Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Tax Clinic Flyer-English

Cargado por

Office on Latino Affairs (OLA)0 calificaciones0% encontró este documento útil (0 votos)

18 vistas1 páginaTax Clinic Flyer-English

Derechos de autor

© © All Rights Reserved

Formatos disponibles

DOCX, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoTax Clinic Flyer-English

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

18 vistas1 páginaTax Clinic Flyer-English

Cargado por

Office on Latino Affairs (OLA)Tax Clinic Flyer-English

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como DOCX, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

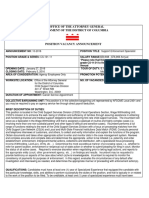

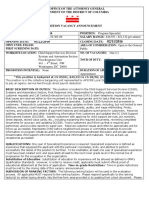

NEED TO FILE YOUR

TAXES?

Call our bilingual center for tax preparation

to make an appointment

202-332-4200 EXT. 1017, 1029, and 1056

For families with an income of $54,000 or less

For individuals with an income of $35,000 or less

February 6 - April 16 | Saturdays 9am-2pm

1420 Columbia Rd. NW

Washington, DC 20009

Please bring the following documents with you:

Services are

FREE!

W-2 for all jobs worked in 2015

1099 forms reflecting other income you may have received

Social security cards or ITIN (Tax ID) for you and every member of your

family

Copies of the filed tax returns from 2015

Bank account with routing number

Picture identification card for you and your spouse

Name, address and tax ID number of child care provider along with

amount paid for each child during 2015

Form 1095 (if you purchased health insurance through the

marketplace)

Income information for all your dependents

CAAB & CARECEN will provide Financial Counseling

Sessions

También podría gustarte

- FEIN Assignment LetterDocumento2 páginasFEIN Assignment LetterKealamākia Foundation0% (1)

- IRS Form SS-4 Guide and InstructionsDocumento7 páginasIRS Form SS-4 Guide and InstructionsChristopher WhoKnows100% (3)

- UK State Pension StatementDocumento7 páginasUK State Pension StatementElmer LeonardAún no hay calificaciones

- Application For A Social Security Card Applying For A Social Security Card Is Free!Documento5 páginasApplication For A Social Security Card Applying For A Social Security Card Is Free!Edward McNattAún no hay calificaciones

- Tax Clinic Flyer-EnglishDocumento1 páginaTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Tax Flyer LevinDocumento1 páginaTax Flyer LevinStephen LevinAún no hay calificaciones

- Hours and ProceduresDocumento4 páginasHours and ProceduresttawniaAún no hay calificaciones

- LITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseDocumento2 páginasLITAC Press RelWill County Low Income Tax Assistance Coalition and The Center For Economic Progress Press ReleaseJoliet_HeraldAún no hay calificaciones

- Rose Hudson Workbook Case StudyDocumento6 páginasRose Hudson Workbook Case StudyMary O'KeeffeAún no hay calificaciones

- Form P50 Income Tax PDFDocumento2 páginasForm P50 Income Tax PDFemesjotAún no hay calificaciones

- HC1 ScotlandDocumento20 páginasHC1 ScotlandshatakanAún no hay calificaciones

- Child Care Application: Keep For Your Records InstructionsDocumento14 páginasChild Care Application: Keep For Your Records InstructionsLaToya CrossAún no hay calificaciones

- IRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromDocumento4 páginasIRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromMarco AbreuAún no hay calificaciones

- FederalDocumento24 páginasFederalNeil NitinAún no hay calificaciones

- Tax HelpDocumento1 páginaTax HelpJen HanAún no hay calificaciones

- Help With School ExpensesDocumento4 páginasHelp With School Expensesapi-140120973Aún no hay calificaciones

- Ein Letter Glenn l CartonDocumento2 páginasEin Letter Glenn l Cartontylermichael912Aún no hay calificaciones

- Call For Location Nearest You Sites inDocumento1 páginaCall For Location Nearest You Sites inapi-26002115Aún no hay calificaciones

- Free Federal & State Tax Preparation: Saint TammanyDocumento1 páginaFree Federal & State Tax Preparation: Saint Tammanyapi-26002115Aún no hay calificaciones

- Ir 595Documento4 páginasIr 595ghostvalleyAún no hay calificaciones

- Change Status RequirementsDocumento7 páginasChange Status RequirementsAnne Michelle LBAún no hay calificaciones

- Us 2022 Tax UpdateDocumento19 páginasUs 2022 Tax Updateapi-263318846Aún no hay calificaciones

- Paper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementDocumento4 páginasPaper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementKarthik NieAún no hay calificaciones

- A Guide To Getting Started: Electronic Federal Tax Payment SystemDocumento5 páginasA Guide To Getting Started: Electronic Federal Tax Payment SystemJermaine BrownAún no hay calificaciones

- Canada Pension Plan Disability BenefitsDocumento10 páginasCanada Pension Plan Disability BenefitsTheCanadiaFreeTraderAún no hay calificaciones

- Steven Maurice Evnas Estate:TrustDocumento2 páginasSteven Maurice Evnas Estate:TrustSteven M EvansAún no hay calificaciones

- Application For A Social Security Card: Free!Documento5 páginasApplication For A Social Security Card: Free!Vhince GreenAún no hay calificaciones

- PDF DocumentDocumento30 páginasPDF DocumentWendy Del ToroAún no hay calificaciones

- BMI-Africa IRS EIN #Documento3 páginasBMI-Africa IRS EIN #Joseph VillarosaAún no hay calificaciones

- Free Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearDocumento1 páginaFree Tax Return Preparation: This Service Is Available For Those Who Earn Up To $54,000 Per YearJoliet_HeraldAún no hay calificaciones

- IRS Form 1040 Return DelinquencyDocumento2 páginasIRS Form 1040 Return DelinquencyCh StoneAún no hay calificaciones

- Application For A Social Insurance Number Information Guide For ApplicantsDocumento8 páginasApplication For A Social Insurance Number Information Guide For ApplicantsMANOJ KUMARAún no hay calificaciones

- English Free School MealsDocumento2 páginasEnglish Free School MealsarktindalAún no hay calificaciones

- Tax Instructions 2013Documento3 páginasTax Instructions 2013Đức Bình NguyễnAún no hay calificaciones

- IL-1040 InstructionsDocumento16 páginasIL-1040 InstructionsRushmoreAún no hay calificaciones

- Form p50Documento2 páginasForm p50Carlos ResendeAún no hay calificaciones

- Colorado Feedlot Horses Fein PapersDocumento3 páginasColorado Feedlot Horses Fein Papersapi-270147093Aún no hay calificaciones

- Claim ConfirmationDocumento7 páginasClaim Confirmationdebra hillAún no hay calificaciones

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDocumento4 páginasUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerAún no hay calificaciones

- IRS EFTPS InstructionsDocumento12 páginasIRS EFTPS InstructionsLeon Hormel100% (2)

- Instructions For Form I-191, Application For Advance Permission To Return To Unrelinquished DomicileDocumento0 páginasInstructions For Form I-191, Application For Advance Permission To Return To Unrelinquished DomicileNestor LopezAún no hay calificaciones

- IRS Fines Ron Paul's Campaign For LibertyDocumento4 páginasIRS Fines Ron Paul's Campaign For Libertytshoes100% (1)

- SPR 23637 N 7204Documento10 páginasSPR 23637 N 7204Balaramkishore GangireddyAún no hay calificaciones

- New Scholarship Application 111609Documento2 páginasNew Scholarship Application 111609rob_crowell_1Aún no hay calificaciones

- IRS EIN Notice: Filing RequirementsDocumento3 páginasIRS EIN Notice: Filing RequirementsLuc BookAún no hay calificaciones

- IRS Recognition LetterDocumento2 páginasIRS Recognition LetterSpartanEconAún no hay calificaciones

- Document (661) EncryptedDocumento52 páginasDocument (661) Encryptedblueblock113Aún no hay calificaciones

- 3169 1306enDocumento3 páginas3169 1306enmilitia14Aún no hay calificaciones

- See Reverse Side For Material Check-List: V I T ADocumento2 páginasSee Reverse Side For Material Check-List: V I T Aapi-123303478Aún no hay calificaciones

- Federal 2016 :DDocumento15 páginasFederal 2016 :DAnguila Angel Anguila AngelAún no hay calificaciones

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocumento17 páginasWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownAún no hay calificaciones

- Financial Aid Appeal 1516Documento7 páginasFinancial Aid Appeal 1516Dylan AshburnAún no hay calificaciones

- Applying for a Social Security Card as a J-1 Exchange VisitorDocumento7 páginasApplying for a Social Security Card as a J-1 Exchange VisitorMahmudul HasanAún no hay calificaciones

- Australian Government Department of Immigration and Citizenship Medical RequirementsDocumento4 páginasAustralian Government Department of Immigration and Citizenship Medical RequirementsRines TyanAún no hay calificaciones

- Immigration: A Fiance Petition Document Preparation Reference.De EverandImmigration: A Fiance Petition Document Preparation Reference.Aún no hay calificaciones

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryDe EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryAún no hay calificaciones

- Bilingual Program AssistantDocumento4 páginasBilingual Program AssistantOffice on Latino Affairs (OLA)Aún no hay calificaciones

- HCS Public Benefits Workshop November 2015Documento1 páginaHCS Public Benefits Workshop November 2015Office on Latino Affairs (OLA)Aún no hay calificaciones

- Vacancy No 10-2016 Support Enforcement Specialistt CS-11Documento3 páginasVacancy No 10-2016 Support Enforcement Specialistt CS-11Office on Latino Affairs (OLA)Aún no hay calificaciones

- Vac Ann - 09-2016 Program Spec CS-301-09 - CSSD - 1st Response UnitDocumento4 páginasVac Ann - 09-2016 Program Spec CS-301-09 - CSSD - 1st Response UnitOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Job Description - Deputy Director 2015Documento2 páginasJob Description - Deputy Director 2015Office on Latino Affairs (OLA)Aún no hay calificaciones

- Director of Curriculum and InstructionDocumento4 páginasDirector of Curriculum and InstructionOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Jan Registration Flyer 2016 EnglishDocumento2 páginasJan Registration Flyer 2016 EnglishOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Tax Clinic Flyer-EnglishDocumento1 páginaTax Clinic Flyer-EnglishOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Executive Assistant Job DescriptionDocumento3 páginasExecutive Assistant Job DescriptionOffice on Latino Affairs (OLA)100% (1)

- Job Ad GED TeacherDocumento1 páginaJob Ad GED TeacherOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Trade Teacher Job DescriptionDocumento1 páginaTrade Teacher Job DescriptionOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Job Ad ESL TeacherDocumento1 páginaJob Ad ESL TeacherOffice on Latino Affairs (OLA)Aún no hay calificaciones

- FINAL ADA Workshop in SPANISH Public Meeting NoticeDocumento4 páginasFINAL ADA Workshop in SPANISH Public Meeting NoticeOffice on Latino Affairs (OLA)Aún no hay calificaciones

- CRS Announcement FinalDocumento2 páginasCRS Announcement FinalOffice on Latino Affairs (OLA)Aún no hay calificaciones

- CO Bilingual Front Office ManagerDocumento2 páginasCO Bilingual Front Office ManagerOffice on Latino Affairs (OLA)100% (1)

- ParentProgESL EngFlyerDocumento1 páginaParentProgESL EngFlyerOffice on Latino Affairs (OLA)Aún no hay calificaciones

- NGYC Brochure CadetDocumento2 páginasNGYC Brochure CadetOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Conference Program Howard University Updated November 2015Documento15 páginasConference Program Howard University Updated November 2015Office on Latino Affairs (OLA)Aún no hay calificaciones

- Employment Workshop Nov DecDocumento2 páginasEmployment Workshop Nov DecOffice on Latino Affairs (OLA)Aún no hay calificaciones

- CEO Mentor AnnouncementDocumento1 páginaCEO Mentor AnnouncementOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Seeking Two Speakers of A Native Language of The AmericasDocumento1 páginaSeeking Two Speakers of A Native Language of The AmericasOffice on Latino Affairs (OLA)Aún no hay calificaciones

- Grant Reviewer Letter Fy 2016 090915Documento2 páginasGrant Reviewer Letter Fy 2016 090915Office on Latino Affairs (OLA)Aún no hay calificaciones

- Development Associate - July 2015 (00000002)Documento2 páginasDevelopment Associate - July 2015 (00000002)Office on Latino Affairs (OLA)Aún no hay calificaciones

- Full Page PhotoDocumento1 páginaFull Page PhotoOffice on Latino Affairs (OLA)Aún no hay calificaciones

- 8 X 10 inDocumento1 página8 X 10 inOffice on Latino Affairs (OLA)Aún no hay calificaciones