Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Panera Bread SWOT Analysis Final

Cargado por

Mark McDonaldDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Panera Bread SWOT Analysis Final

Cargado por

Mark McDonaldCopyright:

Formatos disponibles

Running head: PANERA BREAD SWOT ANALYSIS

Panera Bread SWOT Analysis Prepared by: Brian McDonald, Ora Carson, Bree McCraw, and Ginger Terry MOD 440 Facilitator Dr. Berry Ziggler Week 4 July 31, 2012

PANERA BREAD SWOT ANALYSIS

HISTORY The Panera Bread restaurant chain was founded by Ron Shaich and Louis Kane as Au Bon Pain Co. After acquiring the St. Louis Bread Company chain, the Panera Bread concept evolved. In 1999, the Au Bon Pain restaurants were sold, and the company put its primary focus on growing the Panera Bread restaurants. The St. Louis Bread Company restaurants continue to operate with the same Panera Bread concept and menu in the state of Missouri. There are currently 1,504 company-owned and franchise-operated bakery cafes (Panera Bread, 1999-2011). Panera Bread is considered to be in the restaurant industry, but they are in a different group as the others. Panera Bread has one of the highest stock market prices of all their competitors in the industry.

PANERA BREAD SWOT ANALYSIS INTRODUCTION In every business there will come a time when the business needs to understand the things that will help a business and what will hurt that business. A business can determine their opportunities and the threats that are associated with that specific business. In determining these opportunities that a business has will help in directing the businesss future plans. The threats that the business determines will help in making that business aware of the potential problems that can plague the business and cause it not to succeed. Panera Bread is a company that is incorporated into the food industry. In being associated with this group of businesses, Panera Bread will be dealing with the government and many other agencies. One of the main agencies that they deal with is the U.S. Food and Drug Administration (FDA). Panera Bread acknowledges both their opportunities and threats, which in turn helps the business to become a success.

STRATEGY Panera Bread is the Apple of fast food. Panera continues with its pre-recession strategy of charging premium prices for its sandwiches and salads as if they were iPhones. While other businesses might be suffering or worse; Panera Breads owner Ron Shaich has no plans on slowing down. He plans to add at least 80 locations to his ever growing company, all the while hes upping Paneras investment in its distribution system. The company's expansion seems sharp actually. The value of commercial real estate has collapsed along with home prices. Shaich says he's been able to bargain down lease rates by 20% to 25%. Plus, Panera can lock in these low terms for the next 20 years. Ron has also set a new bar by bringing in fresh produce daily opposed to the 12 to 18 day old produce that is typical for most restaurants. So far, selling high-

PANERA BREAD SWOT ANALYSIS quality, high-priced fast food has worked just fine for Panera. Its same-store sales increased 3.6% in 2008 (see Exhibit 1), vs. declines at many other chains including Starbucks (see Exhibit 2). Its average check rose to $8.50, and each restaurant is now pulling in $2 million on average, putting Panera just behind McDonald's and double what a typical Arby's and KFC unit grosses. Main Issue The main issue with Panera Bread is the economy. Many consumers because of the downturn in the economy have cut back on their dining out. This has cause a loss of customers at Panera Bread Cafes. If Panera Bread cannot get customers into the cafes then they do not sell their product and do not make a profit. Panera Bread prices for their product is higher than the average fast food product which determines if a customer will visit their store or one of their competitors. Panera Bread will need to determine new ways and promotions that will entice the customers to visit their cafes. SWOT

Strengths Well-known brand name High quality product Strong financial condition Great strategy Weaknesses Consumer preferences Decline in customer service Narrow product line Higher prices

Opportunities Expansion Culture Introduce new items Expand product line

Threats Economy Competitors Government regulations Price changes in product

PANERA BREAD SWOT ANALYSIS Recommendations Panera Bread needs to understand the customers needs and desires in the present economy. The promotions that the company presents will help in getting the customers into the cafes and buying the product. Panera Bread strategy of introducing new products on a regular basis will help in convincing the consumers that Panera Bread is the choice that they want to make for that lunch or dinner trip out.

Conclusion Panera Bread has shown that they know how to manage their business to delight of their investors and creditors. They have kept their ratios to the correct levels and maintained decent inventories for the company. Their stock has risen very high and seems to be going even higher. The future of this company seems very bright and will keep bringing in profit for the investors and security for its creditors. Panera Bread is trying to provide premium specialty bakery and caf experience to urban workers and suburban dwellers. Panera is trying to be "better than the guys across the street." They are trying to make the experience of dining at Panera so attractive that customers would be willing to pass by the outlets of other fast-casual restaurants competitors to dine at a near-by Panera Bread. Every business needs to know what its strengths and weaknesses are in the industry. A business that knows its opportunities and threats will become a more stable company and make plans for its future. A business needs to use its strengths in making decisions. The business needs to understand its weaknesses and improve on them. A business that uses its strengths and manages its weaknesses will determine if that business will be a success.

PANERA BREAD SWOT ANALYSIS Exhibit 1

Annual Income Statement (values in 000's)

Get Quarterly Data

Period Ending:

Trend

12/27/2011 $1,822,032 $1,185,969 $636,063

12/28/2010 $1,542,489 $1,005,912 $536,577

12/29/2009 $1,353,494 $904,419 $449,075

12/30/2008 $1,298,853 $1,031,155 $267,698

Total Revenue Cost of Revenue Gross Profit Operating Expenses

Sales, General and Admin. Non-Recurring Items Other Operating Items

$329,320 $6,585 $79,899 $220,259 $466 $220,725 $822 $219,903 $83,951 $0 $135,952 $135,952 $135,952

$278,553 $4,282 $68,673 $185,069 ($4,232) $180,837 $675 $180,162 $68,563 $267 $111,866 $111,866 $111,866

$238,565 $2,451 $67,162 $140,897 ($273) $140,624 $700 $139,924 $53,073 ($801) $86,050 $86,050 $86,050

$84,393 $3,374 $67,225 $112,706 ($883) $110,314 $1,606 $108,708 $41,272 ($1,509) $67,436 $67,436 $67,436

Operating Income Add'l income/expense items Earnings Before Interest and Tax

Interest Expense

Earnings Before Tax

Income Tax

Minority Interest Net Income-Cont. Operations Net Income Net Income Applicable to Common Shareholders

Taken from nasdaq.com

PANERA BREAD SWOT ANALYSIS

Exhibit 2

Income Statement

Get Income Statement for:

GO

View: Annual Data | Quarterly Data

All numbers in thousands

Period Ending

Total Revenue Cost of Revenue Gross Profit

Oct 1, 2011 Oct 2, 2010 Sep 26, 2009

11,700,400 4,949,300 6,751,100 Operating Expenses 10,707,400 4,458,600 6,248,800 9,774,600 4,324,900 5,449,700

Research Development Selling General and Administrative Non Recurring Others Total Operating Expenses Operating Income or Loss

4,703,200 523,300 1,524,600

4,414,100 53,000 510,400 1,271,300

4,142,500 332,400 534,700 440,100

Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Minority Interest Net Income From Continuing Ops 146,100 1,844,400 33,300 1,811,100 563,100 (2,300) 1,419,400 50,300 1,469,700 32,700 1,437,000 488,700 (2,700) 1,093,700 37,000 599,000 39,100 559,900 168,400 (700) 512,700

Non-recurring Events Discontinued Operations Extraordinary Items Effect Of Accounting Changes Other Items -

PANERA BREAD SWOT ANALYSIS

Net Income Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 1,245,700 1,245,700 945,600 945,600 390,800 390,800

Taken from nasdaq.com

PANERA BREAD SWOT ANALYSIS

10

PANERA BREAD SWOT ANALYSIS References Admin. (2010, April). Managing Growth in Business. Nasdaq. (2012). Panera Bread Company Financials. Retrieved from Nasdaq Stock Market Panera Bread. (2012). Panera Bread Corporation. Retrieved from www.panerabread.com

También podría gustarte

- Modern Portfolio Theory and Investment Analysis, 6th SolutionsDocumento153 páginasModern Portfolio Theory and Investment Analysis, 6th SolutionsXiaohe Chen86% (7)

- Chick-Fil-A Ib Group ProjectDocumento27 páginasChick-Fil-A Ib Group Projectapi-380293554Aún no hay calificaciones

- Replication: The Art and Science of Franchising Your BusinessDe EverandReplication: The Art and Science of Franchising Your BusinessAún no hay calificaciones

- Starbucks:: Delivering Customer ServiceDocumento9 páginasStarbucks:: Delivering Customer ServiceAlfedAún no hay calificaciones

- Marketing Plan Proposal: Naked JuiceDocumento30 páginasMarketing Plan Proposal: Naked JuiceMannan RahimAún no hay calificaciones

- Panera Bread Case AnalysisDocumento18 páginasPanera Bread Case AnalysisTamar 'Daws' Webster100% (5)

- Shake Shack Marketing ReportDocumento34 páginasShake Shack Marketing Reportmisharawal1067% (6)

- MM1 - Case Study - Pret A MangerDocumento5 páginasMM1 - Case Study - Pret A MangerJoydip SarkarAún no hay calificaciones

- Inventory Management (NTPC)Documento118 páginasInventory Management (NTPC)Mohd Farhan Sajid33% (3)

- Analysing Marketing Environment To Open RestaurantDocumento9 páginasAnalysing Marketing Environment To Open RestaurantKishan SolankiAún no hay calificaciones

- Acknowledgement: A Case StudyDocumento23 páginasAcknowledgement: A Case StudyAyunda UtariAún no hay calificaciones

- SHAKE SHACK Final RecommendationDocumento184 páginasSHAKE SHACK Final RecommendationShamsa Al Jaradi100% (1)

- Panera CaseDocumento18 páginasPanera CaseF100% (1)

- Subway Porter 22.3Documento17 páginasSubway Porter 22.3Ritesh JainAún no hay calificaciones

- The Value of Shake Shack: Fast-Casual Leader Poised for GrowthDocumento17 páginasThe Value of Shake Shack: Fast-Casual Leader Poised for Growthaltecvix100% (3)

- Virat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013Documento97 páginasVirat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013InfiniteKnowledgeAún no hay calificaciones

- C A S E 8 Panera Bread CompanyDocumento24 páginasC A S E 8 Panera Bread CompanyMary Ann Melo100% (2)

- Subway FinalDocumento19 páginasSubway FinalKanika Juneja100% (1)

- Panera Bread SWOT Analysis and Financial PerformanceDocumento18 páginasPanera Bread SWOT Analysis and Financial PerformanceAvnchick100% (1)

- Raising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.De EverandRaising the Bar: Integrity and Passion in Life and Business: The Story of Clif Bar Inc.Calificación: 3.5 de 5 estrellas3.5/5 (15)

- PepsiCo's Diversification Strategy in 2008Documento18 páginasPepsiCo's Diversification Strategy in 2008Traci Jancasz100% (1)

- Panera Bread Co - FINALDocumento18 páginasPanera Bread Co - FINALnaimul_bari50% (2)

- Burger King USADocumento16 páginasBurger King USAMohammedali KakalAún no hay calificaciones

- FM QuizDocumento3 páginasFM QuizSheila Mae AramanAún no hay calificaciones

- An Analysis of Panera Bread CompanyDocumento4 páginasAn Analysis of Panera Bread CompanyVânAnhĐào100% (1)

- Pret A Manger's Growth and Innovation in 2016Documento10 páginasPret A Manger's Growth and Innovation in 2016AnaMaria DragomirAún no hay calificaciones

- Panera Case AnalysisDocumento9 páginasPanera Case Analysisblockeisu67% (3)

- MGMT 479 - Week 3 - Dropbox - Panera Case Study - Jeremy SvagdisDocumento10 páginasMGMT 479 - Week 3 - Dropbox - Panera Case Study - Jeremy SvagdisF4AR100% (1)

- Food BusinessDocumento15 páginasFood BusinessKharen DomilAún no hay calificaciones

- Panera BreadDocumento8 páginasPanera BreadRenton Ragwan100% (1)

- Ricoh ReportDocumento4 páginasRicoh Reportapi-352787809Aún no hay calificaciones

- SWOT Analysis On Second Cup CoffeeDocumento14 páginasSWOT Analysis On Second Cup CoffeeHasibul IslamAún no hay calificaciones

- Sample Business Plan Outline PDFDocumento4 páginasSample Business Plan Outline PDFmelkamuAún no hay calificaciones

- Pizza Hut and Dominos Marketing StrategyDocumento25 páginasPizza Hut and Dominos Marketing StrategyRavi RockAún no hay calificaciones

- Panera Bread Case 3Documento51 páginasPanera Bread Case 3Tariq67% (3)

- Starbucks Company ProfileDocumento25 páginasStarbucks Company ProfileVidya NatawidhaAún no hay calificaciones

- Will's Grill SWOT and market expansionDocumento2 páginasWill's Grill SWOT and market expansionPellAún no hay calificaciones

- WendyDocumento5 páginasWendyNiranjan NotaniAún no hay calificaciones

- Case 19pepsi AnswersDocumento3 páginasCase 19pepsi AnswersKathy Moncher100% (2)

- The Balanced Scorecard at StarbucksDocumento19 páginasThe Balanced Scorecard at StarbucksChandra NurikoAún no hay calificaciones

- Truearth Healthy FoodsDocumento3 páginasTruearth Healthy FoodshariAún no hay calificaciones

- Campbell Soup Company - Back To BasicsDocumento2 páginasCampbell Soup Company - Back To BasicsanamtaAún no hay calificaciones

- Chipotle 2006 Annual Report Highlights Record GrowthDocumento68 páginasChipotle 2006 Annual Report Highlights Record GrowthJames BrownAún no hay calificaciones

- Boston Pizza Page 308, Q1 & 2Documento1 páginaBoston Pizza Page 308, Q1 & 2Ashish AroraAún no hay calificaciones

- Vera Bradley in 2014Documento9 páginasVera Bradley in 2014Adrian BenczeAún no hay calificaciones

- Title of Case: Sweets Business Who Have Earned Love and Loyalty of Million of Customers. (Nirala Sweets)Documento9 páginasTitle of Case: Sweets Business Who Have Earned Love and Loyalty of Million of Customers. (Nirala Sweets)Muhammad Ali Rizwan100% (1)

- Subway11 1223394095586172 8Documento26 páginasSubway11 1223394095586172 8Resha MehtaAún no hay calificaciones

- Hard Rock CafeDocumento10 páginasHard Rock CafeAditya YadavAún no hay calificaciones

- Operations Management PresentationDocumento7 páginasOperations Management Presentationmahum raufAún no hay calificaciones

- ICE Sierra LeoneDocumento34 páginasICE Sierra LeonesanglethilAún no hay calificaciones

- Scom 425 Final Exam 2Documento5 páginasScom 425 Final Exam 2api-549309123Aún no hay calificaciones

- NestleDocumento7 páginasNestleloga priyavimal rajAún no hay calificaciones

- BurgerDocumento58 páginasBurgerSyed Sohaib Ahmed100% (1)

- Wall's Ice Cream Marketing Report AnalysisDocumento43 páginasWall's Ice Cream Marketing Report AnalysisMurtaza AslamAún no hay calificaciones

- Wendy'sDocumento6 páginasWendy'sSeptian Setia Dwi Putra100% (1)

- Group 4 - (Logistics Partner of Max's Restaurant)Documento2 páginasGroup 4 - (Logistics Partner of Max's Restaurant)Chime Mikee GequintoAún no hay calificaciones

- Panera Bread Media PlanDocumento119 páginasPanera Bread Media PlanMarvin Ting100% (1)

- The Gap Model of A RestaurantDocumento13 páginasThe Gap Model of A RestaurantPrateek ShettyAún no hay calificaciones

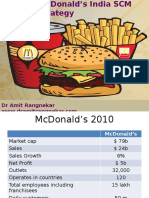

- McDonalds SCMDocumento57 páginasMcDonalds SCMDr Amit Rangnekar100% (1)

- Jaskarn Garcha ProjectDocumento40 páginasJaskarn Garcha ProjectNamrat SidhuAún no hay calificaciones

- Panera Bread Case 5 KeyDocumento3 páginasPanera Bread Case 5 KeyAmmar YahyaAún no hay calificaciones

- KFC CaseDocumento18 páginasKFC Caseshibanini100% (1)

- How Beverage Marketers Build Reputations: And Brands: The Best Alcohol Beverage Social Responsibility Programs of 2012De EverandHow Beverage Marketers Build Reputations: And Brands: The Best Alcohol Beverage Social Responsibility Programs of 2012Aún no hay calificaciones

- Lecture Notes: Introduction To Financial Derivatives: Jaeyoung SungDocumento9 páginasLecture Notes: Introduction To Financial Derivatives: Jaeyoung SungRizki MaulanaAún no hay calificaciones

- Sharekhan Satisfaction LevelDocumento116 páginasSharekhan Satisfaction LevelamericaspaydayloansAún no hay calificaciones

- Stores Ledger 20101012Documento36 páginasStores Ledger 20101012Rafeek Shaikh0% (2)

- Facilities Provided by Bank To Export and Import: A Project Report OnDocumento70 páginasFacilities Provided by Bank To Export and Import: A Project Report OnVinidra WattalAún no hay calificaciones

- PESTEL Analysis of Indian Capital MarketDocumento4 páginasPESTEL Analysis of Indian Capital MarketRohith50% (2)

- Biocon's Kiran Mazumdar Shaw on Developing Cost Competitive BiosimilarsDocumento7 páginasBiocon's Kiran Mazumdar Shaw on Developing Cost Competitive BiosimilarsNiruAún no hay calificaciones

- Resume - Aansh DesaiDocumento2 páginasResume - Aansh Desaisiddhant jainAún no hay calificaciones

- CPC Platform 2019Documento103 páginasCPC Platform 2019stephenmtaylor100% (1)

- Cerner Company financial statement analysis for year ending December 31, 2008Documento2 páginasCerner Company financial statement analysis for year ending December 31, 2008Steff100% (3)

- Chapter 25 - Evaluation of Portfolio PerformanceDocumento32 páginasChapter 25 - Evaluation of Portfolio PerformanceMukesh Karunakaran100% (1)

- Tata-Digital-India-Fun0 2222233333333Documento42 páginasTata-Digital-India-Fun0 2222233333333yasirAún no hay calificaciones

- Equity Trader's 20+ Years Financial ExperienceDocumento2 páginasEquity Trader's 20+ Years Financial ExperiencepsmadhusudhanAún no hay calificaciones

- Entrepreneurship MindsetDocumento24 páginasEntrepreneurship MindsetChinoDanielAún no hay calificaciones

- Amul: One of The India's Strongest BrandsDocumento7 páginasAmul: One of The India's Strongest BrandsUdayKiranRajuAún no hay calificaciones

- Role of Financial IntermediariesDocumento8 páginasRole of Financial Intermediariesashwini.krs80Aún no hay calificaciones

- Banking MCQsDocumento20 páginasBanking MCQsWaqar Nisar100% (2)

- The EU Strategy - Connecting Europe and Asia - FactsheetDocumento2 páginasThe EU Strategy - Connecting Europe and Asia - FactsheetIuliana FolteaAún no hay calificaciones

- Amend Non-Financial Details FormDocumento2 páginasAmend Non-Financial Details FormDhin PadayaoAún no hay calificaciones

- Rovers Agenda For ChangeDocumento26 páginasRovers Agenda For Changecurlywurly2Aún no hay calificaciones

- FUJIYA-Cover To Page 172Documento192 páginasFUJIYA-Cover To Page 172kokueiAún no hay calificaciones

- Caceres Semilla Case StudyDocumento6 páginasCaceres Semilla Case StudyJoyce Anne RenacidoAún no hay calificaciones

- Domestic Tax Policy - Tax Academy - Bernadette WanjalaDocumento24 páginasDomestic Tax Policy - Tax Academy - Bernadette WanjalaKwesi_WAún no hay calificaciones

- Annual Reports - 2013 - Malaysia - Airports - Holding - Berhad PDFDocumento373 páginasAnnual Reports - 2013 - Malaysia - Airports - Holding - Berhad PDFAnonymous 05Ra5rgAún no hay calificaciones

- AAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance IndustryDocumento3 páginasAAOIFI - Introduction: 2-How AAOIFI Standards Support Islamic Finance Industryshahidameen2Aún no hay calificaciones

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDocumento8 páginasL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalAún no hay calificaciones

- Fme Financial Ratio Formulas Checklist PDFDocumento2 páginasFme Financial Ratio Formulas Checklist PDFWahyu WidayatAún no hay calificaciones