Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Meaning and Features of Bank Savings Accounts

Cargado por

Prashant SawantDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Meaning and Features of Bank Savings Accounts

Cargado por

Prashant SawantCopyright:

Formatos disponibles

Meaning of Saving Account in Bank

Commercial banks (like ICICI, HDFC, etc.), co-operative banks (like Saraswat, Cosmos, etc.), public sector banks (like State bank of India, Bank of India, etc.) and postal departments accept deposits by way of opening saving bank account with them. The 'saving account' is generally opened in bank by salaried persons or by the persons who have a fixed regular income. This facility is also given to students, senior citizens, pensioners, and so on.

Image credits newsusa.

Saving accounts are opened to encourage the people to save money and collect their savings. In India, saving account can be opened by depositing 100 (approx. US $2) to 5000 (approx. US $100). The saving account holder is allowed to withdraw money from the account as and when required. The interest which is given on saving accounts is sometime attractive, but often nominal. At present, the rate of interest ranges between 4% to 6% per annum in India. The interest rates vary as per the amount of money deposited (lying) in the saving bank account, scheme opted, and its maturity range. It is also subject to current trend of banking policies in a country.

Features of Saving Account

The main features of saving account in bank are as follows:

1. 2. 3. 4. 5. 6. 7. 8. 9.

The main objective of saving account is to promote savings. There is no restriction on the number and amount of deposits. However, in India, mandatory PAN (Permanent Account Number) details are required to be furnished for doing cash transactions exceeding 50,000. Withdrawals are allowed subject to certain restrictions. The money can be withdrawn either by cheque or withdrawal slip of the respective bank. The rate of interest payable is very nominal on saving accounts. At present it is between 4% to 6% p.a in India. Saving account is of continuing nature. There is no maximum period of holding. A minimum amount has to be kept on saving account to keep it functioning. No loan facility is provided against saving account. Electronic clearing System (ECS) or E-Banking are available to pay electricity bill, telephone bill and other routine household expenses.

10. Generally, equated monthly installments (EMI) for housing loan, personal loan, car loan, etc., are paid (routed) through saving bank account.

Advantages of Saving Account

The advantages of saving account are as follows: 1. 2. 3. 4. 5. 6. 7. 8. 9. Saving account encourages savings habit among salary earners and others who have fixed income. It enables the depositor to earn income by way of saving bank interest. Saving account helps the depositor to make payment by way of issuing cheques. It shows income of a salaried and other person earned during the year. Saving account passbook acts as an identity and residential proof of the account holder. It provides a facility such as Electronic fund transfer (EFT) to other people's accounts. It helps to do online shopping via facility like internet banking. It aids to keep records of all online transactions carried on by the account holder. It provides immediate funds as and when required through ATM.

10. The bank offers number of services to the saving account holders.

Meaning of Fixed Deposit Account - Bank

The account which is opened for a particular fixed period (time) by depositing particular amount (money) is known as Fixed (Term) Deposit Account. The term 'fixed deposit' means that the deposit is fixed and is repayable only after a specific period is over.

Image Credits goh-wz.livejournal.com

Under fixed deposit account, money is deposited for a fixed period say six months, one year, five years or even ten years. The money deposited in this account can not be withdrawn before the expiry of period. The rate of interest paid for fixed deposit vary (changes) according to amount, period and from bank to bank.

Features of Fixed Deposit Account

The main features of fixed deposit account are as follows:1. 2. 3. 4. 5. The main purpose of fixed deposit account is to enable the individuals to earn a higher rate of interest on their surplus funds (extra money). The amount can be deposited only once. For further such deposits, separate accounts need to be opened. The period of fixed deposits range between 15 days to 10 years. A high interest rate is paid on fixed deposits. The rate of interest may vary as per amount, period and from bank to bank. Withdrawals are not allowed. However, in case of emergency, banks allow to close the fixed account prior to maturity date. In such cases, the bank deducts 1% (deduction percentage many vary) from the interest payable as on that date. 6. The depositor is given a fixed deposit receipt, which depositor has to produce at the time of maturity. The deposit can be renewed for a further period.

Advantages of Fixed Deposit Account

The advantages of fixed deposit account are as follows:1. 2. 3. Fixed deposit encourages savings habit for a longer period of time.. Fixed deposit account enables the depositor to earn a high interest rate. The depositor can get loan facility from the bank.

4. 5. 6. 7. 8.

On maturity the amount can be used to make purchases of assets. The bank can get the funds for a longer period of time. The bank can lend such funds for short term loans to businessmen. Fixed deposits indirectly boost economic development of the country. The bank can also invest such funds in profitable areas.

Meaning of Current Bank Account

Current bank account is opened by businessmen who have a number of regular transactions with the bank, both deposits and withdrawals. It is also known as Demand Deposit.

Image Credits stefanrechsteiner Current account can be opened in co-operative bank and commercial bank. Incurrent account, amount can be deposited and withdrawn at any time without giving any notice. It is also suitable for making payments to creditors by using cheques. Cheques received from customers can be deposited in this account for collection. In India, current account can be opened by depositing Rs.500 (US $ 11) to Rs.1,000 (US $ 22). The customers are allowed to withdraw the amount with cheques and they generally do not get any interest. In India Co-operative bankmay allow interest upto 1%. Current account holder get one important advantage of overdraft facility.

Features of Current Bank Account

The main features of current account are as follows:1. The main objective of current bank account is to enable the businessmen to conduct their business transactions smoothly.

2. 3. 4.

There is no restriction on the number and amount of deposits. There is also no restriction on the withdrawals. Generally bank does not pay any interest on current account. Nowadays, some banks do pay interest on current accounts. Current account is of continuing nature and as such there is no fixed period.

Advantage of Current Bank Account

The advantages of current account are as follows:1. 2. 3. 4. 5. 6. 7. Current account enables businessmen to conduct his business transactions smoothly. The businessmen can withdraw any amount at any time from their current accounts. There are also no restrictions on withdrawals. The businessmen can make direct payment to their creditors with the help of cheques. The bank collects money on behalf of its customers and credits the same to their accounts. Current account enables the account holder to obtain overdraft facility. The creditors of the account holder can get credit-worthiness information of the account holder through inter bank connection. Current account facilitates the industrial progress of the country. Without the help of this account, businessmen would have difficulties in running their business.

What is Recurring Deposit Account ? Meaning

Recurring deposit account is generally opened for a purpose to be served at a future date. Generally opened to finance pre-planned future purposes like, wedding expenses of daughter, purchase of costly items like land, luxury car, refrigerator or air conditioner, etc.

Image Credits pamelalong Recurring deposit account is opened by those who want to save regularly for a certain period of time and earn a higher interest rate. In recurring deposit account certain fixed amount is accepted every month for a specified period and the total amount is repaid with interest at the end of the particular fixed period.

Features of Recurring Deposit Account

The main features of recurring deposit account are as follows:1. 2. 3. 4. 5. 6. The main objective of recurring deposit account is to develop regular savings habit among the public. In India, minimum amount that can be deposited is Rs.10 at regular intervals. The period of deposit is minimum six months and maximum ten years. The rate of interest is higher. No withdrawals are allowed. However, the bank may allow to close the account before the maturity period. The bank provides the loan facility. The loan can be given upto 75% of the amount standing to the credit of the account holder.

Advantage of Recurring Deposit Account

The advantages of recurring deposit account are as follows:1. 2. 3. Recurring deposit encourages regular savings habit among the people. Recurring deposit account holder can get a loan facility. The bank can utilise such funds for lending to businessmen.

4.

The bank may also invest such funds in profitable areas.

También podría gustarte

- Running FinanceDocumento10 páginasRunning FinanceAnum Zahra100% (1)

- How To Get Unlimited Anon Debit CardsDocumento4 páginasHow To Get Unlimited Anon Debit CardsSteen PuistAún no hay calificaciones

- Loans& AdvancesDocumento80 páginasLoans& AdvancesSatyajit Naik100% (2)

- Banking Products Assignment FINAL 2Documento19 páginasBanking Products Assignment FINAL 2satyabhagatAún no hay calificaciones

- Free Study MaterialsDocumento17 páginasFree Study MaterialsRamanjotAún no hay calificaciones

- Cash Credit Proposal For Bank FinanceDocumento15 páginasCash Credit Proposal For Bank Financeajaya thakurAún no hay calificaciones

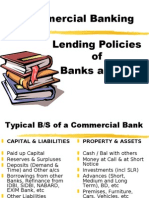

- Lending Policies of Indian BanksDocumento47 páginasLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)

- Iwm Customer 2Documento9 páginasIwm Customer 2irfan sururiAún no hay calificaciones

- Chapter 1 Introduction: Risk & ReturnDocumento32 páginasChapter 1 Introduction: Risk & ReturnMaridasrajanAún no hay calificaciones

- CBSE Class 11 Accountancy Study Material PDFDocumento148 páginasCBSE Class 11 Accountancy Study Material PDFKaushik SenguptaAún no hay calificaciones

- External Commercial BorrowingDocumento32 páginasExternal Commercial BorrowingNishant RajaAún no hay calificaciones

- Function of Commercial BankDocumento7 páginasFunction of Commercial BankEmranul Islam ShovonAún no hay calificaciones

- India's Top Banking Jobs and SalariesDocumento47 páginasIndia's Top Banking Jobs and SalariesHemlata NambisanAún no hay calificaciones

- Maths Project: Name: Anshit Gupta Class: X Sec.: A (Commerce) Roll No.: 7Documento22 páginasMaths Project: Name: Anshit Gupta Class: X Sec.: A (Commerce) Roll No.: 7Harish GAún no hay calificaciones

- Meaning and Functions of Commercial BankDocumento4 páginasMeaning and Functions of Commercial BankP Janaki Raman100% (6)

- Types of Bank AccountsDocumento20 páginasTypes of Bank AccountsNisarg Khamar73% (11)

- SBLC Rwa JMR Solutions LTD 20220318Documento5 páginasSBLC Rwa JMR Solutions LTD 20220318Pedro GonzalezAún no hay calificaciones

- Dena Bank Working Capital and Ratio Analysis VinayDocumento106 páginasDena Bank Working Capital and Ratio Analysis Vinayविनय गुप्ता75% (4)

- Regional Rural Banks of India: Evolution, Performance and ManagementDe EverandRegional Rural Banks of India: Evolution, Performance and ManagementAún no hay calificaciones

- Icse Mathematics Project: Class-10Documento13 páginasIcse Mathematics Project: Class-10Manju Yadav100% (1)

- Types of Bank DepositeDocumento4 páginasTypes of Bank DepositeShailendrasingh DikitAún no hay calificaciones

- Neta Ji Subhash Chandra BoseDocumento18 páginasNeta Ji Subhash Chandra BoseShabi HameedAún no hay calificaciones

- BRPD Circular No 05Documento14 páginasBRPD Circular No 05Iftekhar Ifte100% (1)

- Different Borrowers Types ExplainedDocumento15 páginasDifferent Borrowers Types Explainedmevrick_guyAún no hay calificaciones

- Functions of Central and Commercial BanksDocumento11 páginasFunctions of Central and Commercial BanksDeepjyotiAún no hay calificaciones

- Credit Information Bureaue (India) LTDDocumento14 páginasCredit Information Bureaue (India) LTDMayank JainAún no hay calificaciones

- Survey of Various Type of Bank AccountsDocumento8 páginasSurvey of Various Type of Bank AccountsAnuradha Mayanikar100% (1)

- Home Loans in Banking Sector ReportDocumento17 páginasHome Loans in Banking Sector ReportMohmmedKhayyumAún no hay calificaciones

- 50 Years of Bank NationalisationDocumento16 páginas50 Years of Bank NationalisationIshita DongreAún no hay calificaciones

- Policy On Loan Classification and ProvisioningDocumento8 páginasPolicy On Loan Classification and Provisioningrajin_rammsteinAún no hay calificaciones

- Commercial Application ProjectDocumento12 páginasCommercial Application ProjectMridul MoolchandaniAún no hay calificaciones

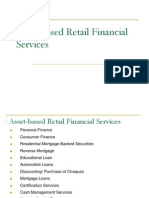

- Asset Retail Financial ServicesDocumento37 páginasAsset Retail Financial Servicesjimi02100% (1)

- Name: Arpita SengarDocumento69 páginasName: Arpita Sengartripti48Aún no hay calificaciones

- Tandon Committee's recommendations for bank lending normsDocumento17 páginasTandon Committee's recommendations for bank lending normsGayathri TAún no hay calificaciones

- Private Sector BanksDocumento3 páginasPrivate Sector BanksBalaji GajendranAún no hay calificaciones

- Financial ManagementDocumento13 páginasFinancial ManagementSunny KesarwaniAún no hay calificaciones

- Kotak Mahindra Bank Loans GuideDocumento15 páginasKotak Mahindra Bank Loans GuideEr Dipankar SaikiaAún no hay calificaciones

- Banking Maths ProjectDocumento16 páginasBanking Maths ProjectAakash Sarkar60% (5)

- Fixed DepositDocumento37 páginasFixed DepositMinal DalviAún no hay calificaciones

- Maths Project On Home BudgetDocumento10 páginasMaths Project On Home BudgetKatyayni KohliAún no hay calificaciones

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocumento3 páginasInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingS100% (2)

- BCom Banking and InsuranceDocumento106 páginasBCom Banking and InsuranceUtsav SinhaAún no hay calificaciones

- Reverse Mortgage in IDBI BANKDocumento66 páginasReverse Mortgage in IDBI BANKMohmmad SameemAún no hay calificaciones

- Commercial Banks in IndiaDocumento29 páginasCommercial Banks in IndiaVarsha SinghAún no hay calificaciones

- Functions of Commercial Banks ReportDocumento14 páginasFunctions of Commercial Banks ReportAryan Khan50% (2)

- Central Bank and Its FunctionsDocumento7 páginasCentral Bank and Its FunctionsayushAún no hay calificaciones

- Government Sponsored SchemesDocumento5 páginasGovernment Sponsored SchemesClassicaverAún no hay calificaciones

- Loans and AdvancesDocumento18 páginasLoans and AdvancesAnupam RoyAún no hay calificaciones

- SBI Home Loan FinalDocumento13 páginasSBI Home Loan Finalnikita_8100% (2)

- Chapter-1: N.R.K&K.S.R Gupta Degree College, TenaliDocumento58 páginasChapter-1: N.R.K&K.S.R Gupta Degree College, TenaligupthaAún no hay calificaciones

- Questionnaire For Education LoanDocumento1 páginaQuestionnaire For Education LoanrjasmeetgiftyAún no hay calificaciones

- FCCBDocumento8 páginasFCCBRadha RampalliAún no hay calificaciones

- Loans &advances (Mantu) - Project - 1-2Documento48 páginasLoans &advances (Mantu) - Project - 1-2Shivu BaligeriAún no hay calificaciones

- Bank Finance For Working CapitalDocumento12 páginasBank Finance For Working CapitalAjilal KadakkalAún no hay calificaciones

- Credit Appraisal Project-School WorkDocumento85 páginasCredit Appraisal Project-School WorkMahadev SubramaniAún no hay calificaciones

- Ch3. Money and CreditDocumento30 páginasCh3. Money and CreditGarima GoelAún no hay calificaciones

- Origin of BankingDocumento6 páginasOrigin of BankingamaznsAún no hay calificaciones

- The Functions of SBIDocumento3 páginasThe Functions of SBISUDARSHAN100% (1)

- Banking and InsuranceDocumento11 páginasBanking and InsuranceGanpat SoundaleAún no hay calificaciones

- Explain The Rationale For The Nationalization of BanksDocumento13 páginasExplain The Rationale For The Nationalization of Bankssanjay parmarAún no hay calificaciones

- Financing Working Capital - Naveen SavitaDocumento7 páginasFinancing Working Capital - Naveen SavitaMurli SavitaAún no hay calificaciones

- IAPM AssignmentDocumento8 páginasIAPM AssignmentgusheenaroraAún no hay calificaciones

- Unit-3 Types of Bank Accounts: E.g:-2-In-1 Deposits, Smart Deposits, Power Saving DepositsDocumento20 páginasUnit-3 Types of Bank Accounts: E.g:-2-In-1 Deposits, Smart Deposits, Power Saving DepositschandrikaAún no hay calificaciones

- MCOM 1 ADV Costing PaperDocumento3 páginasMCOM 1 ADV Costing PaperPrashant SawantAún no hay calificaciones

- MCOM 1 ADV Costing PaperDocumento3 páginasMCOM 1 ADV Costing PaperPrashant SawantAún no hay calificaciones

- Education Loan Scholarship GuideDocumento14 páginasEducation Loan Scholarship GuideParitosh PragyaAún no hay calificaciones

- Education Loans in India - Frequently Asked QuestionsDocumento3 páginasEducation Loans in India - Frequently Asked QuestionsPrashant SawantAún no hay calificaciones

- Pristine-FRM Part I BrochureDocumento2 páginasPristine-FRM Part I BrochureSharoot BhardwajAún no hay calificaciones

- Vaish College of Education, Rohtak: PPT On BankingDocumento10 páginasVaish College of Education, Rohtak: PPT On BankingSuraj NagpalAún no hay calificaciones

- HDFC Bank 20072020 IciciDocumento15 páginasHDFC Bank 20072020 IciciVipul Braj BhartiaAún no hay calificaciones

- Development BankingDocumento7 páginasDevelopment BankingBenjamin KimaniAún no hay calificaciones

- Sample Mock Call SimulationDocumento3 páginasSample Mock Call SimulationEchoAún no hay calificaciones

- Bank Reconciliation StatementDocumento7 páginasBank Reconciliation StatementAhmed DeoAún no hay calificaciones

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Documento3 páginas18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.Aún no hay calificaciones

- List of Relevant Master Circulars - 5Documento4 páginasList of Relevant Master Circulars - 5booksanand1Aún no hay calificaciones

- o 9 PFZPD CK5 LCFV ZNDocumento14 páginaso 9 PFZPD CK5 LCFV ZNBHUNES GABLEAún no hay calificaciones

- Application Form JaysreeDocumento11 páginasApplication Form Jaysreedaniella farishaAún no hay calificaciones

- Bookkeeping NC III Accounting Recording Process: JournalizingDocumento3 páginasBookkeeping NC III Accounting Recording Process: JournalizingLav Casal CorpuzAún no hay calificaciones

- Group 1 (Roll No. 1,3,4,5,6,7,8)Documento13 páginasGroup 1 (Roll No. 1,3,4,5,6,7,8)Prince JoshiAún no hay calificaciones

- Management of Short Term Assets and Liabilities by P.rai87@gmailDocumento22 páginasManagement of Short Term Assets and Liabilities by P.rai87@gmailPRAVEEN RAI100% (4)

- Improving Agribank's International Debit Card ServicesDocumento32 páginasImproving Agribank's International Debit Card ServicesLe duc NghiaAún no hay calificaciones

- Details of The Unclaimed Dividends (Upto FY Ended 31.03.2018) For The AGM Held On August 02 2018Documento345 páginasDetails of The Unclaimed Dividends (Upto FY Ended 31.03.2018) For The AGM Held On August 02 2018Md. Mehedi HasanAún no hay calificaciones

- Brazil and India Payment SystemDocumento6 páginasBrazil and India Payment SystemRahul SinghAún no hay calificaciones

- Exercise - Week 7Documento7 páginasExercise - Week 7Precious MarksAún no hay calificaciones

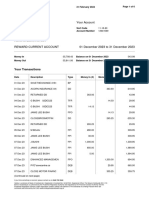

- E-STATEMENT SUMMARYDocumento16 páginasE-STATEMENT SUMMARYRifal Rafiudin RestuAún no hay calificaciones

- Statement 12 2023Documento6 páginasStatement 12 2023bgazi4888Aún no hay calificaciones

- 1 BanksDocumento6 páginas1 BanksRajni KumariAún no hay calificaciones

- 213-C-46295-Assignment Acc Xi BrsDocumento7 páginas213-C-46295-Assignment Acc Xi BrsMannatAún no hay calificaciones

- Final Examination Principles of Finance (DPF 24153)Documento9 páginasFinal Examination Principles of Finance (DPF 24153)USHA PERUMALAún no hay calificaciones

- The evolution of the Romanian banking system 2007-2015Documento16 páginasThe evolution of the Romanian banking system 2007-2015TV Series RoAún no hay calificaciones

- Proposal Final Edited FinalDocumento22 páginasProposal Final Edited FinalNyakoojo simonAún no hay calificaciones

- Chapter 6 - Business Transactions Their AnalysisDocumento10 páginasChapter 6 - Business Transactions Their Analysisgeyb awayAún no hay calificaciones

- Banking Sector in India: BY Divyabharathi (109) Vamsiprakash (110) DEEPAK (111) Goutham Reddy (112) HEMALATHADocumento31 páginasBanking Sector in India: BY Divyabharathi (109) Vamsiprakash (110) DEEPAK (111) Goutham Reddy (112) HEMALATHAamulrocksAún no hay calificaciones

- Cash and Cash EquivalentsDocumento3 páginasCash and Cash EquivalentsMae Richelle D. DacaraAún no hay calificaciones

- Indonesian Rupiah Falls To Record Low Amid Rising PressuresDocumento1 páginaIndonesian Rupiah Falls To Record Low Amid Rising Pressuresalex hudionoAún no hay calificaciones