Documentos de Académico

Documentos de Profesional

Documentos de Cultura

REALTORS® Confidence Index June

Cargado por

narwebteamDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

REALTORS® Confidence Index June

Cargado por

narwebteamCopyright:

Formatos disponibles

Realtors Confidence Index

ReportandMarketOutlook

June2012Edition

BasedonDataCollectedJune25July3,2012

National Association of Realtors

Research Department LawrenceYun,SeniorVicePresidentandChiefEconomist

Table of Contents

Summary Real Estate Markets Continue to Recover..... ..... .3 Realtor Confidence Index: Current Conditions..3 Realtor Confidence Index: Six Month Outlook..5 Section 1: Market Conditions Single Family Properties: Confidence Stabilizes......7 Townhouse Properties: Confidence Continues to Build Up.....7 Condos: Confidence Heading Towards Moderate.....8 Sixty-four Percent of Realtors Report Constant or Higher Prices on Recent Transactions Compared to a Year Ago ....8 Eighty-six Percent of Responding Realtors Expect Constant or Higher Residential Prices in the Next Year9 Buyer Traffic is Rising. Seller Traffic is Flat...9 Time On the Market is Declining.....10 Distressed Sales at 25 Percent of Market ....11 Distressed Real EstateBelow Market Prices....12 Property Condition Also Affects Selling Price of Distressed Properties.....12 Section 2: Buyer and Seller Characteristics Cash Sales: 29 Percent of Residential Sales........13 First Time Buyers: 32 Percent of Residential Buyers .........14 Relocation Buyers: 15 Percent of Residential Market..........14 Residential Sales to Investors: 19 Percent of Residential Market... 15 Second Home Purchases: 12 Percent of Residential Market............15 Mortgage Down Payments....16 Realtors Continue to Report Rising Rents for Residential Properties....16 International Transactions : Two Percent of Residential Market......17 Section 3: Current Issues AppraisalsA Continuing Problem.17 Credit and Lending Conditions.....18 Section 4: Recent NAR Articles Homebuilding in the Sweltering Summer Heat Lawrence Yun......20 Housing Foot Traffic -Ken Fears............22 Commercial Investments Advance in First Quarter 2011George Ratiu.23

SUMMARY Real Estate Markets Continue to Recover

Gay Cororaton and Jed Smith The Realtors Confidence Index (RCI) report provides monthly indicators on current conditions and the outlook for the residential real estate markets. The report summarizes information pertaining to Realtor confidence, price trends and expectations, buyer/seller traffic, buyer profiles, and issues affecting real estate. The June edition is based on responses of over 3,400 Realtors to a survey conducted for the time period June 25 July 3, 2012.1 Given that all real estate is local, conditions in specific markets may vary from the overall national trends presented in this report. The respondents comments generally indicate that the real estate markets around the country are continuing their recoveries in terms of sales and price2. Realtor confidence about current market conditions for all types of residential property was sustained in June after a rapid buildup earlier in the year. The RCI-SF (single family) current index is at 57.9. The level of confidence in the markets for townhouses and condominiums is still generally weak, but the indexes are trending up, which indicates that a greater proportion of Realtors have moderate to strong expectations. An index of 50 reflects a medium level of confidence.

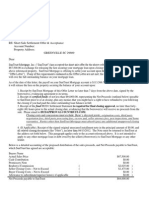

June2012Realtors ConfidenceIndex CurrentConditions

70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0

SF:57.9TH:37.5Condo30.6

SF

TH

Condo

Prices continue to firm up with 64 percent of Realtors reporting constant or increasing prices compared to the same time a year ago. Looking forward, 84 percent of Realtors expect constant or rising prices in the forthcoming year.

Therewere3,415respondentstotheJunesurvey. Allreal estate is local, so comments were varied, diverse, and in some cases contradictory depending on the respondents location.

2 1

There is strong buyer interest but not enough listings: buyer demand is reported to be growing faster than supply, and many respondents are reporting multiple offers. The buyer traffic index is at 60.01, with the seller traffic index at 41.22. The percentage of Realtors reporting distressed (foreclosed and short sales) property sales was stable at 25% , compared to approximately a third a year ago

However, a lack of inventory for sale, major problems in obtaining mortgages on a timely basis, and appraisals that do not capture the current state of the market were reported as having a negative impact on the housing recovery: There is a reported lack of inventory in a number of areas around the country. The mortgage approval process is reported to be exasperatingly slow, and lenders continue to impose substantial information requirements on potential borrowers, tending to delay the process. The mortgage process is reported as especially protracted for short sales. Appraisals are reported to be coming in at unrealistically low levels relative to the underlying market conditions, not reflective of actual market values. Respondents reported that appraisals do not recognize that market prices are increasing. Respondents reported extended time requirements to close foreclosures and short sales.

This months RCI survey results confirm the trends reported in the NAR data for Existing Home Sales (http://www.realtor.org/topics/existing-home-sales/data) and the NAR Economic Outlook (http://www.realtor.org/sites/default/files/reports/2012/economic-forecast-2012-0530.pdf), which outlines an economy expected to grow at 2.2 percent in 2012 (3.0 percent in 2013), creating 2.1 million jobs in 2012 (3million jobs in 2013). The graph for Total Home Sales on a twelve-month roll (i.e., total sales for the current and previous 11 months reported monthly) shows a market with sales growth projections for Existing Home Sales. In addition, a modest improvement in home prices is expected, based on continued economic expansion. ExistingHomeSales:ActualandForecast Outlookfor2012:4.7MillionHomeSales

8000000 6000000 4000000 2000000 0 1999Dec 2000Aug 2001Apr 2001Dec 2002Aug 2003Apr 2003Dec 2004Aug 2005Apr 2005Dec 2006Aug 2007Apr 2007Dec 2008Aug 2009Apr 2009Dec 2010Aug 2011Apr 2011Dec 2012Aug 2013Apr 2013Dec TwelveMonthRoll Forecast

PricesbyMonth,NotStatisticallyAdjusted OutlookProjectingImprovement

250000 200000 150000 100000 50000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan Jan MedianPrice Forecast

Market Outlook Realtors have moderate to strong expectations about the direction of the housing market for the next 6 months. The sixmonth expectations index for single family home sales is above 50 while the indexes for townhouse and condominiums continue to rise. An index above 50 indicates that respondents expressed moderate to strong expectations (strong=100; moderate =50; weak=0) for the outlook.

June2012Realtors ConfidenceIndex SixMonthOutlook

70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0

SF:61.4TH:41.6Condo35.9

SF

TH

Condo

Continued increases in residential sales are projected along with continued price improvement, although both sales and prices will vary from market to market. There continue, however, to be risks to the market outlook: Potentially Positive Factors/News Falling Inventories of homes for sale: Months supply of homes for sale as of May was at 6.6 months compared to approximately 10 months in 2010. The lower level of Distressed Sales continues, indicating continued if slow market improvement. Home Affordability: Continued low interest and inflation rates contribute to high affordability. Demographics: The U.S. population has expanded substantially in the past 10 years, but sales are at a level of approximately 10 years ago.

Potentially Negative Factors/News The economic recovery continues to proceed at a slow pace: job creation is positive but not sufficient to absorb new entrants and the unemployed; the economy has so far generated about 80,000 new jobs each month in the last 3 months, but the economy needs to generate about 250,000 a month to get back to 5 % unemployment rate. The slowdown in economic growth especially in the Euro countries and the possibility of recession in Europe is as much a political as an economic issue. Our housing market and economic projections are based on muddling through the problem. The potentially adverse economic effect of the fiscal cliff(expiration of Bush tax cuts and mandated spending cuts in the absence of legislative action) is also a political as well as an economic issue. Again, projections are based on muddling through the problem. Credit standards and information requirements imposed by financial institutions in mortgage lending continue to be excessively stringent, having a negative effect on closings and closing times.

What Does This Mean For Realtors? The currently available data indicate that the residential real estate markets continue to recover. Realtor confidence and price expectations are higher than was the case a few months ago. Rising rental rates also have favorable implications for home sales. Time on market continues to decrease. Prices and interest rates continue to be lower than has been the case in the past. These are the reasons that we continue to view the outlook as favorable for home sales. Given that the typical homeowner will occupy a house for approximately 8 years after purchase and that home ownership is basically a lifestyle decision in addition to a financial commitment, one can make a good case that this is a good time to buy a house, remembering that staying within a reasonable budget and prudent mortgage is important.

I. Market Conditions

Realtor Confidence Remains Upbeat The REALTORS Confidence Index is an indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Respondents indicate whether conditions are, or are expected to be "strong" (100 points), "moderate" (50 points), and "weak" (0 points). A score of 50 for the index is the threshold between strong" and weak conditions. Realtor confidence in the market outlook is presented in terms of the current market and the market outlook for the next six months for single family, townhouse, and condo markets. Across all types of indexes, the RCI is either above moderate (i.e., greater than 50 for single family homes) or continues to move towards moderate (townhouses and condominiums). Single Family Properties: Confidence Stabilizes, Remains Above Moderate in June

June2012Realtor Confidence CurrentandSixMonthOutlook:SingleFamilyProperties

70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0

Current:57.9Outlook: 61.4

CurrentConfidence

ConfidenceinOutlook

Townhouse Properties: Confidence Continues to Increase, Approaching Moderate in June

June2012Realtor Confidence CurrentandSixMonthOutlook:TownhouseProperties

50.0 40.0 30.0 20.0 10.0 0.0

Current:37.5Outlook:41.6

CurrentConfidence

ConfidenceinOutlook

Condom miniums: Co onfidence Heading Tow H wards Mode erate as of J June

June2012R J Realtor Con nfidence CurrentandSixMont thOutlook:CondoProp perties

40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0

Curre ent:30.6Outlook:35.9

CurrentConfidenc ce

ConfidenceinOu utlook

Sixty-fou Percent of Realtors Reported Constant o Higher Pr ur o or rices on Rec cent Transact tions Comp pared to a Year Ago Y Home prices continue to firm up as demand is re H d eported to be increasing faster than e supply. For the curre survey, 64 percent of respondent to the RCI reported co F ent 6 f ts I onstant prices (30 percent) or rising pric (34 percent). An inc ces creasing prop portion of re espondents ( percent) (5 reported seeing price increases of 10 percent or more. e

Eighty-six Percent of Respondi Realtors Expect C o ing s Constant or Higher Res r sidential Pr rices in the Ne 12 Mont as of Jun 2012 ext ths ne Eighty-six pe E ercent of resp pondents rep ported the ex xpectation of constant or higher price in f r es the next year. Since the last quar of 2011, the proporti of respondents has e y rter , ion expecting constant or rising prices has been consistently rising. n

Buyer Traffic is Ris sing While Seller Traffi is Flat as of June S fic Buyer and sel traffic in B ller ndexes are po ointing towa ards an imba alance betwe demand a een and supply. The buyer tra T affic index is above mod s derate at 60.0 although essentially unchanged 01, h compared to May. However, the seller traffic index has n budged a is below moderate, w d c not and w with the index at 41.22. Po x otential selle appear to be holding back from listing their p ers o properties, possibly still recover ring from the housing ma e arket of the G Great Reces ssion. A num mber of ents nted mbalance bet tween supply and deman with avai y nd, ilable invent tories responde commen on an im significan lower th would no ntly han ormally be the case.

IndexesofBuyerandS SellerTraffi ic

70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0

Buye er:60.01Selle 41.22 er:

200801

200804

200807

200810

200901

200904

200907

200910

201001

201004

201007

201010

201101

201104

201107

201110

201201

BuyerTr raffic

SellerTraffic

201204

Time On Market Co n ontinues to Decline More homes are being sold in less tha a month. Approxima M an ately a third o properties of s were on the market for less than a month whe sold, and 58 percent w sold w t f en d were within 3 mont ths.

Conversely, 24 percent of homes wer on the mar C 2 f re rket 6 month or more w hs when sold, an n improvem over a year ago. ment

10

Distresse Sales at 25 Percent of Market in June ed 2 o n Twen nty-five perc of respo cent ondents repor selling d rted distressed pr roperty (fore eclosed and s short sales), un nchanged fro May figu om ures, but low than last y wer years figure of 30 perce e ent. Approxim mately 42 pe ercent of dist tressed sales were for ca s ash.

. Distressed sales go through several stagesthe initia overdue st g al tatus for mor rtgage paym ments, the actua foreclosure by the fina al e ancial institut tion unless s sold in a sho sale, and t final sale of ort the e the prope erty, frequen by Realt ntly tors throug the MLS. gh The Existing Hom Sales ma E me arket is bifurcated, with d distressed pr roperties freq quently bein ng sold at si ignificant dis scounts to market, frequently in subp condition when goin to market, and m par n ng , reported to be popula with inves ar stors seeking bargain pri g ices. In the c current surve investors ey, s paid cash in 72 perce of their overall purch h ent o hases of prop perties (both distressed a nonand distressed in compa d), arison to first-time buyer who overa paid cash in 10 percen of their rs all h nt purchases. In the cas of distress propertie with a sell who wou like to close a transac se sed es ler uld ction without waiting for th buyer to obtain a mor w he o rtgage, an in nvestor is rep ported as som metimes bing the g preferabl buyer. Re le espondents re eported a nu umber of inst tances of inv vestors purch hasing a property for cash even when a first-time prospective buyer had of e p b ffered a high price, but with the need to her t obtain a mortgage. m Distresse Real Esta ed ateBelow Market Pr w rices Distressed pro D operties typi ically sell be elow the mar rket price of similar, non f n-distressed propertie the discou level fluc es; unt ctuates depending on sal location, type of prop les perty, and property condition. Foreclosures have been selling at app F s s proximately 20 percent b below marke 18.3 per et: rcent as of June 20 a 012. Short Sales have been se S h elling at appr roximately 1 percent be 15 elow market 14.8 perce as t: ent of June 2012 o 2.

11

Property Condition Affects the Selling Pri of Distre y n e ice essed Properties The discount to market ex T xperienced by distressed property is affected by the property b d ys physical condition. Well maintai W ined propert tend to s at a lowe discount th is the ca ties sell er han ase erties in poor condition. The un-wei r ighted averag price disc ge counts to ma arket are for prope presented for the time periods Ju 2011 thro d uly ough June 20 012. Prices f distressed houses wit for th above av verage condit tion are discounted at ab bout 13 18 percent, wit the discou increasin th unt ng significan dependi on prope deteriora ntly ing erty ation.

PercentPr P riceDiscou untbyProp pertyCond dition

Un nweightedA AverageforJ July2011to oJune2012S Surveys

40.0 30.0 20.0 10.0 0.0 1Above average 2Average 3Below average 4Wellbelow 5Bottom1% ave 15.4 13.5 17.6 13.4 29.4 22.5 17.0 24.0 7.3 36.7 37

Forecl losed

Short tsale

12

Property Discounts as a Functi of Cond y ion ditionJune Data e

Me Percent Below Market Value ean t June 20 RCI Survey 012 House Cond H dition 1-Above ave erage 2-Average 3-Below average w 4-Well below ave Fo oreclosure 13.3 16.0 18.4 29.3 t Short Sale 11 1.3 13 3.3 17 7.8 22 2.1

II. Buy and Seller Ch yer S haracteris stics

Cash Sal les: 29 Perc cent of Resi idential Sale es The percentag of cash sa was 29 percent in Ju compare to 28 perc in May. T ge ales p une, ed cent The prop portion of cas sales is su sh ubstantially higher than t rate prio to the dow h the or wnturn of the e housing market in 20 The high preponder m 008. h rance of all-c cash sales ap ppears to be due to stricter mortgage e/underwritin standards and purcha by inve stors and sec ng s, ases cond home b buyers, who frequentl lypay cash, possibly edg p ging edged ou buyers ne ut eeding to sec cure a mortga age.

13

First Tim Buyers: 32 Percent of Residential Buyers me t First time hom buyers ac me ccounted for 32 percent of total buye slightly lower than t r ers, the May figu of 34 per ure rcent. Norma first time buyers are in the neigh ally e hborhood of 40 percent o f of 3 total resid dential sales according to NARs Pr s, rofile of Hom Buyers a Sellers . The proport me and tion of first-ti homebuy hit a pe of approx ime yers eak ximately 50 percent in 2 2009. The rel latively low level of first tim buyers in part reflect the difficu of securi mortgag financing and/or the d me n ts ulty ing ge delay with distr ressed sales. Realtors have also no that that investors offering all-cash sales to . h oted t sellers ha crowded out first-tim buyers in some cases, particularly in the case of distresse ave d me , y e ed propertie Unsucces es. ssful first-tim buyers ty me ypically cont tinue their pr roperty searc sometim ch, mes making a number of bids before securing a property. p

Buyers Due to Reloc D cation/Job Changes: 15 Percent of Residentia Market C 5 f al Realtors rep that 15 percent of re R port p esidential sal were to b les buyers for re elocation purposes, i.e., a job move, retirem m ment, etc. Approximate 13 percen of relocati buyers p A ely nt ion pay cash.

3 In nthe2011surv vey,firsttimeh homebuyersaccountedfor3 37percentofa allbuyers.

14

Resident Sales to Investors: 19 Percent of Resident Market tial tial t In nvestors acco ounted for 19 percent of total residen f ntial sales in June, up from 17 perce in n ent May. Inv vestors have reported tha in many ca they can obtain a po at ases n ositive cash flow conver rting propertie to rental units. Realtors have be reporting that the ma es een g arket could a absorb additi ional distressed properties coming onto the market with sales to investors or first time buyers. d o t, e Approxim mately 72 pe ercent of inv vestors pay cash.

Second Home Purch H hases: 12 Pe ercent of Re esidential M Market Second home purcha accounte for 12 per h ases ed rcent of resid dential sales Approximately 53 perc s. cent of second home buye paid in ca d ers ash.

15

Mortgag Down Pay ge yments with 20 Percen Down Acc h nt count for 36 Residen 6% ntial Sales Mortgages wi a down payment of 20 percent or more were 36 percent o all mortga M ith p 2 r of ages. Down pa ayments of 11-19 percen have remai nt ined in the n neighborhood of 4 to 5 p d percent of all l mortgage es.

Realtors Continue to Report Rising Rents for Resid s e dential Prop perties Higher reside H ential rents compared to a year ago w reported by 54 perc of were d cent Realtors Lower re were rep . ents ported by 10 percent of R 0 Realtors. C Constant ren were repo nts orted by 17 per rcent of Rea altors. The continued trend of risin rents incre e t ng eases the val of lue homeown nership.

16

Internat tional Trans sactions: Tw Percent of Residenti Market wo o ial Sales of U.S. residential real estate to foreigners n residing in the U.S. w at 2 pe r o not were ercent of total tr ransactions in June. App i proximately 81 percent o internatio clients p cash, up from of onal pay May figu of 71 per ure rcent. Inform mation on international ac ctivities is av vailable at http://ww ww.realtor.or rg/research/r research/repo ortsintl.

III. Cu urrent Iss sues

alsA Con ntinuing Pro oblem Appraisa Appraisals co A ontinue to be a problem. Several resp e pondents rep ported that ap ppraisals are not e keeping pace with the appreciatio in market values. Re p on t espondents a reported encounters with also d out-of-town appraise who have little knowl ers e ledge of the neighborhoo od/local con nditions. Appraisa are also coming in slo als owly and one respondent noted that a e t appraisers ar busy with re h refinanci applicatio ing ons. Thirty-five pe T ercent of Rea altors repo orted having had a proble with an a em appraisal in the past 3 mo onths. Appr roximately 10 percent of the respond f dents reporte contract c ed cancellation, 11 percent reported a de r elay, and 15 percent repo orted that the appraisal p e problems led to lower pri d ices.

17

Tight Cr redit Condit tions and Sl Lending Process low g One of the mo frequent comments by Realtors was a conc O ost b cern over un nreasonably t tight credit con nditions. Respondents indicated tha credit con R at nditions cont tinue to be to tight, that oo t lenders are taking too long in app a o proving an application, a that info a and ormation requ uired from borrower is excessiv rs ve. Some respond dents expres ssed frustrati that finan ion ncial institut tions appear to be focusi ing ng y uals els s n on makin loans only to individu with the highest leve of credit scores. It is well known that a number of financial institutions have weak loan portfol due to previous lend r s lios ding standard ds now perc ceived as hav ving been too loose. The lending pe endulum app pears to have swung to th e he other extreme in som cases, resu me ulting in som institution decreasin their overa lending me ns ng all efforts an nd/or imposi unrealist ing tically high credit standa c ards. Respon ndents noted that regiona d al and comm munity bank as well as credit union were poten ks ns ntial alternat sources of mortgage ative es. A comparison of FICO sc n cores for loa transaction as reporte by Realto an ns ed ors respond ding to the RC survey over the Febru CI uary through June time sp compare with FICO scores pan ed O reported for Fannie Mae and Fred Mac sin family h M ddie ngle home loans for the lendi condition in ing ns boom housing market of a few years ago shows t that credit av vailability to lower scori o ing the pre-b applicant appears to have declin substanti ts o ned ially. Realto ors provide FICO info ed formation based on their understandin of the buy u ng yers credit situations; in many cases the informa s n s ation was estimated Overall th data seem to substantiate relativel tight cred conditions d. he m ly dit sa situatio on discussed in detail by Realtors responding to the survey d y y.

18

19

IV. Recent NAR Articles

Homebuilding in the Sweltering Summer Heat

On June 29, 2012, in Economist Commentaries, by Lawrence Yun, Chief Economist More Sharing ServicesShare|Share on facebookShare on twitterShare on emailShare on print The weather heat map is all red today across the country. The best course is to stay indoors with the air conditioner on, and postpone lawn mowing for another day. Yet, there are construction workers with hard hats and hammers pounding away outside. In reviewing home construction activity by each month, there is no discernible trend of holding back construction in the summer in very hot places like Phoenix or Dallas. Homebuilding is more impacted by market conditions of bubble and collapse, but not heat. The following chart shows the raw counts of housing permits issued by each month in the Greater Phoenix area. Note that the big swings in data are over several years, such as the sharp rise from 1982 to 1984 and the sharp decline from 2005 to 2010. The small month-to-month changes are all but invisible in the bigger multiyear trend. A closer inspection of the monthly data shows more building in March in some years, but also more building in July in other years. There is nothing to indicate that workers want to cool off during summer.

20

The same type of phenomenon of long-term dominating short-term weather trends is also observed in Houston and Atlanta. If anything, there appears to be more activity in summer compared to winter.

Though construction workers evidently can take on the heat, they are unwilling to freeze. There are definite big seasonal swings in housing permits in cold weather cities such as Minneapolis, Milwaukee, and Buffalo. Much more activity occurs in late spring to autumn before pretty much going into hibernation in winter.

21

For most of us who have indoor jobs, we sho t h j ould be quite grateful. As mentioned frequently i e d in these columns this ye without the current U.S. housing recovery, A ear, U g America may be facing a y similar mild recession like that occurring in Europe. So l m E lets give big thanks to th g hose wearing hard hats as they are contributing to U.S. eco s g onomic grow wth.

Lawren Yun, Chief Econo nce C omist

Lawrence Yun is Chi Economi and Senio Vice Presi ief ist or ident of Research at NA He direct AR. ts research activity for the associati and regu t ion ularly provid comment des tary on real e estate marke et trends for its 1 millio REALTO on OR member rs.

SentriLock Data Rel D lated to Buyer F Foot Tra affic

Ken Fear Manager, Regional Economics an Housing F rs, , E nd Finance

Each mon SentriLock LLC. provi nth k, ides NAR Re esearch with d on the nu data umber of show wings, which is correlated with future contracts and closings. In the latest read d c ding, foot tra affic improved in June after a d r sharp drop in May. p The diffus sion index for June, which measures the share of ma r h e arkets showing an improve g ement over the 12e month per riod ending in June, jumpe more than 50% to 60.1 f n ed from 38.7 in M May. While this measure does not suggest the absolut level of imp te provement or decline of sa in July or August, it do suggest th r ales r oes he direction and that the number of ma n arkets experiencing growth in traffic reb h bounded sharp from May ply y. While con ncerns over European econ E nomic stability linger, U.S. unemploym remains s . ment stable and rec cord low mortg gage rates hav helped to maintain buye interest. ve m er

22

CommercialInvestmentsAdvanceinFirstQuarter2011 ByGeorgeRatiu,Manager,Quantitative&CommercialResearch Commercialrealestatetransactionspostedgoodfirstquarterperformance.Salesvolume totaled$51.4billion,a40percentincreaseofthefirstquarter2011.Retailpropertiesprovided astrongboosttotheupwardtrend,rising89percentfromayearago.Capratesmovedlower forapartment,retailandCBDofficebuildings. DealscontinuedtoflowduringAprilandMay.Salesvolumetotaled$14.8billioninApriland closedat$17.9billioninMaysecondhighestmonthlyvolumeoftheyear.However,Mayalso representedthefirstyearoveryeardeclineinsalessinceNovember2009,down10percent. Privateinvestorsremainedthedominantbuyerinthemarketduringthefirstquarter, accountingfor42percentofacquisitions.Inatellingsignofthemarketsrebound,institutional andequityfundswerethesecondmostactivebuyergroup,makingup24percentofdeals, followedbyREITs,with15percentoffirstquartersales.Crossborderinvestorswerealso active,with10percentofthemarket. Thetopmarketsforinvestmentdealswerecoastal,withafewexceptions.NewYork maintaineditsnumberonespot,followedbySanFranciscoandWashington,DC. MostActiveMarkets Market Vol.($Bil.) 1 NYCMetro $38.00 2 SFMetro $15.30 3 DCMetro $15.10 4 LAMetro $15.00 5 Chicago $10.60 6 Houston $7.30 7 Dallas $7.10 8 Boston $7.10 9 So.Florida $6.90 10 Atlanta $6.10

Source:RealCapitalAnalytics

Caprate 6.05% 5.94% 6.11% 6.33% 6.69% 6.91% 7.09% 6.81% 7.21% 6.85%

Basedonlivedata;dealsvaluedat$10Morgreaterreportedincontractorclosedinpast12months

Overthepastyear,distressedcommercialpropertieshavedeclined,duetoalargervolumeofworkouts versusinflows.Apartmentsandhotelspostedthelargestdeclinesofoutstandingdistress.Justas 23

importantly,withtheexceptionofCMBS,alltheotherlendergroupsmanagedtoreducedtheir distressedbalancesoverthepast12months.Giventhat2012isapeakyearformaturingcommercial debt,especiallythatoriginatedin2007,thetrendsareencouraging. Top25PropertySalesbyInvestmentVolume2012.Q1 InvVol($M)* SF/Units PPSF/Unit Transaction Location 615.0 1,305,000 $471 1BankofAmericaBuilding Boston,MA 390.0 537,800 725 2530FifthAvenue NewYork,NY 334.8 837,130 400 3fmrReliantEnergyPlaza Houston,TX 257.0 388,000 662 410East53rdStreet NewYork,NY 252.0 421,901 747 5HomerBuilding Washington,DC 230.0 589 390,492 6PerrySouthBeach MiamiBeach,FL 228.0 1,243,000 183 7350WMartCenterDr Chicago,IL 226.1 1,395,980 162 8TowersatWilliamsSquare Irving,TX 207.5 623,000 333 92FederalReservePlaza NewYork,NY 200.0 676 295,858 10FairmontSanFrancisco SanFrancisco,CA Source:RealCapitalAnalytics|Par alInterest

24

También podría gustarte

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Highlights From The 2011 Profile of Home Buyers and SellersDocumento17 páginasHighlights From The 2011 Profile of Home Buyers and SellersnarwebteamAún no hay calificaciones

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Smart Growth Program Public Schools ToolkitDocumento135 páginasSmart Growth Program Public Schools ToolkitnarwebteamAún no hay calificaciones

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- REALTORS® Confidence Index July 2012Documento26 páginasREALTORS® Confidence Index July 2012National Association of REALTORS®Aún no hay calificaciones

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- REALTOR AE Magazine Summer 2012Documento32 páginasREALTOR AE Magazine Summer 2012narwebteamAún no hay calificaciones

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Resources & Services: For The Global Real Estate ProfessionalDocumento30 páginasResources & Services: For The Global Real Estate ProfessionalnarwebteamAún no hay calificaciones

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Profile of International Home Buying in Miami 2011Documento25 páginasProfile of International Home Buying in Miami 2011narwebteamAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- 2010 Local Association Compensation Profile Survey ResultsDocumento45 páginas2010 Local Association Compensation Profile Survey ResultsnarwebteamAún no hay calificaciones

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- GSE and FHA Condo RatesDocumento4 páginasGSE and FHA Condo RatesnarwebteamAún no hay calificaciones

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Spring 2012: Making Strides in A Jumpy EconomyDocumento12 páginasSpring 2012: Making Strides in A Jumpy EconomynarwebteamAún no hay calificaciones

- NAR Global Research Report Highlights: Profile of International Home Buying Activity 2012Documento12 páginasNAR Global Research Report Highlights: Profile of International Home Buying Activity 2012narwebteamAún no hay calificaciones

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Simplify: Real Estate Trends in A Time of UncertaintyDocumento21 páginasSimplify: Real Estate Trends in A Time of UncertaintynarwebteamAún no hay calificaciones

- Resources & Services: For The Global Real Estate ProfessionalDocumento30 páginasResources & Services: For The Global Real Estate ProfessionalnarwebteamAún no hay calificaciones

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The 3.8% Tax: Real Estate Scenarios & ExamplesDocumento10 páginasThe 3.8% Tax: Real Estate Scenarios & ExamplesnarwebteamAún no hay calificaciones

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Creating A Chain of OwnershipDocumento1 páginaCreating A Chain of Ownershipnarwebteam100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- Profile of International Home Buying Activity 2012Documento28 páginasProfile of International Home Buying Activity 2012narwebteamAún no hay calificaciones

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Smart Growth Program ToolkitDocumento168 páginasSmart Growth Program ToolkitnarwebteamAún no hay calificaciones

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- CIVIX NAR License Agreement With Vendor AmendmentDocumento7 páginasCIVIX NAR License Agreement With Vendor AmendmentnarwebteamAún no hay calificaciones

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- Brief of National Association of REALTORS® As Amicus Curiae in Support of RespondentDocumento40 páginasBrief of National Association of REALTORS® As Amicus Curiae in Support of RespondentnarwebteamAún no hay calificaciones

- Report and Recommendations of The Internet Data Exchange Presidential Advisory Group August, 2011Documento8 páginasReport and Recommendations of The Internet Data Exchange Presidential Advisory Group August, 2011narwebteamAún no hay calificaciones

- 2012 Economic and Housing Market OutlookDocumento38 páginas2012 Economic and Housing Market OutlooknarwebteamAún no hay calificaciones

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Home Price Monitor: April 2012Documento13 páginasHome Price Monitor: April 2012narwebteamAún no hay calificaciones

- Global Perspectives: East Meets West, February 2012Documento8 páginasGlobal Perspectives: East Meets West, February 2012narwebteamAún no hay calificaciones

- Vendor License AgreementDocumento14 páginasVendor License AgreementnarwebteamAún no hay calificaciones

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Application For Patent LicenseDocumento2 páginasApplication For Patent LicensenarwebteamAún no hay calificaciones

- Patent License Agreement FormDocumento11 páginasPatent License Agreement FormnarwebteamAún no hay calificaciones

- 2012 Mediation Training Registration FormDocumento3 páginas2012 Mediation Training Registration FormnarwebteamAún no hay calificaciones

- 2012 Professional Standards Education SeminarDocumento3 páginas2012 Professional Standards Education SeminarnarwebteamAún no hay calificaciones

- 2010 Local Association Compensation Profile Survey ResultsDocumento45 páginas2010 Local Association Compensation Profile Survey ResultsnarwebteamAún no hay calificaciones

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- 2011 REALTOR® Association Certified Executive ADF Workshop PresentationDocumento41 páginas2011 REALTOR® Association Certified Executive ADF Workshop PresentationnarwebteamAún no hay calificaciones

- Navy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixDocumento2 páginasNavy Federal Credit Union - Home Affordable Foreclosure Alternative (HAFA) MatrixkwillsonAún no hay calificaciones

- PA Language DetailsDocumento460 páginasPA Language Detailssaad essalmaniAún no hay calificaciones

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Oregon Foreclosures - The Mess That MERS MadeDocumento5 páginasOregon Foreclosures - The Mess That MERS MadeQuerpAún no hay calificaciones

- The Missouri Foreclosure Process - For Lenders' and Borrowers' Attorneys 3 PageDocumento45 páginasThe Missouri Foreclosure Process - For Lenders' and Borrowers' Attorneys 3 PageKimberly Parton Bolin100% (1)

- Real Estate Lead Scripts EbookDocumento34 páginasReal Estate Lead Scripts EbookResearch Chain100% (1)

- Ocwen Short Sale Approval (2nd Mortgage)Documento6 páginasOcwen Short Sale Approval (2nd Mortgage)kwillsonAún no hay calificaciones

- The FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry InsidersDocumento31 páginasThe FBI Estimates That 80 Percent of All Mortgage Fraud Involves Collaboration or Collusion by Industry Insiders83jjmack100% (1)

- USDC Awards MFE Founder Over $40K in Landmark TILA LawsuitDocumento5 páginasUSDC Awards MFE Founder Over $40K in Landmark TILA LawsuitStorm BradfordAún no hay calificaciones

- Short Sale Approval LettersDocumento24 páginasShort Sale Approval LettersBryant TutasAún no hay calificaciones

- Foreclosure Attorney Retainer AgreementDocumento12 páginasForeclosure Attorney Retainer AgreementB_KLAWGROUP100% (1)

- Seller GuideDocumento18 páginasSeller Guidekberg1Aún no hay calificaciones

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Agent Guidelines For Equator Short SaleDocumento17 páginasAgent Guidelines For Equator Short SalecpdeschenesAún no hay calificaciones

- John E. Steele, Civil RICO, and The Florida Bar - Cayo Costa GateDocumento246 páginasJohn E. Steele, Civil RICO, and The Florida Bar - Cayo Costa GateJudicial_FraudAún no hay calificaciones

- How To Be A Real Estate Investo - Phil Pustejovsky PDFDocumento353 páginasHow To Be A Real Estate Investo - Phil Pustejovsky PDFKenya Wooden100% (2)

- Ben Carter - Foreclosure Continuing Legal EducationDocumento48 páginasBen Carter - Foreclosure Continuing Legal EducationGlenn AugensteinAún no hay calificaciones

- Solitude - Lockett - BOA 2-13 PDFDocumento3 páginasSolitude - Lockett - BOA 2-13 PDFDarian MooreAún no hay calificaciones

- Purchaseworkshop PDFDocumento44 páginasPurchaseworkshop PDFNikkie White100% (1)

- Taxes that may be owed when inheriting a houseDocumento2 páginasTaxes that may be owed when inheriting a househafuchieAún no hay calificaciones

- Loan Modifications - Workout Plans and ModificationDocumento43 páginasLoan Modifications - Workout Plans and ModificationSudershan ThaibaAún no hay calificaciones

- 1024.41 - Loss Mitigation Procedures.: Official InterpretationDocumento12 páginas1024.41 - Loss Mitigation Procedures.: Official InterpretationJohn LongAún no hay calificaciones

- Foreclosure ActionsDocumento30 páginasForeclosure ActionsForeclosure Fraud100% (2)

- SunTrust Short Sale Approval (Fannie Mae)Documento3 páginasSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- BOFA AddendumDocumento6 páginasBOFA AddendumkwillsonAún no hay calificaciones

- Cranberry - Scott - Suntrust 3-13 PDFDocumento7 páginasCranberry - Scott - Suntrust 3-13 PDFDarian MooreAún no hay calificaciones

- Washington RCW 61.24.163 Foreclosure Mediation Lies and Failures On Michael D. Levitz & Christopher King/Mortgage Movies File.Documento3 páginasWashington RCW 61.24.163 Foreclosure Mediation Lies and Failures On Michael D. Levitz & Christopher King/Mortgage Movies File.Christopher KingAún no hay calificaciones

- 4.29.14 CED Report PDFDocumento17 páginas4.29.14 CED Report PDFRecordTrac - City of OaklandAún no hay calificaciones

- Maximizing Cash Flow from Real Estate Deals with Wholesale PropertiesDocumento40 páginasMaximizing Cash Flow from Real Estate Deals with Wholesale PropertiesMahid SamadAún no hay calificaciones

- Taking the Offensive Stance on ForeclosuresDocumento64 páginasTaking the Offensive Stance on ForeclosuresDonna EversAún no hay calificaciones

- Bank of America HELOC Short Sale ApprovalDocumento2 páginasBank of America HELOC Short Sale ApprovalkwillsonAún no hay calificaciones

- FHFA Short Sale GuidelinesDocumento4 páginasFHFA Short Sale Guidelinesthomas_guidry_2Aún no hay calificaciones

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedDe EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedCalificación: 4.5 de 5 estrellas4.5/5 (38)

- Creative Personal Branding: The Strategy To Answer What's Next?De EverandCreative Personal Branding: The Strategy To Answer What's Next?Calificación: 4.5 de 5 estrellas4.5/5 (3)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeDe EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeCalificación: 4.5 de 5 estrellas4.5/5 (85)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDe Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurCalificación: 4 de 5 estrellas4/5 (2)

- Transformed: Moving to the Product Operating ModelDe EverandTransformed: Moving to the Product Operating ModelCalificación: 4 de 5 estrellas4/5 (1)

- Workin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherDe EverandWorkin' Our Way Home: The Incredible True Story of a Homeless Ex-Con and a Grieving Millionaire Thrown Together to Save Each OtherAún no hay calificaciones

- When Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfDe EverandWhen Helping Hurts: How to Alleviate Poverty Without Hurting the Poor . . . and YourselfCalificación: 5 de 5 estrellas5/5 (36)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveDe EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveAún no hay calificaciones

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelDe EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelCalificación: 5 de 5 estrellas5/5 (51)