Documentos de Académico

Documentos de Profesional

Documentos de Cultura

March 2012 - Week 4

Cargado por

RENewslettersDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

March 2012 - Week 4

Cargado por

RENewslettersCopyright:

Formatos disponibles

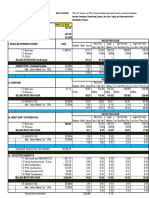

MARCH #4

REAL ESTATE NEWS

FOR ALL OF YOUR REAL ESTATE NEEDS

R

2012

Forgiven Debt and Taxes

Suppose you do a short sale on your home and you sell your home for less than the amount of your mortgage. The bank may call it even and let you go, but the IRS wont necessarily look at it the same way. In general, the IRS says that any debt forgiveness is taxable; that is, the amount of debt that is forgiven is the same amount that is treated as taxable income. Thus, until recently, a struggling home loan borrower in this situation could not only lose their home, but could be stuck with a large tax bill. A 2007 law (the Mortgage Forgiveness Debt Relief Act) created an exception to this. Under this law, a borrower does not have to pay tax on forgiven mortgage debt if that debt is secured by a principal residence and the amount of outstanding debt does not exceed the original mortgage amount plus the cost of any improvements. This exception can apply to a short sale, a foreclosure where some debt is wiped out, bankruptcy with principal reduction or a modification with a principal reduction. The debt must have been forgiven between 2007 and 2012 and the protection is limited to $2 million. Keep in mind that even though you may not have to pay tax, you do have to file additional paperwork with the IRS declaring the forgiveness. Tax relief may not be available for all refinances, second mortgages or lines of credit so check with your tax advisor or lawyer if that applies to you. The act also does not cover forgiven debt on rental or business properties. These exceptions are set to expire at the end of 2012 and have not yet been extended. However, industry groups are currently lobbying to have the law extended.

Location: 94 La Gorce Cr., Miami Beach, FL 33141 Beds: 9 Baths: 9 full and 2 half baths Square Feet: 15,101 Owner: Dwayne Michael Carter, Jr. -- better known as rapper Lil Wayne Asking Price: $12,900,000 History: The rapper purchased the home for approximately $14 million last year. However, he reportedly is trying to sell this home quickly to settle a large tax lien (roughly $5.6 million). Features: To start with, this home has 1,200 feet of water frontage and a boat dock allowing for direct access to the water. You will also find an outdoor pool and hot tub as well as multiple sky terraces to enjoy the beautiful Florida weather. Inside, this three level estate has glass walls providing fantastic views of the water and the Miami skyline. An entertainment room and a two-story master suite (accessible by a glass elevator) are some of the highlights. There is also a 3 bedroom guesthouse and a 3 car garage.

Question and Answer

Seller Question: Im selling my parents house. I think I can get more money if I do some repairs but I want it to be profitable. Whats a good rule of thumb? In general, you want to get at least a 15% - 20% return on your money. So if it costs you $100 dollars to fix something, you should make sure that fix will add about $115-$120 worth of value when you sell the house. Of course, this gets a bit trickier if you do the work yourself in that case you have to consider the cost of your time and labor. Something may be a cheap financial fix, but if it takes you 3 days to do it, it may not be worthwhile. Buyer Question: When does the seller of a home move out? This should typically be covered in the sales contract and is negotiable between the buyer and seller. Normally, the buyer will get control at closing (which means the seller has to be out by then and will usually move out a few days prior). However, it is possible for the seller to be out well before closing. The opposite is true as well, and the seller may want to stay a few days after the closing. If this is the case, you need to negotiate an arrangement (a short term lease, for example). There is also the possibility that there is a tenant in the home. In that case, you would still have to honor the terms of the lease (although you could certainly ask them to move out early). Finally, although rare, it is possible the seller just doesnt leave the home, even though your contract states the property should be vacated. It has happened that the seller just never moved. In that case, its probably time to call your lawyer.

Worlds Safest Cities

The 2011 Mercer Quality of Living survey looked at 221 worldwide cities and determined a personal safety ranking for each one, by measuring internal stability, crime levels, law enforcement effectiveness, and internal relations. Here are the 10 safest cities: 1) Luxembourg, Luxembourg 2) Bern, Switzerland 3) Helsinki, Finland 4) Zurich, Switzerland 5) Vienna, Austria 6) Geneva, Switzerland 7) Stockholm, Sweden 8) Singapore, Singapore 9) Auckland, New Zealand 10) Wellington, New Zealand

You will notice no cities in the United States made this list. In fact, there were none in the top 50. Baghdad was found to be the most dangerous, followed by NDjamena, Chad, then Abidjan, Cote DIvoire and two other African cities.

Riddle of the Week:

Question: You throw away the outside and cook the inside. Then you eat the outside and throw away the inside. What did you eat? Answer: An ear of corn.

The information in this newsletter is not meant as legal, financial, or any other type of recommendation. Please consult a qualified professional to discuss the details of your individual situation.

También podría gustarte

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Branding For Impact by Leke Alder PDFDocumento22 páginasBranding For Impact by Leke Alder PDFNeroAún no hay calificaciones

- Service Catalog Template DocDocumento3 páginasService Catalog Template DocBabul BhattAún no hay calificaciones

- Del Monte Philippines, Inc. vs. AragoneDocumento1 páginaDel Monte Philippines, Inc. vs. AragoneLeizle Funa-FernandezAún no hay calificaciones

- Janaury 2012 - Week 2Documento2 páginasJanaury 2012 - Week 2RENewslettersAún no hay calificaciones

- December 2011 - Week 4Documento2 páginasDecember 2011 - Week 4RENewslettersAún no hay calificaciones

- December 2011 - Week 1 - All WebDocumento2 páginasDecember 2011 - Week 1 - All WebRENewslettersAún no hay calificaciones

- December 2011 - Week 1Documento2 páginasDecember 2011 - Week 1RENewslettersAún no hay calificaciones

- November 2011 - Week 4Documento2 páginasNovember 2011 - Week 4RENewslettersAún no hay calificaciones

- November 2011 - Week 4 - ALLDocumento2 páginasNovember 2011 - Week 4 - ALLRENewslettersAún no hay calificaciones

- November 2011 - Week 3Documento2 páginasNovember 2011 - Week 3RENewslettersAún no hay calificaciones

- Newsletter Sample - Filled in PDFDocumento2 páginasNewsletter Sample - Filled in PDFRENewslettersAún no hay calificaciones

- Newsletter Sample - Filled in PDFDocumento2 páginasNewsletter Sample - Filled in PDFRENewslettersAún no hay calificaciones

- November 2011 - Week 2Documento2 páginasNovember 2011 - Week 2RENewslettersAún no hay calificaciones

- Security agency cost report for NCRDocumento25 páginasSecurity agency cost report for NCRRicardo DelacruzAún no hay calificaciones

- Minors AgreementDocumento12 páginasMinors AgreementDilip KumarAún no hay calificaciones

- Capital StructureDocumento2 páginasCapital StructurenidayousafzaiAún no hay calificaciones

- Scanner for CA Foundation covers key conceptsDocumento34 páginasScanner for CA Foundation covers key conceptsMadhaan Aadhvick100% (2)

- Review MODULE - MATHEMATICS (Algebra-Worded Problems) : Number Problems Age ProblemDocumento1 páginaReview MODULE - MATHEMATICS (Algebra-Worded Problems) : Number Problems Age ProblemYeddaMIlaganAún no hay calificaciones

- (Income Computation & Disclosure Standards) : Income in Light of IcdsDocumento25 páginas(Income Computation & Disclosure Standards) : Income in Light of IcdsEswarReddyEegaAún no hay calificaciones

- Tolerance KeyDocumento38 páginasTolerance Keyupkumar871Aún no hay calificaciones

- An Examination of Audit Delay Further Evidence From New ZealandDocumento13 páginasAn Examination of Audit Delay Further Evidence From New ZealandAmelia afidaAún no hay calificaciones

- Thermo-020H Decanter DownLoadLy - IrDocumento6 páginasThermo-020H Decanter DownLoadLy - IrLuis Rodriguez GonzalesAún no hay calificaciones

- 10 Types of Entrepreneurial BMsDocumento36 páginas10 Types of Entrepreneurial BMsroshnisoni_sAún no hay calificaciones

- BUITEMS Entry Test Sample Paper NAT IGSDocumento10 páginasBUITEMS Entry Test Sample Paper NAT IGSShawn Parker100% (1)

- Reshmi Rao Anudeep: Sai Ram KalyanDocumento11 páginasReshmi Rao Anudeep: Sai Ram KalyanSai Ram KumarAún no hay calificaciones

- MTC Strategic Plan 2012 To 2016Documento42 páginasMTC Strategic Plan 2012 To 2016Ash PillayAún no hay calificaciones

- Application - VarianceDocumento6 páginasApplication - Varianceadama02Aún no hay calificaciones

- Module 6 - Applied Economics MODULE 6: Contemporary Economic Issues Faced by Filipino EntrepreneursDocumento4 páginasModule 6 - Applied Economics MODULE 6: Contemporary Economic Issues Faced by Filipino EntrepreneursRuby CocalAún no hay calificaciones

- Ikea 6Documento39 páginasIkea 6My PhamAún no hay calificaciones

- Telesales Tips From A - ZDocumento20 páginasTelesales Tips From A - ZKing Solomon CatralAún no hay calificaciones

- Activity #1:: V F3QpgxbtdeoDocumento4 páginasActivity #1:: V F3QpgxbtdeoSafaAún no hay calificaciones

- Section What Is Entrepreneurship? Section Characteristics of An EntrepreneurDocumento12 páginasSection What Is Entrepreneurship? Section Characteristics of An EntrepreneurAashir RajputAún no hay calificaciones

- Argyris Maturity Theory by RameshDocumento8 páginasArgyris Maturity Theory by RameshHarish.PAún no hay calificaciones

- Netflix Survey ReportDocumento7 páginasNetflix Survey ReportShantanu Singh TomarAún no hay calificaciones

- Marketing Domain ...........................Documento79 páginasMarketing Domain ...........................Manish SharmaAún no hay calificaciones

- HACCP Assessment Audit ChecklistDocumento6 páginasHACCP Assessment Audit ChecklistnataliatirtaAún no hay calificaciones

- North America Equity ResearchDocumento8 páginasNorth America Equity ResearchshamashmAún no hay calificaciones

- The Venture Capitalist With A Silicon Valley Solution For Minority Owned BusinessesDocumento4 páginasThe Venture Capitalist With A Silicon Valley Solution For Minority Owned BusinessesAngel AlijaAún no hay calificaciones

- Ets 2021Documento4 páginasEts 2021Khang PhạmAún no hay calificaciones

- Overview of Persuasive Advertising-R8-N8.2.2014Documento52 páginasOverview of Persuasive Advertising-R8-N8.2.2014Tawfik EwedaAún no hay calificaciones