Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Comparison of Standard Chartered Bank With Citibank and HSBC

Cargado por

arpit_t0 calificaciones0% encontró este documento útil (0 votos)

8K vistas5 páginasTítulo original

COMPARISON OF STANDARD CHARTERED BANK WITH CITIBANK AND HSBC

Derechos de autor

© Attribution Non-Commercial (BY-NC)

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

8K vistas5 páginasComparison of Standard Chartered Bank With Citibank and HSBC

Cargado por

arpit_tCopyright:

Attribution Non-Commercial (BY-NC)

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 5

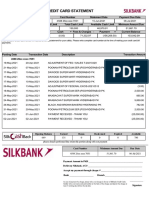

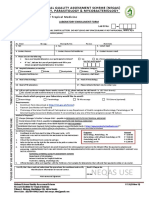

COMPARISON OF STANDARD CHARTERED BANK WITH

CITIBANK AND HSBC

BASIS STANDARD CHARTERED BANK CITIBANK HONG KONG & SHANGHAI BANKING

(AXCESS PLUS ACCOUNT) (SUVIDHA SAVINGS CORPORATION LIMITED (HSBC)

ACCOUNT)

Average Rs.25000 per quarter of 3 Rs. 25000 per month Rs. 25000 per quarter

Quarterly months each

Balance (AQB)

Minimum Rs. 3 lakhs

account

opening

amount

Charges for If AQB < RS.250 - AQB < 25000 : AQB<10000 Rs.1000

lower AQB If AQB < Rs.7500 Rs.1500 Monthly fee of Rs. per

If AQB > or = Rs.1250 250 quarter

Rs.7500 & <

Rs.10000

If AQB > or = Rs.1250 25000>AQB>10000 Rs.750 per

Rs.10000 & < quarter

Rs.15000

If AQB > or = Rs.750

Rs.15000 & <

Rs.25000

Demand draft Free : 2 DD & 2 PO per month Payable at citi branch Payable at par at HSBC branches :

& Pay order (without carry forwards) locations Up to 1 lakh : Rs.100

Charges: For SC Branch – Online banking 1 lakh & above : 0.1% of value

Rs.100 per DD : Free ( max Rs.2500)

For Non SC Branch – Phone Payable at par on other banks at non-

0.15% banking: Free branch locations :

up to Rs.50000 Drawn on correspondent

per month , banks : 0.3% of DD value (min

Rs.2(min Rs.75 Rs. 100)

& max Rs.750) Inter branch transfers across

In branch: HSBC accounts in India : Free

Rs.2.5/1000

(min Rs.100 &

max Rs.750)

Doorstep Free : 2 Doorstep banking One time registeration charge :

Banking Charges : Rs. 100 per visit Rs.2000

Annual fees : Rs.500

Cash pick up & delivery : Rs.250

Draft delivery : Rs.50

Cheque pick up & delivery : Rs.

50

Cheque Book Free : At par or local Free Free

(unlimited)

Reorder of Free Citibank online Urgently issued at the branch :

cheque book Rs. 1 lakh or Rs. 100

more : Cheque leaf issued over the

Re.1/leaf counter : Rs. 50

Rs.25000 or

more :

Re.1/leaf

Less than

Rs.25000 :

Rs.2/leaf

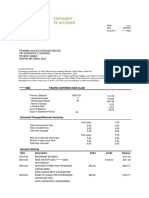

National Totally free Outside of internet banking:

Electronic (money is transferred within Upto Rs.1lakh : Free

Fund Transfer 24 – 48 hours) Rs.1lakh & above : Rs.25 per

(NEFT) transaction

Real Time Free Rs.5 per Outside of internet banking:

Gross (money is transferred in a sec) transaction for Upto Rs.5 lakh : Rs.25 per

Settlement Applicable for other bank less than Rs.1 transaction

(RTGS) accounts also lakh Rs.5 lakh & above : Rs.50 per

Rs.25 per transaction

transaction

Rs.100000 or

more(outward

)

Phone Free Free Free

Banking

Mobile Free Available Available

Banking

Anywhere Every branch is treated as Unlimited free in non-

Banking home branch home branches also

Relationship Yes Yes Yes

Manager

3rd Party Cash Yes

Deposit

Mobile Mobile transfer Card to card transfer

Transfer/card USP of Standard money transferred using the

to card Chartered VISA money transfer service

transfer Transfer money to any from VISA.

non account holder Money transferred within 72

Max amt transferred : working hours

Rs.20000 per day Transfer limit : Rs. 50000

Charges for transfer : NIL

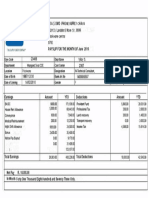

ATM Free withdrawal from Free Annual fees : Rs.150

ATM of Standard transactions at 1st 5 transactions free in other

Chartered. ATM of bank’s ATM. Further charge of

1st 5 transactions free Citibank Rs. 20

in other bank’s ATM. 1st 2 Cash withdrawal at other bank’s

Further charge of Rs. transactions ATM : Rs.25000

20 free Cirrus

Withdrawal limit : (further

Rs.25000 per day charges at

(Rs.18000 withdrawn Rs.50)

at 1 time) Further

No annual fee charges in

Lost card re-issuance : Euronet Rs.70

Rs.100 Cash

Cash withdrawal at withdrawal

other bank’s ATM : charges

Rs.10000 outside India:

$2.50/transac

tion

Cash

withdrawal

limit :

Rs.75000 per

day

Re-issuance

charge: Rs.100

ATM cum Globally valid Value added Use of debit cards at the petrol

Debit Card Annual bank charges : ATM/Debit Card: pump will attract a surcharge of

Rs.200 Joining fee : 2.5% of the purchase value or

Cash withdrawal limit : NIL Rs.10000(whichever is higher)

Rs.25000 per day Cash

Shopping limit : withdrawal

Rs.25000 per day limit :

No extra charges Rs.75000 per

except a surcharge of day

2.5% while swiping the

card at the petrol

pump & booking

tickets at the railway

station

Purchase goods at Visa

Electron Merchant

establishments

Withdraw cash from

any Visa Electron in

India & Abroad

Reward awarded

through points

1 swipe = 1 point*

1 point = Re.1

Max 20 points awarded

in a month i.e. 240

points in a year

Lost card re-issuance :

Rs.200

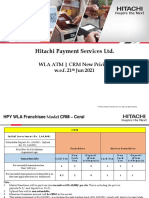

Platinum Premium card: Premium Platinum Debit card:

Annual charges : Annual fee : free

Rs.799 + Survice charge Cash withdrawal limit:

= Rs.900(approx.) Rs.150000 per day

Withdrawal limit : Purchase transaction limit :

Rs.200000 per day Rs.150000

Shopping limit : Added advantage :

Rs.200000 per day Exclusive dinning

No extra charges at the privileges in Mumbai,

petrol pump & raiway Bangalore, Delhi and

station Kolkata

Added advantage : 24 * 7 concierge

Dinning Plus Card services where the

10 – 20% cardholder gets free

discount on a access to a wide range

list of hotels & of special assistance

restaurants in services

India ATM cash withdrawl outside

Free PVR tickets India : Rs.120 per transaction

but conditioned Card re-issuance fee : free

to online

booking

Lost card re-issuance :

Rs.799

Account Within 6 months from the Within 12 months Within 6 months from the date of

closure date of opening an account : from the date of opening an account : Rs.1000

Rs.500 opening :

For individual :

Rs. 220

For companies

: Rs. 500

Duplicate Free Citibank onlin :

statement Free

Citiphone :

Rs.25

Branch :Rs.100

Overdraft 24% + Interest Tax

interest Overdraft facility of

upto Rs. 1,00,000

También podría gustarte

- 1571060994055Documento2 páginas1571060994055Moneytap RblAún no hay calificaciones

- Í U, Joè Masangkay Mikoâââââââ V Çtâ&03:Î Mr. Miko Verbo MasangkayDocumento4 páginasÍ U, Joè Masangkay Mikoâââââââ V Çtâ&03:Î Mr. Miko Verbo Masangkayleny artozAún no hay calificaciones

- Í Hebnè Juanitoâkingâ&Âso Âââ Â Ç/Â 85?Î Juanito King & Sons, IncDocumento4 páginasÍ Hebnè Juanitoâkingâ&Âso Âââ Â Ç/Â 85?Î Juanito King & Sons, IncPrincess Maevelle Chan PecaocoAún no hay calificaciones

- Transaction 9228125685Documento1 páginaTransaction 9228125685Veun SaomAún no hay calificaciones

- Sample Lease AgreementDocumento3 páginasSample Lease AgreementAna Marie Creencia100% (1)

- Í Nctãè Paderes Randyââââââââ Â Ç, Â#82Rî Mr. Randy Sadorra PaderesDocumento5 páginasÍ Nctãè Paderes Randyââââââââ Â Ç, Â#82Rî Mr. Randy Sadorra PaderesRandy PaderesAún no hay calificaciones

- Affidavit of CohabitationDocumento3 páginasAffidavit of Cohabitationflorina atanacioAún no hay calificaciones

- Acct Statement XX8993 30042022Documento42 páginasAcct Statement XX8993 30042022Sarvesh JukarAún no hay calificaciones

- Csscorp Ict Services, Inc. Payslip For: 06 Apr 2018 To 20 Apr 2018Documento1 páginaCsscorp Ict Services, Inc. Payslip For: 06 Apr 2018 To 20 Apr 2018Fawaz SayedAún no hay calificaciones

- Account Details and Transaction History: Air Asia SaverDocumento4 páginasAccount Details and Transaction History: Air Asia SaverSeema KhanAún no hay calificaciones

- Í Ui$Iè Sy Charmagneâkennethâ C Ç/Â (+2vî Mr. Charmagne Kenneth Carreon SyDocumento3 páginasÍ Ui$Iè Sy Charmagneâkennethâ C Ç/Â (+2vî Mr. Charmagne Kenneth Carreon SyGenevieve SyAún no hay calificaciones

- Histori TransaksiDocumento1 páginaHistori TransaksiChicy IntanAún no hay calificaciones

- StatementDocumento8 páginasStatementSophia KatzAún no hay calificaciones

- Histori TransaksiDocumento3 páginasHistori TransaksiAwwalul Khair FatwaAún no hay calificaciones

- Akinfenwa, Oladimeji Ali: Customer StatementDocumento9 páginasAkinfenwa, Oladimeji Ali: Customer StatementALI OLADIMEJI100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento3 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKrishna Prasad KanchojuAún no hay calificaciones

- BNI Mobile Banking: Histori TransaksiDocumento1 páginaBNI Mobile Banking: Histori Transaksilutfi desiAún no hay calificaciones

- Payslip For The Month of May 2020: Earnings DeductionsDocumento1 páginaPayslip For The Month of May 2020: Earnings DeductionsRAún no hay calificaciones

- Vikas KalalDocumento1 páginaVikas Kalalsanket shahAún no hay calificaciones

- BillDocumento6 páginasBillVelmani KananAún no hay calificaciones

- PDF Awit DDDocumento2 páginasPDF Awit DDWaqas RazaAún no hay calificaciones

- Bank StatementDocumento10 páginasBank Statementjeniferbarry0905Aún no hay calificaciones

- BillSTMT 4588260003287051Documento4 páginasBillSTMT 4588260003287051Munwer AliAún no hay calificaciones

- FIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Documento1 páginaFIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Zyrha ZelrineAún no hay calificaciones

- Dec 2018Documento1 páginaDec 2018Parag ChandakAún no hay calificaciones

- Nedbank Investment Statement - 28 Oct 2021Documento2 páginasNedbank Investment Statement - 28 Oct 2021Janice MkhizeAún no hay calificaciones

- 24jan2011Documento8 páginas24jan2011Sanusi KasimAún no hay calificaciones

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento9 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceLohit MataniAún no hay calificaciones

- Account Statement 101021 090122Documento31 páginasAccount Statement 101021 090122Mohammed jawedAún no hay calificaciones

- Bill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Documento6 páginasBill Statement: Previous Charges Amount (RM) Current Charges Amount (RM)Sarah AriffAún no hay calificaciones

- Customer StatementDocumento1 páginaCustomer StatementadesinaifakunleAún no hay calificaciones

- Statement 1696557549Documento5 páginasStatement 1696557549DBS4 F1010 NURSHAMIRAHAún no hay calificaciones

- Billing Statement: AnggraitoDocumento3 páginasBilling Statement: Anggraitoamelia mutiara rezaAún no hay calificaciones

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocumento4 páginasPayment Slip: Summary of Charges / Payments Current Bill AnalysisZaharuddin ZakariaAún no hay calificaciones

- Chapter 04 FormsDocumento62 páginasChapter 04 FormsClovis MeroAún no hay calificaciones

- Opening Balance As Of: 47,889.36: Description Reference Value Date Debit Credit DateDocumento1 páginaOpening Balance As Of: 47,889.36: Description Reference Value Date Debit Credit DateSayed Rasully SadatAún no hay calificaciones

- PDF DocumentDocumento4 páginasPDF DocumentFrannie NicoleAún no hay calificaciones

- 132/133, Landdros Mare ST, 0699: Polokwane CentralDocumento1 página132/133, Landdros Mare ST, 0699: Polokwane CentralMichael Bone-crusher PhiriAún no hay calificaciones

- NagadDocumento1 páginaNagadK.M.TowfiqeUzZaman Shanto100% (2)

- Joubert 20 Caledon Statement 03 January 2022Documento1 páginaJoubert 20 Caledon Statement 03 January 2022Wynand van den BergAún no hay calificaciones

- Easter ChickDocumento3 páginasEaster Chickmarythorne17Aún no hay calificaciones

- Í Ximâè Agravante Venusââââââ S Çeâ (+6%Î Ms. Venus Sersenia AgravanteDocumento5 páginasÍ Ximâè Agravante Venusââââââ S Çeâ (+6%Î Ms. Venus Sersenia AgravantejoelAún no hay calificaciones

- Ferdinand Ikeji 79, Emenike Street, Mile 1 Diobu, PHC CV - NT-1 Lagos Account Number Currency Opening Balance Total Debit Total Credit Closing Balance Debit Count Credit CountDocumento1 páginaFerdinand Ikeji 79, Emenike Street, Mile 1 Diobu, PHC CV - NT-1 Lagos Account Number Currency Opening Balance Total Debit Total Credit Closing Balance Debit Count Credit CountIkeji FerdinandAún no hay calificaciones

- PreviewDocumento5 páginasPreviewIon MoldovanuAún no hay calificaciones

- 11 Sep 2021 FNBDocumento1 página11 Sep 2021 FNBDon MadzivaAún no hay calificaciones

- October 2021Documento1 páginaOctober 2021Zaynn17Aún no hay calificaciones

- EbillDocumento1 páginaEbillwongAún no hay calificaciones

- AssDocumento3 páginasAssAshokAún no hay calificaciones

- Your Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodDocumento2 páginasYour Money Master Savings Account Summary: Here's What Happened in Your Account This Statement PeriodVISHAL BANSALAún no hay calificaciones

- E-Bill From Enagic India PDFDocumento3 páginasE-Bill From Enagic India PDFHitesh ChavdaAún no hay calificaciones

- HSBC Bank 2023-05-01 - StatementDocumento2 páginasHSBC Bank 2023-05-01 - StatementelaAún no hay calificaciones

- Rohan Dutt U127, 548-568 Canterbury Road Campsie NSW 2194Documento1 páginaRohan Dutt U127, 548-568 Canterbury Road Campsie NSW 2194Rohan Dutt SharmaAún no hay calificaciones

- Bill Statement 02 2024Documento3 páginasBill Statement 02 2024rk34550450Aún no hay calificaciones

- Up To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementDocumento3 páginasUp To 2020-02-18 - HSBC Business Direct Portfolio Summary 02 - StatementLevi dos SantosAún no hay calificaciones

- Statement 20220601 20220831Documento12 páginasStatement 20220601 20220831Chenny SangAún no hay calificaciones

- Cim B ClicksDocumento18 páginasCim B ClicksNethiyaAún no hay calificaciones

- 701018-Icea Uganda Money Market FundDocumento1 página701018-Icea Uganda Money Market FundChrispus MutabuuzaAún no hay calificaciones

- User Statement 65246 5409888907720648Documento27 páginasUser Statement 65246 5409888907720648Muniru QudusAún no hay calificaciones

- SOC DCB Privilege Savings AccountDocumento4 páginasSOC DCB Privilege Savings AccountBVS NAGABABUAún no hay calificaciones

- SOC DCB Privilege Current AccountDocumento4 páginasSOC DCB Privilege Current Accountsunilverma202320Aún no hay calificaciones

- OEM DatasheetsDocumento14 páginasOEM DatasheetsPhenomenal techAún no hay calificaciones

- Globe Bill 929104011Documento2 páginasGlobe Bill 929104011Mona Victoria B. PonsaranAún no hay calificaciones

- D1 - The Air Transport FrameworkDocumento72 páginasD1 - The Air Transport FrameworkAngel Cepedano BetetaAún no hay calificaciones

- NBP Schedule of Bank ChargesDocumento15 páginasNBP Schedule of Bank ChargesaavaraichAún no hay calificaciones

- Introduction To Depository Institutions Info Sheet 2 2 1 f1Documento5 páginasIntroduction To Depository Institutions Info Sheet 2 2 1 f1api-296017752Aún no hay calificaciones

- P3 MTP 2 For Nov 23 Questions @CAInterLegends PDFDocumento11 páginasP3 MTP 2 For Nov 23 Questions @CAInterLegends PDFtchargeipatchAún no hay calificaciones

- Reimbursement PolicyDocumento21 páginasReimbursement PolicyTIME100% (3)

- VILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Documento8 páginasVILLANTE, Stephen U. Bachelor in Public Administration 3-1 Case Study (Midterm Exam) (Open Format)Stephen VillanteAún no hay calificaciones

- Accessibility of Digital Banking On Customer Satisfaction: National Bank of Kenya.Documento7 páginasAccessibility of Digital Banking On Customer Satisfaction: National Bank of Kenya.IOSRjournalAún no hay calificaciones

- HDFC Bank Rupay Debit Card: Usage GuideDocumento5 páginasHDFC Bank Rupay Debit Card: Usage GuideAbhijitAún no hay calificaciones

- Savara PDFDocumento1 páginaSavara PDFANISUR RAHMANAún no hay calificaciones

- A Project Report On Comparison Between HDFC Bank Amp Icici BankDocumento75 páginasA Project Report On Comparison Between HDFC Bank Amp Icici BankSAHIL AGNIHOTRIAún no hay calificaciones

- A Thesis On Correlation Between Customer Services and Its Satisfaction Level in HDFC BankDocumento52 páginasA Thesis On Correlation Between Customer Services and Its Satisfaction Level in HDFC Bankbittu jain100% (1)

- 12 - Computer and Computerised Accounting System (168 KB) PDFDocumento14 páginas12 - Computer and Computerised Accounting System (168 KB) PDFramneekdadwalAún no hay calificaciones

- 0417 m15 Ms 12 PDFDocumento7 páginas0417 m15 Ms 12 PDFfawad212Aún no hay calificaciones

- Time Bound DILR - 4Documento17 páginasTime Bound DILR - 4Ajay TiwariAún no hay calificaciones

- CommandsDocumento6 páginasCommandskumar327Aún no hay calificaciones

- Marketing Strategies at Kotak-Mahindra Bank by AKASH DIXITDocumento41 páginasMarketing Strategies at Kotak-Mahindra Bank by AKASH DIXITAkash Dixit67% (3)

- An Appraisal of The Performance of Mercantile Bank LimitedDocumento68 páginasAn Appraisal of The Performance of Mercantile Bank LimitedarcrusselAún no hay calificaciones

- Cuscal Annual Report 2019Documento88 páginasCuscal Annual Report 2019ShakespeareWallaAún no hay calificaciones

- WLA Pricing For MF 30-Mar-22Documento11 páginasWLA Pricing For MF 30-Mar-22sb RogerdatAún no hay calificaciones

- Statement of Axis Account No:914010048627688 For The Period (From: 20-12-2020 To: 18-01-2021)Documento2 páginasStatement of Axis Account No:914010048627688 For The Period (From: 20-12-2020 To: 18-01-2021)karanAún no hay calificaciones

- Agentbanking Fullpaper 15.05.17Documento31 páginasAgentbanking Fullpaper 15.05.17Mohamed Abdi LikkeAún no hay calificaciones

- Vidyadeepam Dec 2019 FinalDocumento46 páginasVidyadeepam Dec 2019 FinalAjit kumarAún no hay calificaciones

- NEQAS Enrollment Form V7.0 PDFDocumento2 páginasNEQAS Enrollment Form V7.0 PDFMyline CampoamorAún no hay calificaciones

- Estmt - 2022 08 18Documento4 páginasEstmt - 2022 08 18CHRIS100% (1)

- An AI Based ATM Intelligent Security System Using Open CV and YOLODocumento3 páginasAn AI Based ATM Intelligent Security System Using Open CV and YOLOEditor IJTSRDAún no hay calificaciones

- IT in Bangking SectorsDocumento16 páginasIT in Bangking SectorsKamrul HasanAún no hay calificaciones

- SBI Statement July 2017-2018 PDFDocumento2 páginasSBI Statement July 2017-2018 PDFSai SameerAún no hay calificaciones

- Base 24Documento4 páginasBase 24readbooksreadAún no hay calificaciones