Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Riding The Value Cycle

Cargado por

Shifath NafisTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Riding The Value Cycle

Cargado por

Shifath NafisCopyright:

Formatos disponibles

F

ederal Express, Airborne Express (now part of DHL), and Genentech are three powerhouse corporations, each successful in its own way. However, it can be shown that, whether consciously or not, they employ a Value Cycle to spur their success. As with many management models that elucidate complex processes, some initial dening of terms will help you to use the concept in your own business. The Value Cycle articulates a broadly applicable management process for achieving and sustaining superior performance; specically, it ties together: Value, which refers to an organizations ability to exceed the specic needs of its customers. The concept of a customer can be more complex than it appears. For a consumer products company, for example, a rm may have two sets of customers the retailers who purchase its products directly and the consumers who buy the rms products from the retailers shelves. To create value for these two sets of customers, the rm must understand each sets distinct needs. For example, while the retailer might list its top three requirements as high prot margins, rapid shelf stocking and generous cooperative advertising budgets, the consumers top needs might be the products excellent taste, low price, and recommendation from family members. To create superior customer value, a rm would need to exceed its competitors performance on each of these attributes. Cycle, which refers to an important notion that in most industries, rms are continually investing to upgrade the value they create for customers. Moreover, new entrants backed with innovative technology may seek to upend the rms basis for creating customer value. Furthermore, over time, the needs of customers and/or the relative

Performance, which is deliberately vague at this point in order to enable managers of both for-prot and non-prot organizations to use the Value Cycle. Superior performance for shareholders of public companies is measured by long-term return on equity and shareholder value creation. By contrast, while they must take in more cash than they spend in order to survive, non-prot organizations measure performance in non-nancial terms based on how well they achieve their stated missions. As illustrated here, the Value Cycle consists of three nodes: customer needs, rm activities and relative protability and three connecting processes: value creation, value capture and value renewal.

3. Va lue ren e

l wa

Relative profitability

Firm activities

2. V alue capture

The nodes anchor the model by focusing on: Customer needs, dened as the managerial imperative to understand the customers specic needs and how well the rm and its competitors meet those needs. As detailed above, a company

The Value Cycles ambition is to articulate a broadly applicable management process for achieving and sustaining superior performance.

importance of their needs may evolve. Thus, while a rm may provide superior customer value at a given point in time, the goal of the Value Cycle concept is to help rms sustain that leadership. Moreover, a rms initial success may lock it into ways of thinking about value creation that impede its ability to adapt to change. And the concept of the cycle helps managers focus on the need to clear away maladaptive mental habits. might have two or more distinct groups of customers whose needs it must understand. In order to create customer value, managers must interview their customers asking them to list and rank the specic criteria they use to choose among competing suppliers. Managers must also ask customers to rank the rm and its competitors with respect to how well they satisfy these criteria. Finally, managers must ask customers to discuss

Business Strategy Review Summer 2008

37

2008 The Author | Journal compilation 2008 London Business School

Best practice

Customer needs

1. V

ion reat ec alu

their unmet needs the satisfaction of which

could provide the rm with a chance to enhance its competitive position. Firm activities, the ways the rm performs business functions such as hiring, purchasing, research, inbound and outbound logistics, manufacturing, sales and service. Managers can benet in choosing how the rm should perform these activities by understanding how competitors perform them. Such understanding can yield insights such as ways to improve how the rm operates and its areas of competitive weakness, the bolstering of which can help the rm improve its long-term performance. Relative protability, which compares the rms protability for a typical product with that of a competitors. This relative protability analysis should identify how much of the products costs are consumed by performing each of the activities detailed above. The analysis should further compare the rm and the competitors product prices and prot margins. Managers can use this relative protability analysis to pinpoint specic competitive advantages and vulnerabilities in its approach to

Value capture is the way the rm sets its prices and costs to earn a prot given the way it chooses to perform activities. The generic strategies are similarly useful for understanding value capture. For low-cost strategy adherents, value capture requires managers to manufacture and distribute the rms product at the lowest unit cost in the industry so that the rm can set the lowest price and still earn a prot. And for rms pursuing a differentiation strategy, value capture generally leads a rm not only to incur higher relative costs but also to charge customers a far higher price, thus enabling the rm to earn attractive prots. Value renewal is how the rm invests its prots and learns to create customer value as customer needs change, new competitors emerge and innovative technology hits the market. When a company can renew its market value, it usually draws on one or more of four sources of advantage: entrepreneurial leadership, open technology, boundaryless product development or disciplined resource allocation.

Best practice

Before getting into specic examples of how the Value Cycle actually works, it is important to emphasize the critical importance of clear linkages between the nodes:

In order to sustain superior performance, managers must create connecting processes that link the nodes through repeated rounds of competition.

setting prices and managing the factors that drive its relative cost position. These insights can help managers make pricing and cost management choices that will improve the rms long-term performance. The nodes of the Value Cycle are useful starting points for creating, capturing and sustaining value. However, in order to sustain superior performance, managers must create connecting processes that link the nodes through repeated rounds of competition:

Value creation converts the needs of customers (articulated as ranked purchase criteria) into how the rm works, as reected in the way it performs activities. Value capture converts how the rm works (as reected in the way it manages protability compared to a key competitor) as articulated in the rms prices and costs per unit of product or service. Value renewal converts the prots and learning from the current round of competition into new prots and learning earned in the next round of competition by adapting the rm to satisfy changing customer needs in light of upstart competitors and evolving technology.

Value creation is how the rm congures its activities to deliver superior value to customers. In general, rms can congure their activities to create value through two generic strategies, low cost and differentiation. A low-cost strategy is particularly useful for customers who place a high priority on purchasing an adequate product or service at the lowest possible price. By contrast, a differentiation strategy is effective for customers who are willing to pay a price premium to buy a product with other attributes, such as the highest quality and the best after-sales service. For such rms, value creation requires managers to congure activities, (such as product design, purchasing, manufacturing, marketing and service) in order to deliver the best quality and service in the industry.

Business Strategy Review Summer 2008

To illustrate how companies use the Value Cycle, lets examine the three companies I mentioned earlier; for each company demonstrates an effective use of one of the three linkages just outlined.

Value creation at Fedex

In 1993, the express mail industry in the US featured three leading competitors: Federal Express, UPS and Airborne Express. These rms positioned

38

2008 The Author | Journal compilation 2008 London Business School

Overhead: $1.32

$7.20 Mgn .32

Pickup $1.07

Long Haul $2.43

Delivery $1.76

Adv. $0.00

Sales $0.30

Airborne Express

Overhead: $1.71

$9.00 Mgn .45

Pickup $1.37

Long Haul $2.99

Delivery $2.05

Adv. $0.22

Sales $0.21

Best practice

Federal Express

themselves differently within the industry. While Federal Express offered a higher-priced service based on its heavy advertising and timely delivery, Airborne Express tailored its service to the specic needs of business customers who outsourced their logistics to the company, such as low price and reliable delivery. To create value for these different groups of customers, Airborne Express and Federal Express performed their activities very differently. Generally, Federal Express spent heavily on advertising, information technology and newer airplanes in order to set and satisfy high customer expectations for quick delivery and to justify a price premium. By contrast, Airborne Express set itself up as a low-cost operator with its own airport, used planes, a mix of airplane and truck delivery, no national advertising and selective technology investment. As a result, Airborne Express was able to sell its service protably while charging 20 per cent less than Federal Express did.

The table below summarizes how Airborne Expresss $1.67 per-package cost advantage over Federal Express results from the differences in the way the two rms performed the activities mentioned above.

Activity

Airborne Per-Package Cost Advantage/(Disadvantage) $0.30 $0.56 $0.29 $0.22 ($0.09) $0.39 $1.67

Package Pick Up Long-Haul Transport Delivery Advertising Sales Overhead Airborne Total Cost Advantage Per Package

Value capture at Airborne Express

These different approaches to value creation produced very different cost structures for each package the two competitors delivered. Business strategists must be able to describe specically how their choices about activities translate into prices and costs at the activity level for each unit of product or service. This ability is important because it is an effective way to identify a rms competitive position and to take action to defend strengths and bolster weaknesses. Its helpful to see graphically how each company translated its strategy into prices and costs (see gure 1).

Heres how Airborne Express achieved the difference; it saved: $0.30 due to more efcient package pickup procedures. Since Airborne used lower-paid contract labour for 65 per cent of its packages, it paid 10 per cent less than Federal Express for its pickup labour. Furthermore, Airborne Express enjoyed a 20 per cent labour-cost advantage, since it picked up more packages at each stop than did Federal Express. $0.56 due to more efcient long-haul transport processes. Since it shipped 15 per cent more of its package volume by lower-cost truck, rather than airplane, Airborne Express enjoyed a 67 per cent cost advantage over Federal

Business Strategy Review Summer 2008

39

2008 The Author | Journal compilation 2008 London Business School

Express in its long-haul transport. Moreover, Airborne Express gained other cost advantages due to its airplanes being 80 per cent full (versus 65 per cent for Federal Express) and its freedom from paying landing fees, since Airborne owned its own airport.

$0.29 due to more efcient delivery. Airborne Express enjoyed a cost advantage in delivery for the same reasons as noted above in the pickup analysis. $0.22 due to lack of advertising. Since it did very little advertising, Airborne Express enjoyed a 22cent per-package cost advantage over Federal Express, which advertised extensively. This advertising contributed to Federal Expresss ability to charge 20 per cent more to deliver a package than Airborne Express. ($0.09) resulting from its larger sales force in proportion to its package volume. In sales, Airborne Express had a cost disadvantage relative to Federal Express because it wanted to establish personal connections with its corporate clients. $0.39 due to lower overhead. Airborne Express disdained waste and as a result it kept its overhead at a relatively low 8% of revenue.

First, it excels at entrepreneurial leadership by: Hiring top scientists Genentechs CEO, Arthur Levinson, studied with Nobel Prize-winning scientists and could have had a successful academic career. Levinson created a universitylike environment that attracted other top scientists.

Driving scientic initiative through self-selected projects Genentech encourages its researchers to spend 25 per cent of their time on projects of their choosing (compared to an industry average of 10 per cent). In 1988, a Genentech scientist, Napoleone Ferrara, became interested in antiangiogenesis, a process for choking off the blood supply to cancer tumours. His research led to Avastin, which was approved as a colorectal cancer treatment in 2004 and is expected to reach $3 billion in peak sales. Using peer recognition to motivate innovation Levinson believes peer recognition is a key motivator for researchers, and he gives them the opportunity to build a reputation for themselves. Genentech, unlike pharmaceutical companies, encourages employees to publish in-house research work in scientic journals. Pharmaceutical companies dont want any of their ndings to get out until theyve got a patent. According to Levinson, by that time, the work is no longer ground-breaking; no one cares about it any more.

Best practice

These details illustrate that management can make choices about how to perform activities that contribute both to how a rm creates value for its

Few organizations have thought through all the managerial choices required to create an effective Value Cycle.

customers and how it captures that value in the form of price, cost and prot margin advantages vis-vis its competitors.

Value renewal at Genentech

Genentech, the biotechnology company, excels at value renewal. Perhaps no statistic testied more eloquently to this than Genentechs June 2005 $83 billion stock market value, which exceeded Mercks by $12 billion a company with ve times Genentechs revenues. At 18 times revenues, Genentech was valued more highly than any leading publicly traded health care company in the eight sectors analyzed in this study. For the decade ending that month, Genentechs stock was up 11-fold; in the ve years ending that month, its revenues had climbed an annual average of 21 per cent and in the 12 months ending in June 2005, Genentech earned a 21 per cent net prot margin on $4.2 billion in revenues. Although I have no reason to believe that Genentech has ever heard of them, it appears that the company nonetheless uses the four sources of advantage I mentioned earlier:

40

Tapping into scientists desire to make the world better Genentech creates a culture in which people believe they can make a big difference. There are 300,000 people who have been treated by Rituxan, a treatment for non-Hodgkins lymphoma. When someone comes up to a Genentech employee and says, You helped save my dads life, it creates a sense that Genentech has a higher purpose that further motivates Genentech scientists.

Second, it utilizes open technology by: Partnering to obtain technologies that its customers want Genentech has forged over 100 partnerships in which it licenses technologies that form the basis of signicant revenue-generating products. For example, Genentech worked with Idec Pharmaceuticals, before that company merged with Biogen in 2003, to develop Rituxan, a blockbuster that generated $1.6 billion in 2004 sales. Third, it employs boundaryless product development by: Using genomics to re-engineer drug discovery Genentech created the Secreted Protein Discovery Initiative that generated ve exciting product

Business Strategy Review Summer 2008

2008 The Author | Journal compilation 2008 London Business School

Lastly, Genentech manages disciplined resource allocation by: Focusing on areas of therapeutic expertise Levinson analyzed the drug industry and concluded that companies with a therapeutic focus earned higher shareholder returns than less focused competitors. After Levinson became CEO in 1995, he concluded that Genentech could best prot from this insight by focusing primarily on cancer treatment.

Setting tight deadlines and beating them In early 2005, Genentech was in a race against Novartis to complete Phase III trials for using Avastin to treat a specic lung cancer. Genentech worked so quickly that Avastin achieved its goals for the Phase III trials by March 2005, effectively eliminating competition from Novartis, which had moved much more slowly and ultimately found

The Value Cycle is a powerful way to articulate an organizations ability to create and sustain benets for its constituents while generating sufcient surplus to survive. Few organizations have thought through all the managerial choices required to create an effective Value Cycle. However, the examples presented here and the methodologies described are intended to illustrate the benets of the Value Cycle and the means of capturing those benets.

Resources

Rivkin, Jan W. Airborne Express, Harvard Business School Publishing, February 5, 1998. Strategy Lecture by Babson College Professor U. Srinivasa Rangan.

Peter Cohan (peter@petercohan.com) is president of Peter S. Cohan & Associates, a management consulting and venture capital rm.

London Business School Regents Park London NW1 4SA United Kingdom Tel +44 (0)20 7000 7000 Fax +44 (0)20 7000 7001 www.london.edu A Graduate School of the University of London

2008 The Author | Journal compilation 2008 London Business School

Business Strategy Review Summer 2008

41

Best practice

leads, including a surprising antiviral molecule, and could spawn as many as 20 more within two years. The project (called Speedy by company insiders) re-engineered Genentechs traditional approach to research, in which scientists worked alone or in tiny teams. Under the assembly-linelike Speedy process, 80 scientists, a quarter of the Genetechs research staff, search enormous gene-data warehouses. Traditionally, scientists chased drug leads, known proteins like insulin and growth hormone, by synthesizing them into marketable products. Today, drug prospects are more likely to lie within the human genome and are found with the help of computers. With Speedy, Genentech simplied the task by focusing on the 10 per cent of all proteins that travel outside the cell, blocking or spreading disease. Those 10,000 proteins are identied by using high-tech screens called signal sequence traps (SSTs), and then run through tests to determine their therapeutic benets.

that its product was no more effective than chemotherapy. Genentech is not above using nancial incentives to encourage workers to meet deadlines. In 1998, Levinson promised employees Genenchecks of $3,000 or more if they beat an FDA marketing application deadline for Herceptin, a breast cancer drug.

Killing development projects which lack tight scientic justication Levinson can be brutal in killing projects he thinks are going nowhere. His presence at Genentechs weekly science meetings is as much feared as appreciated because the CEO takes pleasure in asking tough questions. Genentech will not move compounds into clinical trials (which cost between $30 million and $100 million) until scientic arguments for pursuing the drug are able to withstand Levinsons intense scrutiny. And, unlike some competitors, Genentech routinely designs drug trials to prove that its therapies extend the lives of patients, an exacting standard that is arduous and timeconsuming but which tends to convince even sceptics when the results are positive.

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- 5 Series LLC Strategies EbookDocumento11 páginas5 Series LLC Strategies EbookjuniormintsAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Beekeeping Business Plan Workbook: Produced byDocumento47 páginasBeekeeping Business Plan Workbook: Produced bychatzisAún no hay calificaciones

- MonmouthDocumento25 páginasMonmouthPerci LunarejoAún no hay calificaciones

- Skills Needs For The ICT Sector in Tanzania - PRDocumento16 páginasSkills Needs For The ICT Sector in Tanzania - PRAbu Khami SombeAún no hay calificaciones

- RyanAir CaseDocumento10 páginasRyanAir Casedian ratnasari100% (13)

- Bark08 Ghahramani Samlbb 01Documento26 páginasBark08 Ghahramani Samlbb 01Shifath NafisAún no hay calificaciones

- Cisco CCNA VoiceDocumento50 páginasCisco CCNA VoiceTrek98Aún no hay calificaciones

- Bmm690 Marketing Strategy: Staff Member Responsible For The ModuleDocumento7 páginasBmm690 Marketing Strategy: Staff Member Responsible For The ModuleShifath NafisAún no hay calificaciones

- Healthcare FactoidsDocumento10 páginasHealthcare FactoidsShifath NafisAún no hay calificaciones

- Investors Pitch v1Documento11 páginasInvestors Pitch v1Shifath NafisAún no hay calificaciones

- What Is Insolvency and Bankruptcy CodeDocumento9 páginasWhat Is Insolvency and Bankruptcy CodeJosef AnthonyAún no hay calificaciones

- John Keells Holdings PLC AR 2017 18 CSEDocumento208 páginasJohn Keells Holdings PLC AR 2017 18 CSEnizmiAún no hay calificaciones

- ACCT 102 Lecture Notes Chapter 13 SPR 2018Documento5 páginasACCT 102 Lecture Notes Chapter 13 SPR 2018Sophia Varias CruzAún no hay calificaciones

- Financial Performance of Textile CompanyDocumento62 páginasFinancial Performance of Textile CompanySelva Kumar0% (1)

- Valuation of BondsDocumento7 páginasValuation of BondsHannah Louise Gutang PortilloAún no hay calificaciones

- Business Breif U06-2 PDFDocumento1 páginaBusiness Breif U06-2 PDFAdam MichałekAún no hay calificaciones

- Ratio Analysis of IJMDocumento26 páginasRatio Analysis of IJMawaismaqbool83% (6)

- Annamalai University Solved AssignmentsDocumento10 páginasAnnamalai University Solved AssignmentsAiDLo50% (2)

- Topic 2 Part 1 Impairment of PpeDocumento37 páginasTopic 2 Part 1 Impairment of PpeXiao XuanAún no hay calificaciones

- Shrewsbury Herbal Products, LTDDocumento1 páginaShrewsbury Herbal Products, LTDWulandari Pramithasari0% (1)

- Cash Flow Statement: (Cheat Sheet)Documento5 páginasCash Flow Statement: (Cheat Sheet)LinyVatAún no hay calificaciones

- Greencrest Financial Services Limited - Queries ListDocumento2 páginasGreencrest Financial Services Limited - Queries Listabhishek shuklaAún no hay calificaciones

- TP 1 - Accounting IIDocumento11 páginasTP 1 - Accounting IIAbiAún no hay calificaciones

- SHAREHOLDERSDocumento6 páginasSHAREHOLDERSJoana MarieAún no hay calificaciones

- Advance Financadvance Financial Accounting and Reportingweek 1 AfarDocumento22 páginasAdvance Financadvance Financial Accounting and Reportingweek 1 AfarCale HenituseAún no hay calificaciones

- IKI Coal Monthly Indonesia Issue 003Documento20 páginasIKI Coal Monthly Indonesia Issue 003Putra KekiAún no hay calificaciones

- Summer Internship Report (MBA)Documento35 páginasSummer Internship Report (MBA)ShivamAún no hay calificaciones

- Internship Report On Habib Bank LimitedDocumento75 páginasInternship Report On Habib Bank LimitedMariyam Khan87% (15)

- Chapter1-Taxes and DefinitionsDocumento37 páginasChapter1-Taxes and DefinitionsSohael Adel AliAún no hay calificaciones

- Ineffective Institutional Investors LawDocumento19 páginasIneffective Institutional Investors LawJustin HalimAún no hay calificaciones

- Solved Assignment For Annamalai University MBA SECOND YEAR 2019Documento30 páginasSolved Assignment For Annamalai University MBA SECOND YEAR 2019palaniappann25% (4)

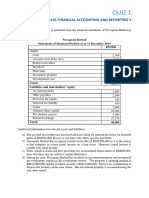

- QUIZ 1 Deferred Taxes SolutionDocumento3 páginasQUIZ 1 Deferred Taxes SolutionMohd NuuranAún no hay calificaciones

- Balanced ScorecardDocumento27 páginasBalanced ScorecardJimsy AntuAún no hay calificaciones

- What Is Return On Equity - ROE?Documento12 páginasWhat Is Return On Equity - ROE?Christine DavidAún no hay calificaciones

- CSL Investor Presentation Aug 18Documento21 páginasCSL Investor Presentation Aug 18gopalptkssAún no hay calificaciones