Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Quan Case Study-Lawsuit Defense Strategy

Cargado por

BeAutiful YouDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Quan Case Study-Lawsuit Defense Strategy

Cargado por

BeAutiful YouCopyright:

Formatos disponibles

CASE STUDY

PRESENTED BY:

Lawsuit Defense Strategy

The Problem

John Campbell, an employee of Manhattan Construction,

claims to have injured his back as a result of a fall while

repairing the roof at one of the Eastview apartment

buildings.

John filed a lawsuit against the owner of the building,

Doug Reynolds asking for $1,500,000 in damages.

John has offered to settle the lawsuit out of court for

$750,000.

Mr. Reynolds insurance company, Allied Insurance,

must now defend the dispute and decide what action to

take regarding the lawsuit.

The Decision Alternative

Should Allied Insurance accept Johns offer to settle

the lawsuit for $750,000, or provide a $400,000

counteroffer?

Possible Outcomes

There are three outcomes the lawyers are considering to

represent Johns possible reaction to a counteroffer of

$400,000.

(1) John Accepts the counteroffer and the case will be closed.

(2) John Rejects the counteroffer and elects to have a jury decide

the settlement amount.

(3) John makes a counteroffer to Allied Insurance of $600,000.

If John does make a counteroffer, Allied will either accept

Johns counteroffer of $600,000 or go to trial.

Allied Insurance Decision Tree

Allied Accepts Johns

Settlement Offer of $750,000

John Accepts Allied

Counteroffer of $400,000

(0.10)

Allied Loses

Damages $1,500,000

(0.30)

John Rejects Allieds Allied Loses

Counteroffer of $400,000 Damages $750,000

Allied Counter offers (0.40) (0.50)

with $400,000

Allied Wins

Damages $0.00

(0.20)

Allied Accepts Johns

Counteroffer of $600,000

John Counteroffers Allied Loses

with $600,000 Damages $1,500,000

(0.50) (0.30)

Allied Rejects Johns Allied Loses

Counteroffer of $600,000 Damages $750,000

(0.50)

Allied Wins

Damages $0.00

(0.20)

1

2 3

4

5

EV Node 1: ($400,000 X 0.1) + ($825,000 X 0.4) +

($600,000 X 0.5)= $670,000

EV Node 2: ($400,000 X 0.1) + ($825,000 X 0.4) +

($600,000 X 0.5)= $670,000

EV Node 3: ($1,500,000 X 0.3) + ($750,000 X 0.5)

+ ($0.00 X 0.2)= $825 000

EV Node 4: ($600,000 X 1.0)= $600,000

EV Node 5: ($1,500,000 X 0.3) + ($750,000 X 0.5)

+ ($0.00 X 0.2)= $825,000

Question 2: Should Allied accept Johns initial offer

to settle for $750,000?

We recommend that Allied not accept Johns initial

offer to settle for $750,000.

The calculated expected value of $670,000 is less

than the settlement offer of $750,000 from John.

Question 3: What decision strategy should Allied follow

if they decide to make John a counteroffer of $400,000?

If John accepts Allied counteroffer of $400,000,

neither parties will be required to attend trial.

But, what if John rejects the counteroffer?

John could offer a different counteroffer of $600,000

Take the case to trail and let the jury decide.

If the parties decide to go to trial:

The jury could award John the full $1,500,000 or the

settlement amount of $750,000.

Allied could win the case leaving John with no compensatory

damages.

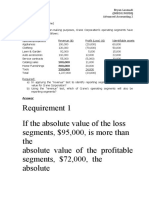

The Risk Profile

The optimal strategy would be for Allied to take the

counteroffer of $600,000, as it is lower than the

expected value of $670,000.

Settlement Amounts Probability of Outcome Expected Value

$0.00 0.08 $0.00

$400,000 0.10 $40,000

$600,000 0.50 $300,000

$750,000 0.20 $150,000

$1,500,000 0.12 $180,000

1.00 $670,000

También podría gustarte

- Lawsuit Defense StrategyDocumento4 páginasLawsuit Defense StrategyBeAutiful You50% (2)

- Lawsuit Defense Strategy, Chapter 4 - Decision Analysis - Sáng TH 5Documento6 páginasLawsuit Defense Strategy, Chapter 4 - Decision Analysis - Sáng TH 5Thanh TuyềnAún no hay calificaciones

- Case Problem 2 Lawsuit Defense StrategyDocumento3 páginasCase Problem 2 Lawsuit Defense StrategySomething ChicAún no hay calificaciones

- Lawsuit Defense Strategy, Chapter 4 - Decision Analysis - Sáng TH 5Documento6 páginasLawsuit Defense Strategy, Chapter 4 - Decision Analysis - Sáng TH 5Thanh TuyềnAún no hay calificaciones

- Accounting For Joint Venture Formation: Ex. 1 Contribution To JV in Return For Interest in JVDocumento3 páginasAccounting For Joint Venture Formation: Ex. 1 Contribution To JV in Return For Interest in JVYnang QueenAún no hay calificaciones

- P15 13 Determining A New Partners InvestDocumento18 páginasP15 13 Determining A New Partners InvestMa'arifa HussainAún no hay calificaciones

- Solman Chap10 Shareholders Equity - CompressDocumento18 páginasSolman Chap10 Shareholders Equity - CompressDump DumpAún no hay calificaciones

- Answer: Unsecured, Nonpriority ClaimsDocumento5 páginasAnswer: Unsecured, Nonpriority ClaimsEleonora VinessaAún no hay calificaciones

- Lesson 5x Practice Exercises SolutionsDocumento8 páginasLesson 5x Practice Exercises SolutionsBEN CLADOAún no hay calificaciones

- Afar 2 - 4Documento1 páginaAfar 2 - 4Panda ErarAún no hay calificaciones

- IM - Chapter 2 AnswersDocumento4 páginasIM - Chapter 2 AnswersEileen WongAún no hay calificaciones

- Investment in AssociateDocumento29 páginasInvestment in AssociateAngela RuedasAún no hay calificaciones

- Akuntansi Menengah 2Documento5 páginasAkuntansi Menengah 2ANGELOXAK202Aún no hay calificaciones

- Nurul Aryani - Forum 3 AklDocumento2 páginasNurul Aryani - Forum 3 AklNurul Aryani100% (1)

- Cash $ 2,020,000 Discount On Bonds Payable ($2.000.000 - $1.940.784) $ 59,216 Bonds Payable $ 2,000,000 Paid in Capital Stock Warrants $ 79,216Documento1 páginaCash $ 2,020,000 Discount On Bonds Payable ($2.000.000 - $1.940.784) $ 59,216 Bonds Payable $ 2,000,000 Paid in Capital Stock Warrants $ 79,216Anggita Aulia LAún no hay calificaciones

- PDF DocumentDocumento1 páginaPDF DocumentMaeggan MagsalayAún no hay calificaciones

- MHXX Skill ListDocumento6 páginasMHXX Skill ListWhycAún no hay calificaciones

- Sol Man Chapter 11 She Part 2 2021 - CompressDocumento27 páginasSol Man Chapter 11 She Part 2 2021 - CompressDump DumpAún no hay calificaciones

- Soal + JawabDocumento4 páginasSoal + JawabNaim Kharima Saraswati100% (1)

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Documento18 páginasSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.Aún no hay calificaciones

- Ordonio - 08 Task Performance - Management ScienceDocumento3 páginasOrdonio - 08 Task Performance - Management ScienceJustine OrdonioAún no hay calificaciones

- 532-16-Isnaini Nur Fauziah (2.2)Documento53 páginas532-16-Isnaini Nur Fauziah (2.2)isnaininurfauziah123Aún no hay calificaciones

- Quiz Adv2 - Bryan LesmadiDocumento9 páginasQuiz Adv2 - Bryan LesmadiBryan LesmadiAún no hay calificaciones

- Chapter 3 ExampleDocumento3 páginasChapter 3 Exampleasistensi varaAún no hay calificaciones

- Assign 4 Natividad BSA 2-13Documento5 páginasAssign 4 Natividad BSA 2-13Natividad, Kered ZilyoAún no hay calificaciones

- Feed Back Kuis Akl Praktikum (Uts)Documento5 páginasFeed Back Kuis Akl Praktikum (Uts)KiwidAún no hay calificaciones

- Canadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1Documento36 páginasCanadian Income Taxation Canadian 19th Edition Buckwold Test Bank 1aliciahollandygimjrqotk100% (22)

- Unrestricted Retained Earnings, Dec 31 445,000.00Documento23 páginasUnrestricted Retained Earnings, Dec 31 445,000.00CmAún no hay calificaciones

- PR Advance 1 Problem 10-7 Statement of AffairsDocumento4 páginasPR Advance 1 Problem 10-7 Statement of AffairsReynaldi100% (1)

- Chapter 11 Shareholders' 2Documento13 páginasChapter 11 Shareholders' 2Thalia Rhine AberteAún no hay calificaciones

- Good Foreign Competitive Conditions Poor Foreign Competitive ConditionsDocumento3 páginasGood Foreign Competitive Conditions Poor Foreign Competitive ConditionsJustine OrdonioAún no hay calificaciones

- ACCT102 - A Alexis Bang CangDocumento4 páginasACCT102 - A Alexis Bang CangAccounting 201Aún no hay calificaciones

- Total Assets Total Liabilities and Equit 300,000Documento38 páginasTotal Assets Total Liabilities and Equit 300,000Alarich Catayoc79% (14)

- Estate Tax Payable ProblemDocumento1 páginaEstate Tax Payable ProblemMarie Tes LocsinAún no hay calificaciones

- Problems Partnership Dissolution and LiquidationDocumento5 páginasProblems Partnership Dissolution and LiquidationNick ivan AlvaresAún no hay calificaciones

- 1 Treasury Shares: PROBLEM 21-1 Requirement 1Documento11 páginas1 Treasury Shares: PROBLEM 21-1 Requirement 1Bella RonahAún no hay calificaciones

- Accounting For Corporations Do It YourselfDocumento5 páginasAccounting For Corporations Do It YourselfBC qpLAN CrOwAún no hay calificaciones

- Assignment 1Documento8 páginasAssignment 1Bianca LizardoAún no hay calificaciones

- Hoyle - 13E - Chapter 1 - Class Problems - SolutionsDocumento2 páginasHoyle - 13E - Chapter 1 - Class Problems - Solutionsyun leeAún no hay calificaciones

- SOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edDocumento27 páginasSOLMAN CHAPTER 14 INVESTMENTS IN ASSOCIATES - IA PART 1B - 2020edMeeka CalimagAún no hay calificaciones

- Review Materials For INTERM2Documento10 páginasReview Materials For INTERM2Danna VargasAún no hay calificaciones

- VI Mo by FreeDocumento90 páginasVI Mo by FreeAyesha DimaculanganAún no hay calificaciones

- 3.10.2021 ConsultationDocumento8 páginas3.10.2021 ConsultationNicoleAún no hay calificaciones

- SHE IntaccDocumento5 páginasSHE IntaccLavillaAún no hay calificaciones

- SHE IntaccDocumento5 páginasSHE IntaccLavillaAún no hay calificaciones

- Chapter 2Documento22 páginasChapter 2ryhanratul874Aún no hay calificaciones

- Midterms Sa2 FARDocumento6 páginasMidterms Sa2 FAREloiAún no hay calificaciones

- Ia2 Ia2 Millan Solution - CompressDocumento6 páginasIa2 Ia2 Millan Solution - CompressWynne RamosAún no hay calificaciones

- Dissolution Sample ProblemsDocumento1 páginaDissolution Sample ProblemsChinAún no hay calificaciones

- Chapter 14Documento5 páginasChapter 14Kiminosunoo LelAún no hay calificaciones

- Sol. Man. - Chapter 16 - Accounting For DividendsDocumento16 páginasSol. Man. - Chapter 16 - Accounting For DividendspehikAún no hay calificaciones

- 123Documento12 páginas123GIANN RHEY HILAAún no hay calificaciones

- Process Sol For StudentsDocumento9 páginasProcess Sol For Studentsfernandesjervis8Aún no hay calificaciones

- Accounts HWDocumento5 páginasAccounts HWDaniella AngellaAún no hay calificaciones

- Bizcom Problem 3-2Documento1 páginaBizcom Problem 3-2kate trishaAún no hay calificaciones

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)Documento6 páginasQuiz 1 Answers and Solutions (Partnership Formation and Operation)cpacpacpaAún no hay calificaciones

- Govt. AcctngDocumento10 páginasGovt. AcctngRizza Mae EudAún no hay calificaciones

- Forum 02 AKL - Resty Arum Pambayu P - 43218010091Documento20 páginasForum 02 AKL - Resty Arum Pambayu P - 43218010091Nayla LukitaAún no hay calificaciones

- Sol Man Chapter 11 She Part 2 2021 - CompressDocumento27 páginasSol Man Chapter 11 She Part 2 2021 - CompressWynne RamosAún no hay calificaciones

- Dominos Media PlanDocumento19 páginasDominos Media PlanBeAutiful You67% (3)

- Domino's Integrated Marketing PlanDocumento11 páginasDomino's Integrated Marketing PlanBeAutiful You0% (1)

- Business Solutions Consulting Business PlanDocumento24 páginasBusiness Solutions Consulting Business PlanBeAutiful You100% (9)

- Chapter 7 E7-16 & BYP7-9Documento1 páginaChapter 7 E7-16 & BYP7-9BeAutiful YouAún no hay calificaciones

- Accountancy Department: Preliminary Examination in MANACO 1Documento3 páginasAccountancy Department: Preliminary Examination in MANACO 1Gracelle Mae Oraller0% (1)

- DBA Daily StatusDocumento9 páginasDBA Daily StatuspankajAún no hay calificaciones

- Memoire On Edgar Allan PoeDocumento16 páginasMemoire On Edgar Allan PoeFarhaa AbdiAún no hay calificaciones

- Faith-Based Organisational Development (OD) With Churches in MalawiDocumento10 páginasFaith-Based Organisational Development (OD) With Churches in MalawiTransbugoyAún no hay calificaciones

- Ar 2003Documento187 páginasAr 2003Alberto ArrietaAún no hay calificaciones

- Thermal Physics Questions IB Question BankDocumento43 páginasThermal Physics Questions IB Question BankIBBhuvi Jain100% (1)

- ScientistsDocumento65 páginasScientistsmohamed.zakaAún no hay calificaciones

- Simple Past TenselDocumento3 páginasSimple Past TenselPutra ViskellaAún no hay calificaciones

- 5HP500-590 4139 - 751 - 627dDocumento273 páginas5HP500-590 4139 - 751 - 627ddejanflojd100% (24)

- University of Dar Es Salaam MT 261 Tutorial 1Documento4 páginasUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaAún no hay calificaciones

- 1027 12Documento3 páginas1027 12RuthAnayaAún no hay calificaciones

- How To Create Partner Function in SAP ABAPDocumento5 páginasHow To Create Partner Function in SAP ABAPRommel SorengAún no hay calificaciones

- 67-Article Text-118-1-10-20181206Documento12 páginas67-Article Text-118-1-10-20181206MadelAún no hay calificaciones

- Lesson Plan MP-2Documento7 páginasLesson Plan MP-2VeereshGodiAún no hay calificaciones

- ImpetigoDocumento16 páginasImpetigokikimasyhurAún no hay calificaciones

- Discussion #3: The Concept of Culture Learning ObjectivesDocumento4 páginasDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellAún no hay calificaciones

- Binary SearchDocumento13 páginasBinary SearchASasSAún no hay calificaciones

- Facilitation TheoryDocumento2 páginasFacilitation TheoryYessamin Valerie PergisAún no hay calificaciones

- Critical Review For Cooperative LearningDocumento3 páginasCritical Review For Cooperative LearninginaAún no hay calificaciones

- Saber Toothed CatDocumento4 páginasSaber Toothed CatMarie WilkersonAún no hay calificaciones

- Global Marketing & R&D CH 15Documento16 páginasGlobal Marketing & R&D CH 15Quazi Aritra ReyanAún no hay calificaciones

- Speech by His Excellency The Governor of Vihiga County (Rev) Moses Akaranga During The Closing Ceremony of The Induction Course For The Sub-County and Ward Administrators.Documento3 páginasSpeech by His Excellency The Governor of Vihiga County (Rev) Moses Akaranga During The Closing Ceremony of The Induction Course For The Sub-County and Ward Administrators.Moses AkarangaAún no hay calificaciones

- Literature Review On Catfish ProductionDocumento5 páginasLiterature Review On Catfish Productionafmzyodduapftb100% (1)

- Intrauterine Growth RestrictionDocumento5 páginasIntrauterine Growth RestrictionColleen MercadoAún no hay calificaciones

- Promising Anti Convulsant Effect of A Herbal Drug in Wistar Albino RatsDocumento6 páginasPromising Anti Convulsant Effect of A Herbal Drug in Wistar Albino RatsIJAR JOURNALAún no hay calificaciones

- Education Law OutlineDocumento53 páginasEducation Law Outlinemischa29100% (1)

- Sayyid Jamal Al-Din Muhammad B. Safdar Al-Afghani (1838-1897)Documento8 páginasSayyid Jamal Al-Din Muhammad B. Safdar Al-Afghani (1838-1897)Itslee NxAún no hay calificaciones

- Data Science Online Workshop Data Science vs. Data AnalyticsDocumento1 páginaData Science Online Workshop Data Science vs. Data AnalyticsGaurav VarshneyAún no hay calificaciones

- Administrator's Guide: SeriesDocumento64 páginasAdministrator's Guide: SeriesSunny SaahilAún no hay calificaciones

- Lodge LeadershipDocumento216 páginasLodge LeadershipIoannis KanlisAún no hay calificaciones