Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Daily Agri Report Aug 29

Cargado por

Angel BrokingDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Daily Agri Report Aug 29

Cargado por

Angel BrokingCopyright:

Formatos disponibles

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Mentha Potato

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narveker@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Associate anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

News in brief

Poor kharif prospects loom large over Andhra Pradesh

The agriculture sector in Andhra Pradesh faces disaster for the second successive year. With monsoon failing to turn up on time and spread evenly across the State, almost all major crops barring cotton and maize are facing the prospect of a complete rout.About 550 mandals, or half of the mandals in the State, are facing drought-like scenario which shows the gravity of the situation. Well into the kharif season, the State still has a deficit of 10 per cent. hough official figures put the total area sown in the State at 65 lakh hectares or 81 per cent of the normal area of 80 lakh hectares, leaders of farmers associations say that the actual health of the crop in the sown area is in a bad shape. Groundnut is a perfect example. The crop is going to be a disaster this time. Farmers are continuing to sow in order to not to miss out a season. It is only cotton that is doing very well. The acreage went up by 33 per cent. to 20.60 lakh ha as against the as-on-date area of 17.50 lakh hectares last year. Fortunately, there is no shortage of seeds, P. Sateesh Kumar, President of Seedsmen Association of Andhra Pradesh, said. Only Telangana could surpass the normal sown area with 35.13 lakh hectares as against the ason-date average of 32.27 lakh hectares. Coastal Andhra reported sowings in 15.85 lakh hectares (19.50 lakh hectares). Rayalaseema too recorded only 75 per cent of the normal sown area of 16.71 lakh hectares at 13.85 lakh hectares. (Source: Business Line)

Market Highlights (% change)

Last Prev. day

as on Aug 28, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

17632 5335 55.65 96.33 1667

-0.27 -0.29 -0.04 0.33 3.13

-1.42 -1.59 0.63 -0.36 1.62

4.66 4.40 -0.64 8.27 3.64

6.87 7.79 21.99 12.75 -10.32

Source: Reuters

Delay in harvesting may keep food inflation high beyond October

Late sowing this summer is expected to delay fresh supplies of crops in many parts of the country, likely keeping food inflation at elevated levels beyond October when prices usually start moderating due to the arrival of new crops. The sowing of summer crops in many regions has been delayed by up to a month due to the late arrival of monsoon showers over the Kerala coast, from where it travels to other parts, and the subsequent halt in its progress as well as below-normal showers initially. Although sowing has rebounded in August, it raises fears of the delay in harvesting by one month, and lower yield where the farmer has resorted to the cultivation of short-duration crops to make up for the delay in planting, a senior scientist with the Indian Agricultural Research Institute said. Analysts said supplies of key crops will remain tight, potentially stoking high food inflation at least for one month beyond October.

(Source: Financial express)

Monsoon on the mend could spring welcome surprise

Prevailing active to vigorous monsoon conditions are now threatening to derail the deficient rain outlook for the country as a whole. The overall deficit has been brought down to 12 per cent as on Monday, an India Meteorological Department (IMD) update said on Tuesday. Sources in the Government told Business Line that, at current reckoning, August might end up showing an overall deficit of around 10 per cent only. They quoted latest forecasts from Pune-based India Institute of Tropical Meteorology (IITM), one of the few models that had forecast a normal monsoon earlier this year. The IITM outlook reportedly points towards a scenario where rains may spread out to all parts of India during the first two weeks of September. This would cut down, if not completely wash out, the remaining deficit to around five per cent. The projected scenarios based on specific timelines went like this: April 99 per cent; June 96 per cent; July 92 per cent; and July end 85 per cent. August is currently running at five per cent more than normal and could end up 100 per cent, if not more, the sources said. (Source: Business Line)

New contract in guar after assessing of new crop: FMC

The Forward Market Commission (FMC) plans to allow new contracts in low production volume commodities such as guarseed and guar gum only after assessing the new crop. FMC Chairman Ramesh Abhishek said: Prices surge unrealistically due to low production. This is not good for market. That is why we have proposed to estimate the production first in order to bring discipline in the market. This assessment will be done mainly for guarseed, guar gum, mentha oil and cardamom. The regulator will seek opinion from other exchanges. Guarseed production in 2011-12 was estimated at 12.1 lakh tonnes (lt) compared with the record 15 lt in the previous year. India accounts for 80 per cent of the total guar produced in the world. Of this, 70 per cent comes from Rajasthan. The regulator ruled out banning future trading completely in these narrow commodities. (Source: Business Line)

Guar sowing area up on monsoon revival

Encouraged by record realisations last year, farmers expedited sowing of guar seeds as monsoon showers revived early this month, leading to an increase of about 20 per cent in the acreage of the temperate crop this kharif season. As a result, the overall area under guar seed is estimated to have topped 3.5 million hectares (ha) this kharif, compared with 2.91 million ha last season. The monsoon rainfalls were delayed during the early guar-sowing season, especially the first fortnight of July. But, farmers in three major producing states Rajasthan, Haryana and Gujarat began by irrigating farm land through canals, rivers and wells, thereby covering around 1.5 million ha until the revival in the monsoon early this month. The remaining area was covered with the showers.

(Source: Business Standard)

Ethanol-blending scheme to benefit TN sugar mills

Six large private sector sugar mills are set to benefit with the oil marketing companies placing ethanol orders for the ethanol-blended fuel programme. In addition, two cooperative sector sugar mills are also set to participate, according to official sources. The total installed capacity is about 320 kilolitres (kl) of ethanol a day, according to official statistics. They will benefit from the new revenue stream provided the pricing is right, according to industry sources. Two of the three oil marketing companies, BPCL and IOC, have placed orders with the sugar mills and orders are awaited from HPCL, the sources said. (Source: Business Line)

Government plans to release 60 lakh tonne wheat this fiscal

Much to the respite of millers and food manufacturers facing wheat crunch, the government is planning to release 60 lakh tonne wheat in the open market this financial year. The government's godowns are overflowing with grains due to a record carry-forward stock of 20 million tonne and further procurement of 38 million tonne. "We will start with releasing 10 lakh tonne next month. Commission for Agricultural Costs and Prices ( CACP) has recommended offloading 10 million tonne wheat from the government's godowns this year," said a senior food ministry official. (Source: Economic Times)

EGoM on drought to meet on Sept 3: Pawar

The Empowered group of Ministers (EGoM) on drought will meet on September 3 to discuss further relief measures in some parts of the country that are facing deficit rains, agriculture minister Sharad Pawar said on Tuesday. Barring some states, he said the crop prospects in the ongoing kharif (summer) season are good. The EGoM on drought will be held on Monday (September 3), Pawar, who heads the EGoM, told PTI.

(Source: Financial Express)

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Chana

NCDEX Chana September futures settled higher by 1.2% on Tuesday owing to profit booking. Prices had declined in the past 3-4 sessions mainly on account of improved rains thereby raising hopes of better sowing. Spot prices however, settled lower by 1.53% on Tuesday. As per the IMD, Monsoon has recovered in the month of August in Northwest and Central India. This has aided kharif sowing in the last one week. Also this may prove beneficial for the chana sowing. However, overall weak rainfall would have a significant impact on yield of kharif pulses. The Cabinet Committee on Economic Affairs approved the Minimum Support Prices (MSP) for Arhar (Tur) and Moong for 2012-13 season. The MSP for Arhar has been fixed at Rs.3850 per quintal and of Moong at Rs.4400 per quintal marking an increase of Rs.650 per quintal and Rs.900 per quintal respectively. Government released fourth advance estimates wherein it revised upward Chana output at 7.58 mn tn from 7.4 mn tonnes estimated in the third advance estimates and 8.22 mn tn in 2010-11.

Market Highlights

Unit Rs/qtl Rs/qtl Last 4738 4650 Prev day -1.53 1.20

as on Aug 28, 2012 % change WoW MoM -2.67 -3.32 -2.96 -2.37 YoY 28.04 28.52

Chana Spot - NCDEX (Delhi) Chana- NCDEX Sept '12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Sept contract

Sowing progress and demand supply fundamentals

According to the Ministry of Agriculture 88.3 Lakh hectare area has been th planted under Kharif pulses as on 24 August, 2012 compared to 99.78 lakh hectare (ha) same period last year. Sowing is reported lower mainly in Rajasthan. Rajasthan Agriculture Department states that, planted area under Kharif Pulses is down at 15.33 lakh hectares ha compared to 24.14 lakh ha same th period last year. (Dated 17 August, 2012). Sowing which was down by more than 55% has gained momentum after improvement in rainfall in the last one week and is now down by 35%. In Maharashtra, Kharif Pulses sowing is down by 7% at 18.63 lakh hectares. While in AP it is up by 5% at 6.98 lakh hectares. According to the Fourth advance estimates, Pulses output is pegged at 17.21 mn tn in 2011-12 compared with 18.24 mn tn produced in the year 2010-11. While Chana output in 2011-12 is estimated at 7.58 million tones, Tur is estimated at 2.65 million tones, Urad is estimated at 1.83 million tones, Moong is estimated at 1.71 million tones. As per the latest release, Ministry of Commerce & Industry revealed that 20.23 lakh tones of peas, 2.03 lakh tons of Chana, 4.32 lakh tons of Urad & Moong, 1.12 lakh tons of Masoor and 4.26 lakh tons of Tur has been imported by India during April11-March 12. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch) India's consumption of pulses is on the rise, while the growth in output in not consistent amid vagaries of weather, which may lead to increase in imports this year. However, rupee weakness may turn import costlier.

Source: Telequote

Technical Outlook

Contract Chana Sept Futures Unit Rs./qtl

valid for Aug 29, 2012 Support 4560-4608 Resistance 4688-4725

Outlook

Chana prices may remain sideways during the intraday as prospects of improved rains have already being discounted in the markets and fresh demand may emerge at the lower price levels. In the medium term to long term, the trend remains positive as supplies may not be sufficient to meet the rising demand of the commodity. Also lower sowing of kharif pulses may support chana prices.

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Sugar

Sugar futures settled 2.49% on Tuesday amid various factors that include emergence of festive season demand, Poor rains, and concerns over Sugar output in Maharashtra amid divergence of cane towards fodder etc. With chances of El Nino weather pattern receding, the Agriculture Ministry hopes that rainfall in September would be better than earlier forecast. Apart from the 45 lakh tonnes quota released during the start of the quarter Jul-Sept, government released additional 2.66 lac tn to be sold off by 31st August. Sugar mills have been directed to sell at least 70% of July-September quota (45 lakh tonnes) by August. Another additional quota of 4 lac tn has also been released on 7th August, 2012 to be sold off by 31stAugust. The quota is sufficient to meet the festive season demand and thus helped contain prices. In the international markets Liffe Sugar as well as ICE sugar settled 1.91% and 2.91% higher respectively on Tuesday.

Market Highlights

Unit Sugar Spot- NCDEX (Kolkata) Sugar M- NCDEX Sept '12 Futures Rs/qtl Last 3630

as on Aug 28, 2012 % Change Prev. day WoW -1.09 -1.63 MoM 1.26 YoY 21.40

Rs/qtl

3504

2.49

2.73

-0.34

24.96

Source: Reuters

International Prices

Unit Sugar No 5- LiffeOct'12 Futures Sugar No 11-ICE Oct '12 Futures $/tonne $/tonne Last 559.9 447.33

as on Aug 28, 2012 % Change Prev day WoW 1.91 2.91 -1.11 -1.80 MoM -9.03 -10.53 YoY -27.36 #N/A

Domestic Production and Exports

The area under sugarcane is estimated at 52.88 lakh ha for 2012-13 crop season, up from 50.63 lakh ha on same period a year ago. Despite of higher acreage, the producers body has estimated next years output lower at 25mn tn, down by 1mn tn compared to the current year. Sugar production in India the worlds second-biggest producer touched 26 million tonne since October 1, 2011. Industry body ISMA has estimated 7 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may exports 2.5-3 mn tn sugar in 2012-13. India will likely produce 25 million tonne of sugar in 2012-13 factoring in dry spells in biggest producer Maharashtra as well as Karnataka. With the opening stocks of 7 mn tn, domestic Sugar supplies are estimated at 32mn tn against the domestic consumption of around 22.523 mln tn for 2012-13. Thus, no curbs on exports are seen as of now.

Source: Reuters

Technical Chart - Sugar

NCDEX Sept contract

Global Sugar Updates

Brazilian cane mills produced 3 mn tn of sugar in the first half of August thanks to dry weather. Unica in its latest report stated said that total sugar output since the start of the crushing season is still down 12 percent from the same period a year ago. Brazil exported 2.489 million tons of sugar, raw value, up from 1.692 million tons in June but lower from 3.06 million tons sugar exported last year same period. The global sugar surplus remains on target to fall in 2012/13 season, though declines will be less than previously suggested, while adverse weather in several producers may stop prices dropping far below recent levels. (Source: Reuters) According to the International Sugar Organization (ISO), the global sugar surplus is forecast to halve to around 3 mln tn in 2012/13 (OctoberSeptember) from a surplus of 6.5 million tonnes in 2011/12).

Source: Telequote

Technical Outlook

Contract Sugar Sept NCDEX Futures Unit Rs./qtl

valid for Aug 29, 2012 Support 3448-3480 Resistance 3543-3568

Outlook

Sugar prices are expected to trade sideways on account of mixed views over next years output. Although sufficient supplies may keep the upside capped, sharp downside will also be restricted amid emergence of fresh demand at lower levels amid festive season ahead.

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Oilseeds Soybean: Soybean Spot as well as Futures declined on Tuesday

taking cues from the international markets. Also, improved rains and higher acreage supported the downside. The Spot as well as Futures settled 0.85% and 0.2% lower respectively on Tuesday. CBOT Soybean settled higher by 0.16% on Tuesday due to increase in export demand from China. According to the newsletter, Pro farmer, Soybean production was seen at 2.60 bn bushels on a yield of 34.8 bushels/ acre, lower compared to the USDAs soybean output estimates of 2.692 billion bushels and yield at 36.1 bushels/ acre. Brazils grain Association expects the number 2 producers of soybean to produce record 81.3 mn tn in 2012-13. Planting in Brazil would commence from Sept. 15 & exports may soar to 37.5 mn tn, beating the 33.8-mn tn record in 2010/11 crop. According to weekly crop progress report, the condition of U.S soybeans declined to 30% during last week from 31% in good to excellent condition due to weather concerns in the US Midwest. th USDA released its monthly crop report on 10 August wherein its cut U.S. 2012/13 soybean production forecast to 2.692 billion bushels, from 3.05 billion in July. India's oil meal exports fell to 2.75 lakh tn in July from 2.82 lakh tn a year earlier led by a sharp drop in the overseas sales of rapeseed meal. Soy meal exports rose to 1.68 lakh tn in July, from 1.39 tn a year ago. th In the domestic markets, as on 24 August Oilseeds have been sown in 164.29 lakh hectares so far, compared with 169.94 lakh hectares same period last year. Soybean area is higher at 106.4 lakh hectares. In 2011-12 season, soybean was sown under 102.9 lakh hectares area and recorded 12.28 million tonne output, down from 12.73 mn tn in 2010-11 season. Refined Soy Oil: NCDEX Soy Oil settled lower taking cues form the oilseeds complex. However, MCX CPO continued to trade on a positive note on global oilseed supply fears and rising export demand. As per Intertek Testing Services, Malaysian palm oil product exports during Aug 1-25 rose 5.7 percent to 1,084,343 compared to 1,026,153 tonnes shipped in July 1-25. India imported 112,611 tonnes of refined palm oil in July, down 9.28 percent from June. Total vegetable oil imports in July were 870,328 tonnes, up from 783,315 tonnes in the previous month (Source: Sea of India). Although, Malaysia's July palm oil stocks rose 17.6 percent to 1,998,870 tn from a revised 1,699,117 tn in June, the export demand is expected to regain momentum amid supply shortage of edible oil globally. Indonesia, the world's top palm oil producer, has lowered its earlier output forecast by 8 percent to 23.6 million tonnes this year Rape/mustard Seed: Mustard seed Futures settled lower by 0.92% on Tuesday on profit taking. Mustard output this season has declined significantly and deficient rains in Rajasthan would not provide proper moisture for mustard sowing next season. According to a circular issued by NCDEX, existing Special Cash Margin of 5% on the Long side shall be increased to 15% on all the running and yet to be launched contracts w.e.f beginning of 18/07/2012.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Oct '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soyoil- NCDEX Aug '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 4556 4000 793.7 798.1

as on Aug 28, 2012 % Change Prev day -0.85 -0.20 -0.43 -0.40 WoW 0.82 0.00 1.46 0.64 MoM 2.22 -8.57 1.59 1.48 YoY 97.23 72.60 19.24 19.66

Source: Reuters

as on Aug 28, 2012 International Prices Soybean- CBOTSept'12 Futures Soybean Oil - CBOTSept '12 Futures Unit USc/ Bushel USc/lbs Last 1733 55.73 Prev day 0.16 -0.32 WoW -1.20 0.29 MoM 2.00 3.68

Source: Reuters

YoY 25.59 -2.74

Crude Palm Oil

% Change Unit

CPO-Bursa Malaysia Sept '12 Contract CPO-MCX- Aug '12 Futures

as on Aug 28, 2012

Last 2974 560.1

Prev day -1.91 -0.81

WoW 2.62 0.48

MoM 1.64 -1.65

YoY -12.53 12.33

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Sept '12 Futures Rs/100 kgs Rs/100 kgs Last 4350 4429 Prev day -0.79 -0.92

as on Aug 28, 2012 WoW 3.12 1.14 MoM 0.58 0.87

Source: Reuters

YoY 48.27 53.52

Technical Chart Soybean

NCDEX Oct contract

Outlook

Oilseed may trade sideways. Higher international prices and good export demand for soymeal may support prices at lower levels. However, good rains in Madhya Pradesh and other parts of India may also lead to a downside movement in the prices in the coming days.

Source: Telequote

Technical Outlook

Contract Soy Oil Sept NCDEX Futures Soybean NCDEX Oct Futures RM Seed NCDEX Sept Futures CPO MCX Sept Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Aug 29, 2012 Support 789-792 3925-3970 4370-4400 555.80-558 Resistance 802-806 4040-4080 4455-4475 566-568

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Black Pepper

Pepper Futures traded sideways with a positive bias yesterday due to very low stocks. The Spot markets remained closed due to Onam, a local festival, and will reopen on Thursday. Farmers are also unwilling to sell their stocks at lower levels. However, lower demand for Indian pepper in the international markets due to huge price parity may cap sharp upside. Good supplies from Indonesia have also pressurized the prices. The Futures settled 0.6% higher on Tuesday. th According to the circular released on June 13 2012 the existing Special margin of 10% (cash) on the long side stands withdrawn on all running contracts and yet to be launched contracts in Pepper from beginning of day Friday June 15, 2012. Pepper prices in the international market are being quoted at $8,0008,400/tonne(C&F) while Indonesia Austa is quoted at $6300-6400/tonne (FOB). Vietnam was offering its produce at $6,000/tonne for 500 GL. Brazil was offering its pepper at $6,150/tonne for the B-Asta grade. As per circular dt. 29/06/2012 issued by NCDEX, Hassan will be available as an additional delivery centre for all the yet to be launched contracts. (not applicable to the currently available contracts-till Dec 2012 expiry).

Market Highlights

% Change Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 41088 42045 Prev day 0.00 0.60

as on Aug 28, 2012 WoW -0.74 0.20 MoM -3.80 -4.35 YoY 20.70 19.31

Source: Reuters

Technical Chart Black Pepper

NCDEX Sept contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till June 2012 is estimated around 73000 mt 73,000 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Sept Futures Unit Rs/qtl

valid for Aug 29, 2012 Support 41550-41800 Resistance 42300-42570

Production and Arrivals

There arrivals in the spot market were reported at 20 tonnes while offtakes were 20 tonnes on Monday. Global Pepper production in 2012 is expected to increase 7.2% to 3.20 lakh tonnes as compared to 2.98 lakh tonnes in 2011 with sharp rise of 24% in Indonesian pepper output and in Vietnam by 10%. According to latest report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) On the other hand production of pepper in India in 2011-12 is expected to decline further by 5% to 43 thousand tonnes as compared to 48 thousand tonnes in the last year. Production is lowest in a decade.

Outlook

Pepper prices are expected to trade sideways with a positive biastoday. Lack of supplies may support prices at lower levels. The spot markets will remain closed due to Onam. However, prices may correct due to lower demand at higher levels in the domestic as well as international markets.

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Jeera

Jeera Futures corrected sharply during the initial part of the day tracking good rains in northern part of Gujarat, the main Jeera growing region. Good rains are expected improve moisture levels which may increase prospects of better yield next season. however, prices bounced back towards the end of the day due to short coverings and expectations that export demand may emerge at lower levels. Supply concerns from Syria and Turkey still exists. The Spot settled 0.92% lower while the Futures settled 1.48% higher on Tuesday. Expectations are that export orders may still be diverted to India from the international markets due to the ongoing civil war in Syria which is hampering supplies. There are reports that there has been an increase in demand from Bangladesh for Indian Jeera. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices in the international market of Indian origin are being offered at $3,000 tn (c&f) while Syria and Turkey are not offering their produce. Carryover stocks of jeera in the domestic market is expected to be around 7-8 lakh bags as compared to 4-5 lakh bags in the last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 15592 14765 Prev day -0.92 1.48

as on Aug 28, 2012 % Change WoW -3.90 -6.67 MoM -3.46 -6.58 YoY 1.25 -4.77

Source: Reuters

Technical Chart Jeera

NCDEX Sept contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 4,000 bags, while off-takes stood at 4,000 bags on Tuesday. Production of jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 2.01 4.01

as on Aug 28, 2012 % Change

Outlook

Jeera prices are expected to trade sideways. Good rains in Gujarat may pressurize the prices. However, revival of export demand at lower levels may support prices at lower levels. In the medium to long term (Aug-September 2012) prices are likely to witness a bounce back as there are limited stocks with Syria and Turkey and crop there is 30% short as compared to last year.

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 5606 6226

WoW 2.57 6.61

MoM 6.22 11.26

YoY 9.34 42.93

Turmeric

Turmeric Futures traded on a bullish note yesterday as farmers and stockists are tracking monsoon progress and thus, not selling their stocks anticipating better prices in the coming days. Exporters are active in the markets due to export demand from Pakistan. Exporters also expect orders to increase in the coming days. Sowing is also reported 30-35% lower during the sowing period. Turmeric has been th sown in 0.49 lakh hectares in A.P as on 22 August 2012. The Spot as well as the Futures settled 2% and 4% higher respectively on Tuesday. The pre expiry margin on Turmeric has been increased to 5% for last 7 trading days increased on a daily basis on both buy and sell side from the existing 3% on daily basis for last 5 days.

Technical Chart Turmeric

NCDEX Sept contract

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 4,000 bags and 2,000 bags respectively on Tuesday. Turmeric production for the year 2011-12 is projected at historical high of 90 lakh bags (1 bag= 70 kgs) compared to 69 lakh bags in 201011. Erode is expected to produce 55 lakh bags of turmeric a rise of 29% as compared to previous year. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Sept Futures Turmeric NCDEX Sept Futures Rs/qtl Rs/qtl

valid for Aug 29, 2012 Support 14400-14635 6070-6140 Resistance 14970-15180 6350-6440

Outlook

Turmeric prices are expected to continue to trade on a positive note due to lower sowing figures as well as reports of export demand from Pakistan. Traders also expect fresh export orders in the coming days. However, improving weather conditions may cap sharp gains. In the medium term (Aug to September) prices may take cues from the sowing figures.

www.angelcommodities.com

Commodities Daily Report

Wednesday| August 29, 2012

Agricultural Commodities

Mentha Oil

Mentha oil Futures traded lower in the intraday on lack of demand from Gutkha and Pan Masala due to ban on them in many states. However, the recovered towards the end due to buying by stockists at lower levels. The spot settled 0.37% lower while the Futures settled 0.45% higher on Tuesday. Total Special Cash margin of 25% on the long side of Mentha Oil has been reduced to 10% in the May contract and 5% in June contract onwards from May 5, 2012. For detailed reference please refer to the Circular No: MCX/T&S/180/2012 dated 03/05/2012.

Market Highlights

Unit Mentha Oil- MCX Spot (Chandausi) Mentha Oil MCX Aug Futures Rs/qtl Rs/qtl Last 1515 1320 Prev day -0.37 0.45

as on Aug 28, 2012 % Change WoW -0.74 -1.43 MoM 3.19 -1.50 YoY 15.73 0.85

Source: Reuters

Production, Arrivals and Exports

According to spot market sources, the overall acreage is estimated to increase from 1.75 lakh ha to 2.1 lakh ha this year. The overall production of Mentha is expected to around 50,000 tonnes. Arrivals of the fresh crop are going on in the mandis and currently stand around 500 drums (each drum weighs 180 kgs). Exports of Mentha during April 2011 to January 2012 witnessed a decline of 6% to 12,850 tonnes as compared to 13,550 tonnes in the same period last year.

Technical Chart Mentha Oil

MCX Sep contract

Outlook

In the intraday trading session Mentha oil is expected to trade sideways in the intraday. Buying at lower levels may emerge from stockists anticipating good demand from pharmaceutical companies in the coming days. However, lower demand due to ban on Gutkha and Pan Masala may cap any sharp upside. In long to medium term (July-September) prices are likely to remain under pressure due to peak arrival period.

Source: Telequote

Market Highlights

Prev day 0.24 1.96

as on Aug 28, 2012 % Change

Potato

Potato futures recovered yesterday after correcting over the last couple of days due to covering of short positions. The Futures settled 1.96% higher on Tuesday. Commodity market regulator FMC has banned launch of new Tarkeshwar potato contracts. Also From 01-08-2012 no fresh positions shall be allowed during the Staggered Delivery period in all running contracts of Potato in MCX and NCDEX. Only squaring off of existing positions will be allowed during the Staggered Delivery period.

Unit Potato SpotNCDEX (Agra) Potato- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 1150 1103

WoW -0.82 -5.29

MoM -2.55 -8.14

YoY 180.03 #N/A

Technical Chart Potato

NCDEX Sept contract

Production and Arrivals Scenario

Around 200-220 lakh MT potato had been stored in the country in different cold storages during the current season. Although 27-30% of the cold storage stocks are released so far from overall producing belts, they are much lower compared to normal 35-38% every year. According to NHRDF, The sowing of potato seed for Kharif production in Karnataka completed but the area sown is adversely affected due to less and delayed rains. The sowing in hills of Himachal Pradesh, Uttarakhand and Jammu and Kashmir are also completed. The seed sowing in Maharashtra for Kharif is continued, which is delayed due to delay arrival of monsoon, which is still scanty. The area for Kharif is expected to be less or may be same with delayed planting compared to last year, but it depends on further rains. With reports of crop damages in Karnataka, the supplies from this region to other states may also be affected as the overall output is expected to decline by 70-75%. In fact, the state may have to rely on the supplies from the north Indian markets.

Source: Telequote

Technical Outlook

Unit Mentha Oil Aug Futures Potato NCDEX Sept Futures Potato MCX Sept Futures Rs/kg Rs/qtl Rs/qtl

valid for Aug 29, 2012 Support 1324-1332 1084-1095 1142-1154 Resistance 1355-1368 1116-1127 1177-1188

Outlook

Potato futures in intraday are expected to trade sideways. West Bengal government has decided to curb its decision to restrict interstate transfer of potato after October that might provide resistance to the prices in short term. However, the upcoming festive season might provide support to the prices from falling sharply in Medium term.

www.angelcommodities.com

También podría gustarte

- Daily Agri Report Aug 31Documento8 páginasDaily Agri Report Aug 31Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 10Documento8 páginasDaily Agri Report Aug 10Angel BrokingAún no hay calificaciones

- Daily Agri Report Oct 3Documento8 páginasDaily Agri Report Oct 3Angel BrokingAún no hay calificaciones

- Daily Agri Report, August 05 2013Documento9 páginasDaily Agri Report, August 05 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 24Documento8 páginasDaily Agri Report Aug 24Angel BrokingAún no hay calificaciones

- Daily Agri Report, July 30 2013Documento9 páginasDaily Agri Report, July 30 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 05Documento7 páginasDaily Agri Report, June 05Angel BrokingAún no hay calificaciones

- Daily Agri Report Oct 4Documento8 páginasDaily Agri Report Oct 4Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 13Documento8 páginasDaily Agri Report Aug 13Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 23Documento8 páginasDaily Agri Report Aug 23Angel BrokingAún no hay calificaciones

- Daily Agri Report, July 19 2013Documento9 páginasDaily Agri Report, July 19 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 11Documento8 páginasDaily Agri Report Sep 11Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 14Documento8 páginasDaily Agri Report Sep 14Angel BrokingAún no hay calificaciones

- Daily Agri Report July 25 2013Documento9 páginasDaily Agri Report July 25 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 17Documento8 páginasDaily Agri Report Aug 17Angel BrokingAún no hay calificaciones

- Daily Agri Report Oct 29Documento8 páginasDaily Agri Report Oct 29Angel BrokingAún no hay calificaciones

- Daily Agri Report Nov 7Documento8 páginasDaily Agri Report Nov 7Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 18Documento8 páginasDaily Agri Report Aug 18Angel BrokingAún no hay calificaciones

- Daily Agri Report, February 23Documento8 páginasDaily Agri Report, February 23Angel BrokingAún no hay calificaciones

- Daily Agri Report, February 25Documento8 páginasDaily Agri Report, February 25Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 10Documento8 páginasDaily Agri Report Sep 10Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 06Documento7 páginasDaily Agri Report, June 06Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 27Documento8 páginasDaily Agri Report Aug 27Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 28Documento8 páginasDaily Agri Report Aug 28Angel BrokingAún no hay calificaciones

- Daily Agri Report, July 23 2013Documento9 páginasDaily Agri Report, July 23 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report, February 13Documento8 páginasDaily Agri Report, February 13Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 31Documento7 páginasDaily Agri Report, May 31Angel BrokingAún no hay calificaciones

- Daily Agri Report Nov 10Documento8 páginasDaily Agri Report Nov 10Angel BrokingAún no hay calificaciones

- Daily Agri Report Oct 31Documento8 páginasDaily Agri Report Oct 31Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 20Documento8 páginasDaily Agri Report Sep 20Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 18Documento7 páginasDaily Agri Report, May 18Angel BrokingAún no hay calificaciones

- Daily Agri Report, August 23 2013Documento9 páginasDaily Agri Report, August 23 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 11Documento8 páginasDaily Agri Report Aug 11Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 11Documento7 páginasDaily Agri Report, June 11Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 09Documento7 páginasDaily Agri Report, May 09Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 13Documento7 páginasDaily Agri Report, May 13Angel BrokingAún no hay calificaciones

- Daily Agri Report Oct 23Documento8 páginasDaily Agri Report Oct 23Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 15Documento8 páginasDaily Agri Report Sep 15Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 10Documento7 páginasDaily Agri Report, June 10Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 21Documento8 páginasDaily Agri Report Sep 21Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 30Documento7 páginasDaily Agri Report, May 30Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 19Documento9 páginasDaily Agri Report, June 19Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 3Documento8 páginasDaily Agri Report Sep 3Angel BrokingAún no hay calificaciones

- Daily Agri Report, April 18Documento8 páginasDaily Agri Report, April 18Angel BrokingAún no hay calificaciones

- Daily Agri Report Dec 3Documento8 páginasDaily Agri Report Dec 3Angel BrokingAún no hay calificaciones

- Daily Agri Report Nov 3Documento8 páginasDaily Agri Report Nov 3Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 12Documento7 páginasDaily Agri Report, June 12Angel BrokingAún no hay calificaciones

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Nov 9Documento8 páginasDaily Agri Report Nov 9Angel BrokingAún no hay calificaciones

- Daily Agri Report September 03 2013Documento9 páginasDaily Agri Report September 03 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Sep 29Documento8 páginasDaily Agri Report Sep 29Angel BrokingAún no hay calificaciones

- Daily Agri Report, August 12 2013Documento9 páginasDaily Agri Report, August 12 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report, August 16 2013Documento9 páginasDaily Agri Report, August 16 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report Aug 30Documento8 páginasDaily Agri Report Aug 30Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 14Documento9 páginasDaily Agri Report, June 14Angel BrokingAún no hay calificaciones

- Daily Agri Report, May 24Documento7 páginasDaily Agri Report, May 24Angel BrokingAún no hay calificaciones

- Daily Agri Report, June 03Documento7 páginasDaily Agri Report, June 03Angel BrokingAún no hay calificaciones

- Daily Agri Report 14th JanDocumento8 páginasDaily Agri Report 14th JanAngel BrokingAún no hay calificaciones

- Daily Agri Report September 02 2013Documento9 páginasDaily Agri Report September 02 2013Angel BrokingAún no hay calificaciones

- Lao People’s Democratic Republic: Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapDe EverandLao People’s Democratic Republic: Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapAún no hay calificaciones

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAún no hay calificaciones

- Technical & Derivative Analysis Weekly-14092013Documento6 páginasTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDocumento2 páginasSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAún no hay calificaciones

- Commodities Weekly Outlook 16-09-13 To 20-09-13Documento6 páginasCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingAún no hay calificaciones

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAún no hay calificaciones

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAún no hay calificaciones

- Metal and Energy Tech Report November 12Documento2 páginasMetal and Energy Tech Report November 12Angel BrokingAún no hay calificaciones

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAún no hay calificaciones

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAún no hay calificaciones

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAún no hay calificaciones

- Technical Report 13.09.2013Documento4 páginasTechnical Report 13.09.2013Angel BrokingAún no hay calificaciones

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAún no hay calificaciones

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAún no hay calificaciones

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAún no hay calificaciones

- Commodities Weekly Tracker 16th Sept 2013Documento23 páginasCommodities Weekly Tracker 16th Sept 2013Angel BrokingAún no hay calificaciones

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAún no hay calificaciones

- TechMahindra CompanyUpdateDocumento4 páginasTechMahindra CompanyUpdateAngel BrokingAún no hay calificaciones

- Sugar Update Sepetmber 2013Documento7 páginasSugar Update Sepetmber 2013Angel BrokingAún no hay calificaciones

- Market Outlook 13-09-2013Documento12 páginasMarket Outlook 13-09-2013Angel BrokingAún no hay calificaciones

- Derivatives Report 16 Sept 2013Documento3 páginasDerivatives Report 16 Sept 2013Angel BrokingAún no hay calificaciones

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAún no hay calificaciones

- MetalSectorUpdate September2013Documento10 páginasMetalSectorUpdate September2013Angel BrokingAún no hay calificaciones

- IIP CPIDataReleaseDocumento5 páginasIIP CPIDataReleaseAngel BrokingAún no hay calificaciones

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAún no hay calificaciones

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAún no hay calificaciones

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAún no hay calificaciones

- MarketStrategy September2013Documento4 páginasMarketStrategy September2013Angel BrokingAún no hay calificaciones

- Daily Agri Tech Report September 06 2013Documento2 páginasDaily Agri Tech Report September 06 2013Angel BrokingAún no hay calificaciones

- 2013 Gerber CatalogDocumento84 páginas2013 Gerber CatalogMario LopezAún no hay calificaciones

- Notes Socialism in Europe and RussianDocumento11 páginasNotes Socialism in Europe and RussianAyaan ImamAún no hay calificaciones

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 páginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pravin AwalkondeAún no hay calificaciones

- Summer Internship ReportDocumento135 páginasSummer Internship Reportsonal chandra0% (1)

- RumpelstiltskinDocumento7 páginasRumpelstiltskinAndreia PintoAún no hay calificaciones

- Set up pfSense transparent Web proxy with multi-WAN failoverDocumento8 páginasSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithAún no hay calificaciones

- Topic 4: Mental AccountingDocumento13 páginasTopic 4: Mental AccountingHimanshi AryaAún no hay calificaciones

- Sigma Chi Foundation - 2016 Annual ReportDocumento35 páginasSigma Chi Foundation - 2016 Annual ReportWes HoltsclawAún no hay calificaciones

- Note-Taking StrategiesDocumento16 páginasNote-Taking Strategiesapi-548854218Aún no hay calificaciones

- 110 TOP Survey Interview QuestionsDocumento18 páginas110 TOP Survey Interview QuestionsImmu100% (1)

- Adic PDFDocumento25 páginasAdic PDFDejan DeksAún no hay calificaciones

- Examination of InvitationDocumento3 páginasExamination of InvitationChoi Rinna62% (13)

- Quiz 1 model answers and marketing conceptsDocumento10 páginasQuiz 1 model answers and marketing conceptsDavid LuAún no hay calificaciones

- Manila Pilots Association Immune from Attachment for Member's DebtDocumento2 páginasManila Pilots Association Immune from Attachment for Member's DebtAngelic ArcherAún no hay calificaciones

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingDocumento2 páginasJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiAún no hay calificaciones

- Compro Russindo Group Tahun 2018 UpdateDocumento44 páginasCompro Russindo Group Tahun 2018 UpdateElyza Farah FadhillahAún no hay calificaciones

- College Wise Form Fillup Approved Status 2019Documento4 páginasCollege Wise Form Fillup Approved Status 2019Dinesh PradhanAún no hay calificaciones

- 2019 Batch PapersDocumento21 páginas2019 Batch PaperssaranshjainworkAún no hay calificaciones

- Database Interview QuestionsDocumento2 páginasDatabase Interview QuestionsshivaAún no hay calificaciones

- Codilla Vs MartinezDocumento3 páginasCodilla Vs MartinezMaria Recheille Banac KinazoAún no hay calificaciones

- Toolkit:ALLCLEAR - SKYbrary Aviation SafetyDocumento3 páginasToolkit:ALLCLEAR - SKYbrary Aviation Safetybhartisingh0812Aún no hay calificaciones

- Chapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Documento6 páginasChapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Barry Lutz Sr.Aún no hay calificaciones

- Bpoc Creation Ex-OrderDocumento4 páginasBpoc Creation Ex-OrderGalileo Tampus Roma Jr.100% (7)

- Environmental Science PDFDocumento118 páginasEnvironmental Science PDFJieyan OliverosAún no hay calificaciones

- Virtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionDocumento16 páginasVirtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionCarlisle ParkerAún no hay calificaciones

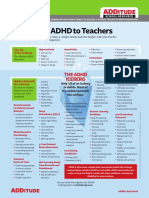

- Explaining ADHD To TeachersDocumento1 páginaExplaining ADHD To TeachersChris100% (2)

- Sergei Rachmaninoff Moment Musicaux Op No in E MinorDocumento12 páginasSergei Rachmaninoff Moment Musicaux Op No in E MinorMarkAún no hay calificaciones

- Political Philosophy and Political Science: Complex RelationshipsDocumento15 páginasPolitical Philosophy and Political Science: Complex RelationshipsVane ValienteAún no hay calificaciones

- Independent Study of Middletown Police DepartmentDocumento96 páginasIndependent Study of Middletown Police DepartmentBarbara MillerAún no hay calificaciones

- University of Wisconsin Proposal TemplateDocumento5 páginasUniversity of Wisconsin Proposal TemplateLuke TilleyAún no hay calificaciones