Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Agrarian Law and Social Justice

Cargado por

kenn1o10 calificaciones0% encontró este documento útil (0 votos)

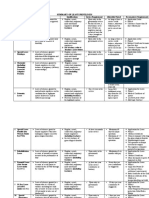

166 vistas18 páginasThis document discusses social justice and social legislation in the Philippines. It provides definitions of key terms like social justice, creditable services, and totalization. It explains that social legislation should be construed liberally in favor of beneficiaries to achieve humanitarian purposes. The document also summarizes the Limited Portability Law, which allows workers to totalize their contributions to the GSIS and SSS when transferring between public and private sectors to qualify for benefits. Overlapping membership periods are credited only once for totalization. This allows workers to retain social security benefits despite changing employment sectors.

Descripción original:

FOR EDUCATIONAL PURPOSE ONLY

Título original

Agrarian Law and Social Legislation Notes

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThis document discusses social justice and social legislation in the Philippines. It provides definitions of key terms like social justice, creditable services, and totalization. It explains that social legislation should be construed liberally in favor of beneficiaries to achieve humanitarian purposes. The document also summarizes the Limited Portability Law, which allows workers to totalize their contributions to the GSIS and SSS when transferring between public and private sectors to qualify for benefits. Overlapping membership periods are credited only once for totalization. This allows workers to retain social security benefits despite changing employment sectors.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

166 vistas18 páginasAgrarian Law and Social Justice

Cargado por

kenn1o1This document discusses social justice and social legislation in the Philippines. It provides definitions of key terms like social justice, creditable services, and totalization. It explains that social legislation should be construed liberally in favor of beneficiaries to achieve humanitarian purposes. The document also summarizes the Limited Portability Law, which allows workers to totalize their contributions to the GSIS and SSS when transferring between public and private sectors to qualify for benefits. Overlapping membership periods are credited only once for totalization. This allows workers to retain social security benefits despite changing employment sectors.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 18

AGRARIAN LAW AND SOCIAL

LEGISLATION

Universal Declaration of Human Rights

(UNO)

What is social justice?

"Social justice is 'neither communism, nor

despositism, nor atomism nor anarchy,'

but the humanization of laws and the

equalization of social and economic forces

by the State so that justice in its rational

and objectively secular conception may at

least be approximated. Social justice

means the promotion of the welfare of all

the people, the adoption by the

Government of measures calculated to

insure economic stability of all the

component elements of society, through

the maintenance of a proper economic

and social equilibrium in the inter-relations

of the members of the community,

constitutionally, through the adoption of

measures legally justifiable, or extraconstitutionally, through the exercise of

powers underlying the existence of all

governments on the time-honored

principle of salus populi est suprema lex."

Calalang v. Williams, (70 Phil. 726) (Bar

Question)

CONSTRUCTION: All doubts in the

implementation and interpretation of

different social legislations shall be

resolved in favor of compensability.

He who has less in life should have more

in law. Ramon Magsaysay

The promotion of the welfare of all the

people, the adoption by the government of

measures calculated to insure economic

stability of all the component elements of

the society through the maintenance of

proper economic and social equilibrium in

the interrelation of the members in the

community, constitutionally through the

adoption of measures legally justifiable or

extra-constitutionally through the exercise

of powers, underlying the exercise of all

governments on the time honoured

principle of salus populi est suprema lex.

Dr. Jose P. Laurel*

The law is geared towards* the concern of

labor because our legislators realized the

social and economic imbalance between

the employer and employee.

Philippines is a signatory to the

International Labor Organization (ILO)

The inflexible rule in our jurisdiction is

that social legislation must be liberally

construed in favor of the beneficiaries.

Retirement laws, in particular, are liberally

construed in favor of the retiree because

their objective is to provide for the

retirees sustenance and, hopefully, even

comfort, when he no longer has the

capability to earn a livelihood. The liberal

approach aims to achieve the

humanitarian purposes of the law in order

that efficiency, security, and well-being of

government employees may be enhanced.

Indeed, retirement laws are liberally

construed and administered in favor of the

persons intended to be benefited, and all

doubts are resolved in favor of the retiree

to achieve their humanitarian purpose.

- Construction (GSIS vs. De Leon. G.R. NO.

186560, November 17, 2010)

LIMITED PORTABILITY LAW (R.A.

7699)

An Act Instituting Limited Portability

Scheme in the Social Security Insurance

Systems by Totalizing the Workers

Creditable Services or Contributions in

each of the Systems

Policy of the State: (PIT)

Promotion of workers welfare by

realizing their efforts in productive

endeavors;

Improvement of workers conditions by

providing benefits for their long years of

contribution to national economy; and

Totalization and portability of social

security benefits with the view of

establishing within a reasonable period a

unitary social security system*

Note: it includes contributions paid by the

employee or worker on account of the

workers membership to the system,

either the GSIS or the SSS.

Totalization refers to the process of

adding up the periods of creditable

services or contributions under each of the

systems, for purposes of eligibility and

computation of benefits.

Portability refers to the transfer of funds

for the account and benefit of a worker

who transfers from one system to the

other.

Who are the covered workers?

Those who transfer employment from

public to private sector or vice-versa; or

Employed in both private and public

sectors.

RULE I : COVERAGE

Section 1. These rules and regulations

shall apply to all workermembers of the

Government Service Insurance System

(GSIS) and/or Social Security System (SSS)

who transfer from one

sector to another, and who wish to retain

their membership in both Systems.*

The creditable services or contributions in

both systems shall be:

CREDITED to their service or contribution

record in each of the systems; and

TOTALIZED for purposes of old-age,

disability, survivorship and other benefits

in case the covered member hoes not

qualify for SSS or GSIS benefits in either or

both systems without totalization.

Note: In case of overlapping periods of

membership, it shall be credited only

ONCE for purposes of totalization.

Proportionality of Benefits:

Benefits to be paid by the system shall

be in proportion to the number of

contributions ACTUALLY REMITTED to that

system.

Note: All contributions paid by such

member personally, and those that were

paid by his employers to both systems

(SSS and GSIS) shall be considered in the

processing of benefits which he can claim

from either or both systems.

f) Creditable services for the public

sector, the following shall be considered

creditable services:

1.1 All previous services rendered by an

official/employee pursuant to an

appointment whether permanent,

provisional or temporary.

1.2 All previous services rendered by an

official/employee pursuant to a duly

approved appointment to a position in the

Civil Service with compensation or salary;

1.3 The period during which an

official/employee was on authorized sick

leave of absence without pay not

exceeding one year;

1.4 The period during which an official or

employee was out of the service as a

result of illegal termination of his service

as finally decided by the proper

authorities; and

1.5 All previous services with

compensation or salary rendered by

elective officials.

g) Period of contribution for the

private sector, the periods of contribution

shall refer to the periods during which a

person renders services for an employer

with compensation or salary and during

which contributions were paid to SSS. For

the purpose of this Section, a self

employed person shall be considered an

employee and employer at the same time.

h) Eligibility means the worker has

satisfied the requirements for entitlement

to the benefits provided for under the Act.

Benefits shall refer to the following:

1. Oldage benefit

2. Disability benefit

3. Survivorship benefit

4. Sickness benefit

5. Medicare benefit, provided that the

member shall claim said benefit from the

System where he was last a member, and

6. Such other benefits common to both

System that may be availed of through

totalization.

Section 1. The process involved in the

prompt payment of money benefits to

eligible members shall be the joint

responsibility of the GSIS and SSS.

RULE V : TOTALIZATION

Section 1. All creditable services or

periods of contributions made

continuously or in the aggregate of a

worker under either of the Sectors shall be

added up and considered for

purposes of eligibility and

computation of benefits.

Section 2. All services rendered or

contributions paid by a member personally

and those that were paid by the

employers to either System shall be

considered in the computation of benefits,

which may be claimed from either or

both Systems. However, the amount

of benefits to be paid by one System

shall be in proportion to the services

rendered/periods of contributions

made to that System.

you have chosen, you would not be

allowed to incorporate your contributions

to the SSS anymore for availment of

additional benefits.

In case of death, disability and old age,

the periods of creditable services or

contributions to the SSS and GSIS shall be

summed up to entitle you to receive the

benefits under either PD 1146 or RA 8291

(expanded GSIS).

If qualified under RA 8291, all the

benefits shall apply EXCEPT the cash

payment. The reason for this is that

the Portability Law or RA 7699

provides that only benefits common

to both Systems (GSIS and SSS) shall

be paid. Cash payment is NOT

included in the benefits provided by

the SSS.

Section 3. Totalization shall apply in the

following instances:

a)If a worker is not qualified for any

benefits from both Systems;

b) If a worker in the public sector is not

qualified for any benefits in the GSIS; or

c) If a worker in the private sector is not

qualified for any benefits from the SSS.

For the purpose of computation of

benefits, totalization shall apply in all

cases so that the contributions made by

the workermember in both Systems shall

provide maximum benefits which

otherwise will not be available. In no case

shall the contribution be lost or forfeited.

54. Under the Limited Portability law,

funds from the GSIS and the SSS maybe

transferred for the benefit of a worker who

transfers from one system to the other. For

this purpose, overlapping periods of

membership shall be:

A. credited only once.

B. credited in full.

C. proportionately reduced.

D. equally divided for the purpose of

totalization. (Bar 2011).

Section 4. If after totalization the

workermember still does not qualify

for any benefit listed in Rule III, Section 1

(j), the member will then get

whatever benefits correspond to

his/her contributions in either or both

Systems.

Section 5. If a worker qualifies for

benefits in both Systems, totalization shall

not apply.

Section 7. Overlapping periods of

creditable services or contributions in

both Systems shall be credited only

once for purposes of totalization.*

If you have satisfied the required years of

service under the GSIS retirement option

How are the portability provisions of R.A.

7699 beneficial or advantageous to SSS

and GSIS members in terms of their

creditable employment services in the

private sector or the government, as the

case may be, for purposes of death,

disability or retirement? Please explain

your answer briefly. (Bar Question.)

Portability provisions of R.A. No. 7699 shall

benefit a covered worker who transfers

employment from one sector to another or

is employed in both sectors, whose

creditable services or contributions in both

systems credited to his service or

contribution record in each of the system

and shall be totalized for purposes of oldage, disability, survivorship and other

benefits. (Sec. 3, R.A. No. 7699)

The portability provisions of R.A. No. 7699

allow the transfer of funds for the account

and benefit of the worker who transfers

from one system to another.

This is advantageous to the SSS and GSIS

members for purposes of death, disability

or retirement benefits. In the event the

employee transfers from the private sector

to the public sector, or vice-versa, their

creditable employment services and

contributions are carried over and

transferred as well.

PATERNITY LEAVE ACT OF 1996 (R.A.

8187)

PATERNITY LEAVE

Refers to the benefits granted to a married

male employee allowing him not to report

for work for seven (7) days* but continues

to earn the compensation therefor, on the

condition that his spouse has delivered a

child or suffered a miscarriage for enabling

him to effectively lend support to his wife

in her period of recovery and/or in the

nursing of the newly-born child.

Section 2. Notwithstanding any law, rules

and regulations to the contrary, every

married male employee in the private and

public sectors shall be entitled to a

paternity leave of seven (7) days with full

pay for the first four (4) deliveries of the

legitimate spouse with whom he is

cohabiting. The male employee applying

for paternity leave shall notify his

employer of the pregnancy of his

legitimate spouse and the expected date

of such delivery.

For purposes, of this Act, delivery shall

include childbirth or any miscarriage.

CONDITIONS: (RIRR Revised

Implementing Rules and Regulations of

R.A. No. 8187)

SECTION 3. Conditions to entitlement of

paternity leave benefits.

A married male employee shall be entitled

to paternity benefits provided that:

a. he is an employee at the time of

delivery of his child;

b. he is cohabiting with his spouse at the

time she gives birth or suffers a

miscarriage.

c. he has applied for paternity leave in

accordance with Section 4 hereof; and

d. his wife has given birth or suffered a

miscarriage.

SECTION 4. Application for leave. The

married male employees shall apply for

paternity leave with his employer within a

reasonable period of time from the

expected date of delivery by the pregnant

spouse, or within such period as may be

provided by company rules and

regulations or by collective bargaining

agreement, provided that prior application

for leave shall not be required in case of

miscarriage.

Note: Delivery shall include childbirth or

any miscarriage. Paternity Leave Benefits

shall not be convertible to cash in case it

is not availed of. (Not commutable)* [vs.

commutation of sentence, RPC]

Unlike maternity leave, paternity leave is

not found in the Labor Code.

The benefit is availed of not later than 60

days after delivery/miscarriage/abortion.

The covered employee is entitled to a

seven-day leave (BASIC SALARY)* for the

first four deliveries/miscarriage of his

lawful spouse.

BASIC SALARY* means your REGULAR

wage, commissions, and allowances

INDEPENDENT of compliance with certain

rules or exertion of additional effort.

SECTION 5. Availment. Paternity leave

benefits shall be granted to the qualified

employee after the delivery by his wife,

without prejudice to an employer allowing

an employee to avail of the benefit before

or during the delivery; provided, that the

total number of days shall not exceed

seven (7) days for each delivery.

G.R. Exception

When Paternity Leave may be Availed of

The paternity benefit may be availed of

before, during or after delivery, provided

the total number of days does not exceed

7 working days. For example, the

employee may take a leave of 2 days

before delivery, 1 day during delivery, and

another 4 days after delivery.

However, the benefit must be availed of

not later than 60 days after date of

delivery.

SECTION 8. Non-diminution clause.

Nothing in these Rules shall be construed

to reduce or replace any existing benefits

of any kind granted under existing laws,

decrees, executive orders, or any contract,

agreement or policy between employer

and employee.

SECTION 9. Crediting of existing benefits.

Where a male employee is already

enjoying the paternity leave benefits by

reason of contract, company policy or

collective bargaining agreement, the

following rules shall apply:

a.If the existing paternity leave benefit is

greater than the benefit herein provided,

the greater benefit shall prevail;

b.If the existing paternity leave is less

than that provided herein, such existing

benefit shall be adjusted to the extent

of the difference. However, where a

contract, company policy or collective

bargaining agreement provides for an

emergency or contingency leave

without specific provisions on

paternity leave, the paternity leave

as herein provided shall apply in full.

There is a pending Senate Bill of Ramon

Bong Revilla, Jr., legislating that paternity

leave be extended on ALL deliveries of the

wife

Non conversion to cash: If the

employee does not avail of the paternity

leave, this benefit is not convertible to

cash (not commutable) nor is it

cumulative (increasing in quantity)

Duration of paternity leave: 7

CALENDAR days with full pay, consisting of

basic pay and mandatory allowances.

Limits: This benefit is applicable to the

first four (4) deliveries of the spouse of the

employee with whom he is cohabiting.

Penal sanctions:

Sec. 5. Any person, corporation, trust,

firm, partnership, association or entity*

found violating this Act or the rules and

regulations promulgated thereunder shall

be punished by a fine not exceeding

Twenty-Five thousand Pesos

(PHP25,000.00)* [PHP, PhP, Php, and/or

P] or imprisonment of not less than thirty

(30) days nor more than six (6) months.

If the violation is committed by a

corporation, trust or firm, partnership,

association or any other entity, the

penalty of imprisonment shall be imposed

on the entitys responsible officers,

including, but not limited to, the president,

vice-president, chief executive officer,

general manager, managing director or

partner directly responsible therefor.

QUESTIONS:

This would address only married fathers

would be a discrimination against

unmarried fathers to be what if they

prioritize the well-being of the baby before

thinking about the marriage? What if they

dont believe in the sanctity of marriage?

Or what if the child has a father who cant

be married again for the father has been

married once? Females can acquire

maternity leave even unwed, why cant

males do so?

Because the law presumes that the

illegitimate child is under the sole custody

of the mother and that the father is not

living with the mother. The rationale is

different for the mother who is granted

maternity leave because regardless of her

civil status, a mother who has just given

birth needs the same amount of care and

rest to heal and get well. Husbands are

allowed paternity leave so that they can

help their wives cope with the special

needs arising from taking care of a

newborn at home. It is related to the legal

obligation of the husband to take care and

support the wife. That kind of legal duty

does not attach to the unwed father. It is

not strictly speaking discrimination but a

reasonable distinction due to

differences in both settings.

Does RA 8187 apply for individuals

working as consultants for a certain

company? It is stipulated in my contract

with the employer that we are not

employees, but rather consultants.

But I do believe that the more appropriate

term to be used is contractual. Does the

RA 8187 applicable on our condition?

The Paternity Leave is granted to ALL

married male employees in the private

sector, regardless of their employment

status which may be probationary,

regular, contractual or project basis. So,

yes. It applies to contractual employees as

well.

Paternity leave benefit is granted to

married employees regardless of their

length of service to the company? So even

if the father is only on his second month of

employment, the company has to grant

him this benefit?

Yes, thats correct. But the employee must

notify the employer of the wifes

pregnancy and expected due date to avail

of this benefit.

Consultant as a contractual employee vs.

consultant as an independent contractor

Consultants are independent contractors,

not employees, who are often hired to

render advice or provide specialized

service that is not in the ordinary course

of the business of the company. Examples

are PR consultants, HR consultants and

marketing consultants. Their scope of

work is limited by a contract or

agreement, which is why a consultant is

often mistaken for contractual.

Contractual employees are those whose

employment are for a fixed term or period.

The contract is often renewed after the

expiry. The difference between the two is

in the control that the company engaging

their services has on them. A consultant

performs work using his own tools,

resources, time and methods. The

contractual employee usually performs

work following specific instructions of and

is subject to the disciplinary rules of the

employer. So, for example, if the company

prohibits moonlighting or holding two or

more employment, the contractual

employee may be terminated on this

ground, while the consultant is not subject

to this restriction unless the terms of his

contract specifically say so.

What if the employee decides not to take

all of the leave days allowed (e.g. he was

on paternity leave only for 2 days). Do the

5 remaining days still apply?

KA KLARO ANA!!!

Is there any specific document needed for

applying paternity leave like maternity

leave?

Generally, there is only an application for

paternity leave that must be filed within a

reasonable period of time from the

expected date of delivery, meaning the

application must be made PRIOR to the

expected date of delivery although the

paternity leave is to be used after delivery.

But you should also check with your HR or

employer if there is an existing company

rule on the kind of notice required. In case

of miscarriage, prior application for

paternity leave is not required.

In the revised IRR issued by DOLE on

March 13, 1997 they delisted abortion

from the coverage of the paternity leave.

How about abortion that intentionally

committed by medical practitioner in order

to save the life of the mother out of a

certain condition. Can the legal husband

avail of paternity leave, given the situation

above?

Abortion is not included in the legal

provisions on Paternity Leave. But this

does not mean that the company cannot

grant paternity leave as its own policy. The

law is a minimum standard employers

can extend its benefits for humanitarian

reasons.

Is the application mechanics for paternity

leave the same for maternity leave

where SSS pays them NOT the company

(because the company has no leave

benefits on its own).

The Paternity leave is not a cash out

benefit unlike the maternity benefit.

Before the child is born, the father notifies

the employer of the expected due date

and the tentative schedule of the paternity

leave after the delivery. Once the child is

born, the father may then use the 7-day

leave without suffering any deduction for

his absence. Hence, it is a paid leave. It

is not convertible to cash if the father does

not use it.

As a GENERAL RULE: the paternity leave

is available after the delivery of the child

with the EXCEPTION of existing company

policy or other agreement where the

EMPLOYER allows the employee to avail of

the leave before the delivery. No

contradiction you just have to read it in

its entirety. One is the general rule, the

other is an exception.

We contracted a Service Provider for a

certain position and that employee is

under the payroll of the Service Provider.

Where will the contractual personnel file

the notification of the wifes childbirth, to

the Service Provider or to us where she/ he

is assigned? Who will pay for the 7 days

paternity leave, the Service Provider or

us? (the employer service provider of

course, unless otherwise agreed upon)

Paternity leave is a benefit that the

employer must provide if the

personnel who is about to become a father

is NOT your employee but of a service

provider then he should notify the service

provider who will take note of the

expected due date including the tentative

dates of the paternity leave. The paternity

leave is not a cash benefit like the

maternity benefit, no amount is actually

disbursed but the employee on

paternity leave is allowed a paid

leave. This means, he will not suffer a

salary deduction for not working on those

days. But this is a matter appropriate for

the employer (who is the service provider)

to consider. The service provider may just

have to inform you, as a matter of

expediency, of the inclusive dates of the

paternity leave.

If the father has already 4 children and

there is another newly born child, can he

avail his paternity leave if he did not avail

it in his first born? The first was born 1997

but for any reason nobody informed or

notified him regarding paternity leave at

that time. By the way when was paternity

leave became a law?

The Paternity leave law was passed in

1996 and took effect in 1997. The

wordings of the law is clear it only applies

to the first 4 deliveries. The law does not

mention any exceptions, so unless there is

an amendment to this law, then the

reasonable interpretation would be to

exclude deliveries after the 4th child.

What if the birth of my baby falls on

national holiday can I still enjoy my 7 days

leave after the holiday? or it overs all

including saturday and sunday in that 7

days paternity leave

The Paternity leave is 7 calendar days,

unless otherwise provided in an existing

CBA or company policy as working days.

(DOLE advisory)

What if may baby was born 7 days before

we got married, would I still be able to

apply for a paternity leave?

No, you are not legally qualified for the

paternity leave, unless your employer has

a company policy that allows it.

Who will pay for the paternity leave,

company or SSS?

The paternity leave is not a cash benefit

that must be paid in case it is not used by

the employee. The employer grants it and

pays the employees usual salary as if he

reported for work at the time he avails of

the paternity leave.

My husbands SSS status is still single and

has not been updated yet by their agency.

I gave an early birth during the holy week

and the 7 days-should-be-paternity leave

is about to end.

It is the employers obligation (not the

SSS) to grant paternity leave. Paternity

leave is not a monetary or cash benefit

but a paid leave, meaning, your husband

can be excused from work for up to 7

calendar days and still get paid his salary

on those days. But to avail of this leave,

he must have informed his employer of

your pregnancy and the expected dates of

the availment.

Under agency.. janitorial. Etc..

For as long as hes an employee of that

agency meaning he performs services and

receives compensation for it, then he is

entitled to paternity leave regardless of

the length of his employment.

41. To avail himself of paternity leave with

pay, when must the male employee file

his application for leave?

A. Within one week from the expected

date of delivery by the wife.

B. Not later than one week after his

wifes delivery or miscarriage

C. Within a reasonable time from the

expected delivery date of his wife.

D. When a physician has already

ascertained the date the wife will give

birth.

43. Which of the following is NOT a

requisite for entitlement to paternity

leave?

A. The employee is cohabiting with his

wife when she gave birth or had a

miscarriage.

B. The employee is a regular or

permanent employee.

C. The wife has given birth or suffered a

miscarriage.

D. The employee is lawfully married to

his wife.

Mans Weto had been an employee had

been an employee of Nopolt Assurance

Company for the last ten (10) years. His

wife of six (6) years died last year. They

had four (4) children. He then fell in love

with Jovy, his co-employee, and they got

married.

In October this year, Wetos new wife is

expected to give birth to her first child. He

has accordingly filed his application for

parternity leave, conformably with the

provisions of the Paternity Leave Law

which took effect in 1996. The HRD

manager of the assurance firm denied his

application, on the ground that Weto had

already used up his entitlement under the

law. Weto argued that he has a new wife

who will be giving birth for the first time,

therefore, his entitlement to paternity

leave benefits would begin to run anew.

Whose contention is correct, Weto of the

HRD manager?

The contention of Weto is correct. The law

provides that every married male is

entitled to a paternity leave of seven (7)

days for the first four (4) deliveries of the

legitimate spouse with whom he is

cohabiting. The fact that Jovy is his second

wife and that Weto had 4 children with his

first wife is beside the point. The

important fact is that this is the first child

of Jovy with Weto. The law did not

distinguish and we should therefore not

distinguish.

The paternity leave was intended to

enable the husband to effectively lend

support to his wife in her period of

recovery and/or in the nursing of the

newly born child. (Sec. 3, R.A. No. 8187) To

deny Weto this benefit would be to defeat

the rationale of the law.

Moreover, the case of Weto if a grey area

and the doubt should be resolved in his

favor.

Is Jovy entitled to maternity leave

benefits?

Yes, Jovys maternity benefit is personal to

her and she is entitled under the law to

avail herself of the same for the first four

times of her delivery. (R.A. No. 8282).

MATERNITY LEAVE

A female member is entitled to a daily

maternity benefit equivalent to 100% of

her average daily salary credit for 60 days

or 78 days* in case of caesarean* delivery.

Requirements:

There is childbirth, abortion* or

miscarriage*; and (vs. Paternity leave (no

abortion{G.R.})

She has paid at least 3 monthly

contributions in the 12-month period

immediately preceding the semester of

her childbirth of miscarriage* (How is this

computed?)

Checklist for Availment

The pregnant woman employee must

have paid at least three monthly

contributions within the 12-month period

immediately preceding the semester of

her childbirth or miscarriage.

She has given the required notification of

her pregnancy through her employer if

employed, or to the SSS if separated,

voluntary or self-employed member.

3-monthly Contribution

Illustration

To avail of maternity benefits, the woman

employee must have paid at least three

monthly contributions within the 12-month

period immediately preceding the

semester of her childbirth or miscarriage.

A semester refers to two consecutive

quarters ending in the quarter of

contingency;

A quarter refers to three consecutive

months ending March, June, September or

December.

To illustrate, assume that the projected

date of delivery is March 2010.

The semester of childbirth would be from

October 2009 to March 2010. This is called

the semester of contingency.

Count 12 months backwards starting

from the month immediately before the

semester of contingency, which is

September 2009.

Hence, the 12-month period immediately

preceding the semester of childbirth or

miscarriage is from October 2008 to

September 2009.

To avail of the benefits, the employee

must have paid at least 3 monthly

contributions during this period.

Note that this requirement supersedes

Article 133, which requires that the

woman employees must have rendered an

aggregate service of at least six months

for the last twelve months.

Conditions:

Employee shall notify her employer of

her pregnancy and the probable date of

her childbirth, which notice shall be

transmitted to the SSS;

The payment shall be advanced by the

employer in two equal installments within

30 days from the filing of the maternity

leave application;

The payment of daily maternity benefits

shall be a bar to the recovery of sickness

benefits for the same compensable period

of 60 days for the same childbirth,

abortion, or miscarriage, or 78 days in

case of caesarean delivery;*

That the maternity benefits provided

under this Section shall be paid only for

the first four deliveries or miscarriages.

That the SSS shall immediately

reimburse the employer of 100% of

the amount of maternity benefits

advanced to the employee by the

employer upon receipt of satisfactory

proof of such payment and legality

thereof; and

If an employee should give birth or suffer

abortion or miscarriage without the

required contributions having been

remitted for her by her employer to the

SSS, or without the latter having been

previously notified by the employer of the

time of the pregnancy, the employer shall

pay to the SSS damages equivalent to the

benefits, which said employee would

otherwise have been entitled to, and the

SSS shall in turn pay such amount.

Abortion

Reproductive Health Act of 2012. (3)

Proscription of abortion and

management of abortion complications;

What if 10 days la na maternity leave?

Punishment?

Penal Provisions under R.A. 8282 (Social

Security Law)

(among others)

"(e) Whoever fails or refuses to comply

with the provisions of this Act or with the

rules and regulations promulgated by the

Commission, shall be punished by a fine of

not less than Five thousand pesos

(P5,000.00) nor more than Twenty

thousand pesos (P20,000.00), or

imprisonment for not less than six (6)

years and one (1) day nor more than

twelve (12) years, or both, at the

discretion of the court: Provided, That

where the violation consists in failure or

refusal to register employees or himself, in

case of the covered self-employed or to

deduct contributions from the employees'

compensation and remit the same to the

SSS, the penalty shall be a fine of not less

Five thousand pesos (P5,000.00) nor more

than Twenty thousand pesos (P20,000.00)

and imprisonment for not less than six (6)

years and one (1) day nor more than

twelve (12) years.

Maternity Leave under Labor Code

Maternity Leave

Under Article 133(a) of the Labor Code,

Every employer shall grant to any

pregnant woman employees who has

rendered an aggregate service of at least

six months for the last twelve months,

maternity leave of at least two weeks prior

to the expected date of delivery and

another four weeks after normal delivery

or abortion, with full pay based on her

regular or average weekly wages.

From the above provision, a qualified

pregnant woman employee shall be

entitled maternity leave of at least two

weeks prior to expected date of delivery

and another four weeks after normal

delivery or abortion. Thats a total of six

weeks maternity leave.

(Note: Article 133, particularly

provisions pertaining to benefits and

procedure for availment, must give

way to Social Security Act.)

Leave extension

Maternity leave may be extended on

account of illness arising out of the

pregnancy, delivery, abortion or

miscarriage, which renders the woman

unfit for work. Extended maternity

leave is without pay, but may be

charged against any unused leave

credits.

Maternity Benefits under SSS Law

A pregnant woman member of SSS who

has paid at least three monthly

contributions in the twelve-month period

immediately preceding the semester of

her childbirth or miscarriage shall be paid

a daily maternity benefit.

Amount

SSS maternity benefit shall be equivalent

to 100% of the pregnant employees

average daily salary credit for 60 days, or

78 days in case of caesarian delivery.

Time of payment

The full payment of maternity

benefits shall be advanced by the

employer within 30 days from the

filing of the maternity leave

application.

Who makes the payment

The SSS shoulders the payment of

maternity benefits. But the procedure

is that the payment is to be initially

advanced by the employer, subject to

immediate reimbursement by SSS.

Valid marriage not required

Unlike in paternity leave where valid

marriage is a requisite for availment, the

existence of a valid marriage is not

required to avail of maternity leave

benefits.

Limitation on Availment

Entitlement to maternity leave under the

Labor Code and maternity benefits under

the SSS Law applies only for the first four

deliveries.

Bar to recovery of sickness benefits.

That payment of daily maternity benefits

is a bar to the recovery of SSS sickness

benefits for the same period for which

daily maternity benefits have been

received.

Effect of Failure of Employer to

Remit Contribution.

If the employer fails to remit the required

contributions, or to notify SSS of the time

of the pregnancy, the employer shall pay

to the SSS damages equivalent to the

benefits which said employee member

would otherwise have been entitled to.

Tax Treatment of Maternity Benefit

Maternity benefits advanced by employer

to employee are excluded from gross

income and thus exempt from

withholding tax. Under the National

Internal Revenue Code (NIRC), all benefits

received from or enjoyed under the Social

Security System in accordance with the

provisions of Republic Act No. 8282 shall

not be included in gross income and shall

be exempt from taxation. (Section 32 [B]

[6][e], NIRC)

SOLO PARENT WELFARE ACT R.A.

8972

WHAT IS THE SOLO PARENT WELFARE

ACT?

RA 8972 or the Solo Parent Welfare Act

provides for benefits and privileges to solo

parents and their children. It aims to

develop a comprehensive package of

social development and welfare services

for solo parents and their children to be

carried out by the Department of Social

Welfare and Development (DSWD), as the

lead agency, various government agencies

including NSO and other related NGOs.

WHEN DID R.A. 8972 TAKE EFFECT?

RA 8972 was signed into law on November

7, 2000 and took effect on November 28,

2000. Its implementing rules and

regulations (IRR) was approved in April

2002.

WHO ARE CONSIDERED AS SOLO

PARENT?

Solo Parent is any individual who falls

under any of the following categories:

1. A woman who gives birth as a

result of rape and other crimes

against chastity even without a final

conviction of the offender, provided

that mother keeps and raises the

child.

2. Parent left solo or alone with the

responsibility of parenthood due to the

following circumstances:

a. Due to death of spouse.

b. Spouse is detained or is serving

sentence for a criminal conviction for at

least one (1) year.

c. Physical and/or mental incapacity of

spouse as certified by a public medical

practitioner.

d. Legal separation or de facto separation

from spouse for at least one (1) year, as

long as he/she is entrusted with the

custody of the children.

e. Declaration of nullity or annulment of

marriage as decreed by a court or by a

church as long as he/she is entrusted with

the custody of the children.

f. Due to abandonment of spouse for at

least one (1) year.

3. Unmarried mother/father who has

preferred to keep and rear her/his

child/children instead of having others

care for them or give them up to a welfare

institution.

4. Any other person who solely

provides parental care and support to

a child or children; provided he or she is

duly licensed as a foster parent by the

DSWD or duly appointed legal guardian by

the court.

5. Any family member who assumes

the responsibility of head of family as

a result of the death, abandonment,

disappearance or prolonged absence

of the parents or solo parent.

CHILDREN

Those living with the solo parent,

dependent for support, unmarried,

unemployed and below eighteen (18)

years old, or eighteen (18) years old and

above but is incapable of self-support

and/or with physical/mental

defect/disability.

WHAT ARE THE CONDITIONS FOR THE

TERMINATION OF THE PRIVILEGES OF

A SOLO PARENT?

A change in the status or circumstances of

the parent claiming benefits under this

Act, such that he/she is no longer left

alone with the responsibility of

parenthood, shall terminate his/her

eligibility for benefits such as change in

the status with marriage*, the concerned

parent is no longer left alone with the

responsibility of parenthood, etc.

DOES THE SOLO PARENT ACT APPLY

TO THOSE WHOSE SPOUSE IS

ABROAD?

The law did not consider this as one of the

categories of solo parent since the other

spouse still exercises duties over his/her

family. However, if the other parent is

abroad and has lost contact with his/her

family for a year or more, the other parent

who is left with the custody of the family,

may be considered as solo parent,

provided proofs are presented to qualify as

such.

WHAT IS THE PACKAGE OF SERVICES

FOR SOLO PARENT?

The comprehensive package of

programs/services for solo parents

includes livelihood, self-employment and

skills development, employment-related

benefits, psychosocial, educational, health

and housing services.

WHAT ARE THE CRITERIA FOR

SUPPORT?

Any solo parent whose income in the place

of domicile falls below the poverty

threshold as set by the National Economic

and Development Authority (NEDA) and

subject to the assessment of the DSWD

worker in the area shall be eligible for

assistance. A Solo Parent can directly

inquire from the following agencies to

avail of their services:

1. Health Services (DOH)

2. Educational Services (CHED, TESDA)

3. Housing (NHA)

4. Parental Leave (Employer, DOLE,

CSC) Solo parent whose income is above

the poverty threshold shall enjoy only

such limited benefits as flexible work

schedule, parental leave and others to

be determined by the DSWD.

WHAT ARE THE STEPS TO AVAIL OF

THE PACKAGE OF SERVICES?

A solo parent shall apply for a Solo Parent

Identification Card (Solo Parent ID) from

the City/Municipal Social Welfare and

Development (C/MSWD) Office. Once the

C/MSWD Office issues the Solo Parent ID, a

solo parent can apply for services he/she

needs from the C/MSWD Office or to

specific agencies providing such

assistance/services.

WHAT ARE THE REQUIREMENTS IN

SECURING A SOLO PARENT ID?

1. Barangay certificate residency in the

area;

2. Documents/Evidence that the

applicant is a solo parent (e.g. death

certificate of spouse, declaration of nullity

of marriage, medical certificate if

incapacitated); and

3. Income Tax Return (ITR) or certification

from the barangay/municipal treasurer.

WHAT DOCUMENT/PROOF WILL A

SOLO PARENT PRESENT IF HE/SHE

HAS CHILD OR IS DE FACTO

SEPARATED FROM HUSBAND/WIFE?

A Certificate issued by the Barangay

Captain indicating the circumstances on

ones being a solo parent.

IF A SOLO PARENT FILES THE

APPLICATION, CAN AN ID BE SECURED

RIGHT AWAY?

No. The Social Worker has to complete the

assessment/evaluation of the solo parent

situation. The ID will be issued after 30

days from filing. The validity of the ID is

one year and is renewable.

IS PARENTAL LEAVE RETROACTIVE

SINCE THE LAW TOOK EFFECT LAST

NOVEMBER 2000?

No. Parental leave is non-cumulative and

can be availed only during the current

year. Further, it can only be availed after

the issuance of the Solo Parent ID.

IS THE 7-DAY PARENTAL LEAVE IN

ADDITION TO THE EXISTING 3-DAY

SPECIAL LEAVE PRIVILEGE?

The law clearly indicates that the granting

of the 7-day parental leave is on top of the

3-day special leave and other mandatory

leave benefits.

CAN A SOLO PARENT APPLY FOR

PARENTAL LEAVE FOR ANY CHILD?

Yes, as long as the child is living with

him/her, dependent for support,

unmarried, unemployed and below

eighteen (18) years old, or eighteen (18)

years old and above but is incapable of

self-support and/or with physical/mental

defect/disability.

WHAT ARE THE CONDITIONS FOR

GRANTING PARENTAL LEAVE TO SOLO

PARENTS?

The parental leave of seven (7) days shall

be granted to any Solo Parent employee

subject to the following conditions:

1. The solo parent must have rendered

service for a least one (1) year, whether

continuous or broken, reckoned at the

time of the effectivity of the law on

September 22, 2002, regardless of the

employment status.

2. The parental leave shall be availed of

every year and shall not be convertible to

cash. If not availed within the calendar

year, said privilege shall be forfeited

within the same year.

3. The parental leave shall be availed of

on a continuous or staggered basis,

subject to the approval of the

Administrator. In this regard, the solo

parent shall submit the application for

parental leave at least one (1) week prior

to availing the solo parent leave, except

on emergency cases.

4. The solo parent employee may avail of

parental leave under any of the following

circumstances:

a. Attend to personal milestones of a

child such as birthday, communion,

graduation and other similar events;

b. Perform parental obligations such as

enrollment and attendance in school

programs, PTA meetings and the like;

c. Attend to medical social, spiritual and

recreational needs of the child;

d. Other similar circumstances necessary

in the performance of parental duties and

responsibilities, where physical presence

of the parent is required.

5. The head of agency/office concerned

may determine whether granting of

parental leave is proper or may conduct

the necessary investigation to ascertain if

grounds for termination and withdrawal of

the privilege exist.

What are the requirements for the

availment of this leave?

The solo parent has:

Rendered at least one year of service

whether continuous or unbroken;

Notified the employer within a reasonable

time period; and

Presented a Solo Parent Identification

Card to his/her employer (while the ID is in

process, any proof may be presented)

What are the criteria for support

under RA 8972?

[1] Any solo parent whose income in the

place of domicile falls below the poverty

threshold as set by the National Economic

and Development Authority (NEDA) and

subject to the assessment of the DSWD

worker in the area is eligible for

assistance; [2] That any solo parent whose

income is above the poverty threshold can

enjoy the benefits mentioned in Sections

6, 7 and 8 of RA 8972.

Section 6. Flexible Work Schedule. - The

employer shall provide for a flexible

working schedule for solo parents:

Provided, That the same shall not affect

individual and company productivity:

Provided, further, That any employer may

request exemption from the above

requirements from the DOLE on certain

meritorious grounds.

Section 7. Work Discrimination. - No

employer shall discriminate against any

solo parent employee with respect to

terms and conditions of employment on

account of his/her status.

Section 8. Parental Leave. - In addition

to leave privileges under existing laws,

parental leave of not more than seven (7)

working days every year shall be granted

to any solo parent employee who has

rendered service of at least one (1) year.

What are government agencies

required to provide under RA 8972?

A comprehensive package of social

development and welfare services for solo

parents and their families will be

developed by the DSWD, DOH, DECS,

CHED, TESDA, DOLE, NHA and DILG, in

coordination with local government units

and a nongovernmental organization with

proven track record in providing services

for solo parents. The DSWD must

coordinate with concerned agencies the

implementation of the comprehensive

package of social development and

welfare services for solo parents and their

families.

parents: But the flexible work schedule

should not affect individual and company

productivity: Provided, further, That any

employer may request exemption from the

above requirements from the DOLE on

meritorious grounds.

What are included in this package of

services for single parents?

The package of services will initially

include:

What is the so-called single parent

leave?

Section 8 of Republic Act No. 8972 states

that in addition to leave privileges under

existing laws, parental leave of not more

than seven (7) working days every year

shall be granted to any solo parent

employee who has rendered service of at

least one (1) year. Please take note of the

phrase in addition to leave privileges

under existing laws.

(a) Livelihood development services

which include trainings on livelihood skills,

basic business management, value

orientation and the provision of seed

capital or job placement.

(b) Counseling services which include

individual, peer group or family

counseling. This will focus on the

resolution of personal relationship and role

conflicts.

(c) Parent effectiveness services which

include the provision and expansion of

knowledge and skills of the solo parent on

early childhood development, behavior

management, health care, rights and

duties of parents and children. (d) Critical

incidence stress debriefing which includes

preventive stress management strategy

designed to assist solo parents in coping

with crisis situations and cases of abuse.

(e) Special projects for individuals in need

of protection which include temporary

shelter, counselling, legal assistance,

medical care, self-concept or ego-building,

crisis management and spiritual

enrichment.

What is flexible work schedule?

It is the right granted to a solo parent

employee to vary arrival and departure

time without affecting the core work hours

as defined by the employer. Under Section

6 of RA 8972, the employer must provide

for a flexible working schedule for solo

What about the issue of work

discrimination, in terms of job

assignments or promotion?

Section 7 of RA 8972 provides that

employers must not discriminate against

solo parents with respect to terms and

conditions of their employment.

What if there are already benefits

under company policies or provisions

of the CBA? Can the parental leave

still be availed of?

Section 20. Non-conversion of

Parental Leave In the event that the

parental leave is not availed of, said leave

shall not be convertible to cash unless

specifically agreed upon previously.

However, if said leave were denied an

employee as a result of non-compliance

with the provisions of these Rules by an

employer, the aforementioned leave may

be used a basis for the computation of

damages. Section 21. Crediting of Existing

Leave If there is an existing or similar

benefit under a company policy, or a

collective bargaining agreement or

collective negotiation agreement the same

shall be credited as such. If the same is

greater than the seven (7) days provided

for in the Act, the greater benefit shall

prevail.

If the company already gives leave

benefits or there are applicable

provisions in the CBA, the question

that should be resolved is: Are the

benefits similar to or greater than the

parental leave under RA 8972? If not,

then such benefits under company

policies or CBA provisions cannot be

credited under Section 21.

Question:

Companies, in seeking ways to save on

costs and expenses, sometimes refuse to

grant the solo parent leave. They claim

that that there are existing or benefits

similar to the solo parent leave under

company policies. If you are a solo

parent working for a company that

refuses to grant the solo parent leave

by claiming that Section 21 of the IRR

applies, then you should seek the

help of the Public Assistance and

Complaints Unit of the DOLE. The PACU

will help you file a complaint and then call

you and your employer to a

mediation/conciliation conference. If

nothing comes out of the conciliation, the

PACU will endorse your complaint to the

National Labor Relations Commission.

A common problem of single parents

is providing educational

opportunities for their children. Does

RA 8972 have provision on this issue?

The DECS, CHED and TESDA are mandated

to provide the following benefits and

privileges:

(1) Scholarship programs for qualified solo

parents and their children in institutions of

basic, tertiary and technical/skills

education; and

(2) Non-formal education programs

appropriate for solo parents and their

children.

Another problem of single parents is

housing. What benefits if any are

provided under RA 8972?

Solo parents shall be given allocation in

housing projects and shall be provided

with liberal terms of payment on said

government low-cost housing projects in

accordance with housing law provisions

prioritizing applicants below the poverty

line as declared by the NEDA.

What about medical assistance?

The DOH shall develop a comprehensive

health care program for solo parents and

their children. The program shall be

implemented by the DOH through their

retained hospitals and medical centers

and the local government units (LGUs)

through their

provincial/district/city/municipal hospitals

and rural health units (RHUs).

How do I avail of the benefits under

RA 8972?

You can communicate with the DSWD

office of your town or city as to the

requirements.

RETIREMENT PAY LAW (R.A. 7641)

Amending Art. 287 of the Labor Code

COVERAGE:

All employees in the private sector;

Part-time employees;

Employees of service and other job

contractors; and

Domestic helpers or persons in the

personal service of another.

Note: The law does not cover employees

of:

Retail, service and agricultural

establishments or operations employing

not more than ten (10) employees; and

Government and its political subdivisions,

including GOCCs, if they are covered by

the Civil Service Law and its regulations.

Dismissed from work due to just cause

(as a rule)

WHEN TO RETIRE:

1.Upon reaching the retirement age

established in the CBA or any other

employment contract.

Retirement Benefits as he may have

earned under existing laws and any CBA

and other agreements, provided that:

It shall not be less than those prescribed

by the Retirement Pay Law; and

If such benefits are less, the employer

shall pay the difference between the

amount due under the Retirement Pay Law

and that provided under the CBA or

retirement plan.

2.In the absence of retirement plan or CBA

regarding retirement, employee upon

reaching the age of 60 years or more and

has served at least 5 years in the said

establishment. (Optional Retirement)

Retirement benefits equivalent to at

least month salary for every year of

service; a fraction of at least 6 months

being considered as one whole year.

Note: Unless parties provide for broader

inclusions, the term 1/2 MONTH SALARY

shall mean 15 days + 2.5 days

representing one-twelfth (1/12) of the 13th

month pay and the cash equivalent of not

more than five (5) days of service

incentive leaves, or a total of 22.5 days for

every year of service.

3. Upon reaching the age of 65.

(Compulsory Retirement)

RETIREMENT PLAN VIS--VIS RETIREMENT

PAY LAW

A retirement plan in a company partakes

of the nature of a contract, with the

EMPLOYER AND THE EMPLOYEE AS THE

CONTRACTING PARTIES. R.A. No. 7641 only

applies in a situation where:

There is no CBA or other applicable

employment contract providing for

retirement benefits for an employee, or

There is a CBA or other applicable

employment contract providing for

retirement benefits for an employee, but it

is below the requirement set for by law.

Even if the company does not include 13th

month pay and service incentive leave as

part of the salary base, R.A. 7641 DOES

NOT APPLY WHERE THE EMPLOYEE

RECEIVES A LUMP SUM OF 1 months

pay per year of service. The company

already grants to its retiring employee

more than what the law gives which is

month salary for every year of service.

(Oxales vs. United Laboratories, Inc. G.R.

No. 152991 , July 21, 2008)

RETIREMENT AGE FOR MINERS

An underground mining employee upon

reaching the age of fifty (50) years or

more, but not beyond 60 years, which

is hereby declared the compulsory

retirement age for underground mine

workers, who has served for at least five

years as underground mine worker, may

retire and shall be entitled to all the

retirement benefits provided for in the

Article.

ANTI-SEXUAL HARASSMENT ACT (R.A.

7877)

DECLARATION OF POLICY

The State shall: (D2H2)

Value the Dignity of every individual;

Enhance the development of its Human

resources;

Guarantee full respect for Human rights;

and

Uphold the Dignity of workers,

employees, applicants for employment,

students or those undergoing training,

instruction or education.

Note: All forms of sexual harassment in

the employment, education or training

environment are hereby declared

UNLAWFUL!

WORK, EDUCATION OR TRAINING-RELATED

SEXUAL HARASSMENT DEFINED

WHO may commit:

Supervisor

Agent of the employer

Manager

Employer

Employee

Teacher

Instructor

Professor

Coach

Trainor; and

Any other person who, having authority,

influence or moral ascendancy (AIM) over

another.

Any person who Directs or induces

another to commit any act of sexual

harassment as herein defined (principal by

induction), or who cooperates in the

commission thereof by another, without

which it would not have been committed

(principal by indispensable cooperation),

shall also be held liable under this Act.

WHEN Sexual Harassment punishable:

(WET)

Work-related;

Education-related; and

Training-related.

WHERE committed:

In a work or training or education

environment.

HOW Committed:

General Rule: Demands, requests or

otherwise requires any sexual favor

from the other regardless of whether the

demand, request or requirement for

submission is accepted by the object of

said act.

Specifically:

In a work-related or employment

environment, sexual harassment is

committed when: (CRI-IHO)

The sexual favor is made as a Condition:

In the hiring or in the employment;

Re-employment or continued

employment of said individual; or

In granting said individual favourable

compensation, terms, conditions,

promotions or privileges.

The Refusal to grant the sexual favour

results in limiting, segregating or

classifying the employee which in any way

would discriminate, deprive or diminish

employment opportunities or otherwise

adversely affect said employee;

The above acts would Impair the

employees rights and privileges under

existing labor laws; and

The above acts would result in an

Intimidating, Hostile or Offensive

environment for the employee (IHO)

2.In an education or training environment,

sexual harassment is committed: (CECIHO)

Against one who is under the Care,

custody or supervision of the offender;

Against one whose Education, training,

apprenticeship or tutorship is entrusted to

the offender;

When the sexual favor is made a

Condition to the giving of a passing grade,

or the granting of honors and scholarships,

or the payment of a stipend, allowance or

other benefits, privileges or

considerations; and

When the sexual advances result in an

Intimidating, Hostile or Offensive

environment for the result, trainee or

apprentice (IHO).

Duty of the Employer or Head of Office in

a Work-Related, Education or Training

Environment It is the duty of the employer

or head of office in a work-related,

education or training environment:

To prevent or deter the commission of

acts of sexual harassment;

To provide the procedures for the

resolution, settlement or prosecution of

acts of sexual harassment;

Promulgate appropriate rules and

regulations in consultation with and jointly

approved by the employees or students or

trainees, through their duly designated

representative, prescribing the procedure

for the investigation of sexual harassment

cases and the administrative sanctions

therefor;

Create a Committee on decorum and

investigation of cases on sexual

harassment to increase understanding and

prevent incidents of sexual harassment;

and

The employer or head of office,

educational or training institution shall

Disseminate or post a copy of this Act for

the information of all concerned.

Note: Administrative sanctions shall

not be a bar to prosecution in the

proper courts for unlawful acts of

sexual harassment.

Liability of the Employer or Head of Office,

Educational or Training Institution

Shall be SOLIDARILY liable for damages

arising from the acts of sexual harassment

committed in the employment, education

or training environment if the employer or

head of office, educational or training

institution is informed of such acts by the

offended party and no immediate action is

taken thereon.

Independent Action for Damages

Nothing in this Act shall preclude the

victim of work, education or trainingrelated sexual harassment from instituting

a separate and independent action for

damages and other affirmative relief.

Penalties

Any person who violates the provisions of

this Act shall, upon conviction, be

penalized by imprisonment of not less

than 1 month nor more than 6 months*

(seriously??), or a fine of not less than

PHP10,000.00 nor more than

PHP20,000.00, or both such fine and

imprisonment at the discretion of the

court.

Prescription

Any action arising from the violation of

the provisions of this Act shall prescribe in

three (3) years.

También podría gustarte

- The Song of Solomon A Study of Love Sex Marriage and Romance by Tommy NelsonDocumento50 páginasThe Song of Solomon A Study of Love Sex Marriage and Romance by Tommy NelsonDeoGratius KiberuAún no hay calificaciones

- Western LuoDocumento49 páginasWestern Luojames museweAún no hay calificaciones

- Social Security Law: R.A. 1161 As Amended by R.A. 8282Documento33 páginasSocial Security Law: R.A. 1161 As Amended by R.A. 8282Shri Marie VillaflorAún no hay calificaciones

- Motion To Take DepositionDocumento4 páginasMotion To Take DepositionDaLe Abella100% (4)

- Motion To Take DepositionDocumento4 páginasMotion To Take DepositionDaLe Abella100% (4)

- Basic legal forms captionsDocumento44 páginasBasic legal forms captionsDan ChowAún no hay calificaciones

- Basic legal forms captionsDocumento44 páginasBasic legal forms captionsDan ChowAún no hay calificaciones

- Bar Ops TechniqueDocumento11 páginasBar Ops Techniquekenn1o1100% (1)

- Car Wash Business Startup-What & Dont'sDocumento7 páginasCar Wash Business Startup-What & Dont'skenn1o1Aún no hay calificaciones

- Articulo Mortis Between Persons Within: Family Relations D MDocumento18 páginasArticulo Mortis Between Persons Within: Family Relations D Mrye736Aún no hay calificaciones

- Limited Portability LawDocumento2 páginasLimited Portability LawKDAún no hay calificaciones

- Judicial Affidavit RuleDocumento4 páginasJudicial Affidavit RuleCaroline DulayAún no hay calificaciones

- Goat Farming As A Business - A Farmers ManualDocumento56 páginasGoat Farming As A Business - A Farmers Manualqfarms89% (9)

- 13 - Duncan Association Vs Glaxo WellcomeDocumento2 páginas13 - Duncan Association Vs Glaxo WellcomeJeremy MaraveAún no hay calificaciones

- Abaca-Production and ManagementDocumento4 páginasAbaca-Production and Managementkenn1o10% (1)

- Remedial Law Q&A GuideDocumento66 páginasRemedial Law Q&A GuideRyla PasiolaAún no hay calificaciones

- UCSP BY ELLA Social Science Multiple Choice QuestionsDocumento13 páginasUCSP BY ELLA Social Science Multiple Choice QuestionsElla Marie MonteAún no hay calificaciones

- GSISDocumento11 páginasGSISClauds GadzzAún no hay calificaciones

- 1040 Exam Prep Module IV: Items Excluded from Gross IncomeDe Everand1040 Exam Prep Module IV: Items Excluded from Gross IncomeAún no hay calificaciones

- Irr Gsis LawDocumento46 páginasIrr Gsis LawMa Geobelyn LopezAún no hay calificaciones

- C. Limited Portability Law (R.a. No. 7699)Documento4 páginasC. Limited Portability Law (R.a. No. 7699)new covenant churchAún no hay calificaciones

- Abaca Activities in PhilippinesDocumento71 páginasAbaca Activities in Philippineskenn1o1Aún no hay calificaciones

- Civil Code Law Case DigestsDocumento37 páginasCivil Code Law Case DigestsArmstrong BosantogAún no hay calificaciones

- Soc Leg - RA 7699Documento4 páginasSoc Leg - RA 7699Sherlyn Paran Paquit-SeldaAún no hay calificaciones

- Transfer Without Consent CSCDocumento5 páginasTransfer Without Consent CSCkenn1o1Aún no hay calificaciones

- SOCIAL SECURITY SYSTEM: A GUIDEDocumento35 páginasSOCIAL SECURITY SYSTEM: A GUIDENJ GeertsAún no hay calificaciones

- (Ebook - English) Student Power Memory SystemDocumento43 páginas(Ebook - English) Student Power Memory SystemMihaela GaidurAún no hay calificaciones

- Agrarian Law Reviewer PDFDocumento10 páginasAgrarian Law Reviewer PDFJunCoyumaAún no hay calificaciones

- RA 7699 PortabilityDocumento16 páginasRA 7699 PortabilityG Carlo Tapalla100% (2)

- GSIS ReportDocumento177 páginasGSIS ReportAbigail PasionAún no hay calificaciones

- Limited Portability Scheme for Social Security SystemsDocumento33 páginasLimited Portability Scheme for Social Security SystemsSherlyn Paran Paquit-SeldaAún no hay calificaciones

- Bloom - ''Rousseau On Equality of The Sexes'' (1986) PDFDocumento21 páginasBloom - ''Rousseau On Equality of The Sexes'' (1986) PDFPécuchetAún no hay calificaciones

- QA Solo ParentsDocumento2 páginasQA Solo ParentsRedddeGuzman100% (1)

- Rundown PDFDocumento6 páginasRundown PDFDevii Agustiani Sandri100% (3)

- RA 7699 (Portability Law - GSIS) PDFDocumento2 páginasRA 7699 (Portability Law - GSIS) PDFRea Jane B. Malcampo100% (1)

- Portability Law SummaryDocumento29 páginasPortability Law SummaryElvin Nobleza PalaoAún no hay calificaciones

- Limited Portability Law IRRDocumento4 páginasLimited Portability Law IRRKira Jorgio100% (1)

- Limited Portability Law By: Hanna Desembrana: How Are Benefits Computed?Documento3 páginasLimited Portability Law By: Hanna Desembrana: How Are Benefits Computed?twenty19 lawAún no hay calificaciones

- PORTABILITY LAW - OdtDocumento1 páginaPORTABILITY LAW - OdtKla AlvarezAún no hay calificaciones

- Limited Portability LawDocumento2 páginasLimited Portability LawIvy PazAún no hay calificaciones

- Security Insurance Systems by Totalizing The Workers' Creditable Services or Contributions in Each of The SystemsDocumento1 páginaSecurity Insurance Systems by Totalizing The Workers' Creditable Services or Contributions in Each of The SystemsDael GerongAún no hay calificaciones

- Questions For Portability and Totalization Law.: ESPARAGOZA, Keneth Jorge A. Agrarian Reform Law LLB - 3 SummerDocumento2 páginasQuestions For Portability and Totalization Law.: ESPARAGOZA, Keneth Jorge A. Agrarian Reform Law LLB - 3 SummerStacy Shara OtazaAún no hay calificaciones

- Totalize Workers' Creditable Services for Social Security BenefitsDocumento2 páginasTotalize Workers' Creditable Services for Social Security BenefitsriaheartsAún no hay calificaciones

- 1994 Portability LawDocumento2 páginas1994 Portability LawJessica Magsaysay CrisostomoAún no hay calificaciones

- SSS Portability LawDocumento5 páginasSSS Portability LawMaria Jennifer SantosAún no hay calificaciones

- Labour Law CREDocumento8 páginasLabour Law CREBirmati YadavAún no hay calificaciones

- Irr Gsis LawDocumento45 páginasIrr Gsis LawManila LoststudentAún no hay calificaciones

- Social Security in IndiaDocumento49 páginasSocial Security in IndiaKaran Gupta100% (1)

- EOIBDocumento28 páginasEOIBZafar Iqbal100% (1)

- COOP LAWS AND SOCIAL LEGISLATIONDocumento24 páginasCOOP LAWS AND SOCIAL LEGISLATIONyannie11Aún no hay calificaciones

- Pension Reform in Ghana: A New Three-Tier SystemDocumento19 páginasPension Reform in Ghana: A New Three-Tier SystemJosephine FrempongAún no hay calificaciones

- B U E S I A: Enefits Nder Mployees Tate Nsurance CTDocumento7 páginasB U E S I A: Enefits Nder Mployees Tate Nsurance CTtanmaya_purohitAún no hay calificaciones

- SSS and GSIS Benefits ComparisonDocumento4 páginasSSS and GSIS Benefits ComparisonAppleSamsonAún no hay calificaciones

- CIA 1 Compensation ManagementDocumento5 páginasCIA 1 Compensation ManagementKURIAN S ABRAHAM 2137908Aún no hay calificaciones

- Nursing Exam Questions on Philippine LawsDocumento5 páginasNursing Exam Questions on Philippine LawsRyll Dela CruzAún no hay calificaciones

- Assignment On LL IDocumento8 páginasAssignment On LL Itanmaya_purohitAún no hay calificaciones

- OVERVIEW OF THE SOCIAL SECURITY CODEDocumento5 páginasOVERVIEW OF THE SOCIAL SECURITY CODE76-Gunika MahindraAún no hay calificaciones

- Labour Law VivaDocumento8 páginasLabour Law Vivavishnu priya v 149Aún no hay calificaciones

- Lecture 3 - The Employee's State Insurance Act, 1948Documento8 páginasLecture 3 - The Employee's State Insurance Act, 1948rishapAún no hay calificaciones