Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Element Global Opportunities Equity Portfolio - June 2011

Cargado por

FilipeDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Element Global Opportunities Equity Portfolio - June 2011

Cargado por

FilipeCopyright:

Formatos disponibles

Element Global Opportunities Equity Portfolio

June 2011

The Element Global Opportunities Equity Portfolio has the mandate to go anywhere in pursuit of attractive investment opportunities, using a bottom-up investment approach. Being equity focused, the portfolio has at least 70% of its assets invested in international equity markets. The portfolio uses as benchmark the MSCI World (Local) but it does not seek to mimic or track this index in any way, which may lead both geographic and sectorial allocation differences.

Fund Details

Net Asset Value : Portfolio Assets (): Launch date: Portfolio Managers: 98.66 47100 14-January-2011 Filipe Alves da Silva Afonso Janurio

Investment Highlights

By mid-month things were getting ugly in Greece. There was a 2 day general strike and people were rioting on the streets of Athens: the Greek parliament had to approve more austerity measures in order to get more aid money and avoid an imminent default. This binary hypothesis, together with the US debt ceiling political fight, upset equity markets, leading to 7 straight weeks of negative returns. In the end the Greeks opted to face the problem head on and default was averted, at least for now. Equity markets quickly made back most of what they had lost. We took advantage of the weakness in equity markets to take a position in Apple, a stock that we have been meaning to add to our portfolio for some time. The tech juggernaut is growing its results at an impressive rate, 57%/yr for the last 5 years, and the future looks bright, with new products on the pipeline and hungry costumers anxiously awaiting for it. When we bought the stock it was trading at around 15x last twelve month earnings. During the month we increased the exposure to China via the Fidelity China Special Situations Fund. The two reasons we chose a fund and not an ETF are: Firstly it is managed by Anthony Bolton, one of the best equity managers of our generation, that will surely add more value than an ETF; Secondly, the fund focuses on sectors where the growth is, Chinese consumption and services, as opposed to infrastructure, commodity and exporting sectors. In June the portfolio performed in line with its benchmark (-1.73% ).

Investment Guidelines

Max. Long Exposure: Min. Long Exposure: Equity Hedging: 130% 70% Fund may use options on single name equities or equity indices to hedge downside risk Hedged on a best effort basis

Currency Hedging:

Weekly Performance Chart

106 104

102

100 98 96

MSCI World Local

Portfolio

94

Monthly Performance

Jan 2011 -1.11% Feb 1.61% Mar -2.05% Apr 3.30% May -1.25% Jun -1.72% Jul Aug Sep Oct Nov Dec YTD -1.34%

Element Global Opportunities Equity Portfolio

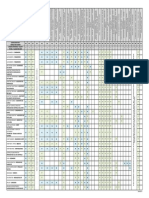

Allocation by Sector

Cash Utilities -0,5% 2,7% 7,3% 7,7% 6,1% 6,6% 15,5% 7,8% 8,0% 22,9% 15,8% -5% 0% 5% 10% 15% 20% 25%

Cash Others Brazil China Netherlands Italy Sweden Spain Switzerland Germany Australia France Canada United Kingdom Japan United States -10% -0,5%

Allocation by Country

3,8% 2,3% 4,9% 1,3% 1,1% 1,3% 9,7% 3,0% 3,3% 2,3% 3,8% 5,5% 7,8% 5,1% 45,3% 0% 10% 20% 30% 40% 50%

Telecommunication Services

Materials Health Care Consumer Staples

Consumer Discretionary

Energy Industrials Information Technology

Financials

Top 10 Positions

i Sha res MSCI Worl d ETF Hedged i Sha res DJ Stoxx 600 ETF Mi cros oft Corpora ti on IBM i Sha res MSCI Al l Country ETF i Sha res MSCI Worl d ETF Tel efoni ca GAP Inc Ama deus IT Hol di ngs Fi del i ty Chi na Speci a l Si tua ti ons

Weight

46.1% 8.8% 5.3% 5.0% 4.9% 4.8% 4.1% 3.6%

100% 80%

60%

93,6%

Currency Exposure

40% 20%

4,8%

2,2% 2,4%

Total

3.2% 2.6% 88.4%

0%

-3,1%

-20%

EUR

USD

CNY

BRL

CAD

Glossary

Bottom-up Investing A bottom-up strategy overlooks broad sector and economic conditions and instead focuses on selecting a stock based on the individual attributes of a company. Advocates of the bottom-up approach simply seek strong companies with good prospects, regardless of industry or macroeconomic factors. Net Asset Value The total value of a companys assets less the total value of its liabilities is its net asset value (NAV). For valuation purposes it is common to divide net assets by the number of shares in issue to give the net assets per share, also known as the price per share. Long Exposure Percentage of the Funds assets that are invested in equity markets and that benefit from the appreciation of equity markets. Currency Hedging Transaction implemented to protect the Funds foreign currency positions (non-Euro) from an unwanted move in exchange rates. Top 10 Positions Top holdings are those securities in which the latest percentage of the Funds total assets are invested. They do not include hedging derivatives. A full list of holdings, including derivatives, is available upon request.

E L E M E N T C A P I T A L

Contacts

For more information please contact Afonso Janurio or Filipe Alves da Silva directly or send an email to element.cap@gmail.com

LONDON

GENEVA

Disclaimer: Past performance is not indicative of future performance. Reference in this document to specific securities should not be construed as a

recommendation to buy or sell these securities.

También podría gustarte

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Element Global Value - 3Q14Documento4 páginasElement Global Value - 3Q14FilipeAún no hay calificaciones

- Element Global Value - 1Q14Documento4 páginasElement Global Value - 1Q14FilipeAún no hay calificaciones

- Element Global Value - June 2013Documento4 páginasElement Global Value - June 2013FilipeAún no hay calificaciones

- Element Global Value - 4Q13 (Year End Letter)Documento14 páginasElement Global Value - 4Q13 (Year End Letter)FilipeAún no hay calificaciones

- Element Global Value - 2Q14Documento6 páginasElement Global Value - 2Q14FilipeAún no hay calificaciones

- Element Global Value - Year End Letter 2014Documento12 páginasElement Global Value - Year End Letter 2014FilipeAún no hay calificaciones

- Element Global Value - 3Q13Documento4 páginasElement Global Value - 3Q13FilipeAún no hay calificaciones

- Element Global Value - May 2013Documento3 páginasElement Global Value - May 2013FilipeAún no hay calificaciones

- Element Global Value - February 2013Documento4 páginasElement Global Value - February 2013FilipeAún no hay calificaciones

- Element Global Value - Letter 2012Documento17 páginasElement Global Value - Letter 2012FilipeAún no hay calificaciones

- Element Global Value - April 2013Documento3 páginasElement Global Value - April 2013Filipe Alves da SilvaAún no hay calificaciones

- Element Global Value - January 2013Documento5 páginasElement Global Value - January 2013Filipe Alves da SilvaAún no hay calificaciones

- Element Global Value - March 2013Documento4 páginasElement Global Value - March 2013FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - August 2012Documento3 páginasElement Global Opportunities Equity Portfolio - August 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - May 2012Documento3 páginasElement Global Opportunities Equity Portfolio - May 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - November 2012Documento5 páginasElement Global Opportunities Equity Portfolio - November 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - October 2012Documento3 páginasElement Global Opportunities Equity Portfolio - October 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - July 2012Documento4 páginasElement Global Opportunities Equity Portfolio - July 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - Feb 2012Documento3 páginasElement Global Opportunities Equity Portfolio - Feb 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - December 2012Documento5 páginasElement Global Opportunities Equity Portfolio - December 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - June 2012Documento3 páginasElement Global Opportunities Equity Portfolio - June 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - September 2012Documento3 páginasElement Global Opportunities Equity Portfolio - September 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - April 2012Documento3 páginasElement Global Opportunities Equity Portfolio - April 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - Mar 2012Documento3 páginasElement Global Opportunities Equity Portfolio - Mar 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - August 2011Documento3 páginasElement Global Opportunities Equity Portfolio - August 2011FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - July 2011Documento3 páginasElement Global Opportunities Equity Portfolio - July 2011FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - November 2011Documento3 páginasElement Global Opportunities Equity Portfolio - November 2011FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - January 2012Documento3 páginasElement Global Opportunities Equity Portfolio - January 2012FilipeAún no hay calificaciones

- Element Global Opportunities Equity Portfolio - October 2011Documento3 páginasElement Global Opportunities Equity Portfolio - October 2011FilipeAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Types of Intermolecular ForcesDocumento34 páginasTypes of Intermolecular ForcesRuschan JaraAún no hay calificaciones

- Combining Wavelet and Kalman Filters For Financial Time Series PredictionDocumento17 páginasCombining Wavelet and Kalman Filters For Financial Time Series PredictionLuis OliveiraAún no hay calificaciones

- Ericsson For Sale From Powerstorm 4SA03071242Documento8 páginasEricsson For Sale From Powerstorm 4SA03071242wd3esaAún no hay calificaciones

- Star Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingDocumento4 páginasStar Wars Galactic Connexionstm Galactic Beckett Star Wars Story Connexions CallingJuan TorresAún no hay calificaciones

- 2022 NEDA Annual Report Pre PubDocumento68 páginas2022 NEDA Annual Report Pre PubfrancessantiagoAún no hay calificaciones

- Company Registration Procedure Handbook in Cambodia, EnglishDocumento124 páginasCompany Registration Procedure Handbook in Cambodia, EnglishThea100% (16)

- Java Edition Data Values - Official Minecraft WikiDocumento140 páginasJava Edition Data Values - Official Minecraft WikiCristian Rene SuárezAún no hay calificaciones

- HYDRAULIC WINCH-MS1059 - Operation & Maintenance Manual Rev ADocumento33 páginasHYDRAULIC WINCH-MS1059 - Operation & Maintenance Manual Rev Azulu80Aún no hay calificaciones

- Ict's - 2022 - Mentorship - Summarized - Thread - by - Trader - Theory - Sep 22, 22 - From - RattibhaDocumento11 páginasIct's - 2022 - Mentorship - Summarized - Thread - by - Trader - Theory - Sep 22, 22 - From - RattibhaChristiana OnyinyeAún no hay calificaciones

- Deloitte - Introduction To TS&A - CloudDocumento2 páginasDeloitte - Introduction To TS&A - Cloudsatyam100% (1)

- Offshore Training Matriz Matriz de Treinamentos OffshoreDocumento2 páginasOffshore Training Matriz Matriz de Treinamentos OffshorecamiladiasmanoelAún no hay calificaciones

- Windows Insider ProgramDocumento10 páginasWindows Insider ProgramVasileBurcuAún no hay calificaciones

- Schermer 1984Documento25 páginasSchermer 1984Pedro VeraAún no hay calificaciones

- R, Axn: Housingand RegulatoryDocumento5 páginasR, Axn: Housingand RegulatoryAce RamosoAún no hay calificaciones

- Distillation ColumnDocumento22 páginasDistillation Columndiyar cheAún no hay calificaciones

- Aavi 3Documento4 páginasAavi 3Arnie IldefonsoAún no hay calificaciones

- Quiz 2 I - Prefix and Suffix TestDocumento10 páginasQuiz 2 I - Prefix and Suffix Testguait9Aún no hay calificaciones

- 5000-5020 en PDFDocumento10 páginas5000-5020 en PDFRodrigo SandovalAún no hay calificaciones

- ACTIX Basic (Sample CDMA)Documento73 páginasACTIX Basic (Sample CDMA)radhiwibowoAún no hay calificaciones

- Carte EnglezaDocumento112 páginasCarte EnglezageorgianapopaAún no hay calificaciones

- PC Engines APU2 Series System BoardDocumento11 páginasPC Engines APU2 Series System Boardpdy2Aún no hay calificaciones

- Mahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportDocumento5 páginasMahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportRavi LoveAún no hay calificaciones

- Paper 4 Material Management Question BankDocumento3 páginasPaper 4 Material Management Question BankDr. Rakshit Solanki100% (2)

- B.e.eeeDocumento76 páginasB.e.eeeGOPINATH.MAún no hay calificaciones

- Honeywell Rondostat Hr20 SpesificationDocumento2 páginasHoneywell Rondostat Hr20 Spesificationfrox123Aún no hay calificaciones

- Newsela Teacher Review - Common Sense EducationDocumento1 páginaNewsela Teacher Review - Common Sense EducationJessicaAún no hay calificaciones

- Jar Doc 06 Jjarus Sora Executive SummaryDocumento3 páginasJar Doc 06 Jjarus Sora Executive Summaryprasenjitdey786Aún no hay calificaciones

- 3 AcmeCorporation Fullstrategicplan 06052015 PDFDocumento11 páginas3 AcmeCorporation Fullstrategicplan 06052015 PDFDina DawoodAún no hay calificaciones

- Historical Perspective of OBDocumento67 páginasHistorical Perspective of OBabdiweli mohamedAún no hay calificaciones

- EvolutionCombatMedic 2022Documento17 páginasEvolutionCombatMedic 2022smith.kevin1420344100% (1)