Documentos de Académico

Documentos de Profesional

Documentos de Cultura

PAS

Cargado por

Arvin Glen Beltran0 calificaciones0% encontró este documento útil (0 votos)

14 vistas1 páginaAccounting PAS

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoAccounting PAS

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

14 vistas1 páginaPAS

Cargado por

Arvin Glen BeltranAccounting PAS

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

CHAPTER 10 OPERATING LEASE

PAS 17, Paragraph 4

A leased is defined as an agreement whereby the lessor

conveys to the lessee in return or a payment or series of payments the right to use

an asset for an agreed period of time.

PAS 17, Paragraph 33 Provides that lease payments under operating lease shall

be recognized as an expense on a straight line basis over the lease term unless

another systematic basis is more representative of the time pattern of the users

benefit.

PAS 17, Paragraph 50 Provides that lease income from operating lease shall be

recognized as rent income on a straight line basis over the lease term, unless

another systematic basis is more representative of the time pattern in which users

benefit derived from the leased asset is diminished.

CHAPTER 11 FINANCE LEASE

PAS 17, Paragraph 4

A finance lease is a lease that transfers substantially all

the risk and rewards incident to the ownership of an asset. Title may or may not

eventually be transferred.

PAS 17, Paragraph 10 Characteristics/situations that would normally lead to a

lease being classified as a finance lease.

PAS 17, Paragraph 11 If the lessee can cancel the lease and the lessors losses

associated with the cancelation are borne by the lessee.

PAS 17, Paragraph 4

Circumstances when Cancelable lease is deemed

noncancelable and thus classified as finance lease

PAS 17, Paragraph 28 Provides that if there is reasonable certainty that the

lessee will obtain ownership by the end of the lease term, depreciation is based on

the useful life of the leased asset.

También podría gustarte

- Gov Acc Assignment JohnDocumento5 páginasGov Acc Assignment JohnArvin Glen BeltranAún no hay calificaciones

- Toa 34a-3Documento1 páginaToa 34a-3Arvin Glen BeltranAún no hay calificaciones

- Background InfoDocumento1 páginaBackground InfoArvin Glen BeltranAún no hay calificaciones

- Sec 30-50 (Negotiation)Documento10 páginasSec 30-50 (Negotiation)Arvin Glen BeltranAún no hay calificaciones

- Sec 7, 8, 9Documento2 páginasSec 7, 8, 9Arvin Glen BeltranAún no hay calificaciones

- Acc 5 Course OutlineDocumento7 páginasAcc 5 Course OutlineArvin Glen BeltranAún no hay calificaciones

- Sec 5,6, 11-13Documento3 páginasSec 5,6, 11-13Arvin Glen BeltranAún no hay calificaciones

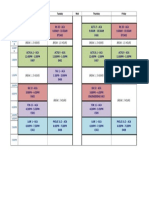

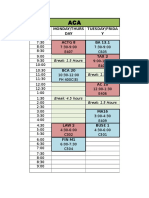

- Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursDocumento1 páginaBreak: 1.5 Hours Break: 1.5 Hours Break: 1.5 Hours Break: 1.5 HoursArvin Glen BeltranAún no hay calificaciones

- 3rd Year ScheduleDocumento2 páginas3rd Year ScheduleArvin Glen BeltranAún no hay calificaciones

- Juan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Documento6 páginasJuan Clyne A. Pray Jcba Company Corrales Avenue, Cagayan de Oro City Misamis Oriental, 9000Arvin Glen BeltranAún no hay calificaciones

- Time Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursDocumento3 páginasTime Monday/Thurs DAY Tuesday/Frida Y Actg 8 BA 13.1: Break: 1.5 HoursArvin Glen BeltranAún no hay calificaciones

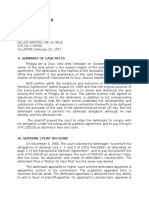

- De Los Santos vs. de La Cruz (Beltran & Mauna)Documento2 páginasDe Los Santos vs. de La Cruz (Beltran & Mauna)Arvin Glen BeltranAún no hay calificaciones

- Infinity Ex Canon Rock Intermediate Sheetmusic Trade ComDocumento3 páginasInfinity Ex Canon Rock Intermediate Sheetmusic Trade ComivyAún no hay calificaciones

- Teachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizDocumento1 páginaTeachers, Take A Bow: By: Arvin Glen B. Beltran of 4-VizArvin Glen BeltranAún no hay calificaciones

- Law OutlineDocumento11 páginasLaw OutlineArvin Glen BeltranAún no hay calificaciones

- NBA 2K16 Keyboard MappingDocumento1 páginaNBA 2K16 Keyboard MappingArvin Glen BeltranAún no hay calificaciones

- SilverStrand by The Corrs PDFDocumento1 páginaSilverStrand by The Corrs PDFArvin Glen Beltran100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)