Documentos de Académico

Documentos de Profesional

Documentos de Cultura

HDFC CSR Strategies

Cargado por

Astha SaithDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

HDFC CSR Strategies

Cargado por

Astha SaithCopyright:

Formatos disponibles

Narsee monjee institue of management studies

HDFC: CSR Case Study

End-Term Project

BYGroup 5 AnkitGoel (22) AsthaSaith (46) AbhinavGoel (23) Hitesh Bhatia (11) SaurabhTandon (59)

HDFC: CSR Case Study

SUSTAINABILITY DEVELOPMENT- HDFC BANK

"We Understand Your World

1. Introduction

HDFC Bank was incorporated in 1994 by Housing Development Finance Corporation Limited (HDFC), India's largest housing finance company. It was among the first companies to receive an 'in principle' approval from the Reserve Bank of India to set up a bank in the private sector. HDFC, being Indias second largest private bank, has a wide network of 294 offices catering to over 2,400 towns & cities spread across the country. The bank deals with three key business segments. - Wholesale Banking Services, Retail Banking Services, Treasury.

2. Corporate Social Responsibility

At HDFC, 'Corporate Social Responsibility' has always been an evolving concept, akin to its 'learning by doing' philosophy. CSR is an integral part of its operation and viewed as commitment to operate ethically and contributing to economic development while improving the quality of life of its employees as well as that of the local communities and society at large. It has professionally nurtured each of its social initiative as an investment, with a special focus on Education and livelihood. The major initiatives taken by the Bank in this direction over the last few years cover the following areas: Education Livelihood training and support Environmental sustainability Employee welfare, health and well being Employee engagement

2.1 CSR at Workplace

(a) Human Resource

The bank constantly trains and empowers its 55,752 large workforce through programs conducted by internal and external faculty. It lists people as one of its stated core values.

HDFC: CSR Case Study

(b) Code of Ethics

HDFC strives for honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest, full, fair, accurate, timely, and understandable disclosure in the periodic reports required to be filed by the issuer; and compliance with applicable governmental rules and regulations across all business functions.1 The Bank adheres to Section 406 of the Sarbanes-Oxley Act of 2002 and the rules and regulations framed by the Securities and Exchange Commission of USA and other statutory and regulatory authorities in India and USA. The code is applicable to the Managing Director (Chief Executive Officer), the Chief Financial Officer and members of senior management of the Bank.

(c) Complaints Handling

The Bank supports a formalised system for receiving, retaining and treating complaints received, and procedures for the confidential and anonymous submission by employees. Under this policy, employees are encouraged to report questionable accounting matters or any fraudulent financial information provided to shareholders, the government or the financial markets, or any conduct that results in a violation of law by the Bank or in a substantial mismanagement of the Banks resources, to the management. HDFC also has a whistle blower policy in place for reporting on any malpractice in the organization.

2.2 CSR at Market-place

(a) Promoting Financial Awareness

In addition to providing various products and services to its clients, the Bank believes that imparting education and training to these target segments is equally essential to ensure transparency and create awareness. Through these programs the Bank provides credit counselling and information on parameters like saving habits, better utilization of savings, features of savings products, credit utilization, asset creation, insurance, income generation program etc.

http://www.openpages.com/solutions/sarbanes-oxley/sarbanes-oxley-sec406.asp

HDFC: CSR Case Study

2HDFC

and UTI together lunched an Investor Education Initiative called "Swatantra" on 5th February, 2011 in the states of Kerala, Karnataka and Tamil Nadu. The programme aimed to create investor awareness about the various financial products and wealth generation options through mobile phones, internet tools (face book, twitter), financial calculators and planners, and also other conventional methods. HDFC Bank utilized huge network of rural and semi-rural branches across Kerala, Karnataka and Tamil Nadu to interact with millions of people living in rural areas to impart financial knowledge.

(b)

Sustainability Reporting

The bank has engaged consultants to create an in-house capability for triple bottom line reporting, based on the Global Reporting Initiative guidelines. This is a disclosure tool used to communicate important information regarding the organization and its performance across social, environmental, and economic parameters to stakeholders.

(c)

Fair Practices Code

This Code is pursuant to the Guidelines issued by the National Housing Bank on Fair Practices Code for Housing Finance Companies. Major Objectives of this code include following fair and transparent business practices, encouraging market forces through fair competition, having cordial relations with its customers.3

Fair Lending

The bank would ensure timely disbursement of loans sanctioned in conformity with the terms and conditions governing such sanction. It would give notice of any change in the terms and conditions including interest rates, service charges etc. The bank would not discriminate on grounds of sex, caste and religion in the matter of lending. However, this does not preclude the bank from participating in credit-linked schemes framed for weaker sections of society. In the matter of recovery of loans, the bank would not resort to undue harassment or use of force.

http://banking.contify.com/story/uti-mutual-fund-and-hdfc-bank-to-aware-investors-in-south-india-2011-0203

3

http://www.ncr.com/about_ncr/media_information/news_releases/2010/april/20100420_hdfc.jsp

HDFC: CSR Case Study

Grievance Reddressal

In case of any grievance or complaint, the customers can contact the Grievance Redressal officer who belongs to the specifically created Grievance Redressal Cell by HDFC.

2.3CSR at Community4

Shelter Assistance Reserve

Close to 190 social and development initiatives were supported during FY 2010-11 through the Shelter Assistance Reserve. The overall utilisation from the Reserve stood at Rs. 8.88 crore. The segment-wise break-up of the utilisation is illustrated in the chart below5:

4 5

http://www.hdfcbank.com/common/pdf/corporate/Bank-Annual-Report-2011-Part1.pdf http://www.hdfc.com/others/social_initiatives.asp

HDFC: CSR Case Study

Table 1 Community development Activities in India

S.No Area Initiative Activities Employee participation in summer camps, English-speaking classes; collection of paper waste, assistance in academic support programs, donation of blood. Other activities Focus on creating self-reliance and promoting education in the interiors of the country A web portal raises funds and contributions from individuals across world (including employees and customers) and directs these donations to NGOs. Payroll Giving program already has more than 26,000 donors contributing over Rs. 60 lacs per month Parternership with NGO, Save The Children focusing on long-term recovery initiatives including livelihood support and school rehabilitation of flood victims in Leh. 18 temporary schools were set up at Igoo, Basgo, Skurbuchan, Phyang and Saspotse with an aim to reach 24 temporary schools HDFC partnered with Folk Arts Rajasthan to provide scholarship to children to pursue higher education and also learn their traditional Merasi artistic legacy(3), with an aim to eradicating illiteracy, fostering community development, and celebrating cultural understanding. A public private partnership to ensure that children in municipal schools have access to quality education. Teachers are also assisted with innovative teaching methods and learning material. HDFC Bank is presently supporting seven schools in Mumbai covering 1,850 children and Partnering organisation

Employee Volunteering

GiveIndia

Payroll Giving

Community Development Save The Children Project

Save The Children

Arts and Sports Folk Arts Rajasthan

Folk Arts Rajasthan, Lok Kala SagarSanstha n (LKSS)

Education and Livelihood School Adoption & Scholarship

HDFC: CSR Case Study

2 Pre-school counselling

Livelihood Training & Support

10 schools in Pune on a reading program that covers over 5,000 children. The bank also supports 1500 girls in Mumbai, Sheopur and Chattisgarh by providing them scholarships. Over 1,000 children in Mumbai, Bangalore, Hyderabad and Kolkata are being covered through the Educational assistance program which aims at reducing the school dropout rates. The bank has operated various pre-schools in areas where drop-out rates are high. Focus on childs first generation learning and counselling of their parents on importance of education. The bank currently reaches out to over 9,000 children in Mumbai, Delhi and Hyderabad. Has tied up with 464 schools in Maharashtra covering over 69,000 rural children to inculcate savings habit Support for vocational training to individuals to enable them to have regular and sustainable income Offers non-formal vocational and technical education programs in trades such as welding, plumbing, electrical maintenance, mobile repair, tailoring, construction, making of paper bags, gel candles, wax candles, basket weaving, agarbatti rolling. An active lending program for customers below the poverty line through the formation of selfhelp groups. Training programs to the borrowers that nurture the appropriate skill sets as well as the provision of market linkages (so that goods are sold at fair price) to the primary markets in order to ensure that the livelihood activities are sustainable. Counselling to all the self-help groups that it works with on the benefits of the savings habit, wise investing habits etc.

HDFC: CSR Case Study

The Bhavishya Yaan Mission

Continuing public private partnership for overall development of underprivileged children of Mumbai helping them to shed their inhabitations and motivate them to move ahead in life.

Running School for Tribal

Running School for Rural children

Empowering of Differently Abled

A school was born from the association which aimed at running schools for tribal children in the interiors of Maharashtra (district Dahanu). The school provides free education, stay, clothing, food and medical treatment for all students. The school caters to over 300 children upto Std. VI and 85% of the students have passed their exams. HDFC supported the running of this school for a period of 1 year. HDFC partnered this initiative by supporting 10 Single Teacher schools in one block of Kanchipuram district of Tamil Nadu, which is engaged in promoting broad-based and costeffective education in arithmetic and languages for under privileged children in rural areas. Partnered with Chirag for lighting of villages in Wada Taluka, Thane District, through Solar energy, by providing them with solar lanterns. These lanterns are made by physically & mentally challenged individuals from economically backward communities. HDFC has been supporting various programs of DEEDS, working with hearing impaired individuals by making them financially selfreliant, over the years VishwasVidyalaya - HDFC partnered with Vishwas to support their initiative of empowering the disabled in Gurgaon. The belief is that everyone has a right to access basic health care and education irrespective of disability, gender, class or caste. It is operational from a leased 4.5 acre site where every child has a right to meaningful and quality education.

Rotary club of Mumbai, Municipal Corporation of Greater Mumbai Savarkar Trust

Swami Vivekanand Society

Chirag

DEEDS.

Vishwas

HDFC: CSR Case Study

Improving Nutrition and Health in urban slums

Health Services Child care

Leprosy Eradication

Betterment of Adults

HDFC partnered SNEHA in its initiative of providing solutions to issues of nutrition and health in urban slum communities. Specifically with respect to the concerns of unhealthy newborn babies and unhealthy lactating mothers. The program is run in 9 wards of Mumbai specifically with health posts covering a population of approximately 100,000 and with maternity homes/tertiary hospitals covering a radius of 6-7 kms. HDFC has been supporting the on-going running expenses of the Centres for the past several years of St. Jude India Child-Care Centres The Centre caters to a huge unmet social need to provide a safe and clean environment for children to recuperate following treatment for serious chronic diseases. The organisation runs 7 centres housing children suffering from cancer in Mumbai where free accommodation is provided to needy children (and their immediate family) HDFC has been regularly supporting the ongoing activities of Alert-India, which is works towards eradication of leprosy for the last 28 years. Their Leprosy Elimination Centre is a one of a kind in the country. It is in contact with over a 1,000 patients living in their project areas. HDFC supported the running expense of the workshop of SPACE, an NGO working for betterment of adults affected by Cerebral Palsy for a period of one year in Pune.

Sneha

St. Jude India Child-Care Centre

Alert India

SPACE

(c) Financial Inclusion

HDFCs initiatives target segments of the population that have limited or no access to the formal banking system for their basic banking and credit requirements, by building

HDFC: CSR Case Study

a robust and sustainable model that provides relevant services and viable and timely credit that ultimately results in economically uplifting its customers.6The bank in partnership with 104 Microfinance institutions and 203 NGOs has extended credit facilities exceeding Rs. 700 crores in 17 states and has financially included over 2 million rural households creating inroads to alleviate poverty that is prevalent in certain sections of the countrya. By March 31, 2014 HDFC Bank will endeavour to bring 10 million households currently excluded from basic banking services under the fold of this program.

(d) Rural Initiative

The Bank offers products and services such as savings, current, fixed & recurring deposits, loans, ATM facilities, investment products such as mutual funds and insurance, electronic funds transfers, drafts and remittances etc in its rural and underbanking locations. Some of these branches are hubs for other inclusion initiatives such as direct linkages to self help groups and to promote mutual guarantee micro-loans, POS terminals and information technology enabled kiosks, as well as other ICT initiatives such as mobile banking in these locations. Apart from loans directly linked to agriculture such as pre and post harvest credit, there are many other credit products that the Bank uses to aid financial betterment in rural locations. Loans for tractors, commercial vehicles, two wheelers etc. supplement the farmers income by improving productivity and reducing expenses.

(e) Loans to Self Help Groups and Mutual Guarantee Micro loans7

HDFC Bank has been working with various non-government organizations in order to cover a wider consumer base than that it could have reached through its branch network. The NGOs that the Bank partners work with the objective of providing credit for income generation activities, (often by providing training, vocational guidance and marketing support to their members). Over the last one year the Bank has accelerated its direct linkage program to self-help groups, under this program the Bank itself works at the grass root level with women in villages, conducts financial literacy programs, forms groups and then funds these groups for income generation activities. Till date the Bank has lent to over 54,000 self-help groups covering approximately 8 lakh households.

6 a

www.Karmayog.org www.moneycontrol.com 7 http://www.hdfcbank.com/common/pdf/corporate/Bank-Annual-Report-2011-Part1.pdf

HDFC: CSR Case Study

10

(f) Agriculture and Allied Activities

An innovative model has currently been implemented with dairy and sugarcane farmers. The initiative currently underway includes the appointment of dairy societies and sugarcane co-operatives as business correspondents, through whom the Bank opens accounts of individual farmers attached to these societies. The societies route all payments to the farmers.

(g) Small and Micro Enterprises

The Bank offers complete banking solutions to micro, small and medium scale enterprises across industry segments including manufacturers, retailers, wholesalers / traders and services. The entire suite of financial products including cash credit, overdrafts, term loans, bills discounting, export packing credit, letter of credit, bank guarantees, cash management services and other structured products are made available to these customers.

2.3 Environmental CSR(5)

(a) Environmental Sustainability

HDFC Bank believes in taking responsibility for the effects of its operations in society and on the environment and this belief embodies its approach to the reduction of carbon emissions. Taking forward this commitment the Bank has undertaken the following projects:

1. Annual Foot-printing / Calculation of its carbon emissions

The Bank has developed and put in place a template to collate and calculate its carbon emissions on an annual basis. This provides us with our emissions regarding travel, electricity, paper and other utilities, which then enables us to take efforts in specific areas in order for the Bank to reduce the impact of its operations on the environment.

2. Carbon Disclosure Project

The Bank has been associated with the carbon disclosure project since 2007, adhering to their disclosure practices, each year they have strived to improve the quality of

HDFC: CSR Case Study

11

reporting and the number of parameters that go into the disclosure. In the year 2010, HDFC Bank registered as a signatory to the carbon disclosure project.

3. Carbon Management Awareness

Employees are made aware of the importance of conservation of natural resources and smart resource management techniques through various e-mailers and other communications sent out periodically.

(b) Green Initiative

In line with its commitment to green and sustainable development HDFC bank has followed green principles in the construction of its back office premises located in Mumbai. The building core and shell has been designed and implemented in lines with a LEED rating of 'gold'. All materials used in the construction of the interiors of the building conform to green norms for commercial premises. The operations of the premises consume less than one watt per square foot of space. Indoor air quality is monitored through Co2 control and sewage for the building is treated and recycled.

Corporate Governance8

The Composition of the Board of Directors of the Bank is governed by the Companies Act, 1956, the Banking Regulation Act, 1949 and the listing requirements of the Indian Stock Exchanges where the securities issued by the bank are listed. The Board has following ten (10) Directors as on March 31, 2011:-

Executive Directors

Mr.AdityaPuri:-Holds a Bachelor's degree in Commerce from Punjab University and is an associate member of the Institute of Chartered Accountants of India. He has been the Managing Director of the Bank since September 1994. Mr. Harish Engineer:-is Science Graduate from Mumbai University and holds a Diploma in Business Management Mr.PareshSukthankar:-Did his Masters in Management Studies (MBA) from Jamnalal Bajaj Institute (University of Mumbai) and the Advanced Management Program (AMP) from the Harvard Business School.

Non Executive Director

8

www.hdfcbank.com/aboutus/cg/annual_reports.htm

HDFC: CSR Case Study

12

Mrs.RenuKarnad:- represents HDFC Limited on the Board of the Bank. She is a Law graduate and also holds a Master's Degree in Economics.

Independent Directors

Mr. C. M. Vasudev :- holds a Master's Degree in Economics and Physics. He joined the Indian Administrative Services in 1966 Mr.AshimSamanta :- holds a Bachelor of Commerce degree from University of Mumbai. He has vast experience in the field of bulk drugs and fine chemicals. Dr.PanditPalande :- extensive experience of working in the fields of business administration, management and agriculture. Mr.ParthoDatta :- appointed as an additional Director during the year. He is an associate member of the Institute of Chartered Accountants of India (ICAI) Mr. Bobby Parikh :- holds a Bachelor's degree in Commerce from the Mumbai University and qualified as a Chartered Accountant in 1987 Mr. A. N. Roy: is M.A., M.Phil. and is a distinguished retired civil servant. During his long career of 38 years in the prestigious Indian Police Service ("IPS")

Various Committees of BOD

Audit and Compliance Committee Compensation Committee Investor Grievance (Share) Committee Risk Policy and Monitoring Committee Credit Approval Committee Premises Committee Nomination Committee Fraud Monitoring Committee Customer Service Committee Efforts would lead to reduced events of critical illnesses or hospitalisation.

Awards9

Various awards and recognition have been conferred on theBank by leading domestic and international organizations during the fiscal year ended March 31, 2011, some of them are: FE-EVI Green Business Leadership Award

Source: www.Contify banking.com

HDFC: CSR Case Study

13

'Best Corporate Social Responsibility Practice' award at The Business for Social Responsibility Awards 2007presented by the Bombay Stock Exchange and Nasscom Foundation. Asian Banker 2011 Strongest Bank in the Asia Pacific region NDTV Business Leadership Awards 2010 Best Private Sector Bank IDRBT Technology 2009 Awards HDFC has bagged a fifth place in annual list of the World's Most Ethical Companies. HDFC is the only Indian company to get a place in the list

Problems faced by HDFC bank while implementing the projects10

Communities often lack awareness about health cover needs and the complex situation of healthcare provision detains them from seeking quality healthcare. There is a need to demystify health insurance, healthcare and hospitalization apprehensions They often try pushing a plain vanilla product to the community ignoring the need to study and develop need-based products. This may often lead to ignoring the opportunity to pass premium benefits to the end user. A better experience results from mechanisms put in place to regularly monitor the products and services, collection of feedback from different stakeholders and innovations in policy and claims administration. Micro-health insurance initiatives should ideally be integrated within a community health intervention.

10

Source:This was the response given by Mr.AyanChatterjee, HDFC , Mumbai to microfinance community

HDFC: CSR Case Study

14

Competitor Analysis

HDFC Profits(in Cr Rs) Spending on CSR(in Cr Rs) % Spending on CSR If government imposes 2% legal binding on CSR activities, future is spending (in Cr Rs.) 3926 8.8 0.22 78.52 ICICI 5151 40 0.77 103.2 SBI 7370 80 1.08 147.4 CITIBANK 48760 460 0.94 17.2 (Citibank India)

HDFC: CSR Case Study

15

Bibliography

1)Openpages .(2010) Retrieved 10 August 2011 from IBM website : http://www.openpages.com/solutions/sarbanes-oxley/sarbanes-oxley-sec406.asp 2)ContifyBanking .(2011) Retrieved 13 August 2011 from Contify website : http://banking.contify.com/story/uti-mutual-fund-and-hdfc-bank-to-aware-investorsin-south-india-2011-02-03 3)NCR .(2011) Retrieved 20 August 2011 from NCR website :http://www.ncr.com/about_ncr/med 4)HDFC .(2011) Retrieved 1 August 2011 from HDFC website : http://www.hdfcbank.com/common/pdf/corporate/Bank-Annual-Report-2011Part1.pdf http://www.hdfc.com/others/social 5)ECONOMIC TIMES .(2011) Retrieved 25 August from Economic Times website : http://economictimes.indiatimes.com/hdfc-bank-ltd/directorsreport/companyid9195.cms 6) KARMYOG .(2011) Retrieved 28 August 2011 from Karmyog website : www. Karmayog.org 7)MONEYCONTROL .(2011) Retrieved 20 August 2011 from MoneyControl website : www.moneycontrol.com 8) MicroFinance problems for HDFC .(2011) Retrieved 28 August 2011 from SolutionExchange website : ftp://ftp.solutionexchange.net.in/public/mf/cr/cr-se-mf30100701-public.pdf

También podría gustarte

- Green Products A Complete Guide - 2020 EditionDe EverandGreen Products A Complete Guide - 2020 EditionCalificación: 5 de 5 estrellas5/5 (1)

- DCB Bank - SipDocumento59 páginasDCB Bank - SipRiya AgrawalAún no hay calificaciones

- Bajaj Allianz PPT-1Documento11 páginasBajaj Allianz PPT-1Akshay MendanAún no hay calificaciones

- Sip ProjectDocumento126 páginasSip Projectsolanki_dipen2000100% (2)

- A PROJECT REPORT On A Study On Effectiveness of Advertisement Carried Out by BIG BAZAARDocumento79 páginasA PROJECT REPORT On A Study On Effectiveness of Advertisement Carried Out by BIG BAZAARBabasab Patil (Karrisatte)75% (4)

- "A Study On Impact of Social Media Marketing of Mamaearth: Ravenshaw UniversityDocumento56 páginas"A Study On Impact of Social Media Marketing of Mamaearth: Ravenshaw UniversityAnjor BurhAún no hay calificaciones

- AbstractDocumento21 páginasAbstractsanyakapAún no hay calificaciones

- Buyer's Buying Behaviour With Special Reference To Two Wheeler BikesDocumento109 páginasBuyer's Buying Behaviour With Special Reference To Two Wheeler BikesSami ZamaAún no hay calificaciones

- Internship Program 2021 We Believe That The Key To Success Can Be Found Among The YouthDocumento4 páginasInternship Program 2021 We Believe That The Key To Success Can Be Found Among The YouthMidhun ThomasAún no hay calificaciones

- Project On Reliance Fresh HubliDocumento41 páginasProject On Reliance Fresh HubliPredhivraj BMAún no hay calificaciones

- ECA & GI-Format Final (1) (1) (1) - 1 (1) - 1Documento31 páginasECA & GI-Format Final (1) (1) (1) - 1 (1) - 1KishanAún no hay calificaciones

- A Study of Effectiveness On Advertisement and Promotional Offers at Big Bazaar, BangaloreDocumento78 páginasA Study of Effectiveness On Advertisement and Promotional Offers at Big Bazaar, BangaloreManu B100% (1)

- 7P's of Axis Bank - Final ReportDocumento21 páginas7P's of Axis Bank - Final ReportRajkumar RXzAún no hay calificaciones

- Marketing Project PrashantDocumento74 páginasMarketing Project PrashantAman MamgainAún no hay calificaciones

- Dsmnru Mba SyllabusDocumento42 páginasDsmnru Mba Syllabusपशुपति नाथAún no hay calificaciones

- Axis BankDocumento16 páginasAxis BankRoshan KamathAún no hay calificaciones

- Corporate Social Responsibility - Tata Consultancy Services (TCS)Documento17 páginasCorporate Social Responsibility - Tata Consultancy Services (TCS)monirba48Aún no hay calificaciones

- Factors Affecting Indian Retail MarketDocumento3 páginasFactors Affecting Indian Retail MarketKeerthana LakshmiAún no hay calificaciones

- Mobile Industry ProjectDocumento45 páginasMobile Industry ProjectJorawar DeolAún no hay calificaciones

- Unit2: Globalization, Addressing A VUCA Environment With A Bottoms - Up Approach (Volatile, Uncertain, Complex and Ambiguous Time)Documento39 páginasUnit2: Globalization, Addressing A VUCA Environment With A Bottoms - Up Approach (Volatile, Uncertain, Complex and Ambiguous Time)Rajeshree JadhavAún no hay calificaciones

- Presentation1 Customer SatisfactionDocumento22 páginasPresentation1 Customer SatisfactionAnjali Angel100% (2)

- Customer Perception Towards Social Media Marketing of Electronic Products in PakistanDocumento13 páginasCustomer Perception Towards Social Media Marketing of Electronic Products in PakistanMadiha RasheedAún no hay calificaciones

- Black Book ArticleDocumento91 páginasBlack Book Articlepohebat143Aún no hay calificaciones

- Customer Preference For HUL Project ReportDocumento102 páginasCustomer Preference For HUL Project Reportarunbishnoi62% (13)

- Shah Publicity Summer ProjectDocumento88 páginasShah Publicity Summer ProjectVatsal MehtaAún no hay calificaciones

- Customer Satisfaction On Demat AccountDocumento92 páginasCustomer Satisfaction On Demat Accountmohammad tanveerAún no hay calificaciones

- PROJECT REPORT BAJAJ ALLIAnzDocumento33 páginasPROJECT REPORT BAJAJ ALLIAnzkittu sahooAún no hay calificaciones

- HDFC BankDocumento72 páginasHDFC BankKishan bembadeAún no hay calificaciones

- Questionnaire On ABSLIDocumento3 páginasQuestionnaire On ABSLIRakeshKumar Maurya100% (1)

- A Study On HR Policies & Practies at SIB LTDDocumento40 páginasA Study On HR Policies & Practies at SIB LTDVivian Divagaran100% (1)

- Itc SrinivasaraoDocumento76 páginasItc SrinivasaraoVenkatesh Periketi100% (2)

- "A Study On Consumer Perception Towards LG Electronics": Meerut Institute of Technology MeerutDocumento13 páginas"A Study On Consumer Perception Towards LG Electronics": Meerut Institute of Technology Meerutdeepak GuptaAún no hay calificaciones

- of Customer SatisfactionDocumento15 páginasof Customer SatisfactionMehak RainaAún no hay calificaciones

- A Study On Advertising in Jio and Its Impact On Customers PDFDocumento111 páginasA Study On Advertising in Jio and Its Impact On Customers PDFUdaypatil100% (1)

- Brand Awairness Cocacola ProjectDocumento70 páginasBrand Awairness Cocacola Projectthella deva prasadAún no hay calificaciones

- Tata Motors Final ReportDocumento107 páginasTata Motors Final ReportNishan ShettyAún no hay calificaciones

- 21 Project Report and Viva Voce - BBADocumento10 páginas21 Project Report and Viva Voce - BBAAbhishek PathakAún no hay calificaciones

- Market Survey On BSNLDocumento39 páginasMarket Survey On BSNLShantanu BakshiAún no hay calificaciones

- Consumer Behavior With Reference To Amway ProductsDocumento56 páginasConsumer Behavior With Reference To Amway ProductsAbhay JainAún no hay calificaciones

- Muthoot Finance Ltd.Documento8 páginasMuthoot Finance Ltd.Hrithik SaxenaAún no hay calificaciones

- Marketing Strategy of Procter & Gamble: Project Report ONDocumento44 páginasMarketing Strategy of Procter & Gamble: Project Report ONRoopendra MauryaAún no hay calificaciones

- IFCI ContributionDocumento3 páginasIFCI Contributionshruti.shindeAún no hay calificaciones

- Chaupal SagarDocumento21 páginasChaupal SagarManoj Butola100% (1)

- A CORPORATE SOCIAL RESPONSIBLITY Hindustan Unilever LTDDocumento72 páginasA CORPORATE SOCIAL RESPONSIBLITY Hindustan Unilever LTDpranjali shindeAún no hay calificaciones

- I. Industry Profile: Part-ADocumento40 páginasI. Industry Profile: Part-Amalthu.malthesh6185100% (1)

- Bibliography and QuestionnaireDocumento9 páginasBibliography and QuestionnaireprateekAún no hay calificaciones

- Consumer Behaviour PPT 1Documento13 páginasConsumer Behaviour PPT 1Anand SinghAún no hay calificaciones

- SIPDocumento20 páginasSIPSanket Bhondage0% (1)

- Swot Analysis InfosysDocumento17 páginasSwot Analysis InfosysAlia AkhtarAún no hay calificaciones

- Cash Flow at Maruti SuzukiDocumento65 páginasCash Flow at Maruti SuzukiMahendra Kumar VishwakarmaAún no hay calificaciones

- Project On AirtelDocumento37 páginasProject On Airtel07gmalik07100% (1)

- Project On Capital Market ReformsDocumento99 páginasProject On Capital Market Reformsthorat82100% (3)

- HDFC Bank Project ReportDocumento15 páginasHDFC Bank Project Reportamit kumarAún no hay calificaciones

- CSR Assignment: Q1. Analyse The Trends in HDFC Spending On CSRDocumento3 páginasCSR Assignment: Q1. Analyse The Trends in HDFC Spending On CSRPrateek SinghAún no hay calificaciones

- A Study On Cooperative and Microfinance: Assignment 1Documento8 páginasA Study On Cooperative and Microfinance: Assignment 1Anjali PaneruAún no hay calificaciones

- Becg Presentation Roll 54Documento3 páginasBecg Presentation Roll 54Sweta BastiaAún no hay calificaciones

- An Overview of CSR Activities Performed by HDFC BankDocumento4 páginasAn Overview of CSR Activities Performed by HDFC BankVital TejaAún no hay calificaciones

- CSR and Ethical Issues of Kotak Mahindra Bank LimitedDocumento12 páginasCSR and Ethical Issues of Kotak Mahindra Bank LimitedvimalrajAún no hay calificaciones

- Digital TransformationDocumento2 páginasDigital TransformationPriteshAún no hay calificaciones

- BE PPT Banks, CSR in BanksDocumento34 páginasBE PPT Banks, CSR in Banksanju2091Aún no hay calificaciones

- Small Hydro Power Plants ALSTOMDocumento20 páginasSmall Hydro Power Plants ALSTOMuzairmughalAún no hay calificaciones

- Offer Price For The Company Branch in KSADocumento4 páginasOffer Price For The Company Branch in KSAStena NadishaniAún no hay calificaciones

- Abnormal Psychology: A Case Study of Disco DiDocumento7 páginasAbnormal Psychology: A Case Study of Disco DiSarah AllahwalaAún no hay calificaciones

- Test 6Documento7 páginasTest 6RuslanaAún no hay calificaciones

- Romanian Architectural Wooden Cultural Heritage - TheDocumento6 páginasRomanian Architectural Wooden Cultural Heritage - ThewoodcultherAún no hay calificaciones

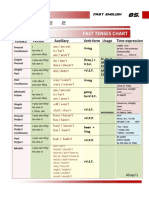

- Table 2: Fast Tenses ChartDocumento5 páginasTable 2: Fast Tenses ChartAngel Julian HernandezAún no hay calificaciones

- 4th Exam Report - Cabales V CADocumento4 páginas4th Exam Report - Cabales V CAGennard Michael Angelo AngelesAún no hay calificaciones

- ReadmeDocumento2 páginasReadmeParthipan JayaramAún no hay calificaciones

- COVID19 Management PlanDocumento8 páginasCOVID19 Management PlanwallyAún no hay calificaciones

- RA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021Documento201 páginasRA-070602 - REGISTERED MASTER ELECTRICIAN - Manila - 9-2021jillyyumAún no hay calificaciones

- WHO in The Philippines-Brochure-EngDocumento12 páginasWHO in The Philippines-Brochure-EnghAún no hay calificaciones

- Assets Book Value Estimated Realizable ValuesDocumento3 páginasAssets Book Value Estimated Realizable ValuesEllyza SerranoAún no hay calificaciones

- Henry Garrett Ranking TechniquesDocumento3 páginasHenry Garrett Ranking TechniquesSyed Zia-ur Rahman100% (1)

- Project Report On "Buying Behaviour: of Gold With Regards ToDocumento77 páginasProject Report On "Buying Behaviour: of Gold With Regards ToAbhishek MittalAún no hay calificaciones

- TATA Steel - Group 8Documento95 páginasTATA Steel - Group 8Wasim Khan MohammadAún no hay calificaciones

- Rotary HandbookDocumento78 páginasRotary HandbookEdmark C. DamaulaoAún no hay calificaciones

- PDF Issue 1 PDFDocumento128 páginasPDF Issue 1 PDFfabrignani@yahoo.comAún no hay calificaciones

- Full Download Health Psychology Theory Research and Practice 4th Edition Marks Test BankDocumento35 páginasFull Download Health Psychology Theory Research and Practice 4th Edition Marks Test Bankquininemagdalen.np8y3100% (39)

- Sarah Richards: - Professional SummaryDocumento3 páginasSarah Richards: - Professional SummaryWendy StarkandAún no hay calificaciones

- Gabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFDocumento2 páginasGabbard - Et - Al - The Many Faces of Narcissism 2016-World - Psychiatry PDFatelierimkellerAún no hay calificaciones

- Assignment 1Documento3 páginasAssignment 1Bahle DlaminiAún no hay calificaciones

- ModernismDocumento4 páginasModernismSiya SunilAún no hay calificaciones

- Urban Transportation System Design and Feasibility Analysis A Case Study of Lagos Mega-CityDocumento8 páginasUrban Transportation System Design and Feasibility Analysis A Case Study of Lagos Mega-CityKaren EstradaAún no hay calificaciones

- X3 45Documento20 páginasX3 45Philippine Bus Enthusiasts Society100% (1)

- Case Report On Salford Estates (No. 2) Limited V AltoMart LimitedDocumento2 páginasCase Report On Salford Estates (No. 2) Limited V AltoMart LimitedIqbal MohammedAún no hay calificaciones

- Why Study in USADocumento4 páginasWhy Study in USALowlyLutfurAún no hay calificaciones

- 240 Marilag v. MartinezDocumento21 páginas240 Marilag v. Martinezdos2reqjAún no hay calificaciones

- What Project Will You Sugggest To The Management and Why?Documento8 páginasWhat Project Will You Sugggest To The Management and Why?Tin Bernadette DominicoAún no hay calificaciones

- Service Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type TempDocumento2 páginasService Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type Tempshiripalsingh0167Aún no hay calificaciones

- Microplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesDocumento13 páginasMicroplastic Occurrence Along The Beach Coast Sediments of Tubajon Laguindingan, Misamis Oriental, PhilippinesRowena LupacAún no hay calificaciones