, Target- 27,400.(CMP: Rs.27,089)

84.0

83.5 83.0 82.5 82.0 81.5 81.0

80.5

80.0 79.5 79.0

Weekly Technical Levels

Spot Gold -$/oz

US Dollar Index

Commodities Weekly Tracker

Monday | May 6, 2013

Silver

Weekly Price Performance

Spot silver gained 0.4 percent in the last week. The white metal prices touched a high of $24.58/oz in the last week and closed at $24.07/oz in last trade of the week. On the domestic front, prices fell by 0.1 percent as a result of appreciation in the Indian Rupee and closed at Rs.44776/kg on Friday after touching a low of Rs.43172/kg in the last week. Holdings in the iShares Silver Trust, the world's largest silver-backed exchange-traded fund, gained by 0.37 percent to 10,431.39 tonnes as on 3rd May 2013 from previous level of 10,392.42 tonnes as on 26th April 2013 . Rise in gold prices Upside in the base metals. Further, favorable economic data from major global economies supported an upside in the prices. Optimistic global market sentiments coupled with weakness in the DX . In the coming week, we expect silver prices to trade higher taking cues from rise in the gold prices coupled with upside in the base metals complex. Further, expectations of favorable economic data from major global economies will support an upside in the prices. Appreciation in the Indian Rupee will cap gains in the prices on the MCX. Spot Silver: Support 23.95/23.30 Resistance 24.70/25.34. (CMP:24.24)

MCX and Comex Silver Price Performance

60,000 58,000 32

56,000

54,000 52,000 50,000 48,000 46,000 44,000

30

28 26 24

ETF Performance

42,000

22

Factors that influenced upside in silver prices

MCX- Near Month Silver Futures - Rs/ kg Comex Silver Futures - $/oz

Spot Silver Vs US Dollar Index

32.0 30.0 28.0 84.0 83.5 83.0 82.5 82.0 81.5 81.0 80.5 80.0 79.5 79.0

Outlook

26.0

24.0

22.0

Weekly Technical Levels

Spot Silver -$/oz US Dollar Index

Buy MCX Silver July between 45,000-44,900, SL-44,100, Target -46,400. (CMP:45,371)

Commodities Weekly Tracker

Monday | May 6, 2013

Copper

Weekly Price Performance

Copper prices increased by 3.6 percent in the previous week. The red metal touched a weekly high of $7306.5/tonne and closed at $7290/tonne in the last trading session of the week. On the domestic front, prices ended on positive note by 3.4 percent and closed at Rs. 395.30/kg on Friday after touching a high of Rs. 395.9/kg in the last week. Appreciation in the Indian Rupee capped sharp gains in the prices on the MCX. LME copper inventories declined around 1.76 percent in the last week and stood at 608,700 tonnes as on 3rd May, 2013 as against 619,600 tonnes as on 26th April, 2013 . Copper inventories in the warehouse monitored by the Shanghai fell by 1.6 percent and stood at 213,782 tonnes for the week ending on 3rd May, 2013. Rise in risk appetite in the global market sentiments coupled with weakness in the DX. Further, favorable unemployment rate and consumer sentiment data from US supported an upside in the prices. Additionally, decline in LME and Shanghai copper inventories acted as a positive factor for the prices. Copper prices are expected to trade on a positive note on the back of optimistic global markets coupled with weakness in the DX. Additionally, decline in LME and Shanghai inventories along with expectations of favorable economic data from the major global economies will support an upside in the prices. Appreciation in the Indian Rupee will cap gains in the prices on the MCX. LME Copper: Support 7125/6944 Resistance 7471/7652. (CMP: $7290) Buy MCX Copper June between 387-385, SL-380, Target -405. (CMP:397.30)

LME and MCX Copper Price Performance

8,400 8,200 8,000 7,800 7,600 455 445 435 425 415 405 395 385 375 365

Copper Inventories

7,400

7,200 7,000 6,800

LME Copper Future ($/tonne)

MCX Near Month Copper Contract (Rs/kg)

Factors that influenced upside in the copper prices

LME Copper v/s LME Inventory

618,000 568,000 518,000 468,000 418,000 368,000 318,000 8,400 8,200 8,000 7,800 7,600 7,400 7,200 7,000 6,800

Outlook

Weekly Technical Levels

Copper LME Inventory (tonnes)

LME Copper Future ($/tonne)

Commodities Weekly Tracker

Monday | May 6, 2013

Crude Oil

Weekly Price Performance

On a weekly basis, Nymex crude oil prices increased around 2.8 percent. On the domestic bourses, prices gained by 1.6 percent and closed at Rs.5,156/bbl on Friday after touching a high of Rs.5168/bbl in the last week. Appreciation in the Indian Rupee prevented sharp upside in the prices on the MCX. As per the US Energy Department (EIA) report, US crude oil inventories increased more than expectations by 6.7 million barrels to 395.30 million barrels for the week ending on 26th April 2013. Crude oil inventories are at the highest level in last 82 years. Gasoline stocks fell by 1.8 million barrels to 216.0 million barrels and whereas distillate stockpiles rose by 0.5 million barrels to 115.80 million barrels for the last week. Unexpected decline in US unemployment rate which led to expectations of rise in demand for the fuel. Further, decline in the Brent crude oil performance led to fall in the spread between WTI and Brent which supported an upside in the crude oil prices. Additionally, rise in US consumer sentiments coupled with weakness in the DX acted as a positive factor for the prices. However, sharp upside in the prices was capped on account of increase in Euro Zone unemployment rate along with decline in manufacturing data from China and US. We expect crude oil prices to trade on positive note on the back of expectations of favorable economic data from the major economies. Further, weakness in the DX, upbeat global market sentiments along with drop in spread between Nymex and WTI will support an upside in the prices. However, sharp upside will be capped as a result of rising US crude oil inventories. Appreciation in the Indian Rupee will cap gains in the prices on the MCX. Nymex Crude Oil: Support: 93.90/91.80 Resistance 97.70/99.85 (CMP:96.49) Buy MCX Crude May between 5070-5050, SL-5000, Target -5250.(CMP:5198)

Nymex and MCX Crude Oil Price Performance

5,400 5,300 5,200 5,100 92.0 98.0 96.0 94.0

US Energy Department Facts and Figures

5,000

4,900 4,800 4,700 90.0 88.0 86.0

Factors that influenced upside in crude oil prices

MCX crude oil (Rs/bbl) NYMEX Crude Oil ($/bbl)

Crude Oil Inventories (mn barrels)

400

395.3

395 390 385 380 375 370 365 360

363.1 361.3 360.3 369.1

371.7

388.6 384

381.4

388.9 387.6

388.6

Outlook

385.9 382.7

376.4 377.53 372.2

Weekly Technical Levels

Commodities Weekly Tracker

Monday | May 6, 2013

DX/ INR Weekly Price Performance

US Dollar Index (DX) declined around 0.5 percent in the last week. The Indian Rupee appreciated by more than 1 percent on weekly basis. Factors that influenced downside movement in the DX Optimistic global market sentiments which led to fall in demand for the low yielding currency. Further, decline in US unemployment rate coupled with rise in consumer sentiments and non-farm employment change data acted as a negative factor for the currency. Additionally, US equities traded on a positive note which exerted downside pressure in the DX. Factors that influenced movement in the Rupee Cut in the repo and reverse repo rates by the central banks of the country. Further, selling of dollars from exporters and custodian banks also supported an upside in the currency. Additionally, upbeat global and domestic market sentiments coupled with weakness in the DX acted as positive factor for the Indian Rupee. FII Inflows For the month of April 2013, FII inflows totaled at Rs.2,606.30 crores ($483.38 million) as on 3rd May 2013. Year to date basis, net capital inflows stood at Rs.63,642.70 crores ($11,793.70 million) till 3rd May 2013. Outlook We expect Indian Rupee to appreciate in the current week on back of expectations of favorable industrial production and manufacturing output data from the country. Additionally, weakness in the DX coupled with rise in risk appetite in the global and domestic market sentiments will support an upside in the currency. However, sharp upside in the currency will be capped as a result of expectations of deficit in trade balance data of the country. Weekly Technical Levels USD/INR MCX May Support 53.70/53.40 Resistance 54.40/54.80. (CMP: 54.0) US Dollar Index: Support 81.50/80.90 Resistance 82.60/83.20. (CMP: 82.07)

US Dollar Index

83.5 83.0 82.5 82.0 81.5 81.0 80.5 80.0 79.5 79.0

$/INR - Spot

56.0 55.5 55.0 54.5

54.0

53.5 53.0

Commodities Weekly Tracker

Monday | May 6, 2013

Euro

Weekly Price Performance

The Euro appreciated by 0.7 percent in the last week. The Euro touched a weekly high of 1.3242 and closed at 1.3113 against dollar on Friday.

1.365

1.355 1.345 1.335 1.325 1.315 1.305 1.295 1.285 1.275

Euro/$ - Spot

Factors that influenced upside movement in the Euro

European Central Bank (ECB) cutting the interest rates by 25 bps coupled with statement from ECB President signaling that bank is ready for negative deposits rate. Further, favorable economic data from the region, upbeat global market sentiments along with weakness in the DX supported an upside in the currency. However, rise in the Euro Zone unemployment rate capped sharp gains in the Euro. Spanish Manufacturing Purchasing Managers' Index (PMI) increased by 0.5 points to 44.7-mark in April as against a rise of 44.2-level in March. Italian Manufacturing PMI rose by 1 point to 45.5-level in April from earlier rise of 44.5mark a month ago. European Minimum Bid Rate cut to 0.5 percent in May from earlier 0.75 percent in April. German Retail Sales declined by 0.3 percent in March as against a fall of 0.6 percent a month ago. Spanish Flash Gross Domestic Product (GDP) declined by 0.5 percent in last month with respect to earlier fall of 0.8 percent in February. Unemployment Rate grew by 12.1 percent in March as compared to rise of 12 percent a month ago. We expect the Euro to trade on positive note on the back of rise in risk appetite in the global market sentiments coupled with weakness in the DX. Further, cut in the interest rates by the European Central Banks (ECB) along with expectations of favorable economic data from the region will support an upside in currency.

News

EURO/INR - Spot

73.0

72.5 72.0 71.5 71.0

70.5

70.0 69.5 69.0

Outlook

Weekly Technical Levels

EURO/USD SPOT: Support 1.296/1.285 Resistance 1.325/1.340. (CMP: 1.3107)

Commodities Weekly Tracker

Monday | May 6, 2013

Chana

Weekly Price Performance

Chana prices declined for the second consecutive week on account of increasing arrivals & subdued demand at higher levels. Chana spot as well as May futures settled 3.14% & 3.48% lower w-o-w. Higher prices since the beginning of the month has led to a significant increase in arrivals last week which dragged prices lower. According to the third advance estimates released last week, Chana output is pegged marginally lower to 8.49 mn tn compared with its second advance estimates of 8.57 million tonnes. Chana output is expected to breach its 2010-11 record of 8.2 mn tn in 2012-13.

Rising inflows at higher levels

Chana output revised marginally down- Third Advance Estimates

Seasonal pressure to keep prices under downside pressure

Chana prices tend to follow a seasonality pattern, wherein prices decline during the harvesting period and bottom out when arrivals reach their peak in the month of May. Thus, we expect the current downward trend to continue till the month end.

At the International Pulse Trade and Industries Confederation annual convention, chick pea (desi), production is pegged up at 9.7 mt from 9.4 mt. in 2012-13 following a huge spurt in Pakistan crop. Downward trend in Chana is expected to continue on the back of increasing arrivals. However, on the downside prices may not sustain below Rs 3200 per qtl mark, the level being a Minimum Support price, below which farmers may not sell their produce. Also stockiest demand may emerge at such low levels and thus we may see a recovery in the Chana prices June onwards. Sell NCDEX CHANA June between 3530-3570, SL -3680, Target - 3360 / 3330

World pulses market well-balanced

Outlook

Weekly Strategy

Commodities Weekly Tracker

Monday | May 6, 2013

Turmeric

Weekly Price Performance

Turmeric Futures remained in the negative territory for the third consecutive week on account of higher arrivals of the new crop coupled with huge carryover stocks. However, buying by stockists as well as demand from interstate buyers, supported prices at lower levels. Lower output expectations for 2012-13 crop on the back of poor sowing also supported the prices. Sowing is reported to be 3035% lower compared to last year. According to the weather department, rainfall in the key grown region (Southern Peninsula) is reported at 10% below normal. The spot as well as the futures settled 4.9% and 0.32% lower w-o-w. Turmeric exports during Apr-Jan 2013 declined by 4% to 66,550 tn. (Source Factiva) Production of turmeric may decline in 2012-2013 season due to weak monsoon as well as lower turmeric prices. The area covered under Turmeric in A.P. as on 10th October, 2012 has been reported at 0.58 lakh hectares. The area covered is lower as compared to last year (0.81 lha), as well as normal as on date (0.67 lha). Turmeric production in 2012-13 is expected around 50% lower compared to last year and is expected around 45-50 lakh bags. Production in 2011-12 is reported at historical high of 90 lakh bags/ 10.62 lakh tns. Turmeric may is expected to trade with a negative bias in the coming week as higher arrivals of the new crop may pressurize prices. Huge carryover stocks may also pressurize prices. However, good demand from the overseas as well as the domestic markets may support prices at lower levels. Lower production estimates coupled with arrivals of good quality crop may also support prices at lower levels. Sell NCDEX Turmeric June between 6450-6500, SL -6800, Target - 6000 / 5940.

Source: Agriwatch & Reuters

Weak exports data

Lower acreage of Turmeric for the 2012-13 season

Source: Reuters & Angel Research.

Lower production in the 2012-2013 season

Outlook

Weekly Strategy

Commodities Weekly Tracker

Monday | May 6, 2013

Weekly Price Performance

After declining over the last two weeks, Jeera recovered from lower levels last week on account of short coverings. The pace of arrivals of the fresh crop have also declined from its peak last month. Prices had declined earlier due to higher output estimates. Sowing in Gujarat was reported at 3.244 lk ha till Jan 2013. Last 3 years average sowing is 3.189 lk ha. Stocks are reported at around 5-6 lk bags. The spot as well as the futures settled 1.02% and 2.23% lower w-o-w. Indias 2013 Jeera output is estimated at 38-40 lakh bags (of 55kgs each), at par with the production in 2012. However, increase in the exports due to supply concerns in the global markets offset the impact of higher supplies on the prices and thus, medium term fundamentals remain supportive for the upside. Jeera exports during Apr-Jan 2013 stood at 64,400 tn, higher by 86%. (Source Factiva) Due to lower production in Syria and Turkey, coupled with the ongoing tensions between them, exports are not taking place and have been diverted to India. They have stopped shipments. Turkey may start offering its Jeera in the coming days. According to reports, production in Syria is reported around 22,000 tonnes while production in Turkey is reported between 5000-7000 tonnes, lower by 20% and around 50% respectively, raising supply concerns in the international markets. Indian Jeera in the international market is being offered at $2,600/tn (c&f). Jeera may continue to decline till no fresh overseas demand is seen. However, prices may recover later in the week if there is any improvement in the domestic as well as overseas demand. Farmers may also be unwilling to sell their stocks at lower levels and may hold back their stocks. Sell NCDEX Jeera June between 13150-13200, SL -13650, Target - 12480 / 12400.

Source: Ministry of Agriculture, Gujarat.

Jeera

Second consecutive year of higher output

Global supply concerns boost Jeera exports

Source: Reuters & Angel Research.

International Scenario

Outlook

Weekly Levels

Commodities Weekly Tracker

Monday | May 6, 2013

Soybean

Weekly price performance

NCDEX Soybean traded in a range bound manner with some negative bias last week. Imposition of special cash margin coupled with Weak meal export demand pressurized prices while poor supplies supported prices at lower levels. IMD has also forecast a normal monsoon this. The futures settled 0.36% lower w-o-w. CBOT Soybean gained 1.69% on account of tight supplies of the old US crop.

India's soy meal Exports Fall by 68 Percent during FY12-13 SEA

Indias soy meal exports for the month of April 2013 were 99.451 tonnes, lower by 68.31 percent from 313,832 tonnes a year ago. As per the 3rd Advance Estimates released by the Ministry of Agriculture, soybean output increased to 14.14 mn tn from 12.24 mn tn in the previous estimates. Special Margin (in Cash) of 10% on the Long side has been imposed in Soybean and Soy meal May 2013, June 2013 & July 2013 contracts wef April 30, 2013.

USDA is scheduled to release its monthly crop report. According to market estimates, the ending stocks are expected to decline. According to the Trade Ministry of Brazil, soybean exports shot up from 3.54 mn tonnes in March to 7.15 mn tonnes in April 2013. Poor supplies in the domestic and US markets may support soybean prices in the current week. Traders also anticipate the USDA monthly report to lower their soybean ending stocks. However, higher long side margin, normal monsoon forecast, and weak soy meal exports from India may exert downside pressure at higher levels.

Increase in the output in the 3rd Advance Estimates

Imposition of Special margin long on Soybean and Soy meal

USDA to release its monthly crop report on 10th May

A jump in Brazil exports

Outlook

Strategy

Buy NCDEX Soybean June between 3820-3860, SL -3680, Target - 4070 / 4100.

Commodities Weekly Tracker

Monday | May 6, 2013

Refine Soy Oil and Crude Palm Oil

Weekly price performance

Edible oil complex remained in the negative territory taking cues from the palm oil futures at KLCE. Strong exports data also supported prices. Palm Oil futures at KLCE declined as traders liquidated long positions ahead of elections. CPO prices at MCX and KLCE settled 2.29% and 3% lower. Soy oil also settled 0.18% and 1% lower on NCDEX and CBOT respectively. Malaysian palm oil products export for April fell 4.3 percent to 13.1 lakh tons from March. Better buying witnessed from Indian and European buyers. Malaysia, the world's No.2 palm oil producer, has set its crude palm oil export tax for May at 4.5 percent, unchanged from April. The Southeast Asian country calculated a reference price of 2,347.26 ringgit per tonne for crude palm oil for May. Indias imports of palm oil fell for a second straight month in March, as domestic supply improved and purchases by the worlds biggest buyer continued to suffer from an import levy imposed in January. Imports of all vegetable oils, including non-edible oils, fell 7.5 per cent to 896,714 tn in March, pulled down by the drop in palm oil imports. Stockpiles of edible oil at ports fell nearly nine percent during March to 850,000 tn, the trade body said, off a record of 930,000 tn on March 1. Stocks were still on the higher side despite the decline in monthly imports. India's imports of palm oil could rise more than 17% in the year to October 2013 to stand at 9 mn tn, compared with 7.67 mn tn of palm oil in 2011/12 as the edible oil is the cheapest available, despite an import duty. Buy NCDEX Ref Soya Oil June between 680-685, SL -663, Target - 711 / 715. MCX CPO May Support 433/445, Resistance 463/473.

Global Scenario

Domestic Scenario

Strategy

Commodities Weekly Tracker

Monday | May 6, 2013

Sugar

Weekly Price Performance

Sugar prices settled marginally lower by 0.1% last week as higher supplies is seen offsetting the summer demand. ICE sugar is currently trading at its lowest levels since June 2010 and settled 0.7% lower on account of global sugar surplus situation for third consecutive year.

Sugar output likely to fall 3% this year

India is expected to have produced around 24.52 million tonnes (mt) of sugar during the first six months of the 2012-13 sugar marketing season. In 2012-13, sugar recovered from crushing was 10.09 per cent.

Sugar inventories in India, the largest consumer, are poised to surge by 37% to 9.2 million tonnes at the start of October, a five-year high as exports grind to a halt because of slumping global prices even as a drought threatens cane planting. Exports have plunged to about 35,000 tonnes since 1 October from 3.4 million tonnes in 2011-2012. .

India sugar reserves at five-year high set to avert imports

Brazil to produce record 35.5 million tonnes of sugar

Brazil's main center-south sugar cane crop will produce a record 35.5 mn tn of sugar in 2013/14 season, an increase of 4.1% from the 34.1 mn tn produced last year, according to Sugar & ethanol industry association Unica. US Department of Agriculture officials in Brasilia forecast sugar exports from Brazil, the top producer and shipper of the sweetener, hitting 29.3m tonnes in 2013-14, for which the cane crush has just begun. Sugar prices are expected to consolidate at lower levels this week. Higher supplies in the local markets will continue to mount pressure on prices as millers will release stocks to clear arrears. This will offset summer season demand.

NCDEX Sugar May :Support-2850/2920, Resistance- 3020/3100.

Outlook

Strategy

Commodities Weekly Tracker

Monday | May 6, 2013

Kapas/Cotton

Weekly Price Performance

Cotton futures recovered last week and settled 1.3% higher on account of short coverings. Lower levels buying also supported an upside in the prices. ICE Cotton futures gained 3% last week on strong export sales data and U.S. plantings delays which prompted worry over upcoming supplies. US export sales for the week ending April 25 reached 314,400 running bales, up 32% from previous week and most since mid-January. Cotton Corporation & NAFED are expected to offload 8 lakh bales at lower prices. After an unsuccessful bid to offload of 2.5 lakh bales of cotton in April, the government has now decided to give it a fresh chance. CAB in its latest meet has projected cotton crop at 34 mn bales for 2012-13 season compared to the previous estimates of 33 mn bales. Mill consumption is expected to go up from 22.3 million bales last year to 23.5 million bales. Exports are estimated at 8.1 mn bales. While Import are estimated 2.5 mn bales.

Govt Likely to Sell More Cotton this Month

Cotton Advisory Board sees lower kharif sowing

China to sell high-quality state cotton reserves

China will start to sell its high-quality reserves of fibre, which should spur purchases by textile mills after Beijing's stockpiling tightened domestic supplies. Starting on Friday, 19th April, govt has offered cotton imported in 2011 and purchased from the 2012 harvest and has allowed textile mills to buy up to 8 months' worth of consumption. Beijing has said it would offer a total of 4.5 million tonnes for the auctions to last until end of July. With CCI and NAFED offloading more stocks in the local markets, Cotton may remain under downside pressure in the current week. However, if international markets recover sharply, then we may see prices taking a rebound from lower levels.

Sell MCX Cotton May between 18500-18600, SL -18950, Target - 17970 / 17890.

Outlook

Strategy

Commodities Weekly Tracker

Monday | May 6, 2013

Thank You!

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3083 7700 Corporate Office: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is apprecia ted on commodities@angelbroking.com

También podría gustarte

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAún no hay calificaciones

- Technical & Derivative Analysis Weekly-14092013Documento6 páginasTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAún no hay calificaciones

- Metal and Energy Tech Report November 12Documento2 páginasMetal and Energy Tech Report November 12Angel BrokingAún no hay calificaciones

- Commodities Weekly Tracker 16th Sept 2013Documento23 páginasCommodities Weekly Tracker 16th Sept 2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAún no hay calificaciones

- Special Technical Report On NCDEX Oct SoyabeanDocumento2 páginasSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingAún no hay calificaciones

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAún no hay calificaciones

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAún no hay calificaciones

- Commodities Weekly Outlook 16-09-13 To 20-09-13Documento6 páginasCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingAún no hay calificaciones

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAún no hay calificaciones

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAún no hay calificaciones

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAún no hay calificaciones

- Derivatives Report 16 Sept 2013Documento3 páginasDerivatives Report 16 Sept 2013Angel BrokingAún no hay calificaciones

- Technical Report 13.09.2013Documento4 páginasTechnical Report 13.09.2013Angel BrokingAún no hay calificaciones

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAún no hay calificaciones

- Sugar Update Sepetmber 2013Documento7 páginasSugar Update Sepetmber 2013Angel BrokingAún no hay calificaciones

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAún no hay calificaciones

- IIP CPIDataReleaseDocumento5 páginasIIP CPIDataReleaseAngel BrokingAún no hay calificaciones

- Market Outlook 13-09-2013Documento12 páginasMarket Outlook 13-09-2013Angel BrokingAún no hay calificaciones

- TechMahindra CompanyUpdateDocumento4 páginasTechMahindra CompanyUpdateAngel BrokingAún no hay calificaciones

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAún no hay calificaciones

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAún no hay calificaciones

- MarketStrategy September2013Documento4 páginasMarketStrategy September2013Angel BrokingAún no hay calificaciones

- MetalSectorUpdate September2013Documento10 páginasMetalSectorUpdate September2013Angel BrokingAún no hay calificaciones

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 06 2013Documento2 páginasDaily Agri Tech Report September 06 2013Angel BrokingAún no hay calificaciones

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5782)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Problem and It'S BackgroundDocumento9 páginasThe Problem and It'S BackgroundGisbert Martin LayaAún no hay calificaciones

- 2016 AP Micro FRQ - Consumer ChoiceDocumento2 páginas2016 AP Micro FRQ - Consumer ChoiceiuhdoiAún no hay calificaciones

- Tender18342 PDFDocumento131 páginasTender18342 PDFKartik JoshiAún no hay calificaciones

- AquaTemp - Submersible Temperature SensorDocumento10 páginasAquaTemp - Submersible Temperature SensorwebadminjkAún no hay calificaciones

- Writ of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Documento2 páginasWrit of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Judicial_FraudAún no hay calificaciones

- Spider Man: No Way Home First Official Poster Is Out NowDocumento3 páginasSpider Man: No Way Home First Official Poster Is Out NowzlatanblogAún no hay calificaciones

- Clifford Clark Is A Recent Retiree Who Is Interested in PDFDocumento1 páginaClifford Clark Is A Recent Retiree Who Is Interested in PDFAnbu jaromiaAún no hay calificaciones

- United BreweriesDocumento14 páginasUnited Breweriesanuj_bangaAún no hay calificaciones

- Find optimal solution using Voggel's and modi methodsDocumento7 páginasFind optimal solution using Voggel's and modi methodsFrew Tadesse FreAún no hay calificaciones

- AgricultureDocumento7 páginasAgricultureAhmad CssAún no hay calificaciones

- Aztec CodicesDocumento9 páginasAztec CodicessorinAún no hay calificaciones

- Russian SU-100 Tank Destroyer (30 CharactersDocumento5 páginasRussian SU-100 Tank Destroyer (30 Charactersjason maiAún no hay calificaciones

- People Vs CA G.R. No. 140285Documento2 páginasPeople Vs CA G.R. No. 140285CJ FaAún no hay calificaciones

- PSR-037: Comprehensive Review and Assessment of RA 9136 or The Electric Power Industry Reform Act of 2001Documento2 páginasPSR-037: Comprehensive Review and Assessment of RA 9136 or The Electric Power Industry Reform Act of 2001Ralph RectoAún no hay calificaciones

- Peta in Business MathDocumento2 páginasPeta in Business MathAshLeo FloridaAún no hay calificaciones

- Skanda Purana 05 (AITM)Documento280 páginasSkanda Purana 05 (AITM)SubalAún no hay calificaciones

- 2020 BMW Group SVR 2019 EnglischDocumento142 páginas2020 BMW Group SVR 2019 EnglischMuse ManiaAún no hay calificaciones

- Lembar Jawaban Siswa - Corona-2020Documento23 páginasLembar Jawaban Siswa - Corona-2020Kurnia RusandiAún no hay calificaciones

- HDFC BankDocumento6 páginasHDFC BankGhanshyam SahAún no hay calificaciones

- Regio v. ComelecDocumento3 páginasRegio v. ComelecHudson CeeAún no hay calificaciones

- Annual GPF Statement for NGO TORA N SINGHDocumento1 páginaAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Indirect Questions BusinessDocumento4 páginasIndirect Questions Businessesabea2345100% (1)

- Hippo 3 Use 2020 V1.EDocumento2 páginasHippo 3 Use 2020 V1.ECherry BushAún no hay calificaciones

- Determining Audience NeedsDocumento5 páginasDetermining Audience NeedsOrago AjaaAún no hay calificaciones

- Regional Director: Command GroupDocumento3 páginasRegional Director: Command GroupMae Anthonette B. CachoAún no hay calificaciones

- Ob Ward Timeline of ActivitiesDocumento2 páginasOb Ward Timeline of Activitiesjohncarlo ramosAún no hay calificaciones

- Computer Shopee - Final Project SummaryDocumento3 páginasComputer Shopee - Final Project Summarykvds_2012Aún no hay calificaciones

- Differences in Indian Culture and American Culture: Comparison EssayDocumento2 páginasDifferences in Indian Culture and American Culture: Comparison EssayHan Huynh PhamAún no hay calificaciones

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterDocumento32 páginasInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Amadioha the Igbo Traditional God of ThunderDocumento4 páginasAmadioha the Igbo Traditional God of ThunderJoshua Tobi100% (2)