Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Mtechtips Equity Index Market News

Cargado por

MtechTipsDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Mtechtips Equity Index Market News

Cargado por

MtechTipsCopyright:

Formatos disponibles

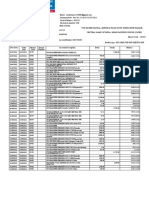

MTECHTIPS EQUITY INDEX MARKET NEWS

MTECHTIPS:-NIFTY

Nifty gave a negative opening taking cues from the world markets, the indices witnessed a range bound trading session with negative bias. The markets witnessed sustained selling, and the index closed the day around days lows failing to recover. The markets dipped on sustained selling to close well below the 5400 levels.Nifty has taken support in Andrew Pitchfork and if 5310 is held on downside then market can rally after 3days of fall. Nifty has been making lower low for 4days, for any reasonable recovery Nifty has to cross 5365 on sustainable basis for 5410 & 5480. Today nifty has to cross 5355 and hold 5315 only then some positivity could come in & revive the market sentiment, so as to boost possible support based buying towards 5375 & 5410. On the flip side if Nifty goes below 5310 and closes below 5290 then the chances of further correction towards 5260-5220, Gap-up levels are high.

MTECHTIPS:-SENSEX

The SENSEX gave a negative opening taking cues from the world markets, and the index traded with negative bias, throughout the trading session. The market did not recover from intraday lows, and closed the session with sharp losses.Sensex has taken support around 17570 and on 14/August low was 17572 and if 17570 support sustains then higher levels can become possible. Today Sensex has to hold 17620 levels and cross 17750 on a closing basis if it has to make any positive up move towards 17900-18000 levels in the days to come. However, If 17590 is broken then a possibility of 17500-17400 levels cannot be ruled out given the circumstances, due to heavy selling pressure, Due to intense selling pressure.

MTECHTIPS:-BANK NIFTY

The Bank nifty witnessed a negative trading session, the index dipped sharply as the banking stocks lost heavily on sustained selling after the RBI announced its annual report. Banks like SBIN, AXISBANK, ICICI BANK, YES BANK saw huge amount of selling & weakness still persists in the stocks. The bank index in yesterdays trade has broken and sustained below the crucial supports of 10200, negative signal. If the Index slips further we may soon witness further downside in the Bank index. Any dip below the levels of 10000 will be a negative signal for the index and we may soon re-test the supports of 9800. The bank nifty will now face stiff resistance above 10400 levels, and if it manages to trade above these levels we may gain witness testing of 10600 and higher levels in coming days. The bank index is in an uptrend so any move below 1000 levels will negate the trend and open up lower levels in coming sessions.

MTECHTIPS:-CNX IT

The Technology index bucked the general trend and gained on sustained buying seen in the sector on hopes of economic reforms in the US which in turn will help the technology stocks.

The levels around 6050 will act as strong support zones for the index, and if these levels are broken we may soon witness the index testing 5950 levels also. The CNXIT if manages to break out and sustain above the 6200 levels we may witness some pull back testing the levels of 6300 in coming days, but stiff resistance is seen at current levels. And the outlook remains positive for the day.

También podría gustarte

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Sharpe Single Index ModelDocumento11 páginasSharpe Single Index ModelSai Mala100% (1)

- Module-1 Introduction To Finanaical ManagementDocumento79 páginasModule-1 Introduction To Finanaical ManagementRevathi RevathiAún no hay calificaciones

- Bengkalis MuriaDocumento10 páginasBengkalis Muriareza hariansyahAún no hay calificaciones

- ch23 Capital BudgetingDocumento50 páginasch23 Capital BudgetingLeo CerenoAún no hay calificaciones

- The Sharing EconomyDocumento60 páginasThe Sharing EconomyRaul Velazquez Collado100% (1)

- Extinguishment of ObligationsDocumento7 páginasExtinguishment of ObligationsJazrine BrielleAún no hay calificaciones

- AccountStatement 3286686240 Aug04 185310 PDFDocumento2 páginasAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekAún no hay calificaciones

- Chapter 32 A Macroeconomic Theory of The Open EconomyDocumento42 páginasChapter 32 A Macroeconomic Theory of The Open EconomyNgoc Tra Le BaoAún no hay calificaciones

- Gold Export GhanaDocumento3 páginasGold Export Ghanamusu35100% (4)

- Chhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24Documento284 páginasChhattisgarh State Electricity Regulatory Commission Raipur: CSERC Tariff Order FY 2023-24eepocapsldcAún no hay calificaciones

- Toshiba Fraud CaseDocumento23 páginasToshiba Fraud CaseShashank Varma100% (1)

- RBF Exchane Control BrochureDocumento24 páginasRBF Exchane Control BrochureRavineshAún no hay calificaciones

- Transaction AnalysisDocumento33 páginasTransaction AnalysisIzzeah RamosAún no hay calificaciones

- EurobondsDocumento217 páginasEurobondslovergal1992Aún no hay calificaciones

- International Finance W2013Documento20 páginasInternational Finance W2013Bahrom Maksudov0% (1)

- Carmela Jia Ming A. Wong Section 20Documento2 páginasCarmela Jia Ming A. Wong Section 20Carmela WongAún no hay calificaciones

- Chapter 04Documento26 páginasChapter 04蓝依旎Aún no hay calificaciones

- Study Guide 10-17Documento22 páginasStudy Guide 10-17minisizekevAún no hay calificaciones

- Document From VandanaDocumento39 páginasDocument From VandanaVandana SharmaAún no hay calificaciones

- Utilization of IP and Need For ValuationDocumento15 páginasUtilization of IP and Need For ValuationBrain LeagueAún no hay calificaciones

- Quotation - Hemas, SERVICE AND REPAIRS PDFDocumento2 páginasQuotation - Hemas, SERVICE AND REPAIRS PDFW GangenathAún no hay calificaciones

- NHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PDocumento30 páginasNHDE - TRAC NGHIEM - B02050 - B02080 - B02082 - B03027 - CUOI KY - G I L PTrân LêAún no hay calificaciones

- Peranan Bank Perkreditan Rakyat Binaan Bank Nagari Terhadap Kinerja Usaha Kecil Di Sumatera BaratDocumento200 páginasPeranan Bank Perkreditan Rakyat Binaan Bank Nagari Terhadap Kinerja Usaha Kecil Di Sumatera BaratPapan AjaAún no hay calificaciones

- Gilbert Company-WPS OfficeDocumento17 páginasGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- Namma Kalvi 12th Commerce Chapter 1 To 15 Study Material emDocumento64 páginasNamma Kalvi 12th Commerce Chapter 1 To 15 Study Material emAakaash C.K.88% (8)

- Agency Theory AssignmentDocumento6 páginasAgency Theory AssignmentProcurement PractitionersAún no hay calificaciones

- midChapterTest 1-1 1-4Documento1 páginamidChapterTest 1-1 1-4VIPAún no hay calificaciones

- Mad About Sports PVT LTD: Venkateswarlu GurramDocumento1 páginaMad About Sports PVT LTD: Venkateswarlu GurramGv IareAún no hay calificaciones

- Share Based Payments ExercisesDocumento5 páginasShare Based Payments ExercisesayhanacruzAún no hay calificaciones

- NKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToDocumento21 páginasNKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToMohammed Asif Ali RizvanAún no hay calificaciones