Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Bernie Sanders' Tax Returns

Cargado por

Nick0 calificaciones0% encontró este documento útil (0 votos)

5K vistas4 páginasThe Vermont Senator made good on his promise to release his "boring" tax returns.

Título original

Bernie Sanders' tax returns

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoThe Vermont Senator made good on his promise to release his "boring" tax returns.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

5K vistas4 páginasBernie Sanders' Tax Returns

Cargado por

NickThe Vermont Senator made good on his promise to release his "boring" tax returns.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF o lea en línea desde Scribd

Está en la página 1de 4

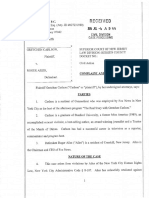

£1040 Gs iscviaiar neomo taxRetsin |201 4 | ns sss04| msn sven sennen

Fran One 9,206 ere Beg Bias ~_ 8) See saparate raructone

‘oor rt asa iad Tate (Your soci scart mambor

Bernard __| sanders _

Ta re GSO a BG tasters pouress000 eeu Ec

Jane 0 sanders

Ti os IDE ER. Ta ae 3 POE, echo TACT] a seth SS) ove

0 BOR ee eee PPE TCS Ta TIRE WS TS BTS TOT, ‘rider acto Compan

Burlington VT 05408 _ _ etiwn tron yom

Foren iy Fa OTE, [Foerster

Se ow Bi once

Fling Status? C1Saie 4D Hn rho thas yng pan Been)

2B Married fing joint (even only one had income} Arecpahng pron ina cis but you dopo is

Check anyone 3] Mared fling separately. Enter spouse's SSN above hts an ae.

box. al name ace 5] Guativing widow th Gapandent SE

Exemptions "Yourself. someone can cam you es @ dependant, donot check box 6a Doses inched

SS Bl snows vee

Dependents @iwomite | aomoanin | Ogres me

(0 Frans Ltmme | _sesasy meer _| tlie yu | MI is —

tt more than fou = - ~ seeatla

‘geaaanoe ee

instractions and Para Ss

check here o td punvers on

a “Toil nuniber of exemptions camed i fe above

income 7 Waaes, salaries, tis, ete Atach Forma Wo 156,441

83 Taxable nierest. Atach Schedule Bi required : ii

bb Tax-exempt interest. Do not incladeon line 8a oo

Agen Form(s) 93, Ordnary cidends. tach Sones 8 equrod om 2

Wzter Ane Qualfed chicence aa

W.26 ond 10 Taxable refunds rect, or offsets of sate and local Income taxes

Y000-Rittex 44. alionyrecsived

waswitineld. 42 Gusinessincome or (os), Alach Schedule Cor -E2 7

styoudie 39 Capital gain or (oes. Attach Schedule Dif request not required, check here » CJ [a3]

yousieret 44 Other gains or Joses), attach Form 4787 i . Fe

setawa iee maderbeton [se 6 Trace fase}

160 Persons and annattes. [160 b Taxable amount 6b 4,582.

47 Rental el estate, rates, parreshps, Semporions sts, ete. Atach Schecuee [47 |

48. Farmincome or os) Attach Sohecue F 18 -

49° Unemployment compensation 19

200 Social security benets [20a 46,213. | b Texble amount 206 59,381

21 Other income. Litt type and amamt 21

22 _ Combine he aroun eter ig coo fr nas 7 rough 21. your total ncome »_| 22 208, 617.

i 23 Educator expenses 2

Adjusted 24 catain tines axpeons of resents peroming ast, and |

Gross fee-basis goverment ofcis. Attach Form 2106 or 0682 | 24

Income — 25 Heatn savings account decison Attach Fom 6830. [25]

25 Moving expenses. Attach Form 2003 28

21 Deceit pat ot sel-oleyent ts, tach Schl SE iis.

23 Sal-employed SEP, SIMPLE, and quale pans

28 Seltemployed health insurance decuction —

30 Penalty on ear witheraal of savings | -

Sta Amory pad b Recpiont's SSN Bia

32 IRA dedvetion 2

133 Student fan nore Seduction 33

‘84 Tuton and foes. Attach Form 2017 «|

285 Domestic preducion actives codton. son Fm 6008. [35 ~ |

96 Add ines 28 though 35 > 36 | 346

37_ Subtract line 36 from line 22, This is your adjusted gross income: > [ar] 205,271

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions, BAA REVoniaTe TO Fen 1040 (ta)

Ferm 1080 2018) Page

= The aiid gos noone) ay TOSI

ae Yeuweeton bvesinay2 60.” Ce rns

eae it | C] Spouse masbom before saruary 2, 1960, E] tnd. J checked» 900 L2

ne b _|Ifyour spouse itemizes on a separate return or you were a dual-status alien, check here® — 30b{_]

ZB itemized deductions (om Scnedde A or your standard deduction (eset magn) 56,377.

“i Subrectin 49 rom ne 08 Tag, 094

42 Exorptonn lw 8152595 ra ips} $4%00 te sabe oie 64 hon, sets

4 Taxable ncome, Subtract ine 42 fom ine #1 le 42s more tan ine, ertar-0-

44 Tax (see instructions}. Check it any from: a [] Form(s) 8814 b [] Form 4972 C)

45. Atornative minimum tax (se isbuction) Atach Ferm 6251

46 Exces advance promis tx rc ropaymart. tach Form 8062

87 ddtines 4445, and 6 : lL}

Alans | SG Forget cut Mesh Fo V8 rege eto

BES | 40 crt orem ard dopendert cw eapanen Atacn Ferm 24st [ao]

EERE | 90 Education crate om Form 6855. Ine 10 =

Mariessing | 51 Retrement savings cantouions ore. Atach For 8600 [sx

| BESO” | ge Gnastacreae eon Sones cota ieusted @

WHE | 53 Residential enero eres, Atach For S605 3 =

Heacet | 56 ObercedtstomFarm: a }9000 6 CJ 8801 oC] [6a

HES | 55 Add ines 48 trough $4 These re your toa ret : ss

$8 _SuDvact inn 55 emt 4. tne 8 ove than ne 4, nie 0 > [oe

17 Sel-employment x. tach Schodkde SE 2

Other 58 Unreported social security and Meticaretaxirom Form: a [4137 Ch ears [os]

58 festa taxon Rds che uated reamert lan, Atach Form 532 qed © -

Taxes 60a Household emplayment taxes from Schedule H 60:

Freie hrs ec repayment tach Farm S406 requted

61 Heath sae nav esponsity os ratucton)—Fulyer cove Bl -

€2 Taras tome a []Fomesse b []Fomd0t0 "e CJinstuctons ener odo) ee -

_ 3. AddinasS6Urough 62. Thiss you total ax . = es Ts,

Payments 64 Federal income tax withheld from Forms W-2 and 1050. | 31,625.)

65 20i4extnntod payments and aoc apoted tom 218 rere [5]

uyeatevea ea Eamed income ced) ona

‘hid attach [ b- Nontaxable combat pay ection | 66t | _

Schecls0.| 6” Adatonal chi tax crest tach Sree OTD af

(8 American opportunity cred rm For 883 ine 8 e

© Net promi tax ore. Atach Fom 8062 [eo]

270 Around ith recut or extern oe 0

71 Eres socal eur ane ATA ext et

72 Gre tor federal tx on cs, Atach Fo 4196 =

73 CedtstonFom a (12086 C] Pemet eCard Ca

74 _Aédinws 6,05, Sa, an 67 tough 73, hese are yor lal peers | 26 |

Refund 75 ine 74ie more than 9, eubiet ire rom ne 7. Tiss he noun you overpaid [78 |

16a rout of ine 75 you want refunded to you. Form E8BBisettache, check hee. >). [76a

Direct deposit? © Routing number ‘me Type: Xj Checking ] Savings

Sa Account number ey oS

weaneters 47 Amount of tne you want applied to your 2018 estimated tax | 77 |

‘Arnournt 79 Amount you owe. Subtract ne 7 om ie Fo dels on howto pa So ats

You Owe 79 _ Estimated tax penalty (see instructions) | 79 |

Third Par DO you want alow ster beeen oda a ou WN SHS ts GORISRL] Woe. Compe low — BIS

Designee Sores oe Soomeeine,

ign a

pct elcome tena evs ene area aan ge rma

Here (tase Yorn a an a ee

mer) Government, Service

a Pamace team ranma tanmaToe ps —— ae a...

wee Selfaeuploved Es,

Sr — RS ea

Preparer — - - 7 setenv

pupae’ enna >“ Salt-Euapared —fmcens

fens Pee

‘ome potatos Pevesrensrio Fam 1040 (0%5)

2014 VI Form IN-t11, Page 2

lustNene SANDERS:

es

This page must be fled with Page 1 of this form.

Yee _No | SECTIONS CREDITSANDUSE TAX

‘oy singRECONPUTED oda Run toate? x 23 Cater none Tx Pao Ob Sis or

Isis amended eta? x Canaan Province (Sehadie INT, the 21.23 o.

i Txpye i ring 20147 x 2A VIC (Seheade N2

(it SposeCu Parmer di cng 20107 x Pasty. Une OR Seale N-) 2 o.

oye authorize he VT Depart Tres 25, TOV Caines 23 and 24) 25 0

to deus i ren wth our rope? x 28. VTncore Tax Ate Cre (Steet 25

Is apayer ge or odo of Decne 31, 20147 x ‘rom tne 22 tts ta 20) 2. 7903.

Is Spas Pare ge 5 or dr sof Deoaer 31, 20147. x 2. Ueta 2. oO.

you cat hatna Use Tax se? x 28a I Tes (nes 2 ar 27 a 7903.

‘SECTIONS VOLUNTARY CONTRIBUTIONS

IN-tH Line-by-Line information 2a. Nergane Wise Fat... me 25.

SECTION? TAKFILING INFORMATION 2. Chis Tut Fa 2 50

Fling Satis: ()Shole— C)headetHasshld Chuang Wow) | 296 v7 Vt Fu Be 50.

BQ Mars, Fng.oay —) Marie Fng Sopa 286. Gren Up vernon. . 2 25

i Union Fig inty 1G nan Fig Sepamey | 298, Te Wei Cations (Lines

AF FLUNG SEPARATELY, Spout or CU Pare Name 2Batragh 2) 2 180.

30. Tot VT Tors & Vota Contes

|F FUNG SEPARATELY, Souter CUPatnr Sail Sout Numba (nes 25 ae 0 wo 8053.

‘SECTION7 PAYMENTS AND CREDITS

FromW2, 108, Tac Wahl... 316

SECTIONS TAKABLEINGOME Sb Fon VI Fom N14 seta Tx 2014 aro

10 itt esc. ‘0 205271. VT Fam Bet, Een wh Paya. 38

1, Feder Txte eae. 2, see nabs 1 140994. | ste. eonat inane tx Coat

‘0TT0NS: {Séhete N12Path se 0.

12, he tm Nan Sate Los Obigaons td, Rest Rebate Farm PRA, ned... 34 0.

(Sete 2, Pan, Une) 12a 0. | te. FomvrFom RIT VIRed Esto

12 Bens Depeiton lowes nde Fedraliow Wonelig (states) se

e204 10, 0. | tt. From vr Fam wes snes name Tax

‘2 Aldbck ol Sale and Loc nome Tares Payment rae by Buses Ent

(Sebo 15 Line 1). s ese HL 4666. Nonsiet Pater, Menber o Sharoboir.. 31 0.

18 Federal Texte name wth sions 34g, Lewin Chl & epee ek

(bd ines 1,125,125, an 120), 1 145660. (Sesiabutes). 3M.

SUBTRACTION: 3th Tl Paynes ard Cres

“ka. rest name fam US. bgt... o. (is es 3a eu) om 8092.

18, Gag Gane Exton (159, Une 21... 1. 0. | secnons reruno

‘he. Adjinenter cr yer Boe Depeiston 0. | 32. OveRPAYWENT ine 20itee on

Ads nes 4, 1 ad 46 Ma 0. Une Sih, wore 0 Fee 332 39.

18 VT Table lnome (Set ine te Une 1 $83, Ronde cetact205 etme tx

ie tis mare tan Line 18, eta 20) 18. 145660. oye. Cactus aroun Lip 31.3. 0.

‘SECTION4 VTINCOME TAX 5, Rela tobe cette 205 Property Tax 330 0.

18, VTlnme xo VT Taree 4 REFNO nowt

“ate Shel cr ine 1 nou 46 7903. (Sic Lins 30 on 580 Fomine 2, 98 39.

17 airs VF cone Tx SECTIONS AMOUNT YOU ONE

(Sthede tz Pat, Une) ‘1 0. | 35 tine 30sec tan Ure 1h stat Ln th

18, Tox Tax wihAbns (Lines 168 718, 7903. fron Ure 30, Seoiretstos ont... 38. 0

18, Staci ton VTincone Tx 38 et and Palo Urcopemerct

(Sere es Pat Le 15) 18 0. sre Tax (Wee N52 FMEA... 3. 0.

2. VTlncone Tax (Stace om ie 18) 37._ hanes 8a 38 3. oO.

ie Bie mor than tn 8, oe zo... 2. 7903. | [Foremendsdrane cay

21. Income Adjisinan (ria rind rete 0.

(Sebel, Linef0OR 0000%) ......2. 100.00 % Rain ue now 0.

22, Aste VT come Tox Ota pament 0:

(Muti ie 20 by in 21. 2 7903. pote 0.

Toss akimiclind al evan WO ‘Wit pyres mato Form INttt

i Deparnore! Tne, PO Box 188, Monta, Vt OSSD

VT Daparnon ot Tats, PO Bae 178, Mone VT 0601-779

Mi

VERMONT

DUE DATE: April 15, 2015

Laid

2014 [income Tax Return| yet 1] il

wu

173%

‘wiearstans SANDERS “BERNARD wr

SpowseCUPama Nine SANDERS JANE, ©} cmseercg

Mig ess Peer

City, State, ZIP BURLINGTON VT 05408

TW Saod Cae 7 aromatres on HTT

035

FOR COMPUTERIZED USE ONLY

Ty 2014 REC ON aMD N TDC WN spc N

psc oN 65 ¥ S65 ON Fs EX 2

SANDERS BERNARD Pe

SANDERS. JANE, Ee

as BURLINGTON vr

95408 035 Eee

10 205271 17 0 29a 25 31g 0

an 140994 18 7903.29 50 31h 8092

lea 0 19 0 28¢ 5032 39

12b 0 20 7903 29d 25 33a a

ize 4666 22 10000 _29e 150 33b 0

13 145660 22 7903 30 805334 39

14a 0 23 0 3la e092 35 0

14b 0 24 0 3b o 36 0

lac 0 25 0 31¢ 0 37 0

144 0 26 7903 31d Oo PrIN

15 145660 27 0 3le 0 PEIN

16 7903 28 79030 31£ o usB ¥

REFUND 39 AMT DUE 0

nce seaies of psu. delete have exained is retuned sxampaning ehedies and tenes andthe best my rane and be fey are wm cones

and compel, Prepares canal uso ru infaan fo pupae oer han prepatng rts

OveRWENY SEC

wana Dae Cenqain Tana Tas

[SELP-EMPLOYED —_PrntFm'sname er yous Isl enpoyd) ard adds blow

Spas CU Paine apna Wajarium, SOMO agR Dis Omvpaion «SELF PREPARED

“psy Telatone Naber

SonuseerCu Petre Taechon Nuno ET

1555 seveanmsr0 Prepare’ Tephene# Form IN-tt4

También podría gustarte

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (894)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2099)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- RNC PlatformDocumento66 páginasRNC PlatformMollie Reilly80% (10)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- Hospitalization Case ReportDocumento2 páginasHospitalization Case ReportMaureen T. CotterAún no hay calificaciones

- Hospitalization Case ReportDocumento2 páginasHospitalization Case ReportMaureen T. CotterAún no hay calificaciones

- Dassey PDFDocumento17 páginasDassey PDFLaw&CrimeAún no hay calificaciones

- FBI PosterDocumento1 páginaFBI PosterNBCNewYorkAún no hay calificaciones

- 2016 Celluloid Ceiling ReportDocumento6 páginas2016 Celluloid Ceiling ReportNickAún no hay calificaciones

- Trump Foundation Notice of Violation 9-30-16Documento2 páginasTrump Foundation Notice of Violation 9-30-16Cristian Farias100% (1)

- Cyber in Security IIDocumento36 páginasCyber in Security IINick100% (1)

- The Complete Noor Salman IndictmentDocumento6 páginasThe Complete Noor Salman IndictmentNickAún no hay calificaciones

- Store Closing ListDocumento4 páginasStore Closing ListMNCOOhioAún no hay calificaciones

- Child Suicide RateDocumento1 páginaChild Suicide RateNick100% (1)

- Trump Foundation Notice of Violation 9-30-16Documento2 páginasTrump Foundation Notice of Violation 9-30-16Cristian Farias100% (1)

- Quinnipiac University Swing State PollsDocumento5 páginasQuinnipiac University Swing State PollsNickAún no hay calificaciones

- July Fact Sheet - LGBTDocumento1 páginaJuly Fact Sheet - LGBTNickAún no hay calificaciones

- Good Dog, Bad FoodDocumento2 páginasGood Dog, Bad FoodAnonymous GF8PPILW5Aún no hay calificaciones

- Sex Offenders MapDocumento2 páginasSex Offenders MapNickAún no hay calificaciones

- July 2016 AP GFK PollDocumento58 páginasJuly 2016 AP GFK PollNickAún no hay calificaciones

- GenForward July 2016 ReportDocumento31 páginasGenForward July 2016 ReportNickAún no hay calificaciones

- Suicide Prevention FactSheet New VA Stats 070616 1400Documento7 páginasSuicide Prevention FactSheet New VA Stats 070616 1400abbryant-1Aún no hay calificaciones

- Carlson ComplaintDocumento8 páginasCarlson ComplaintMediaite100% (1)

- GAO: Face Recognition TechnologyDocumento68 páginasGAO: Face Recognition TechnologyNickAún no hay calificaciones

- Academy New Members 2016Documento15 páginasAcademy New Members 2016NickAún no hay calificaciones

- Nelson June 8 Letter To Automakers - Sale of New Vehicles With Defective AirbagsDocumento3 páginasNelson June 8 Letter To Automakers - Sale of New Vehicles With Defective AirbagsNickAún no hay calificaciones

- 12 35221Documento44 páginas12 35221NocoJoeAún no hay calificaciones

- Gawker Bankruptcy FilingDocumento24 páginasGawker Bankruptcy FilingMotherboardTVAún no hay calificaciones

- Redacted Threat Examples 3222016-2Documento37 páginasRedacted Threat Examples 3222016-2Colin MinerAún no hay calificaciones

- Read Whole Woman's Health v. Hellerstedt DecisionDocumento107 páginasRead Whole Woman's Health v. Hellerstedt Decisionkballuck1Aún no hay calificaciones

- Zika Mosquito MapsDocumento1 páginaZika Mosquito MapsNickAún no hay calificaciones

- Hi V Prevention MemoDocumento4 páginasHi V Prevention MemoNickAún no hay calificaciones