Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Dalrymple On Depardieu Tax Exile

Cargado por

bluebabboon9823Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Dalrymple On Depardieu Tax Exile

Cargado por

bluebabboon9823Copyright:

Formatos disponibles

That holiday home in France just got costlier - Telegraph

10/07/12 09:34

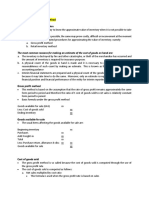

That holiday home in France just got costlier

Proposed higher taxes on second homes in France wont keep the average Briton away

La belle vie: most Britons buy a place in France to escape their countrymen Photo: Alamy

By Anthony Daniels

7:30AM BST 06 Jul 2012

Here in my French fastness, where the wild boar are even more destructive to the garden than the drunks who scream and shout on Friday nights outside my English home, I received the news of Franois Hollandes proposed taxes on foreign-owned second houses with what the French call flegme. I dont rent it out, didnt buy it as a speculation, and dont intend to sell it, so taxes on rental income and capital gains will not affect me. Besides, a reduction in the size of an anticipated profit is not quite the same thing as a loss. But I am more fortunately placed than many who are not in a position to keep their sangfroid in the face of Mr Hollandes announcement. My house is as we all imagine one in rural France to be: isolated and peaceful, a clear stream babbling through its large garden, the cicadas singing and the bees busy with the lavender. Alas, the peaches are now finished, as are the cherries and wild strawberries, but the apricots and apples are still ripening.

http://www.telegraph.co.uk/news/worldnews/europe/france/9378612/That-holiday-home-in-France-just-got-costlier.html

Page 1 sur 3

That holiday home in France just got costlier - Telegraph

10/07/12 09:34

Mr Hollandes proposals regarding such properties are entirely consistent with his programme, which is to decrease the French budget deficit without reducing the number of his core constituents, the public sector workers. His political calculation is sound, since 75 per cent of French students would like to be civil servants. And on his own admission he does not like the rich, presumably as defined in the normal way by haters of the rich; that is to say, those with more money than they. The President is no believer in the Laffer curve, according to which, after a certain level, revenues decline as taxes increase. He takes a more citrus fruit view of the matter: you squeeze the lemon until the pips squeak. This is good politics: demagogic taxes on the rich are always popular in countries where most people hope to get more out of the state than they put into it. It is like running a lottery with compulsory contributions in which 55 or 60 per cent of the ticket holders are winners. Such a lottery will always be popular. Most British people come to France, however, not to avoid taxes, but to avoid their fellow countrymen, especially the younger ones. In France, even the most uncouth people address you as monsieur, not mate. The burglar who broke into my mother-in-laws flat in Paris, not expecting her to be there, withdrew with a courteous Excusez-moi, madame. An English burglar would have bound and gagged her. So while we may think that the French political economy is rather primitive, with its constant appeal to envy and other low emotions, French society somehow manages to be more civilised than our own. This is an interesting paradox. It helps, of course, that the social problems in France are relegated to the suburbs and cits, where they may safely be ignored until the next riots. In Britain, by contrast, you cant escape social problems, even when you just pop out for a pint of milk. So I doubt that there will be a mass exodus of British from France. If its low taxes youre after, France is not your destination; and, after all, there is more to life than only 19 per cent capital gains tax, however outrageous you consider any such tax. It must also be said that the attitude of the British government, which may now be expected to huff and puff a little on behalf of its oppressed citizens in France, to the question of taxation has not been consistent. Indeed, it might be taken as a perfect illustration of that American Indian insight, White man, he speak with forked tongue. For while Mr Osborne was excoriating rich Britons for devising schemes by which to avoid their taxes, Mr Cameron was laying out the red carpet for rich Frenchmen who wanted to avoid Mr Hollandes taxes. Thus Mr Osborne thinks he has found the level of taxation that it is morally obligatory to pay, while Mr Cameron thinks he has found the level of taxation that it is morally permissible to avoid, between them having solved one of the greatest questions of political

http://www.telegraph.co.uk/news/worldnews/europe/france/9378612/That-holiday-home-in-France-just-got-costlier.html Page 2 sur 3

That holiday home in France just got costlier - Telegraph

10/07/12 09:34

philosophy. How hard will Mr Hollande squeeze us poor foreign owners of second homes in his country? It depends, I suppose, on whether revenue or demagoguery is the more needful for him: now the former, now the latter. But I am glad to say that I have an escape other than selling my house or stumping up: I can become tax-resident in France. As a journalist I would be entitled to a special, highly favourable tax regime, which is by far the best perhaps the only way of keeping journalists in order in a free country.

Copyright of Telegraph Media Group Limited 2012

http://www.telegraph.co.uk/news/worldnews/europe/france/9378612/That-holiday-home-in-France-just-got-costlier.html

Page 3 sur 3

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Frank Ochoa - Secrets of Pivot Boss 1Documento196 páginasFrank Ochoa - Secrets of Pivot Boss 1Zorif Demha100% (5)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Ail Setup AdxDocumento5 páginasAil Setup Adxharish20050% (1)

- Gold and Silver Club EbookDocumento22 páginasGold and Silver Club Ebookmfaisalidreis100% (1)

- Business Plan Foe Beauty ParlourDocumento14 páginasBusiness Plan Foe Beauty ParlourŠúDéb Dáš100% (2)

- Service MarketingDocumento36 páginasService MarketingDhara SharmaAún no hay calificaciones

- KFC CompleteDocumento18 páginasKFC CompleteMuhammad Asif AyazAún no hay calificaciones

- Survey QuestionnaireDocumento2 páginasSurvey QuestionnaireCarla Pabuaya100% (2)

- ECO1003 Microeconomics Case Study QuestionsDocumento7 páginasECO1003 Microeconomics Case Study Questionsnouman faraz khan100% (1)

- Kinds of WarrantyDocumento10 páginasKinds of WarrantyJodie Ann PajacAún no hay calificaciones

- Report 1Documento112 páginasReport 1Amrit IyerAún no hay calificaciones

- Business Information System - AIRLINE SYSTEMDocumento17 páginasBusiness Information System - AIRLINE SYSTEMFirdaus RosnanAún no hay calificaciones

- Estimate Inventory Value Using Gross Profit MethodDocumento2 páginasEstimate Inventory Value Using Gross Profit MethodJoanne Rheena BooAún no hay calificaciones

- 10 - Chapter 5 PDFDocumento20 páginas10 - Chapter 5 PDFMuthupandi NadarAún no hay calificaciones

- Hotels Sector Analysis Report: SupplyDocumento7 páginasHotels Sector Analysis Report: SupplyArun AhirwarAún no hay calificaciones

- Optimize capital structure and maximize ROEDocumento13 páginasOptimize capital structure and maximize ROESneha Dwivedi100% (1)

- Quiz ReceivablesDocumento9 páginasQuiz ReceivablesJanella PatriziaAún no hay calificaciones

- Corporation Accounting - Treasury SharesDocumento4 páginasCorporation Accounting - Treasury SharesGuadaMichelleGripalAún no hay calificaciones

- Study Material Economics 2009Documento90 páginasStudy Material Economics 2009Rohit PatelAún no hay calificaciones

- Tender BaseDocumento45 páginasTender BasevirtechAún no hay calificaciones

- D10 CacDocumento4 páginasD10 CacaskermanAún no hay calificaciones

- Fact Sheet Concentrating Solar Power 3Documento5 páginasFact Sheet Concentrating Solar Power 3Rahul SinghAún no hay calificaciones

- Chapter 1 5 FinalDocumento24 páginasChapter 1 5 FinalChara etangAún no hay calificaciones

- The Dinkum Index - Q211Documento13 páginasThe Dinkum Index - Q211economicdelusionAún no hay calificaciones

- 2004 Option Pricing Valuation Models and ApplicationsDocumento33 páginas2004 Option Pricing Valuation Models and ApplicationsAvik BanerjeeAún no hay calificaciones

- 039 Viveks - Retailing StrategiesDocumento5 páginas039 Viveks - Retailing StrategiesMahadev ExplorerAún no hay calificaciones

- On Accounting Flows and Systematic RiskDocumento10 páginasOn Accounting Flows and Systematic RiskKinshuk AcharyaAún no hay calificaciones

- UTILITY AnalysisDocumento2 páginasUTILITY AnalysisImtiaz RashidAún no hay calificaciones

- Emerging Oil MarketsDocumento230 páginasEmerging Oil MarketsdragoslavaAún no hay calificaciones

- End Term Exam SSCM PGP19-21Documento3 páginasEnd Term Exam SSCM PGP19-21Asawari JoshiAún no hay calificaciones

- P5-4, 6 Dan 8Documento18 páginasP5-4, 6 Dan 8ramaAún no hay calificaciones