Documentos de Académico

Documentos de Profesional

Documentos de Cultura

External Commercial Borrowing by Indian Companies

Cargado por

Rachit SharmaDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

External Commercial Borrowing by Indian Companies

Cargado por

Rachit SharmaCopyright:

Formatos disponibles

Salvus Capital Advisors Pvt. Ltd.

A research report on

EXTERNAL COMMERCIAL BORROWING BY INDIAN COMPANIES

A research report on External Commercial Borrowing by Indian Companies

TABLE OF CONTENTS

Overview ........................................................................................................................................................................................ 3 Regulations.................................................................................................................................................................................... 3 Eligible Borrowers ............................................................................................................................................................... 3 Recognized Lenders ............................................................................................................................................................ 4 Amount and Maturity ......................................................................................................................................................... 4 All-in-cost ceilings ................................................................................................................................................................ 4 End Use ...................................................................................................................................................................................... 5 Procedure ................................................................................................................................................................................. 5 Guarantees ............................................................................................................................................................................... 5 Security ...................................................................................................................................................................................... 5 Parking of ECB proceeds overseas .............................................................................................................................. 6 Prepayment ............................................................................................................................................................................. 6 Refinance of existing ECBs ............................................................................................................................................... 6 Debt servicing ......................................................................................................................................................................... 6 Policy Impact: Tightening in ECB norms .................................................................................................................. 6 Market Analysis .......................................................................................................................................................................... 7 Amount of ECB raised over the previous year on a monthly basis ............................................................. 7 Purpose wise distribution of ECBs raised during March10-February11 .............................................. 7 Modes of raising ECBs ........................................................................................................................................................ 8 Reasons for ECBs attractiveness to ............................................................................................................................ 8 Benefits of ECBs over other sources of funds ........................................................................................................ 8 Investment Scenario................................................................................................................................................................. 8 Major Indian Companies availing ECB facility:- .................................................................................................... 8 Major arrangers for ECBs in India ............................................................................................................................... 9 Recent Major ECB deals ..................................................................................................................................................... 9 Future Outlook ....................................................................................................................................................................... 9 Key issues with ECB policy ................................................................................................................................................... 9

Page 2

A research report on External Commercial Borrowing by Indian Companies

OVERVIEW

Foreign currency borrowings raised by the Indian companies from sources outside India are called External Commercial Borrowings (ECBs). These are commercial loans with minimum average maturity of 3 years. The ECBs include: Bank Loans Buyers Credit Suppliers Credit Securitized instruments (e.g. floating rate notes and fixed rate bonds) Credit from official export credit agencies Commercial borrowings from the private sector window of multilateral financial institutions Investment by Foreign Institutional Investors (FIIs) in dedicated debt funds

ECBs act as an additional source of funds for companies to finance its investment needs. Balance of payment and foreign exchange reserves position are two important drivers to decide the level of ECBs.

REGULATIONS

In India, ECBs can be accessed through automatic and approval route. Major regulators governing the ECBs in India are Exchange Control Department of RBI and ECB Division in Department of Economic Affairs at Ministry of Finance. ECB policy aims at keeping maturities long, costs low and encourages infrastructure and export sector financing so as to ensure overall growth of the economy. ECB policy focuses on three aspects: Eligibility criteria for accessing external markets Total amount of borrowings to be raised and their maturity structure End use of the funds raised

ELIGIBLE BORROWERS AUTOMATIC ROUTE

1. Companies except financial intermediaries 2. Units in Special Economic Zones( SEZ) 3. NGOs engaged in micro finance activities

APPROVAL ROUTE

1. Infrastructure or export finance companies such as IDFC, IL&FS, Power Finance Corporation, IRCON, Power trading corporation and EXIM bank 2. Banks and financial institutions which participated in the textile or steel restructuring package 3. NBFCs to finance import of infrastructure equipment for leasing 4. Multistate Co-operative society engaged in manufacturing activities Page 3

A research report on External Commercial Borrowing by Indian Companies

RECOGNIZED LENDERS

1. Internationally recognized sources such as international banks, international capital markets, and multilateral financial institutions such as IFC, ADB and CDC, export credit agencies, suppliers of equipment, foreign collaborators and foreign equity holders. 2. Overseas organizations and individuals with a certificate of due diligence from overseas bank adhering to host country regulations (applicable only under the automatic route). In case of foreign equity holders,

AUTOMATIC ROUTE

For ECBs up to USD 5 million at least 25 percent to be held directly by the lender For ECBs more than USD 5 million - at least 25 percent to be held directly by the lender and proposed ECB should not exceed four times the direct foreign equity holding

APPROVAL ROUTE

At least 25 percent to be held directly by the lender but proposed ECB exceeds four times the direct foreign equity holding.

AMOUNT AND MATURITY AUTOMATIC ROUTE

Maximum Amount of ECB in a financial year Companies other than those in hotel, hospital and software sectors Companies in services sector viz. hotels, hospitals and software sector NGOs engaged in micro finance activities Minimum Maturity Period ECBs up to USD 20 million ECBs between USD 20 million and USD 500 million 3 years 5 years - USD 500 million - USD 100 million - USD 5 million

APPROVAL ROUTE

Corporate can avail an additional amount of USD 250 million with average maturity of more than 10 years over and above the existing limit of USD 500 million under the automatic route.

ALL-IN-COST CEILINGS

All-in-cost includes rate of interest, other fees and expenses in foreign currency except commitment fee, pre-payment fee, withholding tax payment and fees payable in Indian Rupees. Following are the all-in-cost ceilings:-

Page 4

A research report on External Commercial Borrowing by Indian Companies Average Maturity Period Three to five years More than five years All-in-cost Ceilings over 6 month LIBOR 300 basis points 500 basis points

END USE

Permitted for 1. Investment (such as import of capital goods, new projects, modernization/expansion of existing production units) in industrial sector including SMEs and infrastructure sector. 2. Overseas direct investment in Joint ventures and Wholly owned subsidiaries 3. First stage acquisition of shares in the disinvestment process and in the mandatory second stage offer under the Governments disinvestment programme of PSU shares. 4. NGOs engaged in micro finance activities can utilize the proceeds for a. lending to self-help groups b. micro credit c. bonafide micro finance activity including capacity building Not permitted for 1. On-lending or investment in capital market or acquiring a company 2. Investment in real estate 3. Working capital, general corporate purpose and repayment of existing rupee loan

PROCEDURE AUTOMATIC ROUTE

Borrower enters into a loan agreement with the lender Submits the agreement to RBI for registration

APPROVAL ROUTE

Borrower submits the application through Authorized Dealer (AD) to RBI

GUARANTEES

Issuance of guarantee, standby letter of credit, letter of undertaking or letter of comfort by banks, financial institutions and NBFCs relating to ECB is not permitted.

SECURITY

Choice of security is left to the borrower but in case of creation of charges over immovable assets and financial securities such as shares is subjected to FEMA regulations.

Page 5

A research report on External Commercial Borrowing by Indian Companies

PARKING OF ECB PROCEEDS OVERSEAS

ECB proceeds should be invested overseas until the actual requirement in India. These investments should be liquid in nature so that they can be liquidated as and when required by the borrower. These investments include:1. Deposits or Certificate of Deposit or other products offered by banks rated not less than AA(-) by Standard and Poor/Fitch IBCA or Aa3 by Moodys 2. Deposits with overseas branch of an authorized dealer in India 3. Treasury bills and other monetary instruments of one year maturity having minimum rating as indicated above

PREPAYMENT

Prepayment up to USD 200 million is allowed by ADs without prior approval of RBI but minimum average maturity period needs to be maintained. For prepayment more than USD 200 million, approval from RBI is required.

REFINANCE OF EXISTING ECBS

Refinancing of ECBs is allowed but outstanding maturity of the original loan needs to be maintained.

DEBT SERVICING

Designated Authorized Dealers (ADs) make remittances of installments of principal, interest and other charges.

POLICY IMPACT: TIGHTENING IN ECB NORMS

In case of tightening ECB norms, capital inflows gets controlled which in turn restricts the rupee to appreciate further.

IMPACT ON VARIOUS SECTORS

Positive 1. Banking a. Need for more credit in domestic market 2. IT and BPO a. Rupee depreciation Negative 1. Infrastructure a. Higher borrowing cost in the domestic market

Page 6

A research report on External Commercial Borrowing by Indian Companies

IMPACT ON ECONOMIC VARIABLES

In case of tightening of ECB norms, Total capital flow in the economy will reduce Domestic credit take off will increase Upward pressure on the lending rate Rupee will depreciate vis--vis foreign currency Domestic liquidity especially the short term will reduce

MARKET ANALYSIS

AMOUNT OF ECB RAISED OVER THE PREVIOUS YEAR ON A MONTHLY BASIS

US $ Billions

4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.1 0.3 0.4 0.6 2.7 1.9 1.5 1.9 1.5 0.7 0.7 0.9 1.1 3.1 3.2 4.3

1.1 1.1

1.3 0.8

2009 2010

1.0 0.5 0.0

PURPOSE WISE DISTRIBUTION OF ECBS RAISED DURING MARCH10FEBRUARY11

0.03% 0.06% FCCB Buy-Back Import of Capital Goods Micro Finance Modernisation New Project On-lending to Power Sector Onward/Sub-lending. Others Overseas Acquisition Power Refinancing of old loans Rupee Expenditure Loc.CG Working Capital

22.01% 30.09%

10.18%

10.25% 2.84% 0.39% 7.42% 12.31% 2.26% 2.16% 0.01%

Page 7

A research report on External Commercial Borrowing by Indian Companies

MODES OF RAISING ECBS

ECBs provide a broad range from where funds can be raised. It provides an option to take both simple forms of credit such as suppliers credit to complex forms of credit such as securitization instruments. Some of the well-known and prevalent ways of raising ECBs are as follows: Commercial Bank Loan in form of term loans from foreign banks Buyers Credit Suppliers Credit Securitized instruments such as Syndicated loans Credit from official export credit agencies Commercial borrowing from the private sector window of multilateral financial institutions such as International Finance Corporation, Asian Development Bank etc. Loan from foreign equity holders and corporate with good credit rating Lines of credit from foreign banks and financial institutions Financial Leases Import Loans Investment by FIIs in dedicated debt funds Non-convertible, optionally convertible or partially convertible debentures

REASONS FOR ECBS ATTRACTIVENESS TO LENDER

ECB is for specific period which can be as short as 3 years Interest and borrowed money is repatriable

BORROWER

Large amounts of funds can be raised Easy availability of funds for large reputed borrowers Diversification of lenders base

BENEFITS OF ECBS OVER OTHER SOURCES OF FUNDS

1. Cost of raising ECBs is much lower than that of domestic borrowings (Current Spread is around 300 bps without considering cost of hedging). 2. Global financial market is a much bigger source of credit. 3. Foreign lenders provide far more flexibility in terms of providing security for ECBs.

INVESTMENT SCENARIO

MAJOR INDIAN COMPANIES AVAILING ECB FACILITY:1. Telecom companies such as Idea, Aircel, Tata Teleservices , Vodafone and Sistema Shyam Teleservices 2. Reliance Industries

Page 8

A research report on External Commercial Borrowing by Indian Companies 3. Financing companies in power sector such as Power Finance Corporation, Rural Electrification Corporation 4. Infrastructure companies such as Jai Prakash Associates, IVRCL and Larsen & Toubro

MAJOR ARRANGERS FOR ECBS IN INDIA

1. 2. 3. 4. 5. State Bank of India Punjab National Bank Industrial Development Bank of India Standard Chartered Citibank

RECENT MAJOR ECB DEALS

1. Usha Martin raised USD 125 million for a tenure of 7 years to part finance its expansion plans with State Bank of India as the lead arranger ( January 11 ) 2. Power Finance Corporation raised USD 260 million for a tenure of 6 years for lending purposes to power sector ( February 11) 3. HPCL Mittal Energy Ltd. mopped up USD 100 million for a tenure of 5 years for new project ( February 11)

FUTURE OUTLOOK

We can expect an increase in demand for ECBs amongst the Indian Companies because of the following reasons:1. Plans for Huge Spending on Infrastructure project 2. Domestic interest rates are moving upwards

KEY ISSUES WITH ECB POLICY

1. Domestic loan refinancing by ECBs is not available to companies in sectors such as retail, construction, services etc. a. Similar policy available for companies developing sea ports, airports, roads, bridges and power b. These sectors require cheap source of funding to remain competitive in global markets 2. Use of ECBs for on-lending is not allowed a. Inability of wholly owned subsidiaries(WOSs) and Special Purpose Vehicles (SPVs) to raise cost effective debt due to lack of strong balance sheet b. SPVs and WOSs prevalent in infrastructure sector which are capital intensive 3. Absence of full capital account convertibility and thus a cap on rupee expenditure of ECBs.

Page 9

www.salvuscapital.com Commercial Borrowing by Indian Companies A research report on External

Vishnu Deuskar Managing Director E-mail: vdeuskar@salvuscapital.com

Kamlesh Thakur Director E-mail: kthakur@salvuscapital.com

Rahul Saxena Associate Vice President E-mail: rsaxena@salvuscapital.com

Salvus Capital Advisors Pvt. Ltd. Gool Mansion, 6 Homji Street, Fort, Mumbai 400 001, INDIA Tel: + 91 22 2267 1111/5237 Fax: + 91 22 2266

2011 Salvus Capital Advisors Pvt. Ltd. All rights reserved. Any unauthorized use, duplication, or disclosure is prohibited by law and will result in prosecution.

Page 10

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2101)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Better Writing Right NowDocumento239 páginasBetter Writing Right NowShabab Hyder100% (6)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Little Black Book of Options Secrets AbDocumento12 páginasLittle Black Book of Options Secrets AbRaju.KonduruAún no hay calificaciones

- Alternative Thinking Tail Hedging StrategiesDocumento8 páginasAlternative Thinking Tail Hedging StrategiesSiddhartha Prabakar NadathurAún no hay calificaciones

- Gautam Baid - The Making of A Value Investor-HarperCollins India (2023)Documento260 páginasGautam Baid - The Making of A Value Investor-HarperCollins India (2023)vijaygawdeAún no hay calificaciones

- The Struggling Forex Trader MindsetDocumento70 páginasThe Struggling Forex Trader MindsetMd Sabbir Ali100% (1)

- The Advanced Trend Trade 2.0Documento24 páginasThe Advanced Trend Trade 2.0Eloy CastellanosAún no hay calificaciones

- The M15 Dance Manual PDFDocumento80 páginasThe M15 Dance Manual PDFAlister Mackinnon100% (1)

- Favorite Harvard Business Review ArticlesDocumento4 páginasFavorite Harvard Business Review ArticlesRachit Sharma100% (1)

- A K Ramanujan Three Hundred Ramayanas PDFDocumento16 páginasA K Ramanujan Three Hundred Ramayanas PDFAbhishek Anbazhagan100% (1)

- Cfa Level 1 LOS Command WordsDocumento0 páginasCfa Level 1 LOS Command WordsHummingbird11688Aún no hay calificaciones

- Swaraj - by Arvind Kejriwal - EnglishDocumento74 páginasSwaraj - by Arvind Kejriwal - EnglishGaurav Bansal67% (3)

- Event Planning GuideDocumento38 páginasEvent Planning GuideSedeenaAún no hay calificaciones

- The Deal 2012 IIML ArrowHeadsDocumento17 páginasThe Deal 2012 IIML ArrowHeadsRachit SharmaAún no hay calificaciones

- Chapter 2 - Overview of The Financial SystemDocumento1 páginaChapter 2 - Overview of The Financial Systemjohn brownAún no hay calificaciones

- Tugas Kelompok - Corporate Financial Management.Documento4 páginasTugas Kelompok - Corporate Financial Management.AgusSetiawanAún no hay calificaciones

- Ar QDocumento2 páginasAr QAyaAún no hay calificaciones

- 7 Negligente Torts: Get Ready! 1 Before You Read The Passage, Talk About These QuestionsDocumento3 páginas7 Negligente Torts: Get Ready! 1 Before You Read The Passage, Talk About These QuestionsJohn OliverAún no hay calificaciones

- Chapter 23 Hedging With Financial DerivativesDocumento15 páginasChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)

- Hoàng Phúc Long - 45k15.1Documento5 páginasHoàng Phúc Long - 45k15.1Hoàng Phúc LongAún no hay calificaciones

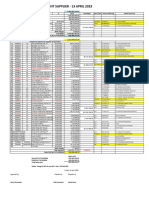

- List Payment Supplier 13 April 2023Documento1 páginaList Payment Supplier 13 April 2023Anggiat Jawarlin SumbayakAún no hay calificaciones

- The Value of Intraday Prices and Volume Using Volatility-Based Trading StrategiesDocumento40 páginasThe Value of Intraday Prices and Volume Using Volatility-Based Trading StrategiesSubrata BhattacherjeeAún no hay calificaciones

- Brokers or TREC HoldersDocumento6 páginasBrokers or TREC HoldersMuhammad SaimAún no hay calificaciones

- 1 Simple InterestDocumento34 páginas1 Simple InterestJeremiah DelgadoAún no hay calificaciones

- Determinants of Capital Structure in TanzaniaDocumento34 páginasDeterminants of Capital Structure in TanzaniaNtogwa Bundala100% (2)

- 56e7 Case1Documento3 páginas56e7 Case1gitmlifeAún no hay calificaciones

- International Review of Financial Analysis: Miwa Nakai, Keiko Yamaguchi, Kenji TakeuchiDocumento9 páginasInternational Review of Financial Analysis: Miwa Nakai, Keiko Yamaguchi, Kenji TakeuchiGhulam NabiAún no hay calificaciones

- IMM (CFTC) Positioning DataDocumento4 páginasIMM (CFTC) Positioning Dataderailedcapitalism.comAún no hay calificaciones

- Prudential Financial: Securities Investment Trust Enterprise (Patricia Tsai)Documento27 páginasPrudential Financial: Securities Investment Trust Enterprise (Patricia Tsai)National Press FoundationAún no hay calificaciones

- How Efficient Is Naive Portfolio Diversification? An Educational NoteDocumento18 páginasHow Efficient Is Naive Portfolio Diversification? An Educational NoteAhsan ZaidiAún no hay calificaciones

- DOW Theory - 6 SecretsDocumento2 páginasDOW Theory - 6 Secretssmksp1Aún no hay calificaciones

- LWS Lite Guide V 2.0Documento17 páginasLWS Lite Guide V 2.0Chulbul PandeyAún no hay calificaciones

- Deepak Gupta ResumeDocumento2 páginasDeepak Gupta ResumescsaAún no hay calificaciones

- Maharaja Surajmal Institution: Minor Project ReportDocumento52 páginasMaharaja Surajmal Institution: Minor Project ReportRaviAún no hay calificaciones

- Stock MarketDocumento21 páginasStock MarketAvinash SharmaAún no hay calificaciones

- Stock Market Report 04122010Documento2 páginasStock Market Report 04122010kaushaljiAún no hay calificaciones

- ING Market Shield: New Product Training Sales TrainingDocumento23 páginasING Market Shield: New Product Training Sales TrainingAnumesh KariappaAún no hay calificaciones

- International Monetary Economics PDFDocumento4 páginasInternational Monetary Economics PDFacm401ptsAún no hay calificaciones