Documentos de Académico

Documentos de Profesional

Documentos de Cultura

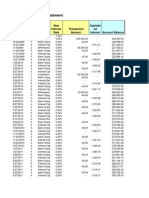

Investment - Column I

Cargado por

Stock WriterDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Investment - Column I

Cargado por

Stock WriterCopyright:

Formatos disponibles

WHAT WE’RE THINKING

Don’t just try to get rich

When I tell people I’m a stock ana- be among the market’s best perform-

lyst, many of them ask me for a tip. ers over the next year or two.

They often seem to be angling for Robert Beating the market over time is a

a pick likely to quadruple over the Sweet, CFA fine way to amass wealth. And even-

next month or two — you know, the tually, those who build wealth can

Managing

kind of return dangled as a teaser in Editor become rich. It takes longer, but the

marketing e-mails. rewards are just as great, and the risks,

Few real-life investors will ever far less.

earn such returns.

Dow Theory Forecasts doesn’t deal A sound strategy Ask the right questions

in stock tips. We focus on investments, Until humans learn to bottle luck So if you meet me at the gas sta-

which are not the same thing. You and sell it at the supermarket, get- tion or the ballgame, don’t ask me for

might say that instead of trying to get rich-quick schemes will remain just a stock tip. I don’t have any.

rich, we try to build wealth. that — schemes. More valuable than stock tips are

Don’t misunderstand me — the For our money, building wealth investing tips. Just in case you never

end result of building wealth is be- means building a diversified portfolio sit next to me on an airplane, here are

coming rich. The difference is in the of high-potential stocks likely to de- two of those investing tips.

approach. Very, very few people get liver strong returns over time, with a ➤ When should I sell? Sell when the

rich overnight by investing. Such in- reasonable amount of risk. The Fore- reason you purchased the stock no

stant success usually results not from casts tries to help investors do just longer applies. That can mean selling

expertise but from mind-bogglingly that. Our Buy List and Long-Term Buy a big gainer that you bought because

good luck and excessive confidence. List represent diversified baskets of of its valuation and now looks expen-

That rags-to-riches approach stocks with quality fundamentals and sive. It can also mean a growth stock

leaves more people wearing sackcloth superior total-return potential. For in- with declining growth potential or a

than satin. But the few who get lucky vestors already diversified, the Focus speculative stock that took a dive on

tend to shout the loudest, advertising List contains our 15 to 20 favorites. some bad news.

that “You can earn 10,000% just like I While all three of our lists are up ➤ How many stocks should I own?

did.” more than 40% since the end of 1999 Academic research suggests that a

Don’t believe it. (versus a 3% gain for the S&P 500 portfolio of 30 to 40 stocks provides

One-stock portfolios are mighty Index) and are beating the S&P 500 adequate diversification. The stock-

risky. One strike and you’re out. so far this year, none are designed to tip method of portfolio allocation is

Stock-tip investing also puts you give you huge short-term returns. We too risky for us. A 10-stock portfolio

at a disadvantage when it comes time don’t look for stocks likely to double is about twice as volatile as a 40-stock

to sell. If you buy based on a tip, you by next month. That’s a sucker’s game, portfolio — and a one-stock portfo-

don’t know why you bought — and and we don’t play at that table. We do lio is about three times as a volatile as

you won’t know when to get out. look for stocks we think are going to a 10-stock portfolio.

The Dow Theory is a method of interpreting and clas- Contributing Editors, Analysts interrupted service. Periodically we rent our mailing

sifying general market trends and does not directly en- Charles B. Carlson, CFA David A. Wright, CFA list to companies with products that may be of interest

compass the selection or rating of individual stocks or to subscribers. If you would prefer not to be included in

Contributors these mailings, please notify us in writing.

the duration of market movements. Dow Theory Fore-

Jennifer R. Hopfinger M. Lisa Springer, CFA POSTMASTER: Send address change to Dow Theory

casts endeavors to supply its subscribers with sound

opinions and advice based on its analysis of public in- Dow Theory Forecasts (ISSN 0300-7324 USPS 997- Forecasts, 7412 Calumet Avenue, Hammond, Indiana

formation from sources believed to be reliable. 000) published weekly by Horizon Publishing Company, 46324-2692.Copyright 2007 Horizon Publishing Com-

7412 Calumet Ave, Hammond, Indiana 46324-2692. pany. Any reproduction without written authorization

Editor, Director of Research is prohibited. If you have any questions about your

Subscription Rate $279 a year. Periodicals postage paid

Richard J. Moroney, CFA at Hammond, Indiana, and at additional mailing of- subscription, please write or phone us at (800) 233-

Managing Editor, Analyst fices. When you move—Please notify us three weeks in 5922 or (219) 852-3200.

Robert A. Sweet, CFA advance of any change in address. This will insure un- MetaStock is a registered trademark of Equis Int’l.

2 Dow Theory Forecasts, October 29, 2007

También podría gustarte

- Fund Spy: Morningstar's Inside Secrets to Selecting Mutual Funds that OutperformDe EverandFund Spy: Morningstar's Inside Secrets to Selecting Mutual Funds that OutperformAún no hay calificaciones

- Cautionary tales for the modern investor: The seven deadly sins of multi-asset investingDe EverandCautionary tales for the modern investor: The seven deadly sins of multi-asset investingAún no hay calificaciones

- Investment - Column IIDocumento1 páginaInvestment - Column IIStock Writer100% (1)

- Billionaires Secrets PDFDocumento28 páginasBillionaires Secrets PDFrammon raymond100% (1)

- Crossroads Capital 2019 Annual FINALDocumento31 páginasCrossroads Capital 2019 Annual FINALYog MehtaAún no hay calificaciones

- The Little Black Book of Billionaire Sec PDFDocumento30 páginasThe Little Black Book of Billionaire Sec PDFCharlie Bob Piñeirua ColumboAún no hay calificaciones

- Billionaires SecretsDocumento28 páginasBillionaires SecretsSaša Lović0% (1)

- Billionaires Secrets PDFDocumento28 páginasBillionaires Secrets PDFgeorgio valentino rayalaAún no hay calificaciones

- The Money Masters July 1993Documento4 páginasThe Money Masters July 1993Rajeev KumarAún no hay calificaciones

- Warren Buffett's Latest Annual Letter 2018Documento4 páginasWarren Buffett's Latest Annual Letter 2018maheshtech760% (1)

- How To Read Financial Statements, Part 1 (Risk Over Reward)Documento9 páginasHow To Read Financial Statements, Part 1 (Risk Over Reward)Arun Rao0% (2)

- Book of Billionaire SecretsDocumento28 páginasBook of Billionaire SecretsSimpliciusAún no hay calificaciones

- Covered Call Expert ReportDocumento50 páginasCovered Call Expert Reporttvadmaker100% (2)

- Guru LessonsDocumento12 páginasGuru LessonsSergio Olarte100% (1)

- Why Do Investors Trade Too Much-Barber - OdeanDocumento6 páginasWhy Do Investors Trade Too Much-Barber - OdeanMatías OlaveAún no hay calificaciones

- 4 Mistakes People Make in Stock InvestingDocumento2 páginas4 Mistakes People Make in Stock InvestingGerald S BigarAún no hay calificaciones

- The Art & Science Of Preferred Dividend InvestingDe EverandThe Art & Science Of Preferred Dividend InvestingCalificación: 4 de 5 estrellas4/5 (1)

- Jeff Saut Being Wrong Still Making MoneyDocumento11 páginasJeff Saut Being Wrong Still Making Moneymarketfolly.com100% (2)

- 2009 Annual LetterDocumento5 páginas2009 Annual Letterppate100% (1)

- Investing AdviceDocumento9 páginasInvesting AdviceAltrosas100% (1)

- Q4 2015 Market CommentaryDocumento5 páginasQ4 2015 Market CommentaryNorthstar Financial Companies, IncAún no hay calificaciones

- 7ingredients PDFDocumento8 páginas7ingredients PDFAmber TajwerAún no hay calificaciones

- 7 IngredientsDocumento8 páginas7 IngredientsAmber TajwerAún no hay calificaciones

- How To Invest in Stocks: How Stocks Work, How To Calculate Return On Investment and Other Investing BasicsDocumento9 páginasHow To Invest in Stocks: How Stocks Work, How To Calculate Return On Investment and Other Investing BasicsAshok Subramaniam100% (1)

- Dividends Stocks Tend To Outperform 1.19Documento2 páginasDividends Stocks Tend To Outperform 1.19paul farcasAún no hay calificaciones

- Payback Time (Review and Analysis of Town's Book)De EverandPayback Time (Review and Analysis of Town's Book)Aún no hay calificaciones

- 16 Rules For Investing - Sir John TempletonDocumento20 páginas16 Rules For Investing - Sir John Templetonjude55Aún no hay calificaciones

- TheStreet - Seven Deadly Sins Every Investor Must AvoidDocumento4 páginasTheStreet - Seven Deadly Sins Every Investor Must AvoidcloudsandskyeAún no hay calificaciones

- How To Measure Mutual FundDocumento5 páginasHow To Measure Mutual FundAmresh SinhaAún no hay calificaciones

- The Little Book That Builds Wealth: The Knockout Formula for Finding Great InvestmentsDe EverandThe Little Book That Builds Wealth: The Knockout Formula for Finding Great InvestmentsCalificación: 4.5 de 5 estrellas4.5/5 (28)

- Markets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment PortfoliosDocumento2 páginasMarkets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment Portfoliostscollin48Aún no hay calificaciones

- EMF BookSummary OneuponWallStreet1808Documento5 páginasEMF BookSummary OneuponWallStreet1808VaishnaviRavipatiAún no hay calificaciones

- Sir Templeton's 16 Rules For Investment SuccessDocumento20 páginasSir Templeton's 16 Rules For Investment Successmstybluemoon100% (1)

- Jean Marie Part 2 - The InterviewsDocumento5 páginasJean Marie Part 2 - The Interviewsekramcal100% (1)

- 5 Best Ways To Manage Your Portfolio PDFDocumento6 páginas5 Best Ways To Manage Your Portfolio PDFJothiManiSAún no hay calificaciones

- Value-Oriented Equity Investment Ideas For Sophisticated InvestorsDocumento117 páginasValue-Oriented Equity Investment Ideas For Sophisticated InvestorsValueWalkAún no hay calificaciones

- Active Value Investing Process by Vitaliy Katsenelson, CFADocumento16 páginasActive Value Investing Process by Vitaliy Katsenelson, CFAVitaliyKatsenelsonAún no hay calificaciones

- WK 5 BF Tutorial Qns and Solns PDFDocumento6 páginasWK 5 BF Tutorial Qns and Solns PDFIlko KacarskiAún no hay calificaciones

- 10 Rules For Successful Long-Term InvestingDocumento8 páginas10 Rules For Successful Long-Term InvestingPGM5HAún no hay calificaciones

- Wisdom on Value Investing: How to Profit on Fallen AngelsDe EverandWisdom on Value Investing: How to Profit on Fallen AngelsCalificación: 4 de 5 estrellas4/5 (6)

- 100 To 1 in The Stock Market - Seeking WisdomDocumento29 páginas100 To 1 in The Stock Market - Seeking Wisdomkrb2709100% (2)

- Mihaljevic On Value Investors' Dilemma: When To Sell A Winner?Documento3 páginasMihaljevic On Value Investors' Dilemma: When To Sell A Winner?The Manual of IdeasAún no hay calificaciones

- Digging into Financial Advice: Finding the Best Help for You to InvestDe EverandDigging into Financial Advice: Finding the Best Help for You to InvestAún no hay calificaciones

- The Five Minute Investor TradingpdfgratisDocumento75 páginasThe Five Minute Investor TradingpdfgratisMiguel BeltranAún no hay calificaciones

- Wiseguy Investing: Beginner Guide & TipsDocumento12 páginasWiseguy Investing: Beginner Guide & TipsGorge LeonAún no hay calificaciones

- 4 Questions and Answers About Value InvestingDocumento3 páginas4 Questions and Answers About Value Investingambasyapare1Aún no hay calificaciones

- The Keys To Successful InvestingDocumento4 páginasThe Keys To Successful InvestingArnaldoBritoAraújoAún no hay calificaciones

- Summary of Joel Greenblatt's You Can Be a Stock Market GeniusDe EverandSummary of Joel Greenblatt's You Can Be a Stock Market GeniusAún no hay calificaciones

- The Hummingbird Value Fund, LP The Tarsier Nanocap Value Fund, LPDocumento20 páginasThe Hummingbird Value Fund, LP The Tarsier Nanocap Value Fund, LPczarny111Aún no hay calificaciones

- Winning With Weekly Options: Schaeffer's Investment Research'sDocumento10 páginasWinning With Weekly Options: Schaeffer's Investment Research'sAdnan ShaukatAún no hay calificaciones

- 9 Best Stocks To Own Right Now November 2014Documento17 páginas9 Best Stocks To Own Right Now November 2014telecoms804183Aún no hay calificaciones

- How To Invest in StocksDocumento3 páginasHow To Invest in StocksRollaine CastilloAún no hay calificaciones

- The Value Investing With Options Minifesto: A Brief Overview of The Best Way To Invest. PeriodDocumento22 páginasThe Value Investing With Options Minifesto: A Brief Overview of The Best Way To Invest. PeriodAmeerHamsa100% (1)

- Investment Theory #9 - Buffett's 1964 Letter - Wiser DailyDocumento6 páginasInvestment Theory #9 - Buffett's 1964 Letter - Wiser DailyVovan VovanAún no hay calificaciones

- A Beginner's Guide to High-Risk, High-Reward Investing: From Cryptocurrencies and Short Selling to SPACs and NFTs, an Essential Guide to the Next Big InvestmentDe EverandA Beginner's Guide to High-Risk, High-Reward Investing: From Cryptocurrencies and Short Selling to SPACs and NFTs, an Essential Guide to the Next Big InvestmentAún no hay calificaciones

- One Up On Wall StreetDocumento5 páginasOne Up On Wall StreetAlexis RoyerAún no hay calificaciones

- 3 The 5 Biggest Stock Market MythsDocumento3 páginas3 The 5 Biggest Stock Market MythsGovind RathiAún no hay calificaciones

- Financial Management PDFDocumento7 páginasFinancial Management PDFdishu kumarAún no hay calificaciones

- Marketing 2.0Documento2 páginasMarketing 2.0covilog567Aún no hay calificaciones

- Investment Account StatementDocumento6 páginasInvestment Account StatementMorgan ThomasAún no hay calificaciones

- Income Funds Annual Report PDFDocumento320 páginasIncome Funds Annual Report PDFHarshal PatelAún no hay calificaciones

- A Study On Portfolio Management and AnalysisDocumento12 páginasA Study On Portfolio Management and AnalysisSunny SharmaAún no hay calificaciones

- 2019 FRM Prestudy Pe2Documento174 páginas2019 FRM Prestudy Pe2indymanAún no hay calificaciones

- Features of Equity SharesDocumento4 páginasFeatures of Equity SharesAnkita Modi100% (1)

- Survey of Economics 8th Edition Tucker Test BankDocumento31 páginasSurvey of Economics 8th Edition Tucker Test Bankamandabinh1j6100% (27)

- Mutual FundDocumento20 páginasMutual FundGeethakrishna GeethuAún no hay calificaciones

- A Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byDocumento23 páginasA Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byVarsha PaygudeAún no hay calificaciones

- Summer Internship Project - Swastika Investmart Limited.Documento50 páginasSummer Internship Project - Swastika Investmart Limited.Ronak Jain100% (3)

- Derivatives ViewDocumento15 páginasDerivatives ViewManojAún no hay calificaciones

- Problems and Questions - 3Documento6 páginasProblems and Questions - 3mashta04Aún no hay calificaciones

- Investigating The Potentially Contradictory Microfoundations of Financialization (Watson 2009)Documento40 páginasInvestigating The Potentially Contradictory Microfoundations of Financialization (Watson 2009)MarcoKreAún no hay calificaciones

- Risk and Return Slides PDFDocumento26 páginasRisk and Return Slides PDFBradAún no hay calificaciones

- Risk Mgmt-Including Basel II and NRB DirectivesDocumento21 páginasRisk Mgmt-Including Basel II and NRB Directivesshyam bkAún no hay calificaciones

- Ivca Private Equity - Venture Capital Report: Advocacy ResearchDocumento24 páginasIvca Private Equity - Venture Capital Report: Advocacy ResearchSubhro SenguptaAún no hay calificaciones

- Methods of Valuation of FirmsDocumento90 páginasMethods of Valuation of Firmsmuskaan bhadadaAún no hay calificaciones

- Investing: When and How To Start?Documento2 páginasInvesting: When and How To Start?Avni GuptaAún no hay calificaciones

- Fi AssignmentDocumento9 páginasFi Assignmentyohannes kindalem0% (1)

- MakalahDocumento8 páginasMakalahAsyam ArkaAún no hay calificaciones

- Treasury Investment Policy - Lecture - Session 4 PDFDocumento36 páginasTreasury Investment Policy - Lecture - Session 4 PDFQamber AliAún no hay calificaciones

- Stated Objective: Dow Jones Stoxx Global 1800 IndexDocumento2 páginasStated Objective: Dow Jones Stoxx Global 1800 IndexMutimbaAún no hay calificaciones

- Bahan Ajar Investasi SahamDocumento9 páginasBahan Ajar Investasi SahamZachra MeirizaAún no hay calificaciones

- MIBG - Malaysian Bank Bonds - 230430Documento16 páginasMIBG - Malaysian Bank Bonds - 230430Guan JooAún no hay calificaciones

- Interest Rates & HY Returns - JPM StudyDocumento12 páginasInterest Rates & HY Returns - JPM Studyvilnius00Aún no hay calificaciones

- Sara Dhuri: CertificateDocumento7 páginasSara Dhuri: CertificateHALOLLOLAún no hay calificaciones

- Economic ExposureDocumento36 páginasEconomic Exposurebuffon100% (1)

- Amortization TableDocumento4 páginasAmortization TableFerdinand SanchezAún no hay calificaciones

- 10 Price Action Patterns You Must KnowDocumento20 páginas10 Price Action Patterns You Must Knowmajid abbasAún no hay calificaciones