Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Assignment 425

Cargado por

Onickul HaqueDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Assignment 425

Cargado por

Onickul HaqueCopyright:

Formatos disponibles

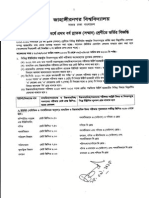

East West University Department of Business Administration Spring 2011 FIN 425 (Investment Analysis and Management) Assignment

Topic: Characteristics of IPO Prospectus Information and Its Relation to Subsequent Price in Secondary Market

1. Each group shall consist of 3-6 Members. 2. Each Group will Work on with Particular Year IPOs to collect the following data and

then arrange it in Excel before working with SPSS. Information available on

http://www.secbd.org/prospectus.html and DSE library.

measures of central tendency.

3. Calculate the characteristics of the financial and operating, offer variables like basic

4. Use small sample t-test, paired sample test, independent sample t-test to gain more insight about the characteristics and proving or disproving hypothesis about the sample companies financial, operating and offer variable characteristics.

5. Develop multiple regressions to understand the impact of these variables on holding

period return for seven different model i.e. model 1 is for the first day HPR, model 2 is for 2nd days HPR etc. 6. Group leader must ensure that everyone participates in the assignment and contributes equitably. 7. Use the SPSS guideline text available in the library as well as statistics books use for STA-217 to complete the assignment.

8. Contact the teaching assistant of STA-217 if you require any help. 9. Submission Date: 1st class of Last week class.

10. Group leaders must resolve any problem that has the chance of being used as an excuse for late submission. No late submission is acceptable and will earn Zero marks.

Data to be collected from the prospectus

Financial and Operational variables: Age of the Company: How many years the company has been incorporated as private or public limited company and operating the business in Bangladesh. Accounts closing date: Account closing date is the companys most recent operational year before going to the IPO. Total Assets: Total asset is the total amount of the companys tangible assets as per balance sheet stated in the prospectus on the account closing date. Total Revenue: Total revenue is the total amount that has been generated through sales or service during the most recent operational year considered in the prospectus.

Net Profit Margin (NPM): NPM is the ratio of Net profit and Total revenue of the company for the most recent operational year before IPO issue. NPM = (Net Profit/Total Revenue) Gross Profit Margin (GPV): GPM is the ratio between Gross profit and Total Revenue. Gross profit is calculated by deducting Cost of Goods Sold (COGS) from total revenue. GPM is calculated by dividing Gross profit by total revenue. GPM = {(Total revenue-COGS)/Total revenue} Return on Assets (ROA): ROA is the ratio between Net profit and total asset. ROA= (Net profit after tax/Total asset) Return on Equity (ROE): ROE is the ratio between n the portion of net profit available to the stock holders and total equity of the stock holders. ROE = (Net profit available to share holder/Total share holders equity) Debt/Equity Ratio: Debt Equity Ratio is the ratio between total debt and total share holders equity of the company. Debt equity ratio = (total debt/total equity) Sales/TA: It is a ratio between total sales and total asset of the company and expressed as a percentage of total asset. It is calculated by dividing total sales by total asset. R&D/TA: It is the ratio between total Research and Development Expenditure and total asset. It is expressed as a percentage of the total asset. R&D/TA= (Total Research and development Expenditure/ Total Asset) Operating Income before Depreciation/TA: It is calculated dividing the operating income after depreciation is added by total asset. It is expressed as the percentage of the total asset. Operating Income before Depreciation/TA= {(Operating Income + Depreciation) / Total Asset} Current Ratio: Current Ratio = Current Asset / Current Liabilities Existing EPS: EPS stands for Earning per Share. Existing EPS is the EPS of the most recent operational year. EPS = (Net Income available to common stock holders / Numbers of common stock holder outstanding) Net Assets Value per share (NAV per share): NAV per share = (Total asset Total Liabilities) / Total No. of shares P/E ratio (Against Offered Price): P/E ratio: (Offer Price per share / EPS) Credit Ratings: It indicates the credit worthiness of the company to the investor conducted by a professional credit rating farm. Historical Dividend: Historical dividend is the most recent years dividend before IPO issued. It is expressed as a percentage of the face value of a share. Projected Dividend: Projected dividend is the proposed dividend which will be distributed after IPO issue. It is expressed as a percentage of the face value of a share. Executive Compensation: Executive compensation is the amount that is paid to the directors as fees and to the employees as salary. It is expressed as a total amount. Offering Variables: Offer size (Shares): Offer size is total number of shares is being offered by the company in IPO. Offer price: Offer price is the per share price of the offerings including or excluding premium or discount respectively.

No. of Risk factors listed in Prospectus: It is the total number of risk factor those are stated IPO prospectus considered as risks for the companys operation. Ratio of Offer size/TA: It is the ratio between offer size in amount and total asset and expressed as percentage of total asset. It is calculated by dividing totals offer size in amount by total asset. Ratio of offer size/TA = (Total offer size in amount / Total Asset) No. of days to finish total subscription: It states how many days it takes to complete total subscription. Basically it indicates that the subscription was opened for how many days to the public. Degree of under pricing: It states the percentage of underpaying of per share is done by the company while pricing the share. Degree of under pricing = {(Opening price for 1st day Offer price) / Offer Price}*100 Underwriting variables (Independent Variables): Underwriters spread (%): it indicates how much of the total offering amount is secured by underwriters. In Bangladesh, the spread is 0.50% which is a requirement as per Securities and Exchange Commission (SEC). But please contact to the company of other websites to get an idea about the correct spread. Subscription ratio: It is a ratio of total offer size in amount and total amount of subscription application. It is calculated by dividing the total offer amount by total amount of subscription application. Subscription ratio = (total offer amount / total amount of subscription application). Other Variables: Holding Period Return for Day1: HPR2 = (Closing price for day1 Issue price of the stock) / Issue price of the stock Holding Period Return for Day2: HPR2 = (Closing price for day2 Closing price for day 1) / Closing price for days 1 Holding Period Return for Day3: HPR3 = (Closing price for day3 Closing price for day 2) / Closing price for days 2 Holding Period Return for Day4: HPR4 = (Closing price for day4 Closing price for day 3) / Closing price for days 3 Holding Period Return for Day5: HPR5 = (Closing price for day5 Closing price for day 4) / Closing price for days 4 Holding Period Return for Day6: HPR6 = (Closing price for day6 Closing price for day 5) / Closing price for days 5 Holding Period Return for Day7: HPR7 = (Closing price for day7 Closing price for day 6) / Closing price for days 6 HPR for 7 Days: HPR2 = (Closing price for day7 Closing price for day 1) / Closing price for days 1

También podría gustarte

- Trining DesignDocumento1 páginaTrining DesignOnickul HaqueAún no hay calificaciones

- HR Practices in BangladehDocumento14 páginasHR Practices in BangladehOnickul HaqueAún no hay calificaciones

- 5.rahim AfrozDocumento16 páginas5.rahim AfrozOnickul HaqueAún no hay calificaciones

- ch-4 CuttingDocumento11 páginasch-4 CuttingOnickul HaqueAún no hay calificaciones

- CIMA Code of Ethics2 PDFDocumento58 páginasCIMA Code of Ethics2 PDFOnickul HaqueAún no hay calificaciones

- Best Practices Invest in HR Daily Star 2.2.14Documento4 páginasBest Practices Invest in HR Daily Star 2.2.14Onickul HaqueAún no hay calificaciones

- Chapter 2. CuttingDocumento16 páginasChapter 2. CuttingOnickul HaqueAún no hay calificaciones

- Chapter 2 - Business Environment: Aims of The ChapterDocumento16 páginasChapter 2 - Business Environment: Aims of The Chaptervicky_n007Aún no hay calificaciones

- Chap 001Documento31 páginasChap 001faran09Aún no hay calificaciones

- Chap 001Documento31 páginasChap 001faran09Aún no hay calificaciones

- EconomicsDocumento8 páginasEconomicsOnickul HaqueAún no hay calificaciones

- CHAPT4-Demonstrating Ethical BehaviorDocumento34 páginasCHAPT4-Demonstrating Ethical BehaviorOnickul HaqueAún no hay calificaciones

- The Interview ADocumento7 páginasThe Interview AOnickul HaqueAún no hay calificaciones

- StandardsDocumento2 páginasStandardsOnickul HaqueAún no hay calificaciones

- Chap - 3 CuttDocumento16 páginasChap - 3 CuttOnickul HaqueAún no hay calificaciones

- Cost Sheet Fall 15Documento3 páginasCost Sheet Fall 15Onickul HaqueAún no hay calificaciones

- The IMA Code of Conduct For Management Accountants: Appendix BDocumento3 páginasThe IMA Code of Conduct For Management Accountants: Appendix BOnickul HaqueAún no hay calificaciones

- Marketing PhilosophiesDocumento3 páginasMarketing PhilosophiesOnickul Haque100% (3)

- BRAC Bank HR Business Partner RoleDocumento1 páginaBRAC Bank HR Business Partner RoleOnickul HaqueAún no hay calificaciones

- Ceramic Industry of Bangladesh A PerspectiveDocumento18 páginasCeramic Industry of Bangladesh A PerspectiveMoinuddin AhmedAún no hay calificaciones

- Preparing for Freshers' Written Exams and InterviewsDocumento7 páginasPreparing for Freshers' Written Exams and InterviewsOnickul HaqueAún no hay calificaciones

- 2886 11351 1 PB - PDF Ogbo DiversityDocumento6 páginas2886 11351 1 PB - PDF Ogbo DiversityOnickul HaqueAún no hay calificaciones

- Organizational Development OfficerDocumento1 páginaOrganizational Development OfficerOnickul HaqueAún no hay calificaciones

- Explain Financial AccountingDocumento3 páginasExplain Financial AccountingSimeesh MathewAún no hay calificaciones

- Name Telephone Fax E-Mail ChairmanDocumento1 páginaName Telephone Fax E-Mail ChairmanOnickul HaqueAún no hay calificaciones

- Bangladeshi Students COVID-19 Vaccination ScheduleDocumento1 páginaBangladeshi Students COVID-19 Vaccination ScheduleOnickul HaqueAún no hay calificaciones

- InterDocumento15 páginasInterOnickul HaqueAún no hay calificaciones

- 15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?Documento8 páginas15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?johnlemAún no hay calificaciones

- .Part-I Busincess Mathemtics June 2013Documento6 páginas.Part-I Busincess Mathemtics June 2013Onickul HaqueAún no hay calificaciones

- 02 Business ObjectivesDocumento18 páginas02 Business ObjectivesOnickul HaqueAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Unit 5-DividendDocumento35 páginasUnit 5-DividendFarshan SulaimanAún no hay calificaciones

- Research Paper On Cash Flow StatementDocumento8 páginasResearch Paper On Cash Flow Statementgz9fk0td100% (1)

- Basic Accounting PrinciplesDocumento2 páginasBasic Accounting Principlesaashir chAún no hay calificaciones

- Up Chapter 6-7 (1) - 2 (Compatibility Mode)Documento39 páginasUp Chapter 6-7 (1) - 2 (Compatibility Mode)EftaAún no hay calificaciones

- Bafb1023 Microeconomics (Open Book Test)Documento4 páginasBafb1023 Microeconomics (Open Book Test)Hareen JuniorAún no hay calificaciones

- Group 1 Fitters Diversified Berhad BA 242 4BDocumento42 páginasGroup 1 Fitters Diversified Berhad BA 242 4BMohd Harith100% (1)

- Recerse DCF Calculation Yellow Manual InputDocumento6 páginasRecerse DCF Calculation Yellow Manual InputErvin Khouw100% (1)

- Quiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3Documento3 páginasQuiz 2 - Finals - Cash Flow Statement-Intermediate Accounting 3kanroji1923Aún no hay calificaciones

- 1 - 1st September 2007 (010907)Documento4 páginas1 - 1st September 2007 (010907)Chaanakya_cuimAún no hay calificaciones

- Bu040815 PDFDocumento86 páginasBu040815 PDFNikita JoshiAún no hay calificaciones

- Group 13 (Candlestick)Documento17 páginasGroup 13 (Candlestick)Ruchika SinghAún no hay calificaciones

- Enhancing The BIS Government Bond StatisticsDocumento10 páginasEnhancing The BIS Government Bond StatisticsJi_yAún no hay calificaciones

- Absa and KCB RatiosDocumento8 páginasAbsa and KCB RatiosAmos MutendeAún no hay calificaciones

- Practice of Forecasting Financial FailureDocumento11 páginasPractice of Forecasting Financial FailureZarish AzharAún no hay calificaciones

- Barbeque-Nation Hospitality Limited: Contracts and Documents For Inspection" On Page 639Documento660 páginasBarbeque-Nation Hospitality Limited: Contracts and Documents For Inspection" On Page 639srivardhan Kaushik AstakalaAún no hay calificaciones

- Financial Accounting and Reporting Statement of Comprehensive IncomeDocumento3 páginasFinancial Accounting and Reporting Statement of Comprehensive IncomeSean H2OAún no hay calificaciones

- Aviation Finance More To The LRF Than Meets The Eye 120718Documento5 páginasAviation Finance More To The LRF Than Meets The Eye 120718a_sharafiehAún no hay calificaciones

- Subprime Mortgage Crisis ExplainedDocumento29 páginasSubprime Mortgage Crisis ExplainedAdeel RanaAún no hay calificaciones

- Ec 1745 Problem Set 4Documento3 páginasEc 1745 Problem Set 4tarun singhAún no hay calificaciones

- Insights into trading major currency pairsDocumento46 páginasInsights into trading major currency pairsaiaiyayaAún no hay calificaciones

- Wonderla Holidays Limited: ICICI Securities Limited Karvy Computershare Private LimitedDocumento434 páginasWonderla Holidays Limited: ICICI Securities Limited Karvy Computershare Private LimitedGaxajeAún no hay calificaciones

- CGT - Slides - Part 1Documento26 páginasCGT - Slides - Part 1AceAún no hay calificaciones

- AML - KYC Compliance Officer CertificationDocumento0 páginasAML - KYC Compliance Officer CertificationVskills Certification0% (1)

- Inflation Linked Bonds - 9-15 PDFDocumento27 páginasInflation Linked Bonds - 9-15 PDFClutch Derivative100% (1)

- Average Down StrategyDocumento11 páginasAverage Down StrategyThines KumarAún no hay calificaciones

- Broker Confirmation LetterDocumento2 páginasBroker Confirmation LetterRocketLawyerAún no hay calificaciones

- AFAR Theories Reviewer For CPALEDocumento25 páginasAFAR Theories Reviewer For CPALEColeen CunananAún no hay calificaciones

- Arbitrage Pricing Theory ExplainedDocumento8 páginasArbitrage Pricing Theory Explainedsush_bhatAún no hay calificaciones

- Ross FCF 11ce Ch19Documento24 páginasRoss FCF 11ce Ch19jessedillon234567Aún no hay calificaciones

- References and Bibliography: Journal, OctoberDocumento3 páginasReferences and Bibliography: Journal, OctoberSatyajit MohantyAún no hay calificaciones