Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Case Study

Cargado por

rohit utekarDescripción original:

Título original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Case Study

Cargado por

rohit utekarCopyright:

Formatos disponibles

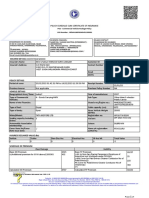

Case Study:

Collaboration in

Group Health Insurance

IndiaVima

Case Study Collaboration in Group Health Insurance

____________________________________________________________

ObjectOrb Technologies 2

Collaboration in Health Insurance

Health insurance is administered by TPAs in India, while insurance is sold by the

insurance companies. Employers often buy group insurance for their employees

health insurance benefits. TPAs manage such policies. Employees need insurance

cards or some documentation that they can use at hospitals for insurance benefits.

It is important for employers (the insured),insurance companies, and TPAs to have

complete and accurate information about beneficiaries covered in the policies.

Situation

There are two main transactions for which collaboration is needed between the

different entities in health insurance. The first is enrolment and the second is

claims settlement and reporting. Insurance companies sell policies to groups. The

policy needs (benefits) are also many times informally communicated by the

employers. The insurance companies need beneficiary information to compute

premium. TPAs also need beneficiary information to issue cards to the insured and

also for claims administration.

Insurance companies receive beneficiary information in different formats and

media today, including, fax, Excel, MS Word document, list of employees sent in

an email, or just hard copy. The insurance companies have to manually input this

information into their system, so do TPAs. This leads to unnecessary manual data

entry and errors. In many cases, insurance companies maintain beneficiary

information in hard copy files and only reference them in their insurance

application.

Claims reports are sent to insurance companies, usually in hard copy formats,

by TPAs. The reports are for specific operating offices from each TPA. The overall

claims experience is hard todiscern for insurance companies (See Claims Analytics

Case Study).

Solution

IndiaVima, a collaborative online platform for insurance companies, TPAs, insured

and brokers, provides unprecedented connectivity and collaborative experience.

The insured is able to specify the insurance needs (benefits) in a structured

manner. India Vima enables the insured to specify different subgroups any

number and any level. In addition, the insured is able to specify sub-limits.

India Vima also provides standardized representation of beneficiary information.

The information is provided to IndiaVima by insured in MS Excel format.

IndiaVima validates the information to validate that clean and accurate data is

presented to insured. Further, IndiaVima analyzes the data to provide various risk

metrics to insurance companies for each group.

Once insurance companies complete the underwriting, the beneficiary data is

available to TPA instantaneously. IndiaVima integrates well with insurance

companys back office systems, like Genisys and Premia. Insurance companies and

TPAs are able to import the beneficiary information directly into their systems and

avoid manual data entry.

IndiaVima generates cards for beneficiaries automatically when the policy

underwriting is complete. This saves TPAs significant effort and cards can be

reliably sent to beneficiaries.

Benefits

1. Standardized representation of beneficiary information, resulting in higher

efficiency and accuracy of processing beneficiary data

2. Connectivity between stake holders improves communication, reduces errors

and results in lower cost of underwriting

3. Interfacing with back office systems results in avoiding unnecessary and

repetitive data entry, resulting in increased accuracy and cost savings

4. Better and more timely access to enrolment data for TPAs

Case Study Collaboration in Group Health Insurance

____________________________________________________________

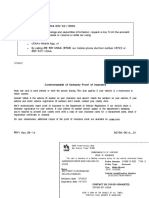

_ PIOs(Policy Issuing Offices) can compute the

Premium even

with minimal available information like No. of

employees to

be covered, no. of beneficiaries to be covered,

average age of

the employees and the sum insured.

_ PIOs can respond to RFPs (floater/non-floater

policies) by

sending proposals online without any delay.

Base Premium can be calculated based on several

criteria like

self age, maximum age, average age per family,

average age of

all beneficiaries in the policy etc.,

_ Multiple Rate Tables can be used for the

computation of the

Premium.

A unique Any Database, Any Format integration solution Transemble

For more information

Visit: www.objectorb.com Call: +91-80-2352 9525 Email : sales@objectorb.com

FEATURES BENEFITS

RFQ (Request for

Quotation)

_ PIOs(Policy Issuing Offices) can compute the Premium even

with minimal available information like No. of employees to

be covered, no. of beneficiaries to be covered, average age of

the employees and the sum insured.

También podría gustarte

- Trustee Instructions: Part I Managing Your Living TrustDocumento38 páginasTrustee Instructions: Part I Managing Your Living Trust:Nikolaj: Færch.71% (7)

- Claims DashboardDocumento12 páginasClaims DashboardSunitha Machiraju100% (1)

- Billing Training CompleteDocumento141 páginasBilling Training CompleteBOBBILI50% (2)

- The New India Assurance Co. LTDDocumento3 páginasThe New India Assurance Co. LTDsarath potnuriAún no hay calificaciones

- INS 21 Chapter9-Insurance PoliciesDocumento27 páginasINS 21 Chapter9-Insurance Policiesvenki_hinfotechAún no hay calificaciones

- AutoIDCards PDFDocumento1 páginaAutoIDCards PDFPaiger RossAún no hay calificaciones

- Project On Web Based Application For Insurance ServicesDocumento54 páginasProject On Web Based Application For Insurance ServicesNnamdi Chimaobi64% (11)

- Loma 301 Chapter 1 Overview of Insurance AdministrationDocumento12 páginasLoma 301 Chapter 1 Overview of Insurance AdministrationJoyce Genuino100% (1)

- A Project Report ON: "Customer Satisfaction Survey OnDocumento66 páginasA Project Report ON: "Customer Satisfaction Survey Onsshane kumarAún no hay calificaciones

- Succession JY Notes Pre-Mid (Mod 1-4)Documento25 páginasSuccession JY Notes Pre-Mid (Mod 1-4)Jandi YangAún no hay calificaciones

- Motor Insurance Customers Expect Value Added ServicesDocumento6 páginasMotor Insurance Customers Expect Value Added ServicesLanston Pinto64% (11)

- Healthcare NotesDocumento13 páginasHealthcare NotesPriyal Garg100% (1)

- Import and Export Finance in India: A GuideDocumento78 páginasImport and Export Finance in India: A Guiderohit utekar100% (1)

- Insurance OperationsDocumento5 páginasInsurance OperationssimplyrochAún no hay calificaciones

- Project in Insurance SectorDocumento51 páginasProject in Insurance Sectoryaminipawar509100% (1)

- Consumer Satisfaction with Tata-AIG Life InsuranceDocumento66 páginasConsumer Satisfaction with Tata-AIG Life Insurancetulasinad123100% (1)

- IBMDocumento51 páginasIBMGayatri Swaminathan100% (1)

- InsuranceDocumento82 páginasInsuranceNikesh KothariAún no hay calificaciones

- InsurTech Trends and the Rise of Peer-to-Peer InsuranceDocumento17 páginasInsurTech Trends and the Rise of Peer-to-Peer InsurancePALLAVI KAMBLEAún no hay calificaciones

- JLL Standard Introduction Agreement v.3.5Documento6 páginasJLL Standard Introduction Agreement v.3.5Bogdan Orosz100% (1)

- Exam DirectionsDocumento17 páginasExam DirectionsHeather LunarAún no hay calificaciones

- CHAPTER 1 IntroductionDocumento6 páginasCHAPTER 1 IntroductionPrerana AroraAún no hay calificaciones

- Final Year Project For MCom in Manufacturing PencilDocumento73 páginasFinal Year Project For MCom in Manufacturing PencilPadmaja MenonAún no hay calificaciones

- AI in InsuranceDocumento8 páginasAI in InsuranceAjay BaviskarAún no hay calificaciones

- The Attitudes of Consumers and Its Effect Over The Business in Life Insurance CompaniesDocumento8 páginasThe Attitudes of Consumers and Its Effect Over The Business in Life Insurance CompaniesiisteAún no hay calificaciones

- Literature Review on Insurance Management AutomationDocumento5 páginasLiterature Review on Insurance Management AutomationAncy KalungaAún no hay calificaciones

- IA Script Phase - 3Documento9 páginasIA Script Phase - 3prakhar guptaAún no hay calificaciones

- Harnessing The Power of Big Data For Insurance: White PaperDocumento8 páginasHarnessing The Power of Big Data For Insurance: White PaperJohn SMithAún no hay calificaciones

- 15 Chapter 6Documento35 páginas15 Chapter 6Sairaj SankpalAún no hay calificaciones

- Health - Wellness - EngagementDocumento27 páginasHealth - Wellness - EngagementNSCC ViganAún no hay calificaciones

- 9999 Ghausia Insurance Services and Consumer AttitudeDocumento13 páginas9999 Ghausia Insurance Services and Consumer AttitudeiisteAún no hay calificaciones

- InsuranceDocumento82 páginasInsuranceNikesh KothariAún no hay calificaciones

- TOP Insurance NewsDocumento1 páginaTOP Insurance NewsTANISTHA MANGARAJAún no hay calificaciones

- Embedded InsuranceDocumento15 páginasEmbedded InsuranceSeerat MahajanAún no hay calificaciones

- Capstone Report - Ensure - Io - Final DraftDocumento13 páginasCapstone Report - Ensure - Io - Final DraftRamapriyaAún no hay calificaciones

- Compusoft, 3 (6), 961-966 PDFDocumento6 páginasCompusoft, 3 (6), 961-966 PDFIjact EditorAún no hay calificaciones

- The Role of Data Analytics in Insurance SectorDocumento4 páginasThe Role of Data Analytics in Insurance SectorIIM Indore Management Canvas100% (2)

- Market Potential of Tata AIG Life InsuranceDocumento105 páginasMarket Potential of Tata AIG Life Insuranceghanshyam1988Aún no hay calificaciones

- Nagindas Khandwala CollegeDocumento50 páginasNagindas Khandwala CollegeRitika_swift13Aún no hay calificaciones

- Baf) 1Documento8 páginasBaf) 1mesfinabera180Aún no hay calificaciones

- Insurance Management System-1Documento13 páginasInsurance Management System-1vikashraj06072000Aún no hay calificaciones

- Insunews: Weekly E-NewsletterDocumento30 páginasInsunews: Weekly E-NewsletterHimanshu PantAún no hay calificaciones

- Unit 6 - Intermediaries and Distribution Channels of Health InsuranceDocumento24 páginasUnit 6 - Intermediaries and Distribution Channels of Health Insurance7ossam AbduAún no hay calificaciones

- Suggestion and ConclusionDocumento4 páginasSuggestion and ConclusionSidhantha Jain100% (1)

- ERP Insurance Industry IndiaDocumento11 páginasERP Insurance Industry IndiaHitesh DudaniAún no hay calificaciones

- InsuranceDocumento7 páginasInsuranceSamadAún no hay calificaciones

- Journal08 - pg32-35Documento4 páginasJournal08 - pg32-35hrsrinivasAún no hay calificaciones

- B Predictive Modeling For InsurersDocumento8 páginasB Predictive Modeling For InsurersMikhail FrancisAún no hay calificaciones

- Presentation Notes 2Documento4 páginasPresentation Notes 2kumutha9913Aún no hay calificaciones

- Research Paper On Insurance in IndiaDocumento8 páginasResearch Paper On Insurance in Indiacaraqpc2100% (1)

- Alternate Data Sources V1.3-FinalDocumento35 páginasAlternate Data Sources V1.3-FinalVijay BalajiAún no hay calificaciones

- 120 Financial Planning Handbook PDPDocumento10 páginas120 Financial Planning Handbook PDPMoh. Farid Adi PamujiAún no hay calificaciones

- Research Paper A Comparative Analysis On Customer Relationship Management in Public Sector and Private Sector Life Insurance Companies Ms. Catherine Nirmala RaoDocumento3 páginasResearch Paper A Comparative Analysis On Customer Relationship Management in Public Sector and Private Sector Life Insurance Companies Ms. Catherine Nirmala RaoSmita KuntayAún no hay calificaciones

- Helping Reduce Insurance Fraud When ApplyingDocumento11 páginasHelping Reduce Insurance Fraud When ApplyingPooja ChavanAún no hay calificaciones

- Indian Insurance SectorDocumento18 páginasIndian Insurance SectorSaket KumarAún no hay calificaciones

- Report On Customer Relationship ManagementDocumento19 páginasReport On Customer Relationship ManagementjerthAún no hay calificaciones

- Literature Review On Motor Insurance UnderwritingDocumento5 páginasLiterature Review On Motor Insurance Underwritingc5sdvcgdAún no hay calificaciones

- Sariga.s - Insurance PresentationDocumento13 páginasSariga.s - Insurance PresentationSasi KumarAún no hay calificaciones

- New Avenues in Insurance Sector ExploredDocumento7 páginasNew Avenues in Insurance Sector ExploredDevesh NamdeoAún no hay calificaciones

- Insurance Company ThesisDocumento7 páginasInsurance Company Thesisdwt5trfn100% (2)

- Insurance System With Tracking ManagerDocumento6 páginasInsurance System With Tracking ManagerIJRASETPublicationsAún no hay calificaciones

- The Future of Insurance - KPMG CanadaDocumento7 páginasThe Future of Insurance - KPMG CanadaZaid KamalAún no hay calificaciones

- Causality Learning With Wasserstein Generative Adversarial NetworksDocumento12 páginasCausality Learning With Wasserstein Generative Adversarial NetworksAdam HansenAún no hay calificaciones

- Predict auto insurance fraud with decision treesDocumento2 páginasPredict auto insurance fraud with decision treesrashidAún no hay calificaciones

- Marketing of InsuranceDocumento22 páginasMarketing of InsuranceshrenikAún no hay calificaciones

- AIDocumento7 páginasAIablatAún no hay calificaciones

- What Does Detariffing MeanDocumento6 páginasWhat Does Detariffing MeanPravesh BansalAún no hay calificaciones

- 2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%De Everand2014: Your Ultimate Guide to Mastering Workers Comp Costs: The MINI-BOOK: Reduce Costs 20% to 50%Aún no hay calificaciones

- Saurabh Suhas Loke: Career ObjectiveDocumento2 páginasSaurabh Suhas Loke: Career Objectiverohit utekarAún no hay calificaciones

- Working Capital Management at DNS BankDocumento10 páginasWorking Capital Management at DNS Bankrohit utekarAún no hay calificaciones

- Introduction of Insurance PDFDocumento21 páginasIntroduction of Insurance PDFrohit utekar50% (2)

- Study of Fire Insurance With Reference To Bharti Axa GiDocumento8 páginasStudy of Fire Insurance With Reference To Bharti Axa Girohit utekarAún no hay calificaciones

- Services Provided by BOIDocumento67 páginasServices Provided by BOIrohit utekarAún no hay calificaciones

- Actuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related JobsDocumento13 páginasActuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related Jobsrohit utekarAún no hay calificaciones

- Insurance BasicsDocumento16 páginasInsurance Basicskavi_prakash6992Aún no hay calificaciones

- Guideline On The Actuarial Function PDFDocumento19 páginasGuideline On The Actuarial Function PDFrohit utekarAún no hay calificaciones

- Pms TemplateDocumento1 páginaPms Templaterohit utekarAún no hay calificaciones

- You Are Here: List of 30 Project Topics On InsuranceDocumento1 páginaYou Are Here: List of 30 Project Topics On Insurancerohit utekarAún no hay calificaciones

- Insurance CLGDocumento19 páginasInsurance CLGrohit utekarAún no hay calificaciones

- Actuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related JobsDocumento13 páginasActuary: Occupation Names Occupation Type Activity Sectors Description Competencies Education Required See Related Jobsrohit utekarAún no hay calificaciones

- Enron ScandalDocumento5 páginasEnron ScandalIshani Bhattacharya0% (1)

- Project: G I B SDocumento26 páginasProject: G I B Srohit utekarAún no hay calificaciones

- Ten-Day Report of Change For Medicaid/Hawki: Iowa Department of Human ServicesDocumento6 páginasTen-Day Report of Change For Medicaid/Hawki: Iowa Department of Human ServicesNephAún no hay calificaciones

- Aufnahmeantrag Englisch 2022Documento2 páginasAufnahmeantrag Englisch 2022soleimany.mehrdadAún no hay calificaciones

- Scheme Account Opening Form: Utt Asset Management and Investor Services PLC (Utt Amis)Documento4 páginasScheme Account Opening Form: Utt Asset Management and Investor Services PLC (Utt Amis)Afya BoraAún no hay calificaciones

- Magma HDI General Insurance Co. LTDDocumento1 páginaMagma HDI General Insurance Co. LTDsarath potnuriAún no hay calificaciones

- Reflection Paper#1Documento2 páginasReflection Paper#1nerieroseAún no hay calificaciones

- Latest Intern ReportDocumento26 páginasLatest Intern ReportParveshAún no hay calificaciones

- Life Insurance MCQ Guide For IC 38Documento17 páginasLife Insurance MCQ Guide For IC 38Shahnawaz AnsariAún no hay calificaciones

- Exam Paper 2 2021Documento32 páginasExam Paper 2 2021amyamy75Aún no hay calificaciones

- FAC4863 NFA4863 Exam Paper 1 ScenarioDocumento10 páginasFAC4863 NFA4863 Exam Paper 1 ScenarioNosipho NyathiAún no hay calificaciones

- Trad Ic Mock ExamDocumento15 páginasTrad Ic Mock ExamArvin AltamiaAún no hay calificaciones

- Calanoc V CA Digested by ANFGDocumento2 páginasCalanoc V CA Digested by ANFGAndrae Nicolo GeronimoAún no hay calificaciones

- AP Junior Linemen Notification 2012 - APSPDCL JLM Notification December 2011 - AP Southern Power Distribution Company Limited JLM Recruitment 2012Documento14 páginasAP Junior Linemen Notification 2012 - APSPDCL JLM Notification December 2011 - AP Southern Power Distribution Company Limited JLM Recruitment 2012Freshers Plane India100% (2)

- Tech Application ROW v2.4-1Documento12 páginasTech Application ROW v2.4-1Byte MeAún no hay calificaciones

- EchoStar 1998 Annual ReportDocumento81 páginasEchoStar 1998 Annual ReportDragon RopaAún no hay calificaciones

- TemplateDocumento36 páginasTemplateSubhan Imran100% (1)

- Insurance Law 2020Documento3 páginasInsurance Law 2020Apoorva DewanAún no hay calificaciones

- Boring Company LVCC Loop FundDocumento25 páginasBoring Company LVCC Loop FundMaria MeranoAún no hay calificaciones

- Stat11 2.2Documento21 páginasStat11 2.2James BagsikAún no hay calificaciones

- CV Account of Fiduciary Sample and InstructionsDocumento16 páginasCV Account of Fiduciary Sample and InstructionsOurCommonVoiceAún no hay calificaciones

- L.1 Sun Insurance Office Ltd. vs. Court of AppealsDocumento6 páginasL.1 Sun Insurance Office Ltd. vs. Court of AppealsAaron CarinoAún no hay calificaciones

- Sun Life Assurance Company of Canada Mail - For Review and Confirmation - Your Sun Life Application PackageRacelisDocumento1 páginaSun Life Assurance Company of Canada Mail - For Review and Confirmation - Your Sun Life Application PackageRacelisWilson Joseph BuschmanAún no hay calificaciones

- Multiple Linear Regression CaseDocumento7 páginasMultiple Linear Regression Casekanika07electro0% (1)

- Finance Process FlowDocumento13 páginasFinance Process FlowHasan NasirAún no hay calificaciones