Documentos de Académico

Documentos de Profesional

Documentos de Cultura

WACC

Cargado por

abhikothari30Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

WACC

Cargado por

abhikothari30Copyright:

Formatos disponibles

COST OF CAPITAL UPDATE

What the Best Companies Do

November 17th, 2008

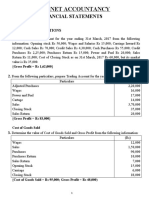

To size the impact of higher credit spreads, we conducted a cost of capital analysis for the S&P 500 which revealed the To size the impact of higher credit spreads, we conducted a cost of capital analysis for the S&P 500 which revealed the following: following: (1) The Weighted Average Cost of Capital has risen for the typical company to between 9% and 12%. (1) The Weighted Average Cost of Capital has risen for the typical company to between 9% and 12%. (2) Approximately a 75% debt-equity ratio is correlated with the lowest cost of capital (across all ratings). (2) Approximately a 75% debt-equity ratio is correlated with the lowest cost of capital (across all ratings). Cost of Capital by Credit Rating, 2006-2008 Median WACC, S&P 500

14.0% 12.0% 10.0% WAC C Q 3 2006 8.0% 6.0% 4.0% 2.0% 0.0% AAA AA A BBB BB B WACC Q 3 2007 8.0% 9.0% WACC Q 3 2008 10.0% 11.0%

Cost of Capital by Debt Ratio, 2008 Median WACC, S&P 500

BB or B: 8.9% A: 8.8% BBB: 8.6%

7.0%

6.0%

AA: 5.5%

5.0% 0.20 0.30 0.50 0.75 2.00 3.00

Credit Rating

Debt/Equity Ratio

*WACC values for 2008 are based on data from Bloomberg. WACC values for 2006-2007 are calculated by the Corporate Executive Board based on data from Standard *WACC values for 2008 are based on data from Bloomberg. WACC values for 2006-2007 are calculated by the Corporate Executive Board based on data from Standard and Poors Compustat. Please refer to the next page for more details. and Poors Compustat. Please refer to the next page for more details.

2008 Corporate Executive Board. All Rights Reserved.

COST OF CAPITAL UPDATE

What the Best Companies Do

November 17th, 2008

Note on Methodology Note on Methodology

2008 WACC this value is calculated by Bloomberg with the following formula: 2008 WACC this value is calculated by Bloomberg with the following formula: WACC = (Cost of Equity * Weight of Equity) + (After Tax Cost of Debt * Weight of Debt) + (Cost of Preferred WACC = (Cost of Equity * Weight of Equity) + (After Tax Cost of Debt * Weight of Debt) + (Cost of Preferred Equity * Weight of Preferred Equity), where Equity * Weight of Preferred Equity), where Cost of Equity = Risk Free Rate + Equity Risk Premium Cost of Equity = Risk Free Rate + Equity Risk Premium Bloombergs calculation of the Cost of Debt is based on a Bloomberg Fair Market Sector Curve (FMC) for the Bloombergs calculation of the Cost of Debt is based on a Bloomberg Fair Market Sector Curve (FMC) for the firm: firm: Cost of Debt = ((Short Term Debt * Pre-Tax Cost of Short Term Debt + Long Term Debt * Pre-Tax Cost of Long Cost of Debt = ((Short Term Debt * Pre-Tax Cost of Short Term Debt + Long Term Debt * Pre-Tax Cost of Long Term Debt) / Total Debt))*(1-Tax Rate). Term Debt) / Total Debt))*(1-Tax Rate). If the appropriate FMC curve is not available (or in rare cases when there is a negative Pre-Tax Cost of Short Term If the appropriate FMC curve is not available (or in rare cases when there is a negative Pre-Tax Cost of Short Term Debt or Long Term Debt), Bloomberg uses a rough approximation of pre-tax cost of debt. Debt or Long Term Debt), Bloomberg uses a rough approximation of pre-tax cost of debt. Bloomberg calculates the weights by dividing debt and equity by total capital (common equity, preferred equity, Bloomberg calculates the weights by dividing debt and equity by total capital (common equity, preferred equity, long-term debt, and short-term debt). long-term debt, and short-term debt). 2006-2007 WACC these values are calculated by the Corporate Executive Board using Standard and Poors 2006-2007 WACC these values are calculated by the Corporate Executive Board using Standard and Poors Compustat data with the following formula: Compustat data with the following formula: WACC = (Cost of Equity * Weight of Equity) + (After Tax Cost of Debt * Weight of Debt), where WACC = (Cost of Equity * Weight of Equity) + (After Tax Cost of Debt * Weight of Debt), where Cost of Equity = Risk Free Rate + *Equity Risk Premium Cost of Equity = Risk Free Rate + *Equity Risk Premium Cost of Debt = Pre-Tax cost of Debt. Cost of Debt = Pre-Tax cost of Debt.

2008 Corporate Executive Board. All Rights Reserved.

COST OF CAPITAL UPDATE

What the Best Companies Do

November 17th, 2008

Corporate Finance Division

Quantitative Research Team

Bob Sanders Senior Analyst Jian Chen Project Manager Oleg Polishchuk Project Manager Michael Griffin Managing Director Scott Bohannon General Manager

Professional Services Note

The Quantitative Research Team has worked to ensure the accuracy of the information it provides to the Corporate Executive Board members. This project relies upon data obtained from many sources, however, and the Quantitative Research Team cannot guarantee the accuracy of the information or its analysis in all cases. Furthermore, the Quantitative Research Team is not engaged in rendering legal, accounting, or other professional services. Its projects should not be construed as professional advice on any particular set of facts or circumstances. Members requiring such services are advised to consult an appropriate professional. Neither Corporate Executive Board nor its programs are responsible for any claims or losses that may arise from any errors or omissions in their reports, whether caused by Corporate Executive Board or its sources.

2008 Corporate Executive Board. All Rights Reserved.

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Globalization Market 2013Documento14 páginasGlobalization Market 2013abhikothari30Aún no hay calificaciones

- 4 EpistaxisDocumento51 páginas4 Epistaxisabhikothari30Aún no hay calificaciones

- Solution Workings - AdamzDocumento5 páginasSolution Workings - Adamzabhikothari30Aún no hay calificaciones

- Solution Workings - AdamzDocumento5 páginasSolution Workings - Adamzabhikothari30Aún no hay calificaciones

- Solution Workings - AdamzDocumento5 páginasSolution Workings - Adamzabhikothari30Aún no hay calificaciones

- DecisionTreePrimer 4Documento14 páginasDecisionTreePrimer 4Andrew Drummond-Murray100% (1)

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocumento66 páginasAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- DecisionTreePrimer 4Documento14 páginasDecisionTreePrimer 4Andrew Drummond-Murray100% (1)

- Wickler Case CompetitionDocumento28 páginasWickler Case Competitionlkja132Aún no hay calificaciones

- Airthread WorksheetDocumento21 páginasAirthread Worksheetabhikothari3085% (13)

- Airthread WorksheetDocumento21 páginasAirthread Worksheetabhikothari3085% (13)

- Airthread WorksheetDocumento21 páginasAirthread Worksheetabhikothari3085% (13)

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocumento66 páginasAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Wickler Case CompetitionDocumento28 páginasWickler Case Competitionlkja132Aún no hay calificaciones

- DecisionTreePrimer 4Documento14 páginasDecisionTreePrimer 4Andrew Drummond-Murray100% (1)

- Solution Workings - AdamzDocumento5 páginasSolution Workings - Adamzabhikothari30Aún no hay calificaciones

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocumento66 páginasAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Airthread WorksheetDocumento21 páginasAirthread Worksheetabhikothari3085% (13)

- Wickler Case CompetitionDocumento28 páginasWickler Case Competitionlkja132Aún no hay calificaciones

- ICD Brochure PDFDocumento5 páginasICD Brochure PDFabhikothari30Aún no hay calificaciones

- Violations Timeline in 2g Spectrum Scam PDFDocumento8 páginasViolations Timeline in 2g Spectrum Scam PDFabhikothari30Aún no hay calificaciones

- Guidline PDFDocumento86 páginasGuidline PDFabhikothari30Aún no hay calificaciones

- Shuttle Bus ScheduleDocumento1 páginaShuttle Bus ScheduleGokul ManiAún no hay calificaciones

- HIPAA ICD Flyer PDFDocumento2 páginasHIPAA ICD Flyer PDFabhikothari30Aún no hay calificaciones

- Case Direct Cash Transfers Poor PDFDocumento7 páginasCase Direct Cash Transfers Poor PDFabhikothari30Aún no hay calificaciones

- Direct Cash Transfer Will Save Rs 33,000 CroreDocumento2 páginasDirect Cash Transfer Will Save Rs 33,000 Croreabhikothari30Aún no hay calificaciones

- HTTP WWW - Sandeepbamzais.blogspot PDFDocumento17 páginasHTTP WWW - Sandeepbamzais.blogspot PDFabhikothari30Aún no hay calificaciones

- 101 Shortcuts in Math Anyone Can DoDocumento95 páginas101 Shortcuts in Math Anyone Can DoNaveed 205100% (3)

- Kelkar Committee ReportDocumento38 páginasKelkar Committee ReportAjay EadakeAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 10Documento24 páginasFinancial Statement Analysis - Concept Questions and Solutions - Chapter 10sakibba80% (5)

- Ca Q&a Dec 2018 PDFDocumento392 páginasCa Q&a Dec 2018 PDFBruce GomaAún no hay calificaciones

- Absorption Vs VariableDocumento10 páginasAbsorption Vs VariableRonie Macasabuang CardosaAún no hay calificaciones

- Balance Sheet TermsDocumento5 páginasBalance Sheet TermsEnglishwithfunAún no hay calificaciones

- Analysis of Financial Statements of IndusInd BankDocumento19 páginasAnalysis of Financial Statements of IndusInd Bankcharu kapoorAún no hay calificaciones

- Fadia Faradiba - 4AF - 061830500955 MYOB CV MAJU LANCARDocumento2 páginasFadia Faradiba - 4AF - 061830500955 MYOB CV MAJU LANCARbagasAún no hay calificaciones

- Past MA Exams by Lecture Topic - Solutions PDFDocumento59 páginasPast MA Exams by Lecture Topic - Solutions PDFbooks_sumiAún no hay calificaciones

- WUHAN Corp Shareholders Equity Transactions 2010Documento2 páginasWUHAN Corp Shareholders Equity Transactions 2010Rosalie Colarte LangbayAún no hay calificaciones

- Non-Current Assets Held For Sale Discontinued OperationsDocumento32 páginasNon-Current Assets Held For Sale Discontinued Operationsnot funny didn't laughAún no hay calificaciones

- GC University M.Com Corporate Finance AssignmentDocumento4 páginasGC University M.Com Corporate Finance AssignmentKashif KhurshidAún no hay calificaciones

- Hampton Machine Tool CoDocumento13 páginasHampton Machine Tool CoArdi del Rosario100% (12)

- Chapter 09 Indirect and Mutual HoldingsDocumento12 páginasChapter 09 Indirect and Mutual HoldingsNicolas ErnestoAún no hay calificaciones

- Financial Reporting Conceptual FrameworkDocumento15 páginasFinancial Reporting Conceptual FrameworkMarielle Mae BurbosAún no hay calificaciones

- Chapter 2 Discussion Questions Rev 0Documento6 páginasChapter 2 Discussion Questions Rev 0Hayley SAún no hay calificaciones

- IAS 7 - Statement of Cash FlowsDocumento3 páginasIAS 7 - Statement of Cash FlowsCaia VelazquezAún no hay calificaciones

- Test Bank For Fundamental Financial Accounting Concepts 10th by EdmondsDocumento53 páginasTest Bank For Fundamental Financial Accounting Concepts 10th by Edmondschompbowsawpagb8Aún no hay calificaciones

- 1988 Valuation of Coca-ColaDocumento39 páginas1988 Valuation of Coca-ColaDhananjaya Hathurusinghe100% (1)

- Upwork FinancialDocumento19 páginasUpwork FinancialVvb SatyanarayanaAún no hay calificaciones

- Guas Inc A Major Retailer of Bicycles and Accessories Operates PDFDocumento3 páginasGuas Inc A Major Retailer of Bicycles and Accessories Operates PDFTaimur TechnologistAún no hay calificaciones

- Fundamentals of Financial Accounting 4th Edition Phillips Solutions ManualDocumento43 páginasFundamentals of Financial Accounting 4th Edition Phillips Solutions ManualGregoryGreenjptqd100% (14)

- Practical Questions (Sandeep Garg 2018-19)Documento10 páginasPractical Questions (Sandeep Garg 2018-19)Kanishk SinglaAún no hay calificaciones

- Intacc (Non Current Assets Held For Sale-Changes On Equity) Reviewer.Documento22 páginasIntacc (Non Current Assets Held For Sale-Changes On Equity) Reviewer.Roselynne GatbontonAún no hay calificaciones

- Dangote Cement's financial charges and tax cut into profit as sales revenue grows slowlyDocumento16 páginasDangote Cement's financial charges and tax cut into profit as sales revenue grows slowlygregAún no hay calificaciones

- Fabm Group 4. Closing EntriesDocumento11 páginasFabm Group 4. Closing Entriesjoel phillip GranadaAún no hay calificaciones

- Financial Management AssignmentDocumento16 páginasFinancial Management AssignmentNishant goyalAún no hay calificaciones

- Fa Far Sesi 2Documento28 páginasFa Far Sesi 2hdyhAún no hay calificaciones

- Q.1. (E) Comparison ChartDocumento19 páginasQ.1. (E) Comparison Chartshiv mehraAún no hay calificaciones

- Nike, Inc. - Cost of CapitalDocumento9 páginasNike, Inc. - Cost of CapitalPutriAún no hay calificaciones

- Greenergy Holdings Incorporated - SEC Form 17-Q - 17 May 2021Documento66 páginasGreenergy Holdings Incorporated - SEC Form 17-Q - 17 May 2021John AzellebAún no hay calificaciones

- Econ F315 1923 CM 2017 1Documento3 páginasEcon F315 1923 CM 2017 1Abhishek GhoshAún no hay calificaciones