Documentos de Académico

Documentos de Profesional

Documentos de Cultura

RPGT and Deductable Incidental Expenses

Cargado por

osteohDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

RPGT and Deductable Incidental Expenses

Cargado por

osteohCopyright:

Formatos disponibles

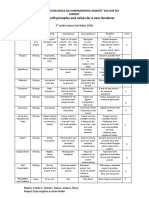

RPGT and Deductable Incidental Expenses 1) RPGT Rates 1 Jan 2013 2010 1 Apr 2007 31 Dec 2012 2011

31 Dec 2009 Within 1st and 2nd year 5% 0% Year 3 to 5 5% 0% > 5 years 0% 0% 15% 10% 0% 10% 5% 0% 31 Dec 1 Jan 2012 1 Jan

See http://www.jsvaluers.com.my/UT-Know_std_rate.htm for Year 2013 rate 2) Stamp Duty, see http://www.jsvaluers.com.my/UTKnow_std_rate.htm Stamp duty for First RM 100,000 1% Memorandum of Transfer 1 Next RM 400,000 2% Above RM 3% 500,000 There are some Stamp Duty Exemption that you will need to know: 50% of the stamp duty chargeable on any instrument of transfer for purchase of a house not exceeding RM250,000 executed on or after 8 September 2007 but not later than 31 December 2010 (both days inclusive). This exemption is granted to only one residential property per individual. Stamp Duty (remission)(no 3) Order 2007 [P.U.(A) 402/2007] - wef 8 Sep 2007 to 31 Dec 2010 The Government had, in the Budget 2009 announcement provided an stamp duty exemption of 50% on the instrument of transfer agreements and loan agreements for the purchase of a first residential property up to RM 350,000. To further enable Malaysians to own their own first residential property, it is proposed that the 50% stamp duty exemption be extended to 31 December 2014 and that the qualifying threshold of the residential property price be raised up to RM 400,000. http://www.wongpartners.com/files/Uploads/Documents/Type %202/WP/al_wongpartners_highlightsmalaysianbudget2013_oct12.pdf

http://www.jsvaluers.com.my/UT-Know_std_rate.htm 50% of the stamp duty chargeable on any instrument of transfer of any immovable property operating as a voluntary disposition between parent and child is remitted Stamp Duty (remission)(no 7) Order 2002 [P.U.(A) 434/2002 ]- Effective from 1 Jan 2003 No Stamp Duty on instruments in connection with the transfer of immovable property operating as a voluntary disposition between husband and wife effective 8 September 2007. Stamp Duty (exemption)(no 10) Order 2007- effective 8 Sep 2007 2) Please look at this website http://tunheang.com/2012/02/05/acquisition-price-and-disposal-pricefor-rpgt/, it says Assessment and Quit Rent is Not deductible from Disposal Price because they are revenue expenses. 3) Estate Agency Fee (http://www.jsvaluers.com.my/UTEstate_agency.htm) Sale or Purchase of Land and Buildings: Maximum fee of 3% with a minimum fee of RM1,000 per property. 4) Valuation Fee See http://www.jsvaluers.com.my/UT-Valuation.htm Fee for other capital valuation / rating valuation services based on an 'Improved Value' basis 1 1/4% of the first RM100,000 1/5% of the residue up to RM2 million 1/6% of the residue up to RM7 million 1/8% of the residue up to RM15 million 1/10% of the residue up to RM50 million 1/15% of the residue up to RM200 million 1/20% of the residue up to RM500 million 1/25% of the residue over RM500 million

Subject to a minimum of RM400 5) Legal fee. See http://www.jsvaluers.com.my/UT-Legal.htm

Legal fee for Sales & Purchase Agreement

First RM 100,000 Next RM 4.9 million Thereafter First RM 10,000 Next RM 90,000 Above RM 100,000

1% 0.5% 0.25% 25% 10% Negotiable

Legal fee for Rental Agreement (monthly)

Subject to a minimum of RM300 or RM250 (for low income group)

También podría gustarte

- Yp With Tax ExplainedDocumento2 páginasYp With Tax ExplainedosteohAún no hay calificaciones

- Land Acquisition Act: Court Document (Summary)Documento1 páginaLand Acquisition Act: Court Document (Summary)osteohAún no hay calificaciones

- VAEA Act: 9 Wrong Doings and 6 OrdersDocumento1 páginaVAEA Act: 9 Wrong Doings and 6 OrdersosteohAún no hay calificaciones

- Land Acquisition Act 1960 Developer Application SequenceDocumento2 páginasLand Acquisition Act 1960 Developer Application SequenceosteohAún no hay calificaciones

- PV FV DepositSummaryDocumento1 páginaPV FV DepositSummaryosteohAún no hay calificaciones

- Malaysia Stamp DutyDocumento2 páginasMalaysia Stamp DutyosteohAún no hay calificaciones

- Sample Mortgage CalculationDocumento9 páginasSample Mortgage CalculationosteohAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- C4 ISRchapterDocumento16 páginasC4 ISRchapterSerkan KalaycıAún no hay calificaciones

- Assignment - Final TestDocumento3 páginasAssignment - Final TestbahilashAún no hay calificaciones

- Job Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaDocumento45 páginasJob Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaClaudette Clemente100% (1)

- Kathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Documento236 páginasKathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Csongor KicsiAún no hay calificaciones

- Flowmon Ads Enterprise Userguide enDocumento82 páginasFlowmon Ads Enterprise Userguide ennagasatoAún no hay calificaciones

- Ecc Part 2Documento25 páginasEcc Part 2Shivansh PundirAún no hay calificaciones

- Three Comparison of Homoeopathic MedicinesDocumento22 páginasThree Comparison of Homoeopathic MedicinesSayeed AhmadAún no hay calificaciones

- Uses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumDocumento6 páginasUses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumEditor IJTSRDAún no hay calificaciones

- Reading and Writing Q1 - M13Documento13 páginasReading and Writing Q1 - M13Joshua Lander Soquita Cadayona100% (1)

- Factors of Active Citizenship EducationDocumento2 páginasFactors of Active Citizenship EducationmauïAún no hay calificaciones

- Kaydon Dry Gas SealDocumento12 páginasKaydon Dry Gas Sealxsi666Aún no hay calificaciones

- Physioex 9.0 Exercise 1 Act 1Documento5 páginasPhysioex 9.0 Exercise 1 Act 1Adela LhuzAún no hay calificaciones

- Committee History 50yearsDocumento156 páginasCommittee History 50yearsd_maassAún no hay calificaciones

- There Is There Are Exercise 1Documento3 páginasThere Is There Are Exercise 1Chindy AriestaAún no hay calificaciones

- A Princess of Mars Part 3Documento4 páginasA Princess of Mars Part 3Sheila Inca100% (1)

- Allan S. Cu v. Small Business Guarantee and FinanceDocumento2 páginasAllan S. Cu v. Small Business Guarantee and FinanceFrancis Coronel Jr.Aún no hay calificaciones

- Essential Rendering BookDocumento314 páginasEssential Rendering BookHelton OliveiraAún no hay calificaciones

- Employee Confidentiality and Non-Disclosure AgreementDocumento5 páginasEmployee Confidentiality and Non-Disclosure AgreementshamoojeeAún no hay calificaciones

- Listening Exercise 1Documento1 páginaListening Exercise 1Ma. Luiggie Teresita PerezAún no hay calificaciones

- GS16 Gas Valve: With On-Board DriverDocumento4 páginasGS16 Gas Valve: With On-Board DriverProcurement PardisanAún no hay calificaciones

- Sinclair User 1 Apr 1982Documento68 páginasSinclair User 1 Apr 1982JasonWhite99Aún no hay calificaciones

- A Guide To in The: First AidDocumento20 páginasA Guide To in The: First AidsanjeevchsAún no hay calificaciones

- Damcos Mas2600 Installation UsermanualDocumento26 páginasDamcos Mas2600 Installation Usermanualair1111Aún no hay calificaciones

- Combined Set12Documento159 páginasCombined Set12Nguyễn Sơn LâmAún no hay calificaciones

- Differential Pulse Code ModulationDocumento12 páginasDifferential Pulse Code ModulationNarasimhareddy MmkAún no hay calificaciones

- Rubric 5th GradeDocumento2 páginasRubric 5th GradeAlbert SantosAún no hay calificaciones

- Maharashtra Auto Permit Winner ListDocumento148 páginasMaharashtra Auto Permit Winner ListSadik Shaikh50% (2)

- Ball Valves Pentair Valves and ControlsDocumento16 páginasBall Valves Pentair Valves and ControlsABDUL KADHARAún no hay calificaciones

- Navistar O & M ManualDocumento56 páginasNavistar O & M ManualMushtaq Hasan95% (20)

- Exercise-01: JEE-PhysicsDocumento52 páginasExercise-01: JEE-Physicsjk rAún no hay calificaciones