Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Leading With Passion and Imagination: CEO Message 2011 Financial Statements

Cargado por

Noman ShaikhDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Leading With Passion and Imagination: CEO Message 2011 Financial Statements

Cargado por

Noman ShaikhCopyright:

Formatos disponibles

Leading with Passion and Imagination

CEO Message 2011 Financial Statements

www.samsungengineering.com 500 Samsung GEC, Samgil-dong, Gangdong-gu, Seoul, 134-090, Korea Tel. +82-2-2053-3000

CEO Message

We are a force with no boundaries, rising above client expectations while creating a visionary future.

CEO Message

2011 Financial Statements

Record financial results and the groundwork for sustainable growth

Thanks to our extensive efforts in 2011, Samsung Engineering achieved impressive and historic financial results of 9,298.2 billion won in sales, 687 billion won in pre-tax profits and 514.5 billion won in net profit. Our sustainable growth has continued this year according to our strategic plans. We are now working closely with our new client ExxonMobil, and we have established GOSP as one of our main hydrocarbon services. Simultaneously we were awarded many power plant projects. In terms of geographical coverage, Samsung Engineering entered the Qatar, Iraq and Uzbekistan market for the very first time. In 2012 we are targeting 16 trillion won in new orders and 11.5 trillion won in sales. By continuously developing new markets and expanding product portfolio, we are looking forward to achieving this goal.

We must enhance our global operation and upgrade our management system. Our headquarters should be able to handle large-scale projects, while our international branch offices deliver the smaller and medium-sized projects. We will work towards closer collaborations between the head office and our global offices using the strength of our integrated management system. We will increase employee capabilities and skills and solidify a strong organizational culture. To this end, more core job groups will be added and the pool of functional experts will be broadened. This will be supported by an organization culture rooted with a challenging spirit as we create and pursue future value for our clients.

Your confidence in us comes first

Samsung Engineering will be a company that values your trust. We will never take your interest and trust granted, because we know your support is what makes us pursue a sustainable and visionary future. Thank you.

Leading in the midst of change

The global economy is still on a slow road to recovery, as we navigate through the European financial downturn and fierce competition in our industry. We are confident that Samsung Engineering will turn this crisis into an opportunity as a true leader amongst engineering firms. Under the same motto of 'taking a new challenge through creativeness and innovation', we will embrace our new motto 'lead the change of a new competition paradigm'. The following is how we plan to keep sustainable growth. First our priority is to invest in the skills and expertise that will support our new business areas, the areas that we believe will drive our future growth. We will focus on successfully completing our current projects and continuously increase our service offerings. We will work towards further cost competitiveness by stronger project management and execution initiatives. Our profit margins will continuously improve as we will minimize COPQ and carry out work in procurement and construction in an effective way. Although we already have a reputation for our competitive pricing, we will pursue even greater value for our clients.

Ki-Seok Park

President & CEO

2011 Financial Statements

Consolidated Statements of Financial Position

December 31, 2011 and 2010 in thousands of U.S dollars Period 45 (current term) Period 44 (previous term)

Consolidated Statements of Income

Years ended December 31, 2011 and 2010 in thousands of U.S dollars Period 45 (current term) Period 44 (previous term)

Consolidated Statements of Cash Flows

Years ended December 31, 2011 and 2010 in thousands of U.S dollars Period 45 (current term) Period 44 (previous term)

Assets I. Current assets II. Non-current assets Total assets Liabilities I. Current liabilities II. Non-current liabilities Total liabilities Equity attributable to owners of the Parent I. Capital stock II. Consolidated surplus III. Retained earnings IV. Other reserve Non-controlling interest Total equity Total liabilities and equity

I. Revenues

8,062,242 7,126,914 935,328 398,621 290,068 204,851 621,924 31 55,410 81,668 595,697 149,566 446,131

4,606,140 3,903,483 702,657 331,023 163,061 177,240 357,455 60,153 19,599 398,009 106,133 291,876

I. Cash flow from operating activities 1. Cash generated from operations 2. Interest received 3. Interest paid 4. Dividends received 5. Income tax paid Net cash generated from operating activities II. Cash flows from investing activities 1. Proceeds from disposal of property, plant and equipment 2. Proceeds from disposal of intangible assets 3. Decrease of deposits 4. Net increase of current financial assets 5. Collection of current portion of held-to-maturity financial assets 6. Proceeds from disposal of available-for-sale financial assets

3,604,287 894,642 4,498,929 3,160,359 199,788 3,360,147 173,415 49,098 1,177,798 (229,203) (32,326) 1,138,782 4,498,929

2,455,324 609,675 3,064,999

II. Cost of sales III. Gross profits 1. Administrative expenses 2. Other operating income

209,397 34,623 (9,702) 1,379

(83,551)

225,484 28,274 (3,084) 1,505 (67,935) 184,244

2,087,910 150,458 2,235,368

3. Other operating expenses IV. Operating profit 1. Share of profit of associates 2. Finance income

152,146 2,106 1,034

39,286 407,206 832 32,747 8 (87) (231,870) (8,833) (158,163) (5,473)

1,222 341 30,562 53,549 1,170 49 (1,127) (548) (262) (297) (147,250) (8,114) (40,268) (110,973)

173,415 49,098 813,160 (171,240) (34,802) 829,631 3,064,999

3. Finance costs V. Profit before income tax Income tax expense VI. Profit for the year VII. Profit attributable to 1. Owners of the parent 2. Non-controlling interests

445,036 1,095

294,195 (2,319)

7. Decrease of other non-current assets 8. Acquisition of available-for-sale financial assets 9. Proceeds from subsidiary

These financial statements serve as a general overview, which were audited by Pricewaterhouse Coopers. Based on Korean GAAP, these financial statements include companies with over 10 billion KRW in assets as of the end of last year, which can differ from the companys performance written in this book. For details, please go to our website or check the electronic public announcement online. Financial Supervisory Services electronic public announcement system - http://dart.fss.or.kr

USD 1 dollar Period 45 (current term) Period 44 (previous term)

10. Acquisition of held-to-maturity financial assets 11. Acquisition of shares of associates 12. Acquisition of property, plant and equipment 13. Acquisition of intangible assets 14. Increase of deposits 15. Increase of other non-current assets Net cash used in investing activities III. Cash flows from financing activities 1. Proceeds from exercise of share options 2. Acquisition of subsidiary 3. Net decrease from borrowings 4. Dividends paid 5. Acquisition of treasury stock Net cash used in financing activities IV. Changes on cash and cash equivalents due to translating currency V. Net (decrease) / increase in cash and cash equivalents VI. Beginning of the year VII. Exchange gains(losses) on cash and cash equivalents VIII. End of the year

VIII. Earnings per share 1. Basic earnings per share 2. Diluted earnings per share 12.05 12.04 7.83 7.82

78,793 130 52 (14,070) (80,048) (93,936)

2,254

10,827 (65,757) (114,369) (169,299) 616 (95,412) 449,211 537 354,336

139,257 354,376 (8,054) 485,579

También podría gustarte

- Joyglobal 2010 Ar FinalDocumento102 páginasJoyglobal 2010 Ar Finalsteve.zhou.real686Aún no hay calificaciones

- InnoTek Limited 2010 Annual ReportDocumento139 páginasInnoTek Limited 2010 Annual ReportWeR1 Consultants Pte LtdAún no hay calificaciones

- Rafhan AR 2011Documento74 páginasRafhan AR 2011Jawad Munir50% (2)

- Hawkins Annual Report 2012 13Documento32 páginasHawkins Annual Report 2012 13srihariks12Aún no hay calificaciones

- Cash Flow Statement: Segregation of Cash FlowsDocumento7 páginasCash Flow Statement: Segregation of Cash FlowsawedawedAún no hay calificaciones

- Skylim ProposalDocumento9 páginasSkylim ProposalsaikacyberemailAún no hay calificaciones

- Technofab Annual Report - 2011-2012Documento80 páginasTechnofab Annual Report - 2011-2012Kohinoor RoyAún no hay calificaciones

- ZPI Audited Results For FY Ended 31 Dec 13Documento1 páginaZPI Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweAún no hay calificaciones

- Ig Group Annualres - Jul12Documento39 páginasIg Group Annualres - Jul12forexmagnatesAún no hay calificaciones

- Wipro AR 2006 07 Part 2Documento133 páginasWipro AR 2006 07 Part 2Mohammed Usama SheriffAún no hay calificaciones

- Ar14c enDocumento327 páginasAr14c enPinaki MishraAún no hay calificaciones

- Tugas Ke 2Documento2 páginasTugas Ke 2Laras atiAún no hay calificaciones

- MERIT Report LoughboroughDocumento19 páginasMERIT Report LoughboroughSamuel DoyleAún no hay calificaciones

- Arabtec HoldingDocumento4 páginasArabtec HoldingArkar SoeAún no hay calificaciones

- SABIC (Detailed Analysis)Documento17 páginasSABIC (Detailed Analysis)Mirza Zain Ul AbideenAún no hay calificaciones

- Completed Exam - Wall Street PrepDocumento12 páginasCompleted Exam - Wall Street PrepBhagwan BachaiAún no hay calificaciones

- MMDZ Audited Results For FY Ended 31 Dec 13Documento1 páginaMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweAún no hay calificaciones

- Final BUSINESS PLAN FOR CONNS LIMITEDDocumento66 páginasFinal BUSINESS PLAN FOR CONNS LIMITEDOwunari Adaye-Orugbani100% (1)

- Goodland Group Limited Annual Report 2014Documento132 páginasGoodland Group Limited Annual Report 2014WeR1 Consultants Pte LtdAún no hay calificaciones

- Working Capital of Vim Dye ChemDocumento15 páginasWorking Capital of Vim Dye ChemJIGAR SHAHAún no hay calificaciones

- Aberdeen Asset Management PLC - Ar - 09!30!2015Documento168 páginasAberdeen Asset Management PLC - Ar - 09!30!2015Tanu ChaurasiaAún no hay calificaciones

- Larsen and Toubro Infotech LimitedDocumento55 páginasLarsen and Toubro Infotech Limitedlopcd8881Aún no hay calificaciones

- July 15, 2023: Gopalakrish NAN Kothandar AmanDocumento18 páginasJuly 15, 2023: Gopalakrish NAN Kothandar AmangreencafeAún no hay calificaciones

- ST Engineering Annual Report 2015Documento278 páginasST Engineering Annual Report 2015Sassy TanAún no hay calificaciones

- Annual Report 2015 LlyodsDocumento139 páginasAnnual Report 2015 Llyodsratan203Aún no hay calificaciones

- WWW - Dlf.in DLF WCM Connect DLF+AR 03082014Documento204 páginasWWW - Dlf.in DLF WCM Connect DLF+AR 03082014Kanika GuptaAún no hay calificaciones

- AkzoNobel ICI Annual Report 2005 Tcm9-51534Documento162 páginasAkzoNobel ICI Annual Report 2005 Tcm9-51534sggggAún no hay calificaciones

- InnoTek Annual Report 2012 - Overcoming ChallengesDocumento162 páginasInnoTek Annual Report 2012 - Overcoming ChallengesWeR1 Consultants Pte LtdAún no hay calificaciones

- Formulas For Calculating FinanceDocumento61 páginasFormulas For Calculating FinanceRukshar KhanAún no hay calificaciones

- Annual Report - Blue Star Infotech LTDDocumento120 páginasAnnual Report - Blue Star Infotech LTDShashi BhagnariAún no hay calificaciones

- Chapter-1: 1. Industry Scenario 1.1 Macro ProspectiveDocumento52 páginasChapter-1: 1. Industry Scenario 1.1 Macro Prospectivemubeen902Aún no hay calificaciones

- Annual Report 2014 KSB Group DataDocumento176 páginasAnnual Report 2014 KSB Group DataRicardo BarrosAún no hay calificaciones

- Chapter-Two: Financial Planning and ProjectionDocumento6 páginasChapter-Two: Financial Planning and Projectionমেহেদী হাসানAún no hay calificaciones

- 188.ASX IAW Aug 14 2013 18.44 Full Year Financial Result and Dividend AnnouncementDocumento12 páginas188.ASX IAW Aug 14 2013 18.44 Full Year Financial Result and Dividend AnnouncementASX:ILH (ILH Group)Aún no hay calificaciones

- SinoTharwa's Annual Report 08 - EnglishDocumento95 páginasSinoTharwa's Annual Report 08 - EnglishrogerwaterAún no hay calificaciones

- Finance For NonfinanceDocumento35 páginasFinance For Nonfinancelasyboy20Aún no hay calificaciones

- Sample FinancialDocumento35 páginasSample Financialhaznawi100% (1)

- New Microsoft Office Word DocumentDocumento99 páginasNew Microsoft Office Word DocumentYasir KhanAún no hay calificaciones

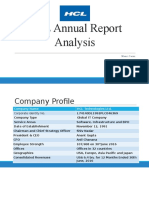

- HCL Annual Report Analysis Final 2015Documento16 páginasHCL Annual Report Analysis Final 2015mehakAún no hay calificaciones

- Detailed Business Plan OutlineDocumento41 páginasDetailed Business Plan OutlineHoang SuperGoatAún no hay calificaciones

- Assignment Lecture 1Documento5 páginasAssignment Lecture 1jaiminAún no hay calificaciones

- RPC Annual Report 2009-2010Documento124 páginasRPC Annual Report 2009-2010Prabhath KatawalaAún no hay calificaciones

- Harmonic LOI For InteQ Oct 7 2022Documento5 páginasHarmonic LOI For InteQ Oct 7 2022shashankAún no hay calificaciones

- Datamatics 2010-11Documento84 páginasDatamatics 2010-11HitechSoft HitsoftAún no hay calificaciones

- Report For The Third Quarter Ended December 31, 2010: Letter To The ShareholderDocumento4 páginasReport For The Third Quarter Ended December 31, 2010: Letter To The ShareholderharikirthikaAún no hay calificaciones

- Adl 13Documento16 páginasAdl 13bhavndAún no hay calificaciones

- Donnan-Exh 6, Exh 7, Exh 8, Exh 9, Exh 10Documento21 páginasDonnan-Exh 6, Exh 7, Exh 8, Exh 9, Exh 10Southern Free PressAún no hay calificaciones

- Ingersoll Rand Annual Report 2012Documento228 páginasIngersoll Rand Annual Report 2012CSRMedia NetworkAún no hay calificaciones

- 2014 Dow Annual Report With 10K PDFDocumento186 páginas2014 Dow Annual Report With 10K PDFKatia LoarteAún no hay calificaciones

- Module - Business Finance Week 4Documento7 páginasModule - Business Finance Week 4dorothytorino8Aún no hay calificaciones

- Session 1 Financial Accounting Infor Manju JaiswallDocumento41 páginasSession 1 Financial Accounting Infor Manju JaiswallpremoshinAún no hay calificaciones

- Alphaville Business PlanDocumento34 páginasAlphaville Business PlanOwunari Adaye-OrugbaniAún no hay calificaciones

- Assignment On Annual ReportsDocumento4 páginasAssignment On Annual ReportsPranay JainAún no hay calificaciones

- Ma Assignment # 7Documento18 páginasMa Assignment # 7Aeron Paul AntonioAún no hay calificaciones

- Annual Report 2012Documento116 páginasAnnual Report 2012shaky4uAún no hay calificaciones

- Harmonic LOI For InteQ Sep 22 2022Documento5 páginasHarmonic LOI For InteQ Sep 22 2022shashankAún no hay calificaciones

- Faca ShristiDocumento11 páginasFaca Shristishristi BaglaAún no hay calificaciones

- SHFL 2012 Annual ReportDocumento13 páginasSHFL 2012 Annual ReportSHFL entertainment, Inc.Aún no hay calificaciones

- Next PLCDocumento4 páginasNext PLCBùi Hồng ThảoAún no hay calificaciones

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDe EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Kansai Nerolac Software TDSDocumento17 páginasKansai Nerolac Software TDSkumargaurav21281Aún no hay calificaciones

- Taxes - Timor Leste Guide (2014)Documento72 páginasTaxes - Timor Leste Guide (2014)Luiz EduardoAún no hay calificaciones

- Take Home Quiz 2Documento2 páginasTake Home Quiz 2Ann SCAún no hay calificaciones

- TDS Certificate PDFDocumento2 páginasTDS Certificate PDFSoumyabrata BhattacharyyaAún no hay calificaciones

- E-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipDocumento2 páginasE-FILING OF RETURN FOR VAT-Return For Vat - Acknowledgement SlipBiswajit SarkarAún no hay calificaciones

- Revised Taxation Reading MaterialsDocumento38 páginasRevised Taxation Reading MaterialsNardsdel RiveraAún no hay calificaciones

- Atlas Honda Motor Company LimitedDocumento10 páginasAtlas Honda Motor Company LimitedAyesha RazzaqAún no hay calificaciones

- Funds Flow StatementDocumento67 páginasFunds Flow Statementtulasinad123Aún no hay calificaciones

- (ACCT203) (2010) (F) Midterm 1356 10016Documento15 páginas(ACCT203) (2010) (F) Midterm 1356 10016peter chanAún no hay calificaciones

- Mfa2023 - Group AssignmentDocumento66 páginasMfa2023 - Group AssignmentadlinfarhanahhhhAún no hay calificaciones

- Domino PizzaDocumento9 páginasDomino Pizzaumarz100% (1)

- Work Sheet AnalysisDocumento7 páginasWork Sheet AnalysisMUHAMMAD ARIF BASHIRAún no hay calificaciones

- Group Assignment FIN 410 - Group #3Documento22 páginasGroup Assignment FIN 410 - Group #3ShahikAún no hay calificaciones

- Ind As & Ifrs Unit 3Documento10 páginasInd As & Ifrs Unit 3Dhatri LAún no hay calificaciones

- Case Analysis of Ayala CorporationDocumento46 páginasCase Analysis of Ayala CorporationNevan NovaAún no hay calificaciones

- 2014-2015 Verification Worksheet-Dependent Student IDOCDocumento4 páginas2014-2015 Verification Worksheet-Dependent Student IDOCJoshChukwubudikeBarnesAún no hay calificaciones

- Tutorial 5Documento3 páginasTutorial 5Shyne SzeAún no hay calificaciones

- Monetary Policy Analysis: A Dynamic Stochastic General Equilibrium ApproachDocumento45 páginasMonetary Policy Analysis: A Dynamic Stochastic General Equilibrium Approachندى الريحانAún no hay calificaciones

- PAS 1 Presentation of Financial StatementsDocumento18 páginasPAS 1 Presentation of Financial Statementslyzza joice javierAún no hay calificaciones

- AbsorptionDocumento28 páginasAbsorptionJenika AtanacioAún no hay calificaciones

- The Gazzat of PakistanDocumento236 páginasThe Gazzat of PakistanFaheem UllahAún no hay calificaciones

- Questionnaire Icici PrudentialDocumento13 páginasQuestionnaire Icici PrudentialKulvinder Singh Mehta100% (2)

- Warren SM Ch.02 FinalDocumento68 páginasWarren SM Ch.02 FinalLidya Silvia Rahma50% (2)

- Chapter1 ExpectedutilityDocumento89 páginasChapter1 ExpectedutilitySijo VMAún no hay calificaciones

- Comprehensive Case 2Documento2 páginasComprehensive Case 2Muhammad AmirulAún no hay calificaciones

- ARC Tender PE GI Cu 2012Documento292 páginasARC Tender PE GI Cu 2012rudrakrAún no hay calificaciones

- Rent ReceiptDocumento1 páginaRent Receiptsaurav mazumdarAún no hay calificaciones

- Major Companies Romania 2012 WebDocumento228 páginasMajor Companies Romania 2012 WebTREND_7425Aún no hay calificaciones

- Financial Statement AnalysisDocumento98 páginasFinancial Statement AnalysisDrRitesh PatelAún no hay calificaciones

- Budget Project - PAD 5227Documento23 páginasBudget Project - PAD 5227Sabrina SmithAún no hay calificaciones