Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Property Tax Assessment Notices Reflect Change in Real Estate Market Since 2013

Cargado por

Aaron KrautTítulo original

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Property Tax Assessment Notices Reflect Change in Real Estate Market Since 2013

Cargado por

Aaron KrautCopyright:

Formatos disponibles

Property Tax Assessment Notices Reflect Change in Real Estate Market Since 2013

For immediate release:

December 29, 2015

Contact:

Ashley Ricker ashley.ricker@maryland.gov

410-767-1142

BALTIMORE, MD - The Maryland Department of Assessments and Taxation today announced its

reassessment of 1/3 of the more than two million real property accounts in the state. By law, the

Department of Assessments and Taxation must assess these properties every three years, ensuring

property owners pay their fair share of local property taxes.

The properties up for reassessment in 2016 are referred to as Group 1. This group consists of 688,440

parcels, which were last assessed for the July 1, 2013 tax year. To view the map for your group visit our

website at http://dat.maryland.gov/sdatweb/maps.html.

The Department of Assessments and Taxation determines the values for both residential and

commercial properties. The new assessments are based on the evaluation of 55,572 sales, which

occurred in Group 1 during the last three years; 17,429 of those sales occurring in 2015. Within Group 1

properties, 70% of residential properties saw an increase with an average increase of 9.5%, and

commercial property values increased by 16.1%. Any increase in property value is phased-in equally over

the subsequent three years. Any decrease in property value is fully implemented in the first tax year and

remains at the reduced assessment for a full three year cycle.

Residential property owners, who apply and are eligible, can receive a Homestead Tax Credit. The

Homestead Tax Credit states that all taxable assessments cannot increase by more than 10% per year.

Please see table R-4 for county Homestead percentages in your area, the allowed caps to property tax

assessment increases are established at the local government level. If you wish to see if you are eligible

for The Homestead Tax Credit and to receive more information, please visit our website at

http://www.dat.maryland.gov/sdatweb/HTC-60.pdf.

Extensive statistics and information is available from the Departments website at

http://www.dat.maryland.gov.html under the heading SDAT/Stats.

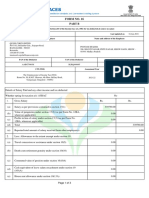

Table R-1

Residential and Commercial Full Cash Value Change

Value and Percent Change for Reassessment Group 1

January 1, 2013 Base Full Cash Values Compared To January 1, 2016 Reassessment Full Cash Values

Group 1

Residential

Commercial

Residential & Commercial Combined

Jurisdiction

1-Jan-13

1-Jan-16

% Change

1-Jan-13

1-Jan-16

% Change

1-Jan-13

1-Jan-16

% Change

Allegany

1,006,459,588

987,332,700

-1.9%

353,097,400

390,071,500

10.5%

1,359,556,988

1,377,404,200

1.3%

Anne Arundel

20,171,076,500

22,214,021,100

10.1%

2,440,067,656

2,986,705,900

22.4%

22,611,144,156

25,200,727,000

11.5%

Baltimore City

9,101,086,440

9,549,551,600

4.9%

5,123,584,800

6,219,758,000

21.4%

14,224,671,240

15,769,309,600

10.9%

Baltimore

15,251,095,000

16,906,946,600

10.9%

6,531,180,000

7,580,839,700

16.1%

21,782,275,000

24,487,786,300

12.4%

Calvert

3,139,936,200

3,267,560,900

4.1%

425,485,300

438,448,500

3.0%

3,565,421,500

3,706,009,400

3.9%

Caroline

764,354,900

770,938,000

0.9%

96,461,000

94,221,200

-2.3%

860,806,900

865,159,200

0.5%

Carroll

6,800,157,800

7,170,389,400

5.4%

754,167,100

835,834,000

10.8%

7,554,324,900

8,006,223,400

6.0%

Cecil

2,417,950,500

2,414,923,500

-0.1%

692,323,000

728,803,500

5.3%

3,110,273,500

3,143,727,000

1.1%

Charles

4,196,674,900

4,715,676,700

12.4%

2,095,213,800

2,353,947,200

12.3%

6,291,888,700

7,069,623,900

12.4%

Dorchester

871,863,000

856,808,600

-1.7%

82,233,700

84,037,700

2.2%

954,096,700

940,846,300

-1.4%

Frederick

8,798,837,200

9,563,465,100

8.7%

2,284,392,117

2,555,560,200

11.9%

11,083,229,317

12,119,025,300

9.3%

Garrett

522,580,900

529,494,600

1.3%

99,320,900

101,920,300

2.6%

621,901,800

631,414,900

1.5%

Harford

5,770,213,700

5,912,226,100

2.5%

693,531,900

758,282,000

9.3%

6,463,745,600

6,670,508,100

3.2%

Howard

12,154,678,900

13,043,636,200

7.3%

2,720,969,600

3,168,900,600

16.5%

14,875,648,500

16,212,536,800

9.0%

Kent

707,797,900

692,249,900

-2.2%

103,412,800

105,929,700

2.4%

811,210,700

798,179,600

-1.6%

Montgomery

48,116,700,800

52,753,477,900

9.6%

7,205,368,300

8,714,272,900

20.9%

55,322,069,100

61,467,720,800

11.1%

Prince George's

13,486,576,100

17,508,993,100

29.8%

7,655,870,200

8,856,827,900

15.7%

21,142,446,300

26,365,821,000

24.7%

Queen Anne's

2,657,097,700

2,829,748,600

6.5%

412,139,500

475,115,100

15.3%

3,069,237,200

3,304,863,700

7.7%

St. Mary's

2,616,930,500

2,631,707,500

0.6%

182,283,000

189,259,600

3.8%

2,799,213,500

2,820,967,100

0.8%

Somerset

320,151,500

303,945,900

-5.1%

48,706,100

45,743,800

-6.1%

368,857,600

349,689,700

-5.2%

Talbot

2,714,658,500

2,738,382,200

0.9%

790,674,047

825,581,000

4.4%

3,505,332,547

3,563,963,200

1.7%

Washington

3,729,320,800

3,798,566,000

1.9%

1,025,466,105

1,162,836,300

13.4%

4,754,786,905

4,961,402,300

4.3%

Wicomico

1,313,626,500

1,361,494,100

3.6%

377,847,700

389,940,000

3.2%

1,691,474,200

1,751,434,100

3.5%

Worcester

3,123,953,900

3,434,244,500

9.9%

1,045,879,000

1,128,067,700

7.9%

4,169,832,900

4,562,312,200

9.4%

TOTAL

169,753,779,728 185,955,780,800

9.5%

43,239,675,025 50,190,904,300

16.1%

212,993,445,753 236,146,655,100

10.9%

State Department of Assessments and Taxation

December-2015

Table R-2

Increases in Group 1 Full Cash Values

Compares the January 1, 2016 Reassessment Full Cash Values

to the Prior Valuation done January 1, 2013

County

Allegany

Anne Arundel

Baltimore City

Baltimore County

Calvert

Caroline

Carroll

Cecil

Charles

Dorchester

Frederick

Garrett

Harford

Howard

Kent

Montgomery

Prince George's

Queen Anne's

St. Mary's

Somerset

Talbot

Washington

Wicomico

Worcester

Totals

Total Number

of Residential

Improved

Properties

7,972

55,569

64,073

77,229

9,426

4,254

20,939

12,074

19,890

5,432

28,129

4,655

21,615

29,452

2,514

97,691

67,708

6,670

9,594

2,194

7,485

17,704

11,272

14,055

597,596

Number

That

Increased

in Value

2,071

47,460

32,804

67,657

6,083

2,256

14,538

3,508

18,732

2,310

27,034

2,316

13,215

24,558

246

87,365

65,707

5,318

4,752

597

4,028

9,312

6,263

11,630

459,760

State Department of Assessments and Taxation

December-2015

Percentage

That

Increased

in Value

25.98%

85.41%

51.20%

87.61%

64.53%

53.03%

69.43%

29.05%

94.18%

42.53%

96.11%

49.75%

61.14%

83.38%

9.79%

89.43%

97.04%

79.73%

49.53%

27.21%

53.81%

52.60%

55.56%

82.75%

76.93%

Total

Number

of All

Properties

11,914

60,656

69,058

87,391

11,828

5,656

23,267

16,738

22,150

7,690

32,827

7,508

25,179

31,595

4,016

104,907

77,926

8,321

13,309

4,191

9,280

20,840

14,414

17,779

688,440

Number

That

Increased

in Value

2,551

50,571

35,530

70,454

6,990

2,508

15,148

4,210

19,679

2,524

28,223

2,525

13,755

25,226

336

90,843

67,793

6,189

4,943

616

4,647

10,177

6,748

13,254

485,440

Percentage

That

Increased

in Value

21.41%

83.37%

51.45%

80.62%

59.10%

44.34%

65.11%

25.15%

88.84%

32.82%

85.97%

33.63%

54.63%

79.84%

8.37%

86.59%

87.00%

74.38%

37.14%

14.70%

50.08%

48.83%

46.82%

74.55%

70.51%

Table R-3

Triennial Change in Full Cash Value ( Residential & Commerical )

January 1, 2004 through January 1, 2016

2004

2005

2006

2007

Group 1 Group 2 Group 3 Group 1

Allegany

Anne Arundel

Baltimore City

Baltimore

Calvert

Caroline

Carroll

Cecil

Charles

Dorchester

Frederick

Garrett

Harford

Howard

Kent

Montgomery

Prince George's

Queen Anne's

St. Mary's

Somerset

Talbot

Washington

Wicomico

Worcester

State Average

10.6%

49.0%

18.5%

19.3%

29.7%

25.0%

35.9%

20.5%

27.5%

19.4%

33.5%

11.1%

25.5%

39.3%

30.6%

51.8%

32.8%

40.9%

19.1%

17.1%

31.3%

21.4%

16.9%

55.5%

36.0%

10.6%

47.6%

21.6%

38.1%

50.4%

38.9%

42.2%

33.1%

47.2%

32.5%

56.0%

39.2%

37.6%

48.5%

46.5%

65.0%

40.1%

48.3%

37.2%

49.5%

47.9%

32.4%

21.3%

26.7%

46.6%

21.4%

65.9%

45.6%

53.4%

71.7%

49.7%

54.0%

56.7%

70.2%

60.8%

60.9%

47.6%

48.2%

58.7%

36.8%

63.3%

60.6%

58.7%

57.2%

65.0%

53.5%

58.6%

40.2%

78.9%

60.2%

State Department of Assessments and Taxation

December-2015

43.3%

55.4%

58.5%

64.8%

69.7%

73.6%

56.9%

54.0%

62.6%

58.5%

52.2%

38.3%

55.5%

50.3%

65.2%

43.4%

79.5%

50.1%

84.3%

79.6%

54.8%

64.7%

53.2%

54.1%

56.1%

2008

Group 2

34.5%

34.9%

75.0%

32.6%

38.3%

40.6%

37.4%

33.3%

41.4%

34.5%

27.4%

29.0%

38.6%

24.2%

37.3%

16.2%

51.6%

36.8%

49.0%

45.5%

42.7%

40.2%

40.6%

33.3%

33.2%

2009

Group 3

16.8%

-0.3%

20.9%

13.3%

3.1%

13.4%

5.1%

2.5%

-4.6%

6.8%

-4.7%

8.5%

9.0%

-2.3%

13.5%

-10.6%

14.6%

7.2%

8.2%

4.4%

13.6%

3.0%

5.1%

-12.7%

0.8%

2010

2011

2012

2013

2014

2015

Group 1 Group 2 Group 3 Group 1 Group 2 Group 3

0.4%

-17.9%

-2.6%

-13.2%

-15.1%

-15.6%

-19.2%

-11.0%

-19.8%

-9.9%

-22.0%

0.0%

-14.3%

-19.8%

-10.3%

-17.0%

-18.4%

-12.4%

-15.5%

-10.6%

-9.0%

-18.4%

-15.6%

-20.0%

-16.1%

-4.5%

-16.6%

-8.7%

-13.6%

-20.7%

-18.8%

-19.6%

-20.0%

-26.6%

-21.4%

-24.1%

-2.4%

-15.3%

-18.8%

-12.5%

-14.5%

-28.7%

-18.6%

-16.0%

-18.5%

-15.0%

-18.3%

-20.1%

-14.9%

-17.9%

-5.3%

-12.6%

-6.8%

-14.5%

-16.1%

-18.9%

-15.4%

-15.4%

-15.2%

-10.8%

-18.8%

-14.7%

-5.8%

-8.7%

-9.0%

-8.6%

-24.8%

-13.7%

-9.6%

-20.6%

-15.3%

-9.0%

-20.2%

-17.4%

-13.0%

-2.4%

-1.9%

-3.1%

-8.1%

-11.4%

-15.7%

-3.8%

-10.4%

-6.8%

-11.7%

-2.2%

-3.6%

-6.5%

2.5%

-6.0%

4.1%

-10.6%

-9.0%

-7.9%

-11.5%

-11.5%

-6.9%

-17.4%

-14.3%

-3.6%

-2.8%

9.9%

7.0%

1.2%

-2.9%

-3.6%

-3.0%

-2.3%

-4.2%

-7.9%

4.0%

-14.0%

1.6%

8.1%

-5.5%

11.0%

5.3%

-10.3%

-2.2%

-13.3%

-11.4%

-3.0%

-6.2%

-7.8%

4.7%

-0.4%

10.8%

9.6%

6.4%

0.8%

-2.8%

4.1%

3.9%

3.3%

-0.8%

11.2%

-2.8%

3.1%

10.5%

-0.7%

18.7%

19.5%

1.2%

1.5%

3.1%

-7.1%

5.5%

2.6%

2.2%

10.8%

2016

Group 1

1.3%

11.5%

10.9%

12.4%

3.9%

0.5%

6.0%

1.1%

12.4%

-1.4%

9.3%

1.5%

3.2%

9.0%

-1.6%

11.1%

24.7%

7.7%

0.8%

-5.2%

1.7%

4.3%

3.5%

9.4%

10.9%

Table R-4

July 1, 2016 County Established Assessment Caps

Jurisdiction

Allegany

Anne Arundel

Baltimore City

Baltimore

Calvert

Caroline

Carroll

Cecil

Charles

Dorchester

Frederick

Garrett

Harford

Howard

Kent

Montgomery

Prince George's

Queen Anne's

St. Mary's

Somerset

Talbot

Washington

Wicomico

Worcester

July 1, 2016

County

Assessment Cap*

4%

2%

4%

4%

10%

5%

5%

4%

7%

5%

5%

5%

5%

5%

5%

10%

0%

5%

5%

10%

0%

5%

5%

3%

*Annual assessment cap applies only to owner-occupied properties.

State Department of Assessments and Taxation

December-15

Change in Assessments Value

70.0%

60.2%

60.0%

56.1%

50.0%

40.0%

46.6%

36.0%

33.2%

30.0%

20.0%

10.8%

10.9%

10.0%

4.7%

0.8%

0.0%

Group 1

Group 2

Group 3

Group 1

Group 2

Group 3

Group 1

Group 2

Group 3

-3.6%

Group 1

Group 2

Group 3

Group 1

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

-10.0%

-13.0%

-16.1%

-20.0%

-30.0%

-17.9%

También podría gustarte

- April Revenue ReportDocumento3 páginasApril Revenue ReportRob PortAún no hay calificaciones

- Senior Manager Indirect Tax in Cincinnati OH Resume Linda TattershallDocumento2 páginasSenior Manager Indirect Tax in Cincinnati OH Resume Linda TattershallLindaTattershallAún no hay calificaciones

- 2015 Annual ReportDocumento19 páginas2015 Annual ReportRob PortAún no hay calificaciones

- Guide To Home Property TaxesDocumento5 páginasGuide To Home Property Taxesfishburn11Aún no hay calificaciones

- Fiscal Sustainability Analysis: Nassau CountyDocumento22 páginasFiscal Sustainability Analysis: Nassau Countyapi-298511181Aún no hay calificaciones

- 2011 1 Stat ReportDocumento9 páginas2011 1 Stat ReportRob PortAún no hay calificaciones

- CAFR DoxDocumento2 páginasCAFR Doxjohn muhanda muAún no hay calificaciones

- USG 10-K Filing Fiscal Year 2015Documento607 páginasUSG 10-K Filing Fiscal Year 2015Jt WuAún no hay calificaciones

- 2013 TX Yr DouglasCoAssr Lot2A MoniparkR0426430Documento3 páginas2013 TX Yr DouglasCoAssr Lot2A MoniparkR0426430Diane SternAún no hay calificaciones

- 2012 2 Stat ReportDocumento9 páginas2012 2 Stat ReportRob PortAún no hay calificaciones

- 2018 1st Quarter TSPDocumento2 páginas2018 1st Quarter TSPRob PortAún no hay calificaciones

- Helen Rosenthal Council Member, Sixth District: Let'S Talk Taxes: Class 2 PropertiesDocumento2 páginasHelen Rosenthal Council Member, Sixth District: Let'S Talk Taxes: Class 2 PropertiesAvi GoodsteinAún no hay calificaciones

- BenchmarkingFY2015 TaxSpendDebt FINALDocumento4 páginasBenchmarkingFY2015 TaxSpendDebt FINALjspectorAún no hay calificaciones

- Office of The State Comptroller: A. Results of ExaminationDocumento5 páginasOffice of The State Comptroller: A. Results of ExaminationNick ReismanAún no hay calificaciones

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransDe EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransAún no hay calificaciones

- Getting Real About Reform: Estimating Revenue Gains From Changes To California's System of Assessing Commercial Real EstateDocumento20 páginasGetting Real About Reform: Estimating Revenue Gains From Changes To California's System of Assessing Commercial Real EstateProgram for Environmental And Regional Equity / Center for the Study of Immigrant Integration100% (1)

- Review of FY 2013 Mid-Year Budget Monitoring ReportDocumento22 páginasReview of FY 2013 Mid-Year Budget Monitoring Reportapi-27500850Aún no hay calificaciones

- County Administrator 2017 Budget MemoDocumento20 páginasCounty Administrator 2017 Budget MemoFauquier NowAún no hay calificaciones

- Quickstart 2013-14Documento29 páginasQuickstart 2013-14Nick ReismanAún no hay calificaciones

- 2011 Annual Stat ReportDocumento19 páginas2011 Annual Stat ReportRob PortAún no hay calificaciones

- Module - Businesses and Real Estate TaxesDocumento2 páginasModule - Businesses and Real Estate TaxesbeckAún no hay calificaciones

- 2020 Budget OverviewDocumento17 páginas2020 Budget OverviewJohn TuringAún no hay calificaciones

- Datapoints - May, 2013Documento2 páginasDatapoints - May, 2013CAPCOGAún no hay calificaciones

- Ipswich Comparable PackDocumento6 páginasIpswich Comparable Packapi-26419872Aún no hay calificaciones

- November 2014 OMB ReportDocumento4 páginasNovember 2014 OMB ReportRob PortAún no hay calificaciones

- SIE CY 2004 Volume 1 NewDocumento54 páginasSIE CY 2004 Volume 1 NewShobi DionelaAún no hay calificaciones

- Multistate Tax Commission ArticleDocumento7 páginasMultistate Tax Commission Articleyfeng1018Aún no hay calificaciones

- Summary of December Finance CommitteeDocumento43 páginasSummary of December Finance CommitteeAthertonPOAAún no hay calificaciones

- Rushern Baker 2010Documento3 páginasRushern Baker 2010jon_mummolo3075Aún no hay calificaciones

- Jobs PlanDocumento3 páginasJobs Planjon_mummolo3075Aún no hay calificaciones

- QLD Housing and Economy 2Q 2011Documento23 páginasQLD Housing and Economy 2Q 2011livermore666Aún no hay calificaciones

- Oregon Department of Revenue Report On Senior Property Tax Deferral ProgramDocumento3 páginasOregon Department of Revenue Report On Senior Property Tax Deferral ProgramStatesman JournalAún no hay calificaciones

- Real Property TaxDocumento5 páginasReal Property TaxRacinef Tee100% (2)

- Belmonte TAX Quiz. WITH PART 1docxDocumento11 páginasBelmonte TAX Quiz. WITH PART 1docxRheyne Robledo-MendozaAún no hay calificaciones

- Estimated Full Value of Real Property in Cook County 2009 - 2018Documento21 páginasEstimated Full Value of Real Property in Cook County 2009 - 2018Ann DwyerAún no hay calificaciones

- School Tax Relief (STAR) Program: o N y S CDocumento32 páginasSchool Tax Relief (STAR) Program: o N y S CjspectorAún no hay calificaciones

- Fao Hydro One enDocumento45 páginasFao Hydro One enGillian GraceAún no hay calificaciones

- Public Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesDocumento291 páginasPublic Accounts 2011-2012 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- County Search For Economic PlanDocumento10 páginasCounty Search For Economic PlanDavid LombardoAún no hay calificaciones

- 2013 AFR LGUs Vol3Documento908 páginas2013 AFR LGUs Vol3LalaLanibaAún no hay calificaciones

- 2006 Ptax CodesDocumento87 páginas2006 Ptax CodescameronAún no hay calificaciones

- 2018 Tax ReportDocumento112 páginas2018 Tax ReportYolandaAún no hay calificaciones

- Personal Income Tax Revenues Show Significant Softening in The Fourth Quarter of 2013Documento26 páginasPersonal Income Tax Revenues Show Significant Softening in The Fourth Quarter of 2013Nick ReismanAún no hay calificaciones

- DCADAnnualReport 2015Documento16 páginasDCADAnnualReport 2015O'Connor AssociateAún no hay calificaciones

- Saratoga Springs City School District: Fund BalanceDocumento13 páginasSaratoga Springs City School District: Fund BalanceBethany BumpAún no hay calificaciones

- Quickstart 2013-14Documento29 páginasQuickstart 2013-14Rick KarlinAún no hay calificaciones

- June 2016 Financial StatusDocumento10 páginasJune 2016 Financial StatusHelen BennettAún no hay calificaciones

- 2014-15 Douglas County Secured Assessment RollDocumento97 páginas2014-15 Douglas County Secured Assessment RollcvalleytimesAún no hay calificaciones

- The Rockland County Budget Crisis: How It Happened, and Plotting A Course To Fiscal HealthDocumento37 páginasThe Rockland County Budget Crisis: How It Happened, and Plotting A Course To Fiscal HealthNewsdayAún no hay calificaciones

- Moody's Upgrades San Diego County (CA) Issuer Rating To Aaa: New IssueDocumento7 páginasMoody's Upgrades San Diego County (CA) Issuer Rating To Aaa: New Issuesteve_schmidt1053Aún no hay calificaciones

- Read The Hampton Roads 2018 Economic AnalysisDocumento6 páginasRead The Hampton Roads 2018 Economic AnalysisBrian ReeseAún no hay calificaciones

- Property Tax CADocumento42 páginasProperty Tax CAElnur5Aún no hay calificaciones

- Aug 14Documento14 páginasAug 14David BravoAún no hay calificaciones

- Public Accounts 2012-2013 Saskatchewan Government Details of Revenue & ExpensesDocumento290 páginasPublic Accounts 2012-2013 Saskatchewan Government Details of Revenue & ExpensesAnishinabe100% (1)

- Many Taxpayers Are Still Not Complying With Noncash Charitable Contribution Reporting RequirementsDocumento43 páginasMany Taxpayers Are Still Not Complying With Noncash Charitable Contribution Reporting RequirementsCara MatthewsAún no hay calificaciones

- 230 Short Sale Packet - BayviewDocumento16 páginas230 Short Sale Packet - BayviewrapiddocsAún no hay calificaciones

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Documento45 páginasBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationAún no hay calificaciones

- General Fund RevenuesDocumento3 páginasGeneral Fund RevenuesRob PortAún no hay calificaciones

- Mapping Property Tax Reform in Southeast AsiaDe EverandMapping Property Tax Reform in Southeast AsiaAún no hay calificaciones

- Freight Forwarding Revenues World Summary: Market Values & Financials by CountryDe EverandFreight Forwarding Revenues World Summary: Market Values & Financials by CountryAún no hay calificaciones

- Van Hollen Urges NPS To Mitigate Impact of Beach Drive Rehabilitation During Red Line SafeTrack SurgeDocumento1 páginaVan Hollen Urges NPS To Mitigate Impact of Beach Drive Rehabilitation During Red Line SafeTrack SurgeAaron KrautAún no hay calificaciones

- Participating Restaurants and MenusDocumento3 páginasParticipating Restaurants and MenusAaron KrautAún no hay calificaciones

- C4A+Open+Letter+to+the+Next+President+-+Mayors+call+for+Immigration+Reform+ (FINAL+7 26 2016)Documento2 páginasC4A+Open+Letter+to+the+Next+President+-+Mayors+call+for+Immigration+Reform+ (FINAL+7 26 2016)Aaron KrautAún no hay calificaciones

- PressRelease Schultz SHPresidentDocumento2 páginasPressRelease Schultz SHPresidentAaron KrautAún no hay calificaciones

- WMAL Park Comment - July.24.2016Documento2 páginasWMAL Park Comment - July.24.2016Aaron KrautAún no hay calificaciones

- Federal Judge Vacates Purple Line Record of Decision-NEWS RELEASEDocumento2 páginasFederal Judge Vacates Purple Line Record of Decision-NEWS RELEASEAaron KrautAún no hay calificaciones

- DCA Fact Sheet 20160815Documento3 páginasDCA Fact Sheet 20160815Aaron KrautAún no hay calificaciones

- Bethesda: Downtown PlanDocumento168 páginasBethesda: Downtown PlanM-NCPPCAún no hay calificaciones

- Trathmore QuareDocumento13 páginasTrathmore QuareM-NCPPCAún no hay calificaciones

- 16 TS 120160290Documento116 páginas16 TS 120160290Aaron KrautAún no hay calificaciones

- General Assembly Session.": Montgomery County CouncilDocumento1 páginaGeneral Assembly Session.": Montgomery County CouncilAaron KrautAún no hay calificaciones

- Hoeber Statement On Clinton Emails - July 5thDocumento1 páginaHoeber Statement On Clinton Emails - July 5thAaron KrautAún no hay calificaciones

- UntitledDocumento54 páginasUntitledM-NCPPCAún no hay calificaciones

- Bag Tax Monthly Report For DEP (With April 2016 Bags)Documento1 páginaBag Tax Monthly Report For DEP (With April 2016 Bags)Aaron KrautAún no hay calificaciones

- 2016 Annual Report - Tree Canopy LawDocumento17 páginas2016 Annual Report - Tree Canopy LawAaron KrautAún no hay calificaciones

- Letter To Postmaster GeneralDocumento1 páginaLetter To Postmaster GeneralAaron KrautAún no hay calificaciones

- Frequently Asked QuestionsDocumento11 páginasFrequently Asked QuestionsAaron KrautAún no hay calificaciones

- National Philharmonic Names Leanne Ferfolia PresidentDocumento3 páginasNational Philharmonic Names Leanne Ferfolia PresidentAaron KrautAún no hay calificaciones

- Draft CalendarDocumento1 páginaDraft CalendarAaron KrautAún no hay calificaciones

- Bag Tax Monthly Report For DEP (With April 2016 Bags)Documento1 páginaBag Tax Monthly Report For DEP (With April 2016 Bags)Aaron KrautAún no hay calificaciones

- Westwood Shopping Center: Sketch PlanDocumento19 páginasWestwood Shopping Center: Sketch PlanAaron KrautAún no hay calificaciones

- Federal Realty Montrose CrossingDocumento11 páginasFederal Realty Montrose CrossingAaron KrautAún no hay calificaciones

- Petition - ApprovedDocumento1 páginaPetition - ApprovedAaron KrautAún no hay calificaciones

- Bowers Letter 20160527Documento1 páginaBowers Letter 20160527Aaron KrautAún no hay calificaciones

- Tesfatsion ReleaseDocumento2 páginasTesfatsion ReleaseAaron KrautAún no hay calificaciones

- Mandatory Referral For County Property AcquisitionDocumento3 páginasMandatory Referral For County Property AcquisitionAaron KrautAún no hay calificaciones

- Sidewalk Temporarily Closed, 12x18Documento2 páginasSidewalk Temporarily Closed, 12x18Aaron KrautAún no hay calificaciones

- Letter To FAA AdministratorDocumento2 páginasLetter To FAA AdministratorAaron KrautAún no hay calificaciones

- 5.13.16 FY 17 Operating BDGT To Floreen - RiceDocumento5 páginas5.13.16 FY 17 Operating BDGT To Floreen - RiceAaron KrautAún no hay calificaciones

- Memorandum From Councilmembers Katz, Leventhal and Elrich Regarding CESCDocumento2 páginasMemorandum From Councilmembers Katz, Leventhal and Elrich Regarding CESCAaron KrautAún no hay calificaciones

- TD WSS Units CSP的技术澄清 PDFDocumento179 páginasTD WSS Units CSP的技术澄清 PDFJindongRenAún no hay calificaciones

- Free Commercial ZoneDocumento12 páginasFree Commercial ZoneQueenie ChongAún no hay calificaciones

- Vol 1Documento254 páginasVol 1BhawnaBishtAún no hay calificaciones

- Gross Sales Declaration Form 2023Documento1 páginaGross Sales Declaration Form 2023Ramon Vinzon67% (9)

- File 8081Documento3 páginasFile 8081RAJKUMAR CHATTERJEE. (RAJA.)Aún no hay calificaciones

- LastthreemonthPayslip 2Documento7 páginasLastthreemonthPayslip 2delicata.benAún no hay calificaciones

- 50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceDocumento30 páginas50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceellirafaeladvAún no hay calificaciones

- Bida-Tech Company Chart of Accounts Account Naccount NameDocumento66 páginasBida-Tech Company Chart of Accounts Account Naccount NameTrisha Mae Mendoza MacalinoAún no hay calificaciones

- TGL AP - List Doc - Owner Code Supplier Vendor Invoice SistemDocumento4 páginasTGL AP - List Doc - Owner Code Supplier Vendor Invoice SistemBego BangetAún no hay calificaciones

- Cdatu, ArtikelDocumento10 páginasCdatu, ArtikelOvie Diana D.Aún no hay calificaciones

- Payroll Workshop: Alaras, Arla Gabrielle (A0012)Documento15 páginasPayroll Workshop: Alaras, Arla Gabrielle (A0012)ellaine villafaniaAún no hay calificaciones

- DocumentDocumento9 páginasDocumentCharlie MorgulisAún no hay calificaciones

- Sep 22Documento1 páginaSep 22austin LevisAún no hay calificaciones

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocumento3 páginasCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharAún no hay calificaciones

- Company Unit 4th - Aug - 2021Documento17 páginasCompany Unit 4th - Aug - 2021cubadesignstudAún no hay calificaciones

- Mad About Sports PVT LTD: Venkateswarlu GurramDocumento1 páginaMad About Sports PVT LTD: Venkateswarlu GurramGv IareAún no hay calificaciones

- InvoiceDocumento2 páginasInvoiceqwrhhemAún no hay calificaciones

- Answers Bus Ad 4 MIDTERMDocumento3 páginasAnswers Bus Ad 4 MIDTERMJophie AndreilleAún no hay calificaciones

- Yatra Bill Format 26-03-2021Documento1 páginaYatra Bill Format 26-03-2021RiteshAún no hay calificaciones

- Wahab UpdateDocumento1 páginaWahab UpdateSumairAún no hay calificaciones

- Deposit Guideline Local Transfer 2: Updated On: 21 March 2022Documento29 páginasDeposit Guideline Local Transfer 2: Updated On: 21 March 2022Zarir Abdul RashidAún no hay calificaciones

- Form 16-Part B - 2020-2021Documento3 páginasForm 16-Part B - 2020-2021Ravi S. SharmaAún no hay calificaciones

- In Voice 1960332922730436660Documento2 páginasIn Voice 1960332922730436660AHAN GUPTAAún no hay calificaciones

- Sworn Declaration FormDocumento1 páginaSworn Declaration FormAnawin FamadicoAún no hay calificaciones

- BillDocumento2 páginasBillMehboob Ul HaqAún no hay calificaciones

- Advance Payment of TaxDocumento3 páginasAdvance Payment of TaxsadathnooriAún no hay calificaciones

- On January 1 Pulse Recording Studio Prs Had The FollowingDocumento1 páginaOn January 1 Pulse Recording Studio Prs Had The FollowingLet's Talk With HassanAún no hay calificaciones

- Sworn Application For Tax Clearance: Annex CDocumento1 páginaSworn Application For Tax Clearance: Annex CpatrickkayeAún no hay calificaciones

- 13th Month PayDocumento14 páginas13th Month Paycarlo melgarAún no hay calificaciones

- TUASON Vs LINGAD (G.R. NO. L-24248, July 31, 1974)Documento6 páginasTUASON Vs LINGAD (G.R. NO. L-24248, July 31, 1974)Gwen Alistaer CanaleAún no hay calificaciones