Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Liquidity

Cargado por

Matteo Gerardo Palumbo0 calificaciones0% encontró este documento útil (0 votos)

13 vistas1 páginaliquidity provision

Derechos de autor

© © All Rights Reserved

Formatos disponibles

TXT, PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoliquidity provision

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como TXT, PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

13 vistas1 páginaLiquidity

Cargado por

Matteo Gerardo Palumboliquidity provision

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como TXT, PDF, TXT o lea en línea desde Scribd

Está en la página 1de 1

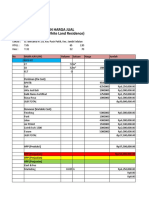

introduction: the model, goals.

exemple of liquidity provision (R=2, r1,r2, show that utility increases)

Optimal r2 (so that banks have enough liquidity)

Optimal r1 (maximizing investors' utility)

Very illiquid assets extension (r2>R!)

Bank runs:

Self fulfiling prophecies and equilibria

-- sequential model: observable behavior under perferct/imperfect information-see paper

Policies to avoid runs:

Suspension (if not stopped in time/misforecast of t (not quick enough suspension

(because more than 100 people

causing lower r2 etc., or some people needing liquidity wouldnt have it

at date 1) ->unhappy investors

--Profit fee: under competition (i.e. no monopoly assumption) it would lead f to

zero, unless cooperation/cartel-Government fee --see original paper-Conclusions: bank good provide liquidity, but bank runs?

También podría gustarte

- Charachterizing The Location v2Documento6 páginasCharachterizing The Location v2Matteo Gerardo PalumboAún no hay calificaciones

- Matteo Gerardo PALUMBO: Personal InfoDocumento2 páginasMatteo Gerardo PALUMBO: Personal InfoMatteo Gerardo PalumboAún no hay calificaciones

- Update VikosDocumento12 páginasUpdate VikosMatteo Gerardo PalumboAún no hay calificaciones

- Homework - Calculus (QF) : Matteo Gerardo PalumboDocumento1 páginaHomework - Calculus (QF) : Matteo Gerardo PalumboMatteo Gerardo PalumboAún no hay calificaciones

- Calculus Homework - PalumboDocumento1 páginaCalculus Homework - PalumboMatteo Gerardo PalumboAún no hay calificaciones

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Permanent Transfer ClaimDocumento2 páginasPermanent Transfer ClaimdpdohisarAún no hay calificaciones

- White Paper On Industries Dept PDFDocumento47 páginasWhite Paper On Industries Dept PDFSunny Dara Rinnah SusanthAún no hay calificaciones

- Hsp-Sby210315fw DamcoDocumento2 páginasHsp-Sby210315fw DamcoGadis Puri RahayuAún no hay calificaciones

- Pt. Hasil Bersama Logistindo: InvoiceDocumento1 páginaPt. Hasil Bersama Logistindo: InvoiceHari SusetyoAún no hay calificaciones

- Modular Harga Jual WLR2Documento25 páginasModular Harga Jual WLR2Next LevelManagementAún no hay calificaciones

- Benefits & Risks of The Resale Price MethodDocumento2 páginasBenefits & Risks of The Resale Price MethodLJBernardoAún no hay calificaciones

- Economics For Today Asia Pacific 5th Edition Layton Test BankDocumento34 páginasEconomics For Today Asia Pacific 5th Edition Layton Test Banklovellednayr984100% (27)

- Exemplar Business Report Eco-Fone Smartphones 2021Documento11 páginasExemplar Business Report Eco-Fone Smartphones 2021sagarika chowdhuryAún no hay calificaciones

- Shorter - Strategic Tools - Efe Ife Ie Space BCG QSPMDocumento23 páginasShorter - Strategic Tools - Efe Ife Ie Space BCG QSPMUTTAM KOIRALAAún no hay calificaciones

- (123doc) Xuat Khau Sua Dau Nanh Vinasoy Sang NhatDocumento26 páginas(123doc) Xuat Khau Sua Dau Nanh Vinasoy Sang NhatChâu Đặng Thị MinhAún no hay calificaciones

- TUTORIAL SOLUTIONS (Week 4A)Documento8 páginasTUTORIAL SOLUTIONS (Week 4A)Peter100% (1)

- SBMC Blank v2 2 PDFDocumento1 páginaSBMC Blank v2 2 PDFSusan BvochoraAún no hay calificaciones

- ACL Chapter 10 Questions and ProblemsDocumento24 páginasACL Chapter 10 Questions and ProblemsUyen NguyenAún no hay calificaciones

- Booklet - Religeous Use Masjid 1685537115859Documento49 páginasBooklet - Religeous Use Masjid 1685537115859chetanjtAún no hay calificaciones

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Documento2 páginasAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonAún no hay calificaciones

- F23 Week 07 OPER8340 LectureDocumento28 páginasF23 Week 07 OPER8340 LectureMurtuza SajidAún no hay calificaciones

- 3-Math Solved MCQs (For FPSC, PPSC, CSS, PMS, NTS)Documento10 páginas3-Math Solved MCQs (For FPSC, PPSC, CSS, PMS, NTS)SajidmehsudAún no hay calificaciones

- Chap 2 - ActivitiesDocumento2 páginasChap 2 - ActivitiesDuyên HồAún no hay calificaciones

- Activity - Statement of Comprehensive IncomeDocumento6 páginasActivity - Statement of Comprehensive IncomeGrace HernandezAún no hay calificaciones

- Y1 Exam BM HL M2022 With Formula SheetDocumento8 páginasY1 Exam BM HL M2022 With Formula Sheetss-alshehriAún no hay calificaciones

- September 21Documento34 páginasSeptember 21AL BURJ AL THAKIAún no hay calificaciones

- Module 2Documento26 páginasModule 2golu tripathiAún no hay calificaciones

- Chapter 2 AssignmentDocumento3 páginasChapter 2 AssignmentJasmin MarreroAún no hay calificaciones

- Transportation AttachmentDocumento3 páginasTransportation AttachmentJessica CrisostomoAún no hay calificaciones

- Equity: Learning ObjectivesDocumento32 páginasEquity: Learning ObjectivesAASAún no hay calificaciones

- Chapter 12 QADocumento6 páginasChapter 12 QAShamara ZamanAún no hay calificaciones

- BMDelhi Class Preparation 2Documento3 páginasBMDelhi Class Preparation 2djAún no hay calificaciones

- Kogta Financial (India) LTDDocumento3 páginasKogta Financial (India) LTDAnandAún no hay calificaciones

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Documento6 páginasIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesAún no hay calificaciones

- MMTC Student's Manual 2021Documento105 páginasMMTC Student's Manual 2021Priyanshu Gupta100% (1)