Documentos de Académico

Documentos de Profesional

Documentos de Cultura

2012 Week 3 Solutions

Cargado por

pengfeijiDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

2012 Week 3 Solutions

Cargado por

pengfeijiCopyright:

Formatos disponibles

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

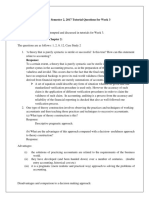

Short answer questions: Deegan (2009) 1.1, 1.7, 1.9, 1.12, 1.20

1.1 What is the difference between a positive theory of accounting and a normative theory of accounting?

Refer pages 7-12 Deegan (2009) and week 2 lecture slides Positive theory of accounting seeks to explain and predict. Can be initially developed through some form of logical reasoning (deductive) but then assessed based on observation ie. how well the explanations or predictions relate to actual observations. In relation to accounting, a positive theory of accounting might predict what type of accounting practices would be adopted by accountants in a particular situation.

Normative theory of accounting - seeks to prescribe what should be done in particular circumstances based on particular assumptions made by the researcher. In relation to accounting, these assumptions might relate to such things as what motivates people or what is the central objective of accounting. Normative theories are not evaluated on the basis of their correspondence with observations of real world phenomena. For example, a researcher may develop a theory that prescribes a particular approach to asset valuation. The theory should not be considered as invalid if people currently do not adopt the prescribed approach to asset valuation.

1.7 If a normative theory of financial accounting has been developed to prescribe how we should do financial accounting, is it possible that we can decide to reject the theory because we do not agree with a central assumption of the theory (such as an assumption about the objective of financial reporting), but at the same time decide that the theory is nevertheless logical? Explain your answer.

Yes, we can reject a theory even though we believe that it is very logical. For example, if we were to adopt an assumption that capital markets are efficient and that individuals are motivated by selfinterest tied to wealth maximisation (two very important assumptions made in a great deal of economics literature) that might lead us to make particular prescriptions about what information organisations should produce. However, if we reject these assumptions (perhaps we consider that markets are not efficient and that human behaviour is not based upon self-interest) then we might consider that the prescriptions provided by the theory are unsound and potentially even damaging to particular groups within society even though we might nevertheless believe that the theory is logically developed. This idea will be further developed through Chwastiak's (1999) reading in week 10.

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

The conceptual framework can also be viewed as a normative theory of accounting that is how we should account and report on the operations and state of affairs of entities. Significant resources have been devoted to this CF to ensure that it is logically consistent (note that it is not yet finished problems with measurement!). However, one of the fundamental assumptions made in the current CF is that the objective of financial reporting is to provide financial information to the providers of capital. This assumption determines the scope of financial reporting, the types of users and their needs, the elements to be included in financial statements, how they are to be measured and disclosed, and the qualitative characteristics of financial statements. The providers of capital have very different information needs to other stakeholders they are concerned with performance indicators, fair values and forward looking information. Relevance of information is more important than reliability. Contrasted to this, other users may require other types of information perhaps historical information on the stewardship of the entity or information on social and environmental impacts of the entity. So, we may acknowledge the logical consistency of the CF, but reject it on the grounds of the assumption regarding the objective of financial reporting.

1.9 Is the study of financial accounting theory a waste of time for accounting students? Explain your answer.

ACCY305 is all about accounting theory. See Week 1 and 2 lecture slides and Deegan (2009, page 5-7)

Those students who work as accountants will probably see little relevance in accounting theories. As a practicing accountant, you follow rules and protocols. You are guided by past practice or supervisors. However, think about how the conceptual framework informs practice, and how it can be used as a rationale for new practices/methods etc. Any profession should have a body of knowledge (or theory) which it relies on to develop and improve practice.

It is also important for students to have some appreciation of theory, as without this there is little understanding of why and how accountants do things (ie. accounting and financial reporting). Without this understanding, it is difficult to critically evaluate accounting practices, and even more difficult to consider new ways of doing things. In particular, in ACCY305 it is important that students understand the assumptions underlying mainstream accounting, so that they can begin to see the limitations and shortcomings of contemporary accounting practice.

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

Exposure to alternative / critical theories also provides students with a different way of looking at the world accounting is far more than a technical activity, it plays many roles in society, it has many consequences on society, and it is shaped by its historical, social, political, institutional and economic contexts. Understanding different ways makes us articulate and reassess what we already know.

1.12 Explain the meaning of the following paragraph and evaluate the logic of the perspective described.

In generating theories of accounting that are based upon what accountants actually do, it is assumed (often implicitly) that what is done by the majority of accountants is the most appropriate practice. In adopting such a perspective there is, in a sense, a perspective of accounting Darwinism a view that accounting practice has evolved, and the fittest, or perhaps best, practices have survived. Prescriptions or advice are provided to others on the basis of what most accountants do, the logic being that the majority of accountants must be doing the most appropriate thing.

Accounting is a human endeavour, practiced in multiple contexts, so of course there are going to be numerous views on how to do accounting and financial reporting. Often the preferred and most successful methods will be those that have the most favourable outcome for companies (eg. maximise profits, smooth profits, maximise share prices or achieve short term gains). These outcomes may not necessarily coincide with those that are in the best interests of the public. Sometimes accounting practices are driven by short term goals, and may in fact even be detrimental to the long term viability of a company (eg. as evidenced in corporate collapses). Further, best practices developed in one sector (or country) may not be consistent with best practice in another sector (or country) (eg, revenue recognition or asset definition/ measurement in different situations,). As professionals, accountants should be mindful of the public interest, and should also ensure that their body of work is based on a logical and consistent framework.

This view also supports the status quo, and does not allow for a broader outlook and the possibility that there may in fact be a better, more equitable, more useful way of accounting and reporting. Just because the majority of accountants do something, this does not necessarily mean there is not a better, unknown approach (unless we start adopting all sorts of assumptions about the high level of efficiency of accountants in determining what methods best reflect the underlying performance and position of particular entities).

The other point that must be appreciated is that the longer the time that particular accounting methods have been used then arguably the greater will be the resistance of accountants to change. A change

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

in accounting methods means that accountants and users of financial statements need to retrain and, realistically, there may be some opposition to this. Also, there could be many contractual arrangements in place that use accounting numbers (for example, borrowing agreements with banks or accounting-based bonus schemes negotiated with employees) and hence there could be all sorts of social and economic consequences if the accounting rules, and hence, the ultimate accounting numbers, change.

There is also an argument by some researchers, identified as critical theorists (covered in Deegan, 2009, Chapter 12), that financial accounting practices tend to provide results that favour people with control over capital at the expense of those without capital. These powerful people will tend to argue against reform if it appears that new rules will favour those who have traditionally had limited wealth. By conforming to the status quo without question, taken-for-granted assumptions are automatically applied, and this can only favour the elite and the most powerful in society (Dillard 1991). For

instance, Macintosh (1994, p 254) suggests that the maximising of shareholder wealth objective of the firm, is a euphemism for top executives' wealth because of the wealth THEY accumulate through excessive salary packages which include bonus stock options and handsome bonus plans.

1.20 What role do value judgements have in determining what particular accounting theory a researcher might elect to adopt to explain or predict particular accounting phenomena?

See Week 2 lecture notes.

Selecting a theory always involves a value judgement. Even if the researcher is adopting a positive theory on the grounds of objectivity, this still involves value judgements. In this case the researcher is making the claim (ie, his or her opinion) that this method is based on scientific method and will necessarily produce the most objective results. However, this methodology involves a number of decisions (ie value judgements) what are the parameters of the study, what variables will be introduced, what will the sample size be, what mathematical model will be used to analyse the data, how the results are interpreted, what is done with exceptions (there are always exceptions!), how and where the results are communicated, what language is used, who is financing the study etc.

Value judgements have a great deal to do with what theory a researcher might elect to use to explain or predict particular phenomena. To demonstrate this, we can consider the alternative theories accounting researchers might use to explain why companies elect to voluntarily produce information about their social and environmental performance. If I believed that corporate managers are motivated by self-interest then I would embrace an economics-based theorysuch as Positive Accounting Theorythat has self-interest (tied to wealth maximisation) as one of the fundamental

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

assumptions about what drives human behaviour. These people would have a predisposition towards believing that all human activityincluding the disclosure of social and environmental information is undertaken to the extent that the activity can somehow be related back to positively impacting the managers wealth. By contrast, if I was a researcher who embraced a vision of sustainable developmentwhich in itself typically requires people of current generations to sacrifice current consumption to the extent it is in the interests of future generationsthen I would reject Positive Accounting Theory as self-interest and sustainable development are to a great extent, mutually exclusive. Such a researcher would embrace another theoretical perspective (perhaps such as legitimacy theory or stakeholder theory, which we discuss in Chapter 8). It is interesting to note that almost no researchers in the area of social and environmental accounting embrace Positive Accounting Theory.

Long Response Question: from Neuman (2011)

Social theories can be classified into:

1. Positivist/Mainstream 2. Interpretive 3. Critical

Provide a brief outline of each, indicating the ontological, epistemological and methodological assumptions. Your answer should include an example of how each could be used in the study of accounting and financial reporting.

Firstly, the meanings of ontology, epistemology and methodology:

Ontology (Neuman, p92-93) the nature of reality, or how one views the world. Can be viewed as a position somewhere along a continuum from Realist to Nominalist.

A realist believes in an objective world that exists independently of humans and their interpretations of it. Typical of natural scientists (eg, physicists, chemists).

A nominalist believes that all reality is subjectively created, and our experiences are always occurring through a lens or scheme of interpretations and inner subjectivity.

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

Epistemology (Neuman, p93) - the nature of knowledge, how knowledge is created, how knowledge is evaluated.

A realist believes that it is possible to observe/collect empirical evidence about real world phenomena, and produce generalisations about the phenomena. Observations must be repeatable.

A nominalist believes that knowledge is subjectively created / constructed, and it is impossible to separate an objective out there reality from interpretations that take place in particular times and places. Generalisations are not possible. To produce social science knowledge, we must inductively observe, interpret, reflect on what other people are saying and doing in specific social contexts while we simultaneously reflect on our own experiences and interpretations (p93). Knowledge is always context bound.

Methodology This refers to the approach taken to the whole research process or the lens through which research is undertaken. It is shaped by ontological and epistemological assumptions and it will determine the methods used to collect and analyse the subject of study (ie specific techniques such as data collection and analysis, case studies, surveys, ethnographies). The direction of the research may be strongly framed by theories, or it may be open to different ways dependent on the researcher.

A realist would typically observe real world phenomena (maybe by collecting a large sample of data), analyse the data using statistical techniques, and draw conclusions based on the research. The realist would not acknowledge that his/her context, prior assumptions and value choices (about approaches, methods, sample selection, interpretation of results) impact on the research at all the things being observed are independent of the researcher.

A nominalist does not desire to draw conclusions, but rather gain insights into a particular situation or to understand how language and interpretations have shaped an occurrence. The nominalist might undertake a study of an organisation or a group of people, using a number of methods (interviews, long term observations, studies of changes to attitudes through history and through the application of law, for instance) to gain insight.

ACCY305 Financial Accounting III Autumn Session 2012

Tutorial Solutions Week 3

Paradigm

Ontological assumptions

Epistemological assumptions

Methodology and methods

Example in accounting and financial reporting Selection of large sample of annual reports. Analysis of specific data contained in reports. Conclusion drawn. Majority of accounting research in this paradigm.

Positivist/ mainstream

Realist. No consideration of broader social, political or historical contexts. No consideration of power or conflict. Emphasises deterministic nature of social pressures and structures on the behaviour of individuals (determinism).

Knowledge drawn from empirical observations. Evaluated by logical consistency and ability to be replicated.

Interpretive

Nominalist. Social reality is what people perceive it to be it exists as people experience it and ascribe meaning to it it is socially constructed

Critical (note this is sometimes split into radical humanist and radical structuralist)

Critical realist. Accepts empirical reality, but our perceptions of this influenced by context, subjective experiences, cultural beliefs and social interactions. Reality is composed of multiple layers the empirical (using senses), the real (structures) and the actual (causal mechanisms). Neuman, p109.Consideration of broad context..

Knowledge is drawn from interpretations, but is always changing. Evaluated by ability to make sense, and whether it allows others to enter the reality of those being studied. Knowledge drawn from multiple sources but rejects positivistic approaches (due to lack of self reflection). Self reflection requires the acceptance of the importance of human agency in the creation of knowledge (Gaffikin, 2008, p151)

Search for generalisations, about social practices, used to explain and predict. Does not seek change (ie. supports the status quo). Researcher independent of research. Use of large scale sample selection and statistical method quantitative method positivistic Search for deep understanding about specific situations or phenomena. Qualitative research. Researcher acknowledges his/her value choices and role in the research endeavour.

Researcher spends a significant period of time within an organisation, speaking with people, making observations, identifying meanings and understandings.

Search to understand the social world and change it. Desire to expose myths, reveal hidden truths and help people in changing their lives. Common use of historical studies, case studies, ethonographies.Often interdisciplinary.

Radical humanist study of language used in organisation to expose accounting as a form of ideological oppression. Radical structuralist - long term historical study of practices and institutions to expose accounting as tool of the powerful (ie. capitalists, big business) to exploit the less powerful (ie. workers or other stakeholders)

También podría gustarte

- Term Paper 3Documento16 páginasTerm Paper 3Bright Alohan100% (1)

- TUTORIAL SOLUTIONS (Week 2A)Documento3 páginasTUTORIAL SOLUTIONS (Week 2A)PeterAún no hay calificaciones

- Accounting and Its Role in SocietyDocumento13 páginasAccounting and Its Role in SocietyPhạm Khánh0% (1)

- Accounting Theory and Conceptual FrameworksDocumento32 páginasAccounting Theory and Conceptual Frameworksmd abdul khalek80% (5)

- Solution Manual Accounting Theory Godfrey 7ed Chapter 4Documento9 páginasSolution Manual Accounting Theory Godfrey 7ed Chapter 4Gregorius Chandra WijayaAún no hay calificaciones

- Accounting Theory and Scientific Method in ResearchDocumento14 páginasAccounting Theory and Scientific Method in ResearchEviAún no hay calificaciones

- An Introduction To Accounting Theory: Learning ObjectivesDocumento25 páginasAn Introduction To Accounting Theory: Learning ObjectivesAngels HeartAún no hay calificaciones

- AF301 Chapter 1Documento3 páginasAF301 Chapter 1Jenika BhanAún no hay calificaciones

- Solution Manual To Accompany: Contemporary Issues in Accounting 2e by Rankin Et AlDocumento8 páginasSolution Manual To Accompany: Contemporary Issues in Accounting 2e by Rankin Et Almark stoweAún no hay calificaciones

- Ethics and Accounting Profession DevelopmentsDocumento8 páginasEthics and Accounting Profession DevelopmentsTara RajanAún no hay calificaciones

- SolmanDocumento9 páginasSolmanYusuf RaharjaAún no hay calificaciones

- Solution Manual Accounting Theory Godfrey 7ed Chapter 4Documento9 páginasSolution Manual Accounting Theory Godfrey 7ed Chapter 4Yusuf RaharjaAún no hay calificaciones

- Chapter 2Documento12 páginasChapter 2KM RobinAún no hay calificaciones

- Positive Accounting Theory in The Derivative Case Study of Pt. IndosatDocumento8 páginasPositive Accounting Theory in The Derivative Case Study of Pt. IndosatDini HermawatiAún no hay calificaciones

- Public Sector Financial Accounting TechniquesDocumento7 páginasPublic Sector Financial Accounting TechniquesRizki RajaAún no hay calificaciones

- Acc Theory 2Documento17 páginasAcc Theory 2Sarah ZulkifliAún no hay calificaciones

- ch01 SM RankinDocumento14 páginasch01 SM RankinDamien SmithAún no hay calificaciones

- Accounting Theory ConstructionDocumento8 páginasAccounting Theory Constructionandi TenriAún no hay calificaciones

- Accounting TheoryDocumento192 páginasAccounting TheoryABDULLAH MOHAMMEDAún no hay calificaciones

- Unit 2Documento16 páginasUnit 2EYOB AHMEDAún no hay calificaciones

- Question 1 (15 Marks)Documento11 páginasQuestion 1 (15 Marks)Li XiangAún no hay calificaciones

- ( (Course Handout in Accounting Theory Version 10) ) PDFDocumento49 páginas( (Course Handout in Accounting Theory Version 10) ) PDFYusufAún no hay calificaciones

- Acct 408 - Accounting Theory and Practice Lecture Notes Sem Ii 2022 - 2023Documento6 páginasAcct 408 - Accounting Theory and Practice Lecture Notes Sem Ii 2022 - 2023John Y DennisAún no hay calificaciones

- Accounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions ManualDocumento36 páginasAccounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions Manualgauntreprovalaxdjx100% (24)

- Islamic Theory AccountingDocumento22 páginasIslamic Theory AccountingNiTholas WeiAún no hay calificaciones

- Empirical Accounting Research Design For Ph.D. StudentsDocumento14 páginasEmpirical Accounting Research Design For Ph.D. StudentslupavAún no hay calificaciones

- ACT301 Week 2 Tutorial PDFDocumento4 páginasACT301 Week 2 Tutorial PDFjulia chengAún no hay calificaciones

- Accounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions ManualDocumento26 páginasAccounting Theory Conceptual Issues in A Political and Economic Environment 8th Edition Wolk Solutions ManualElizabethBautistadazi100% (50)

- An Introduction To 2Documento5 páginasAn Introduction To 2sanjuladasanAún no hay calificaciones

- Summary Complete Final RevisionDocumento31 páginasSummary Complete Final RevisionOk ayAún no hay calificaciones

- FABM1 - Module 4 Accounting Concepts and PrinciplesDocumento5 páginasFABM1 - Module 4 Accounting Concepts and Principlesaeyesha.regaloAún no hay calificaciones

- Accounting Theory Chapter on Financial Reporting StandardsDocumento12 páginasAccounting Theory Chapter on Financial Reporting StandardskateAún no hay calificaciones

- Accounting TheoryDocumento9 páginasAccounting TheoryDerek DadzieAún no hay calificaciones

- Accounting Theory Text BookDocumento12 páginasAccounting Theory Text BookRoopa YadavAún no hay calificaciones

- ch01 SM RankinDocumento14 páginasch01 SM Rankinhasan jabrAún no hay calificaciones

- An Events Approach To Basic AccountingDocumento9 páginasAn Events Approach To Basic AccountingEycha ErozAún no hay calificaciones

- Acc Theory Question Assignment 2Documento7 páginasAcc Theory Question Assignment 2Stephanie HerlambangAún no hay calificaciones

- Accounting Theory Construction1-4Documento26 páginasAccounting Theory Construction1-4Nur FarahAún no hay calificaciones

- Approaches To Accounting Theory MidDocumento11 páginasApproaches To Accounting Theory MidMd Mubashwir Chowdhury100% (1)

- Accounting Theory Conceptual Issues in A Political and Economic EnvironmentDocumento486 páginasAccounting Theory Conceptual Issues in A Political and Economic EnvironmentSyifa100% (1)

- Final Exam Revision Notes 2012 Financial Accounting Theory Final Exam Revision Notes 2012 Financial Accounting TheoryDocumento19 páginasFinal Exam Revision Notes 2012 Financial Accounting Theory Final Exam Revision Notes 2012 Financial Accounting TheoryShariful IslamAún no hay calificaciones

- Contemporary Issues in Accounting TheoryDocumento16 páginasContemporary Issues in Accounting Theorymark stoweAún no hay calificaciones

- 2nd Resume Alvianty 18102067 AS-BDocumento9 páginas2nd Resume Alvianty 18102067 AS-BAlviantyAún no hay calificaciones

- Accounting Practices Shape SocietyDocumento25 páginasAccounting Practices Shape Societyyizhi liuAún no hay calificaciones

- Af301 TQ W3 S2 2017Documento9 páginasAf301 TQ W3 S2 2017IsfundiyerTaunga100% (1)

- TAPDocumento3 páginasTAPcikyayaanosuAún no hay calificaciones

- Accounting Theory Summary CH 2 and 16Documento10 páginasAccounting Theory Summary CH 2 and 16lulukpu3Aún no hay calificaciones

- Corporate Governance and Creative AccountingDocumento15 páginasCorporate Governance and Creative AccountingdudeAún no hay calificaciones

- Essay Type DDocumento19 páginasEssay Type D丁昕Aún no hay calificaciones

- Chapter 2 - Lecture NotesDocumento5 páginasChapter 2 - Lecture Notesanisulislam asifAún no hay calificaciones

- CHAPTER 1.an Introduction To Accounting TheoryDocumento15 páginasCHAPTER 1.an Introduction To Accounting TheoryIsmi Fadhliati100% (2)

- Accounting Context: Tutorial 11Documento4 páginasAccounting Context: Tutorial 11Wee Hao GanAún no hay calificaciones

- Modul: Accounting For Manager (MAN 653)Documento29 páginasModul: Accounting For Manager (MAN 653)kiki dutaAún no hay calificaciones

- Chapter 2 - Accounting Theory and Accounting ResearchDocumento19 páginasChapter 2 - Accounting Theory and Accounting Researchelizabeth100% (1)

- Inductive vs deductive approaches to accounting theoryDocumento4 páginasInductive vs deductive approaches to accounting theoryrajkrishna03Aún no hay calificaciones

- The IASB and The Standard Setting ProcessDocumento9 páginasThe IASB and The Standard Setting ProcessJessAún no hay calificaciones

- Science and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comDocumento28 páginasScience and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comdebjyoti sealAún no hay calificaciones

- Nipas Act, Ipra, LGC - Atty. Mayo-AndaDocumento131 páginasNipas Act, Ipra, LGC - Atty. Mayo-AndaKing Bangngay100% (1)

- Monroes Motivated Sequence LessonDocumento3 páginasMonroes Motivated Sequence Lessonapi-257123630Aún no hay calificaciones

- Fire Exit Doors SizeDocumento3 páginasFire Exit Doors SizeBerlin Andrew SionAún no hay calificaciones

- Archana PriyadarshiniDocumento7 páginasArchana PriyadarshiniJagriti KumariAún no hay calificaciones

- USA Vs Andrei KulagoDocumento260 páginasUSA Vs Andrei KulagoAndrew KerrAún no hay calificaciones

- The Retired Adventurer - Six Cultures of PlayDocumento14 páginasThe Retired Adventurer - Six Cultures of Playfernando_jesus_58Aún no hay calificaciones

- Fiitjee Two Year Crp-2013-2015 Reshuffling Test - II Marks Test Date 30.03.2014Documento35 páginasFiitjee Two Year Crp-2013-2015 Reshuffling Test - II Marks Test Date 30.03.2014Prateek__ManochaAún no hay calificaciones

- Airasia Online Print Tax InvoiceDocumento15 páginasAirasia Online Print Tax InvoiceDarshan DarshanAún no hay calificaciones

- Bulletin 13.9.22Documento4 páginasBulletin 13.9.22dbq088sAún no hay calificaciones

- Drug AddictionDocumento29 páginasDrug Addictionavilaaubrey89% (9)

- Detect3D Fire and Gas Mapping Report SAMPLEDocumento29 páginasDetect3D Fire and Gas Mapping Report SAMPLEAnurag BholeAún no hay calificaciones

- Activity 1.docx AjDocumento2 páginasActivity 1.docx AjMaya BabaoAún no hay calificaciones

- Nucor at A CrossroadsDocumento10 páginasNucor at A CrossroadsAlok C100% (2)

- Chennai Contact - 1Documento12 páginasChennai Contact - 1Jvr SubramaniaraajaaAún no hay calificaciones

- Verify File Integrity with MD5 ChecksumDocumento4 páginasVerify File Integrity with MD5 ChecksumSandra GilbertAún no hay calificaciones

- Rail Section As Per IrsDocumento6 páginasRail Section As Per IrskarnagaAún no hay calificaciones

- Federal Decree Law No. 47 of 2022Documento56 páginasFederal Decree Law No. 47 of 2022samAún no hay calificaciones

- Chapter 4.1 Decision Theory Part 2Documento38 páginasChapter 4.1 Decision Theory Part 2ernieAún no hay calificaciones

- Hrm-Group 1 - Naturals Ice Cream FinalDocumento23 páginasHrm-Group 1 - Naturals Ice Cream FinalHarsh parasher (PGDM 17-19)Aún no hay calificaciones

- Test Booklet Primary-1 PDFDocumento53 páginasTest Booklet Primary-1 PDFReynold Morales Libato100% (1)

- Training Manual W Appendix 3-20-14 RsDocumento193 páginasTraining Manual W Appendix 3-20-14 RsZakir Ullah100% (5)

- MEM - Project Pump and TurbineDocumento22 páginasMEM - Project Pump and TurbineAbhi ChavanAún no hay calificaciones

- W1 PPT ch01-ESNDocumento21 páginasW1 PPT ch01-ESNNadiyah ElmanAún no hay calificaciones

- Teaching Position DescriptionDocumento9 páginasTeaching Position DescriptionBrige SimeonAún no hay calificaciones

- Curriculum Design and Development Part IDocumento18 páginasCurriculum Design and Development Part IAngel LimboAún no hay calificaciones

- Shariese-Moore-Resume NonumberDocumento1 páginaShariese-Moore-Resume Nonumberapi-404271214Aún no hay calificaciones

- (Ebook - PDF - Cisco Press) DNS, DHCP and IP Address ManagementDocumento29 páginas(Ebook - PDF - Cisco Press) DNS, DHCP and IP Address ManagementRachele AlbiottiAún no hay calificaciones

- Buck ConverterDocumento31 páginasBuck Converterbalak144Aún no hay calificaciones

- Heart Disease SpeechDocumento3 páginasHeart Disease Speechshamim326150% (2)