Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Rare Earth Facts

Cargado por

gzb012Descripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Rare Earth Facts

Cargado por

gzb012Copyright:

Formatos disponibles

Background Paper Rare Earths Last update: January 2011 ------------------------------------------

Rare Earths Facts & Figures

The European Commission ranked 14 raw materials as the most critical metals as part of the activities of the Raw Materials Initiative. This group of 14 raw materials contains the whole group of the rare earths elements. Rare earths are used today in the production of many consumer goods such as computers, LCD screens and digital cameras as well as in green technologies such as wind turbines, electric cars and energy efficient lighting. The group of the rare earth elements is sub-divided in the heavy rare earth elements (HREE) and the light rare earth elements (LREE):

Heavy rare earth elements (HREE)

ko-Institut e.V. Berlin Office Schicklerstrae 5-7 10179 Berlin Germany Public Relations & Communications Mandy Schoig tel.: +49 (0) 30 - 40 50 85-334 e-mail: m.schossig@oeko.de

Y

yttrium

Gd

gadolinium

Tb

terbium

Dy

dysprosium

Ho

holmium

Er

erbium

Tm

thulium

Yb

ytterbium

Lu

lutetium

Light rare earth elements (LREE)

Sc

scandium

La

lanthanum

Ce

cerium

Pr

praseodymium

Nd

neodymium

Pm

promethium

Sm

samarium

Eu

europium

1. Rare Earths Reserves and Mine Production Worldwide

The U.S. Geological Survey (USGS) estimates the global reserves of the sum of all rare earth oxides which could be economically extracted in future to be at 99,000,000 tons. The global production in 2009 is estimated be 124,000 tons. Overview of current and planned short-term mine production as well as further large deposits

Mine production 2009

Production planned in the short term

Further large deposits

4

Though China produces more than 95 percent of the global production, their share of the reserves is much lower at 38 percent. The main reserves outside of China occur in the United States, Australia, the states of the former Soviet Union and other states as shown in the next figure.

Global rare earth reserves by country (in million tons; data from USGS 2010)

other countries* 22 Mio t 22% India 3 Mio t 3%

United States 13 Mio t 13%

Australia 5,4 Mio t 5%

Former Soviet Union 19 Mio t 19%

China 36 Mio t 38%

* Other countries: Canada, Greenland, Brazil, Malaysia, South Africa, Malawi, Vietnam

World Mine production of rare earths in 2009 (USGS 2010)*

Country China India Brazil Malaysia Kyrgyzstan Total tons of rare earth oxide (REO) 120,000 2,700 650 380 n.d. 124,000 Share 97 % 2.1 % 0.5 % 0.3 % 100 %

* These data from USGS do not include the illegal Chinese production of up to 20,000 t and smaller Russian production volumes.

At present, only few amounts of rare earths are coming from other countries than China. Due to the high demand for rare earths and the decreasing Chinese exports, there are many activities aiming at the opening of new mines outside of China. The most advanced mining projects outside of China are: the re-opening of the Mountain Pass mine in California (Molycorp Minerals) and the new rare earth mine at Mt Weld in Australia (Lynas) with processing in Malaysia.

2. Environmental aspects of rare earth mining

The main environmental risk in rare earth mining are the huge amounts of tailings, which are a toxic waste being stored in artificial ponds surrounded by the tailing dam. A dam failure as it happened in Hungary in 2010 to the tailings from an alumina factory leads to destructive sitespecific emissions such as thorium, uranium, heavy metals, acids and fluorides. Furthermore, most rare earth deposits contain radioactive materials which impose the risk of radioactive dust and water emissions.

Risks of rare earth mining without or with insufficient environmental protection systems

Leachate into groundwater (site-specific, e.g. heavy metals, arsenic, fluorides, sulphides, thorium, uranium) Leachate into groundwater (site-specific; e.g. heavy metals, sulphides, thorium)

Risk of dam Collapse by

Poor construction Overtopping Seismic events

Dust (site-specific, e.g. with heavy metals, thorium, uranium)

Rain water

Waste rock storage

land use

Rain water

Tailings (impoundment areas) land use Air Waste emission water

Mining

(<1-10% REO)

Milling Ores with low concentration

Flotation

(~30-70% REO)

Further processing

land use

concentrate chemicals

The Chinese government intends to reduce the environmental harm in the coming years by installing environmental technologies in the large mines and by reducing the numerous small illegal mines. China also aims at higher efficiencies in mining and processing and is running some research projects on a sustainable rare earth economy. The most advanced mine projects outside China at the Mountain Pass in the United States and at Mt. Weld in Australia will provide environmental protection systems. However, the global pressure for a cheap and steady rare earth supply might lead to further new mines outside of China with inacceptable environmental standards. One example of potential concern about environmental damage is the plan for a joint mining of uranium and rare earths in Greenland. The interested mining company intends to store the tailings in a natural lake with connection to maritime waters.

3. Exports, Imports, Processing and Applications

The export volume of rare earths from China increased gradually from 1979 until 2006, where the volume reached a peak with 57,400 tons and then declined from 2007 onwards. In 2010 the export rates decreased by 29 percent compared to 2008. Additionally, illegal exports from China amount up to 20,000 tons per year. The major importers of rare earth compounds in 2008 were Europe, USA and Japan. The figures mean a total of 78,000 tons of imported rare-earth compounds in 2008. Hereby, around 90 % are imported from China.

Imports Share of imports from China 90 %1 Compounds included in the statistic Data source Eurostat 2010 USGS 2010c Trade Statistics Japan 2010

EU 27

23,013 t

USA

20,663 t

91 %

Metals, intermixtures or interalloys of rare-earths, Sc and Y Compounds of rare-earth metals, mixtures of these metals, Y or Sc Rare-earth and Y compounds, Rare-earth metals, Mixtures of rare-earth chlorides, Ferrocerium and other pyrophoric alloys Cerium-, Lanthanum- and Yttrium Oxide, other cerium compounds, others

Japan

34,330 t

91 %

Imports of rare earth compounds by the European member states

(from outside the EU-27)

BELGIUM 2%

SPAIN 2% UNITED KINGDOM 8% GERMANY 8%

ITALY 2% FRANCE 38%

NETHERLANDS 16%

AUSTRIA 24%

European companies importing rare earth components are mainly involved in manufacturing processes for semi-finished or finished products which contain rare earths like magnets, alloys, automotive catalysts etc. Most of the core rare earth refining and processing activities are located in China and some small-scale processing is done in Japan. One example for the dominance of the Chinese rare earth processing is the fact that China is the only country holding production capacities for all stages of the permanent magnet production chain.

The statistics from Eurostat provides no data on the origin of the imports to Austria. The share of Chinese imports to total imports of all EU-27 members besides Austria is 90%.

Main application fields of rare earths

- Water treatment - Pigments - Fertiliser - Nuclear technology - Defence

- Energy efficient lighting - LED - LCD - Plasma display - Laser

- Automotive catalysts - Catalysts in refining and chemical processing - Diesel additive

Ce La Ce La Eu Tb Y Gd Others

Pr

Nd

Phosphors, Luminescence

Catalysts

Magnets

Nd Pr Sm La Tb Dy

- Motors and generators Wind turbines Electric vehicles Hybrid vehicles - Hard Discs - MRI - Speakers - Magnetic cooling

Metal alloys / batteries La Ce Pr Nd

Sm Sc

Glass, Polishing, Ceramics Ce La Y

Pr Nd

- Alloys for steel and iron casting - Super alloys - Flint ignition devices - NiMH-battery - Fuel cell - H2-storage - Light weight construction

- Polishing compounds - Colouring and decolouring agent in glass - Stabilizer in ceramics - Ceramic capacitors - UV adsorption

A closer look: rare earths in wind turbines

Rare earths are part of neodymium magnets (Nd-magnets). These permanent magnets are the strongest available magnets and can be used in generators of wind turbines. 14 percent (or about 1/6) of newly installed wind turbines on the market already use Nd-magnets. They work without gear, which makes them robust and a good candidate for off-shore applications. In 2010, the global capacity of wind power was already 175 GW. For the future use of rare earths, the global growth rate of wind turbines is a crucial driver The next figure shows the newly installed wind power capacity in the first half of 2010 (WWEA 2010):

USA

1 200 MW 8%

Rest of the World

3 790 MW 23%

France

500 MW 3%

Italy

450 MW 3%

India

1 200 MW 8% Spain 400 MW 3%

China Germany

660 MW 4% 7 800 MW 48%

Already now, almost half of the new capacities are implemented in China and Chinese wind power is expected to grow further tremendously. To date it is not clear which direction the technology development will take. The potential supply shortages of terbium, dysprosium and neodymium might slow down the dissemination of turbines with neodymium magnets and might lead to a shift to alternative turbine types. A reinforced research on a higher reliability of traditional techniques with gear would support this substitution. Furthermore, a higher efficiency in the whole magnet production chain as well as recycling from used magnets could contribute to a sustainable use of these valuable raw materials.

4. Development of Prices

The figures below show a moderate price development until the end of 2009 and the steep increase due to the increasing global demand and the reduction of Chinese exports in the second half of 2010. The steep price increase does not only affect the rare earths for which supply shortages are forecasted but also less scarce elements such as cerium.

Price development of selected cheap REE (Oxide) in recent years

90 80 70 Price ($/kg) 60 50 40 30 20 10 0 Jun 2001 01 Jun 2002 02 Jun Jun 2003 2004 03 04 Jun Jun 2005 2006 05 06 Jun Jun 2007 2008 07 08 Jun 2009 09 Jun 2010 10

Nov 10

Nd Ce La

Price development of selected expensive REE (Oxide) in recent years

Price development of HREE in recent years 800 700 600 Price ($/kg)

Price ($/kg)

Nov 10

500 400 300 200 100 0 2001 Jun 01

Tb Eu Dy

2002 Jun 02 2003 2004 Jun Jun 03 04 2005 2006 2007 2008 2009 Jun Jun Jun Jun Jun 05 06 07 08 09 2010 Jun 10

5. Strategy for a sustainable rare earth economy

The expected supply shortages of up to seven rare earth elements (dysprosium, europium, lanthanum, neodymium, praseodymium, terbium, yttrium) until 2014 and the current high prices provide for the first time the incentive to promote an efficient use of rare earths, to develop substitution options and to implement a recycling scheme for rare earths in Europe. Building-up a recycling scheme provides a number of advantages: The secondary rare earths potential arises in Europe Lower dependency on foreign material supply Building up of know-how on rare earth processing No radioactive wastes arising in secondary rare earth processing Environmental benefits concerning air emissions, groundwater protection, acidification, eutrophication and climate protection

Eight steps towards an efficient rare earths recycling

1) Establishment of a European Competence Network on Rare Earths with all relevant stakeholders such as recyclers, manufacturers, public authorities, politicians and researchers is essential for a successful implementation. 2) Start of basic research activities in order to gain knowledge about rare earth refining and processing in Europe and become more independent from Asia. 3) Start a European Material Flow Analysis to close significant data gaps and to gain a broader knowledge on the material flows in Europe related to rare earths. 4) Identification of initial products to be recycled, e.g. waste from the magnet and lighting production, magnets from used electric motors, used lamps and displays, reuse of large magnets and spent catalysts. 5) Design of collection and pre-treatment schemes for rare earth containing waste which have to be integrated in already implemented waste management procedures. 6) Development of pilot recycling plants necessary for learning on complex recycling processes. This also comprises research activities. 7) Correspond to financial issues: The long-term investment in recycling plants as well as the uncertainty of the future price development for primary rare earths bears high risks for investors. The European Investment Bank (EIB) could reduce large risks for investors. 8) Creation of a legal framework: Screening on gaps in legal framework concerning existing recycling schemes and adaptation of the legal EU framework in order to optimize post consumer rare earths recycling. If we start now, we can implement an efficient European recycling scheme for rare earths within a minimum of five to ten years. For further information please contact:

Dr. Doris Schler Division Infrastructure & Enterprises ko-Institut e.V. Darmstadt office e-mail: d.schueler@oeko.de www.oeko.de www.resourcefever.org

ko-Institut is a leading European research and consultancy institute working for a sustainable future. Founded in 1977, the institute develops principles and strategies for realising the vision of sustainable development globally, nationally and locally. 7

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Environmental Impact Assessment by L.W. CanterDocumento38 páginasEnvironmental Impact Assessment by L.W. CanterDewi Hadiwinoto33% (9)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Climbing Film EvaporatorDocumento8 páginasClimbing Film Evaporatorsaz140% (1)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Laserline Alarm Mod 996Documento12 páginasLaserline Alarm Mod 996John Ha100% (1)

- Methods of Coal StackingDocumento2 páginasMethods of Coal StackingJulio César Párraga CurielAún no hay calificaciones

- SICON-4000MZi in English (Rev1 8) PDFDocumento116 páginasSICON-4000MZi in English (Rev1 8) PDFAdjie89% (9)

- Speech Processing PDFDocumento12 páginasSpeech Processing PDFgzb012Aún no hay calificaciones

- T.V. AntennasDocumento11 páginasT.V. Antennasgzb012Aún no hay calificaciones

- 05739208Documento6 páginas05739208gzb012Aún no hay calificaciones

- Parabolic AntennaDocumento10 páginasParabolic Antennagzb012Aún no hay calificaciones

- Laplace Transforms Chapter 2 DykeDocumento12 páginasLaplace Transforms Chapter 2 Dykegzb012Aún no hay calificaciones

- Protecting Digital Content PDFDocumento14 páginasProtecting Digital Content PDFgzb012Aún no hay calificaciones

- Design WCDMA UE PDFDocumento12 páginasDesign WCDMA UE PDFgzb012Aún no hay calificaciones

- Performance Evaluation of Galois Field Arithmetic Operators For Optimizing Reed Solomon CodecDocumento6 páginasPerformance Evaluation of Galois Field Arithmetic Operators For Optimizing Reed Solomon Codecgzb012Aún no hay calificaciones

- Quadratic ResiduesDocumento5 páginasQuadratic Residuesgzb012Aún no hay calificaciones

- Accurate BER Analysis of Orthogonal Space-Time Block Codes With MMSE Channel EstimationDocumento6 páginasAccurate BER Analysis of Orthogonal Space-Time Block Codes With MMSE Channel Estimationgzb012Aún no hay calificaciones

- Capacity Evaluation of Cellular CDMA: Q Ang WangDocumento8 páginasCapacity Evaluation of Cellular CDMA: Q Ang Wanggzb012Aún no hay calificaciones

- Complex Simulation Model of Mobile Fading Channel: Tomáš Marek, Vladimír Pšenák, Vladimír WieserDocumento6 páginasComplex Simulation Model of Mobile Fading Channel: Tomáš Marek, Vladimír Pšenák, Vladimír Wiesergzb012Aún no hay calificaciones

- High-Speed Serial I/O Made Simple: A Designers' Guide, With FPGA ApplicationsDocumento210 páginasHigh-Speed Serial I/O Made Simple: A Designers' Guide, With FPGA ApplicationseliomayAún no hay calificaciones

- MIMO ReceiverDocumento32 páginasMIMO Receivergzb012Aún no hay calificaciones

- Analyst CornerDocumento5 páginasAnalyst Cornergzb012Aún no hay calificaciones

- The Impact of Channel Estimation Errors On Space-Time Block CodesDocumento26 páginasThe Impact of Channel Estimation Errors On Space-Time Block Codesgzb012Aún no hay calificaciones

- MTGP Slide Mcqmc2Documento35 páginasMTGP Slide Mcqmc2gzb012Aún no hay calificaciones

- FFT 5Documento36 páginasFFT 5putih_138242459Aún no hay calificaciones

- Software Defined RadioDocumento6 páginasSoftware Defined Radiogzb012Aún no hay calificaciones

- Bandlimited Intensity ModulationDocumento28 páginasBandlimited Intensity Modulationgzb012Aún no hay calificaciones

- Lambert W-Function: Problem: W e X, Find W (X) - ? Solution: The Lambert W-FunctionDocumento16 páginasLambert W-Function: Problem: W e X, Find W (X) - ? Solution: The Lambert W-Functiongzb012Aún no hay calificaciones

- Convergence of Lte and WimaxDocumento11 páginasConvergence of Lte and Wimaxgzb012Aún no hay calificaciones

- Power Control Algorithms in Wireless CommunicationDocumento19 páginasPower Control Algorithms in Wireless Communicationgzb012Aún no hay calificaciones

- The Superhet ReceiverDocumento8 páginasThe Superhet Receivergzb012Aún no hay calificaciones

- Elements of Detection TheoryDocumento28 páginasElements of Detection Theorygzb012Aún no hay calificaciones

- Ohms LawDocumento9 páginasOhms Lawapi-225496804Aún no hay calificaciones

- Digital Modulation I August09Documento14 páginasDigital Modulation I August09gzb012Aún no hay calificaciones

- Antennas and Transmission LİnesDocumento40 páginasAntennas and Transmission LİnesSelvi ÖnkoyunAún no hay calificaciones

- Impulse Response Measurement ToolboxDocumento28 páginasImpulse Response Measurement Toolboxgzb012Aún no hay calificaciones

- DiffractionDocumento36 páginasDiffractiongzb012Aún no hay calificaciones

- CAT 777G FiltersDocumento3 páginasCAT 777G FiltersettoscarAún no hay calificaciones

- 092 M-002 Mechanical Symbols and LegendsDocumento1 página092 M-002 Mechanical Symbols and Legendseuri08Aún no hay calificaciones

- Chapter 11 - Valves and Actuators With The NAMUR-InterfaceDocumento13 páginasChapter 11 - Valves and Actuators With The NAMUR-InterfaceJoseph MagonduAún no hay calificaciones

- 8.13 - Glycol Heat Tracing 11Documento1 página8.13 - Glycol Heat Tracing 11Greg EverettAún no hay calificaciones

- 25 SP650 1 MS Series SeparatorsDocumento2 páginas25 SP650 1 MS Series SeparatorsLa Ode AdhanAún no hay calificaciones

- Hazardous Area Classification: Codes of Practice and StandardsDocumento13 páginasHazardous Area Classification: Codes of Practice and StandardsborrowmanaAún no hay calificaciones

- Design 8 ConsheetDocumento7 páginasDesign 8 ConsheetEryl David BañezAún no hay calificaciones

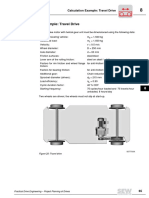

- Travel Drive ExampleDocumento10 páginasTravel Drive Examplep-nicoAún no hay calificaciones

- Engine Oil CoolerDocumento2 páginasEngine Oil Coolerma.powersourceAún no hay calificaciones

- Bazam Company ProfileDocumento30 páginasBazam Company ProfileIbrahimrashid Billow HusseinAún no hay calificaciones

- Issue 3 Battery Talk Exploding BatteriesDocumento2 páginasIssue 3 Battery Talk Exploding BatterieseigersumarlyAún no hay calificaciones

- Municipal Solid Waste Project SKTGDocumento3 páginasMunicipal Solid Waste Project SKTGDevanSandrasakerenAún no hay calificaciones

- Hphysics5 Roller Coaster Marbles Lab Report Jose GallardoDocumento1 páginaHphysics5 Roller Coaster Marbles Lab Report Jose Gallardoapi-345842338Aún no hay calificaciones

- BEKON Broschure en WebDocumento7 páginasBEKON Broschure en WebEko TjahjantokoAún no hay calificaciones

- The Nine Billion Names of GodDocumento6 páginasThe Nine Billion Names of GodJason MeyerAún no hay calificaciones

- Looksfam EngineersDocumento70 páginasLooksfam EngineersJohn PingkianAún no hay calificaciones

- SVAT Model IntroductionDocumento29 páginasSVAT Model IntroductionChamila DiasAún no hay calificaciones

- H1000e 6Documento472 páginasH1000e 6GesAún no hay calificaciones

- RVSDX Instruction Manual 23.09.2012Documento60 páginasRVSDX Instruction Manual 23.09.2012edgarcooAún no hay calificaciones

- Sowinkumar Namel A/l Nagarajan (Ee095367) Raneej A/l Sukumaran (Ee095356) Section 4 Bench 05Documento2 páginasSowinkumar Namel A/l Nagarajan (Ee095367) Raneej A/l Sukumaran (Ee095356) Section 4 Bench 05Sowin HustleAún no hay calificaciones

- Fuel, Lubricants and Fluids: en-GBDocumento59 páginasFuel, Lubricants and Fluids: en-GBRuanAún no hay calificaciones

- Electromagnetic Induction: Theory and Exercise BookletDocumento62 páginasElectromagnetic Induction: Theory and Exercise Bookletabc9999999999Aún no hay calificaciones

- Classical Mechanics Problem SetDocumento1 páginaClassical Mechanics Problem SetDevanshu GargAún no hay calificaciones

- Domestic RobotDocumento58 páginasDomestic RobotAshMere MontesinesAún no hay calificaciones

- Nhce Hydraulic Excavator E505c EvoDocumento4 páginasNhce Hydraulic Excavator E505c EvoYew LimAún no hay calificaciones