Documentos de Académico

Documentos de Profesional

Documentos de Cultura

TARO Valuation

Cargado por

JohnDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

TARO Valuation

Cargado por

JohnCopyright:

Formatos disponibles

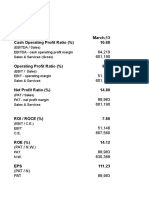

Price per share in m Market Cap EBIDTA Debt Cash Enterprise Value

PERRIGO TARO 105.68 9860.00 593.15 1510.00 531.41 10838.59

TARO** 44.53 1980.00 222.69 46.11 242.72 1783.39 44.53 1980.00 318.00 44.7 258.8 1765.90

SUN's Offer 24.5

TEVA 45.08 42460.00 4174.00 14520.00 1100.00

876.15

55880.00

EV/EBIDTA

18.27

8.01

5.55

2.76

13.39

Operating Margin%

17.79

40.33

50.3

16.98

Debt/Equity ROE EPS

58.39 25.99 3.7

7.88 38.61 4.11

65.4 12.5 3.09

P/E

28.56

10.83

14.6

Note: Price based of April 20th closing All data TTM Taro** indicates analysis based of materially higher Annualized Q4 2011 results

What does this indicate ?

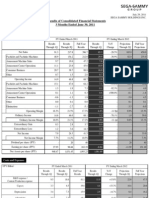

Indicates TARO is significantly mispriced in the market (reasons explained later). Roughly 40% of TEVA's current earnings constitute Brand Copaxone's earnings, which is slated to become generic in 2014. If TARO were to trade based of Perrigo's market multiple , From 2011 earnings, it should be ~$96 per share. From Q4-annualized earnings, it should be ~$135 per share. Higher Operating margin indicates the strength of Taro's business and the limited competition it enjoys for its products. Hence TARO deserves much higher market multiple Taro's Debt/Equity is <13 times Perrigo. Perrigo is highly leveraged. Taro carries almost zero Financial risk and has significant leeway to grow organically & inorganically in future by taking on Debt. Hence Taro deserves higher market multiple than Perrigo

Roughly 40% of TEVA's current earnings constitute Brand Copaxone's earnings, which is slated to become generic in 2014. Hence Teva is trading at lower market multiple . Taro is severly mispriced in the market http://www.bloomberg.com/news/2012-01-02/teva-says-jeremy-levin-named-to-succeed-shlomo-yanai-as-ceo.html

95.86088475 135.3908445

También podría gustarte

- TARO Valuation 2Documento1 páginaTARO Valuation 2JohnAún no hay calificaciones

- Other Manufacturing Expenses 0% Selling and Admin Expenses 0%Documento2 páginasOther Manufacturing Expenses 0% Selling and Admin Expenses 0%Saket LohiaAún no hay calificaciones

- ACF CaseDocumento22 páginasACF CaseHaris AliAún no hay calificaciones

- Asian Paints - Financial Modeling (With Solutions) - CBADocumento47 páginasAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745Aún no hay calificaciones

- Income StatementDocumento1 páginaIncome StatementDeepan BaluAún no hay calificaciones

- DCF valuation of Yeats and TSE corporationsDocumento24 páginasDCF valuation of Yeats and TSE corporationsSagar IndranAún no hay calificaciones

- Ceres Algorithmic TradingDocumento15 páginasCeres Algorithmic TradingAndrea OraniAún no hay calificaciones

- Q2FY12 - Results Tracker 28.10.11Documento7 páginasQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsAún no hay calificaciones

- FTSE Vietnam Index Series FactsheetDocumento2 páginasFTSE Vietnam Index Series FactsheetAnh Phuong NguyenAún no hay calificaciones

- Investment Thoughts: Bharti Airtel LTDDocumento4 páginasInvestment Thoughts: Bharti Airtel LTDNikita AgrawalAún no hay calificaciones

- Bharti Airtel Q2FY16 Result Update: Maintain Buy with Target Price of Rs 480Documento12 páginasBharti Airtel Q2FY16 Result Update: Maintain Buy with Target Price of Rs 480arun_algoAún no hay calificaciones

- Tata Tea Limited - Brand ValuationDocumento37 páginasTata Tea Limited - Brand ValuationKunal MehtaAún no hay calificaciones

- Key Business Indicators Q1 2014Documento1 páginaKey Business Indicators Q1 2014Hitesh MoreAún no hay calificaciones

- Edmonton Real Estate Stats 2015Documento14 páginasEdmonton Real Estate Stats 2015Anonymous QRCBjQd5I7Aún no hay calificaciones

- Corporate Valuation Yeats and Tse CostingDocumento27 páginasCorporate Valuation Yeats and Tse CostingSagar IndranAún no hay calificaciones

- ACC Q4CY11 Result Update Fortune 09022012Documento5 páginasACC Q4CY11 Result Update Fortune 09022012anknkulsAún no hay calificaciones

- Beta SecuritiesDocumento5 páginasBeta SecuritiesZSAún no hay calificaciones

- First Resources 4Q12 Results Ahead of ExpectationsDocumento7 páginasFirst Resources 4Q12 Results Ahead of ExpectationsphuawlAún no hay calificaciones

- Result Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Documento6 páginasResult Update: Tata Motors LTD (TTML) CMP: Rs.1,252.30Gautam GokhaleAún no hay calificaciones

- Project Investment Particulars No Per Unit CostDocumento28 páginasProject Investment Particulars No Per Unit CostMirza JunaidAún no hay calificaciones

- National Database PakistanDocumento2 páginasNational Database PakistanLiaqat AliAún no hay calificaciones

- Havells India 3QF14 Result Review 30-01-14Documento8 páginasHavells India 3QF14 Result Review 30-01-14GaneshAún no hay calificaciones

- Aseanas 20140430Documento3 páginasAseanas 20140430bodaiAún no hay calificaciones

- Institutional Research Technical ReportDocumento4 páginasInstitutional Research Technical ReportRajasekhar Reddy AnekalluAún no hay calificaciones

- EQUITY Projection4Documento3 páginasEQUITY Projection4Zyrus ManglapusAún no hay calificaciones

- Bajaj Bal SheetDocumento3 páginasBajaj Bal SheetSukshith ShettyAún no hay calificaciones

- 2013 Mar 13 - Pernod Ricard SADocumento21 páginas2013 Mar 13 - Pernod Ricard SAalan_s1Aún no hay calificaciones

- Econ Eportfolio Part 2Documento3 páginasEcon Eportfolio Part 2api-252980817Aún no hay calificaciones

- KLSE Stock Screener PDFDocumento4 páginasKLSE Stock Screener PDFleekiangyenAún no hay calificaciones

- Peak Sport Products (1968 HK) : Solid AchievementsDocumento9 páginasPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeAún no hay calificaciones

- BEL - RatiosDocumento4 páginasBEL - RatiosArtiAún no hay calificaciones

- CEMEX Financials 1988-1999Documento3 páginasCEMEX Financials 1988-1999William HendersonAún no hay calificaciones

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDocumento5 páginasQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsAún no hay calificaciones

- RMN - 0228 - THCOM (Achieving The Impossible)Documento4 páginasRMN - 0228 - THCOM (Achieving The Impossible)bodaiAún no hay calificaciones

- Financial Feasibility of Business PlanDocumento14 páginasFinancial Feasibility of Business PlanmuhammadnainAún no hay calificaciones

- Results Tracker: Wednesday, 19 Oct 2011Documento6 páginasResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsAún no hay calificaciones

- Operational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedDocumento1 páginaOperational / Financial Analysis 2007 2008 2009 2010 2011 Audited Audited Audited Estimates ProjectedparamsnAún no hay calificaciones

- Revenue Table.55555Documento11 páginasRevenue Table.55555tilahunthmAún no hay calificaciones

- Bajaj Electricals: Pinch From E&P To End SoonDocumento14 páginasBajaj Electricals: Pinch From E&P To End SoonYash BhayaniAún no hay calificaciones

- Maruti Suzuki, 1Q FY 2014Documento16 páginasMaruti Suzuki, 1Q FY 2014Angel BrokingAún no hay calificaciones

- Mahindra & Mahindra: 3 August 2009Documento8 páginasMahindra & Mahindra: 3 August 2009Chandni OzaAún no hay calificaciones

- IT Market 2020 FullDocumento178 páginasIT Market 2020 FullBoldsaikhan TavkhaiAún no hay calificaciones

- Number Crunching File For Markstrat ProjectDocumento35 páginasNumber Crunching File For Markstrat ProjectNishant Kumar100% (1)

- Gas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Documento3 páginasGas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Kazmi Qaim Ali ShahAún no hay calificaciones

- Ays 082914 3331 PDFDocumento18 páginasAys 082914 3331 PDFFabian R. GoldmanAún no hay calificaciones

- American Home ProductsDocumento6 páginasAmerican Home Productssunitha_ratnakaram100% (1)

- Lady M Case - 08.07.2016Documento14 páginasLady M Case - 08.07.2016Sabyasachi Mukerji40% (5)

- 2006 To 2008 Blance SheetDocumento4 páginas2006 To 2008 Blance SheetSidra IrshadAún no hay calificaciones

- COMPANY/RATIOS/VALUATION RATIOS/175/Nestle IndiaDocumento1 páginaCOMPANY/RATIOS/VALUATION RATIOS/175/Nestle IndiabhuvaneshkmrsAún no hay calificaciones

- Loan and Revolver For Debt Modelling Practice On ExcelDocumento2 páginasLoan and Revolver For Debt Modelling Practice On ExcelMohd IzwanAún no hay calificaciones

- Tata Motors Income & Expenditure SummaryDocumento2 páginasTata Motors Income & Expenditure SummaryRahul GuptaAún no hay calificaciones

- Hosoku e FinalDocumento6 páginasHosoku e FinalSaberSama620Aún no hay calificaciones

- First Global: DanoneDocumento40 páginasFirst Global: Danoneadityasood811731Aún no hay calificaciones

- Analysis of Financial StatementDocumento4 páginasAnalysis of Financial StatementArpitha RajashekarAún no hay calificaciones

- Associate Bearings Company LimitedDocumento18 páginasAssociate Bearings Company LimitedKnt Nallasamy GounderAún no hay calificaciones

- Biocon - Ratio Calc & Analysis FULLDocumento13 páginasBiocon - Ratio Calc & Analysis FULLPankaj GulatiAún no hay calificaciones

- Projected Flow of Income (Per Hub)Documento2 páginasProjected Flow of Income (Per Hub)Swarup RanjanAún no hay calificaciones

- Grand Total: Name 3% Commission 5% Commission Total Individual Sales Total Individual CommissionDocumento6 páginasGrand Total: Name 3% Commission 5% Commission Total Individual Sales Total Individual CommissionAlex TangAún no hay calificaciones

- Chapter 2 Solutions - Matching Supply With DemandDocumento13 páginasChapter 2 Solutions - Matching Supply With Demanddonutshop100% (1)

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDe EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsAún no hay calificaciones

- Voice of Shareholders - SurveyDocumento11 páginasVoice of Shareholders - SurveyJohnAún no hay calificaciones

- Knight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012Documento13 páginasKnight Capital Group, Inc.: Sandler O'Neill Global Exchange and Brokerage Conference - June 7, 2012JohnAún no hay calificaciones

- Novexatin Expert Clinical OpinionDocumento14 páginasNovexatin Expert Clinical OpinionJohnAún no hay calificaciones

- Taro Why The Valuation DiscountDocumento3 páginasTaro Why The Valuation DiscountJohnAún no hay calificaciones

- TarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012Documento3 páginasTarominorityshareholderspetitiontoSpecialCommitteeandBoard 05202012JohnAún no hay calificaciones

- Dear Members of The TARO Boardv2-0927-LetterDocumento6 páginasDear Members of The TARO Boardv2-0927-LetterJohnAún no hay calificaciones

- Anacor Investor Presentation June 2013 (Compatibility Mode)Documento51 páginasAnacor Investor Presentation June 2013 (Compatibility Mode)JohnAún no hay calificaciones

- Shareholder Proposals - Annual Shareholders MeetingDocumento3 páginasShareholder Proposals - Annual Shareholders MeetingJohnAún no hay calificaciones

- Quality Affordable Healthcare Products™: William Blair Growth Stock ConferenceDocumento37 páginasQuality Affordable Healthcare Products™: William Blair Growth Stock ConferenceJohnAún no hay calificaciones

- Fusilev (Levoleucovorin) Humana Coverage PolicyDocumento6 páginasFusilev (Levoleucovorin) Humana Coverage PolicyJohnAún no hay calificaciones

- TARO VIC ThesisDocumento3 páginasTARO VIC ThesisJohnAún no hay calificaciones

- Bill Ackman's Ira Sohn JCP PresentationDocumento64 páginasBill Ackman's Ira Sohn JCP PresentationJohnCarney100% (1)

- Thirdpoint 4q12investorletter 010913Documento9 páginasThirdpoint 4q12investorletter 010913DistressedDebtInvestAún no hay calificaciones

- 12 Civ 8195 ComplaintDocumento51 páginas12 Civ 8195 ComplaintJohnAún no hay calificaciones

- 001 Investor Presentation June2012Documento27 páginas001 Investor Presentation June2012JohnAún no hay calificaciones

- 13272520Documento23 páginas13272520JohnAún no hay calificaciones

- Lavin DeclarationDocumento21 páginasLavin DeclarationJohnAún no hay calificaciones

- Amended Claims-MarineDocumento5 páginasAmended Claims-MarineJohnAún no hay calificaciones

- Marine Patent Applicant ArgumentsDocumento11 páginasMarine Patent Applicant ArgumentsJohnAún no hay calificaciones

- Disclosure ComparisonDocumento1 páginaDisclosure ComparisonJohnAún no hay calificaciones

- Amrn Response To Final RejectionDocumento4 páginasAmrn Response To Final RejectionJohnAún no hay calificaciones

- Patent CaseDocumento15 páginasPatent CaseJohnAún no hay calificaciones

- Taro GrowthDocumento1 páginaTaro GrowthJohnAún no hay calificaciones

- Fairholme Case Study I (With Disclaimers)Documento27 páginasFairholme Case Study I (With Disclaimers)VariantPerceptionsAún no hay calificaciones

- Disclosure ComparisonDocumento1 páginaDisclosure ComparisonJohnAún no hay calificaciones

- Taro Pharmaceutical Industries LTDDocumento4 páginasTaro Pharmaceutical Industries LTDJohnAún no hay calificaciones

- 12815569Documento7 páginas12815569JohnAún no hay calificaciones

- TaroPharmaceuticalIndustriesLtd 20F 20120405Documento157 páginasTaroPharmaceuticalIndustriesLtd 20F 20120405JohnAún no hay calificaciones