Documentos de Académico

Documentos de Profesional

Documentos de Cultura

A Summary of Established

Cargado por

José Alejandro NgDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

A Summary of Established

Cargado por

José Alejandro NgCopyright:

Formatos disponibles

A SUMMARY OF

ESTABLISHED

& EMERGING

IP BUSINESS

MODELS

Raymond Millien

PCT Capital LLC

McLean, VA

Ron Laurie

Inexion Point Strategy LLC

Palo Alto, CA

Copyright 2007, The Sedona Conference,

Raymond Millien & Ron Laurie.

2007 by Raymond Millien and Ron Laurie. All rights reserved.

THE EIGHTH ANNUAL SEDONA CONFERENCE ON PATENT

LITIGATION

OCTOBER 12, 2007

SEDONA, AZ

Established and Emerging IP Business Models

Raymond Millien

PCT Capital, LLC

McLean, Virginia

www.pctcapital.com

Ron Laurie

Inflexion Point Strategy, LLC

Palo Alto, California

www.ip-strategy.com

2

I. Introduction

The last couple of years has brought about rapid and dramatic changes in patent law. The

impetus for this change has come not only from the usual sources the U.S. Court of Appeals for

the Federal Circuit and the U.S. Patent and Trademark Office, but also as a result of an

unprecedented combination of increasing attention on patent cases by the U.S. Supreme Court

and patent reform debate in Congress. Against the backdrop of this new patent environment, this

paper discusses the various existing and emerging business models within the evolving

intellectual property (IP) marketplace.

II. What Are The Different IP Business Models?

A. The Evolving IP Marketplace

In the last thirty years, there has been a shift from a labor-driven economy to a knowledge-based

economy. Illustrative of this fact is that, for the first time since the industrial revolution, the

percentage of American workers employed in manufacturing has fallen below 10% and may be

as little as 5%.

1

Consequently, intangible assets produced by a more highly-skilled and services-

oriented workforce have emerged as the most powerful asset class, overtaking traditional capital

assets such as real property, plant and equipment. Independent research has demonstrated that

nearly 80% of the value of a U.S. publicly-traded company now comes from intangible assets.

2

This is an inversion from 30 years ago when only 20% of a companys value came from

intangible assets, and is significant because the largest component (or subset) of intangibles is

intellectual property. Further, data showing that small businesses generate 13-14 more patents

per employee than large firms

3

would empirically suggest that this 80% figure applies, if not

more so, to smaller (and private) companies as well.

The identification of this 80/20 inversion is not new. Alan Greenspan recognized, in 2003,

that: In recent decades . . . the fraction of the total output of our economy that is essentially

conceptual rather than physical has been rising. This trend has, of necessity, shifted the

emphasis in asset valuation from physical property to intellectual property and to the legal rights

that inhere in the latter.

4

In fact, one scholar noted as far back as 1992 that IP rights

especially those in the form of patents will represent the most significant form of wealth in the

new millennium.

5

We are no longer in the era when feudal lords (i.e., a small handful of large old economy

companies) controlled all the (intellectual) property and those who were without property had no

rights. In those times, the legal landscape defining the rights associated with IP did not exist and

those without (intellectual) property had virtually no say in the licensing and enforcement of

such rights. The IP marketplace has matured (and continues to do so) and in 2006, IP-related

damage awards and settlements in the U.S. totaled $3.4B

6

and global IP licensing revenue

approached $90B as early as 2003.

7

3

B. Established IP Business Models

8

Given that IP feudal lords no longer rule, one can say that we are now in an era of IP for the

masses, where the IP marketplace operates according to the Golden Rule -- those with the gold

(i.e., IP rights) can now make the rules.

Necessarily, the evolving IP marketplace has been accompanied by a change in the players

within the marketplace. Traditionally, in the feudal lords period, such players were

overwhelmingly patent lawyers and large patent owners (with a few smaller or individual players

making the occasional appearance and splash). Today, however, the cast of players has grown.

That is, this new era is characterized by the rise of market-maker intermediaries who seek to

make IP a liquid asset class and, of course, profit from it.

Who are these new players? Well, these new players are generally referred to as IP

intermediaries because they are neither the IP creators nor the IP consumers, e.g. licensees

and purchasers. These intermediary business models, however, attempt to perform one or more

services or offer one or more products that connect the IP creators and the IP consumers. More

specifically, these IP business models include:

4

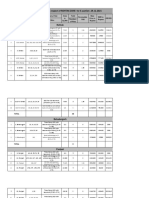

Model Description Exemplary

Players

9

Patent Licensing and

Enforcement Companies

(PLECs)

These are entities that own one or more patent

portfolios, attempt to license them through

targeted letter-writing campaigns, and then file

patent infringement suits against those letter

recipients who refuse to enter into non-exclusive

licenses. Those that practice this business model

are often called (rightly or wrongly) patent

trolls.

10

In some cases, the PLECs have

purchased the patents they are asserting and, in

other cases, the PLEC entity is actually founded

by the inventor(s) of the asserted patent portfolio.

(Although in the latter case, such entities are not

technically intermediaries). PLECs therefore

generate revenue both from license fees and from

the annual $3.4B IP awards and settlements

market.

Acacia Research

Lemelson Foundation

LPL

Institutional Patent

Aggregators/IP

Acquisition Funds

These are entities that operate in a sort of private

equity fashion. That is, they typically operate as

general partners of a limited partnership and raise

money either from large technology companies or

from the capital markers (institutional investors

(and sometimes high-net-worth individuals). The

investors are promised above average ROI from

selective, targeted or large-scale patent purchases

with the goal of instituting licensing programs

and/or employing various arbitrage strategies.

Coller IP Capital

Intellectual Ventures

IP/Technology

Development Companies

These are entities that engage in R&D activities

and produce IP (including both patents and know-

how) much like traditional operating companies;

however, the developed technology is not used to

manufacture products in the form of physical

goods. Rather, the IP associated with the

technology is licensed by these entities to one or

more operating companies so that the operating

company may bring products and services

employing the technology and IP to the

marketplace. Often the IP creator provides

consulting services to the licensee to integrate the

technology into the licensees products or

processes. Thus, these firms are not true

intermediaries between patent owner and patent

licensee. They are intermediaries, however, in

the sense that they form a link between the

creator of the patented technology and those who

commercially deploy it in the form of products

AmberWave

InterDigital

MOSAID

Qualcomm

Rambus

Tessera

5

Model Description Exemplary

Players

9

and services .

Licensing Agents These are entities that function as intermediaries

by attempting to assist patent owners in finding

licensees. Entities that function under this

business model often call themselves IP

advisory, IP management or technology

transfer firms. While the amount, quality and

depth of services vary, to some degree in shape or

form, they all earn retainer and/or success fees by

assisting patent owners find licensees.

Accordingly, these entities may function more

like traditional consultants where the patent

owner stays very involved in the licensing

process, or they may function more like IT

companies where the patent owner essentially

outsources patent monetization and is not

involved in day-to-day licensing operations, but

still collects a majority of any licensing revenue.

The various licensing agents also differ as to

whether they engage in carrot licensing or

stick licensing activities. In the latter case,

these entities tend to engage in activities that start

to closely resemble the PLEC business model.

General Patent Corp.

IPValue

ThinkFire

Litigation

Finance/Investment Firms

These are entities that are a cross between IP

Acquisition Funds and PLECs. That is, like IP

Acquisition Funds, they operate as general

partners of a limited partnership and raise money

from large institutional investors and high-net-

worth individuals. Like PLECs, however, their

stated goal is to acquire a financial interest in

patent portfolios for assertion. The assertions

typically take the form of targeted letter-writing

campaigns, followed by patent infringement suits

against those letter recipients who refuse to enter

into non-exclusive licenses. Variances in the

model (and from a PLEC) include the level and

nature of ownership (equity vs. debt) that the firm

takes in the patent portfolios being asserted or in

the patent owning entity itself (typically an LLC

formed for the purpose of assertion)..

Altitude Capital

Rembrandt IP Mgmt.

Patent Brokers These are entities that function essentially the

same as Licensing Agent model discussed above.

The key distinction, however, is that they seek to

assist patent owners in finding buyers rather than

Iceberg

Inflexion Point

iPotential

Ocean Tomo

6

Model Description Exemplary

Players

9

licensees. Also, unlike licensing agents they

operate both on the sell-side and the buy-side. In

the latter case they often assist technology

companies in acquiring patents having strategic

(i.e., defensive) value vis--vis their competitors.

Thus, a typical engagement between a Patent

Brokerage firm and a patent owner is shorter than

a Licensing Agent firm. This is because once the

patent or portfolio is sold, the Broker takes a

percentage of the sale as a success fee and the

engagement is done. (It is a one hit and done

engagement.) Thus, there is no opportunity for

recurring revenue. In contrast, buy-side brokerage

engagements can continue indefinitely as the

brokers client strengthens and extends its patent

position over time. Entities that function under

this business model also often call themselves IP

advisory, IP management IP merchant

banking or technology transfer firms. While

the amount, quality and depth of services vary, in

some shape or form, however, when representing

a seller, they all prepare a pitch package,

identify potential buyers and earn retainer and/or

success fees by actually assisting patent owners

in executing patent sale agreements with buyers.

These entities may function more like traditional

consultants where the patent owner stays very

involved in the process, or they may function

more like IT companies when the patent owner

essentially outsources the monetization of the

patent(s) and is not involved in the day-to-day

sale efforts, but still collects a majority of the sale

revenue (minus the Brokers commission and, in

some cases, the Brokers expenses). In contrast,

buy-side, brokerage engagements almost always

involve a close working relationship between

buyer and broker.

Pluritas

ThinkFire

IP-Based M&A Advisory

These are entities that operate in a traditional

investment banking model advising technology

companies in their merger and acquisition

(M&A) activities and earning fees based on the

value of the entire deal (or apportioned according

to the value of the IP within the deal). Whether

doing sell side or buy side engagements,

these entities obviously focus on the IP assets

within contemplated corporate transactions where

IP is driving, or a major component of, the

Analytic Capital

Blueprint Ventures

Inflexion Point

Pluritas

7

Model Description Exemplary

Players

9

transaction. Services provided by such entities

include, IP due diligence, consultation on the

integration of IP assets and operations as a result

of M&A activity and IP deal structuring and

general consultations related to contemplated

investments, mergers, acquisitions, divestitures,

joint ventures and other corporate transactions.

Second generation IP investment banking

involves not just maximizing IP value in the

context of a traditional corporate acquisition or

divestiture but actually sourcing the transaction

based, at least in part, on IP considerations. Here

the IP investment banker helps to identify

potential corporate acquisition targets or

acquirors with complimentary IP assets .

IP Auction Houses

These are entities that are attempting to do for the

patent marketplace what famed London auction

houses Christies and Sothebys did for the

antique and art marketplace. That is, these

entities are auction houses that hold multi-lot, live

auctions for patents with the intent of providing a

marketplace for facilitating the exchange of such

historically illiquid assets. While there are

various auction formats and structures (English,

Dutch, etc.), such auctions enable sellers to offer

one or more patents according to a pre-

determined set of terms and conditions and

allows the auction house to charge listing fees,

attendance fees, buyers premiums and/or sellers

commissions. Also, other entities aim to be the

eBay of patents by offering online patent

auctioning services.

IPAuctions.com

IPA GmbH

Ocean Tomo

On-Line IP/Technology

Exchanges/Clearinghouses

These are entities that function like the business-

to-business (B2B) web sites that became the rage

during the late 1990s dot com boom. These

entities, however, offer web platforms and

interfaces specialized for patent and other IP

assets. Essentially, this model can be thought of

as online classifieds like Craigs List, but for IP.

(Using the analogy of an online version of the

Licensing Agent or Patent Broker IP business

model would also be appropriate.) Within the

model, there are variances such as whether listing

fees are charged to patent owner/sellers in

addition to, or versus, back-end fees for

successful patent sale or licensing transactions.

The Deans List

Tynax

Yet2.com

8

Model Description Exemplary

Players

9

Additional variances include whether these sites

are public and browseable for free, or whether

they are private, members only sites that

require registration (and presumably a

registration/membership fee).

IP-Backed Financiers These are entities that provide financing for IP

owners, either directly or as intermediaries,

usually in the form of loans (debt financing),

where the security for the loan is either wholly or

partially IP assets (i.e., IP collateralization).

Thus, these parties often function as

intermediaries between borrowers and

commercial lending institutions, such as banks.

Unlike traditional bankers who focus on accounts

receivable and tangible assets, however, these IP-

backed Financiers take into account a borrowers

or target companys (potential or actual) IP assets

in structuring a financing transaction. Variances

in this model include entities who deploy their

own capital (and thus resemble IP investment

firms) or who maintain a network of technology-

or industry-specific investors to whom they refer

IP owners (and thus resemble patent brokers).

IPEG Consultancy BV

Paradox Capital

Royalty Stream

Securitization Firms

These are entities that counsel, assist and/or

provide capital to patent owners performing IP

securitization financing transactions (which

resemble the more common mortgage-backed

securities). In such transactions, the patent owner

sells the patents underlying the transaction to a

bankruptcy remote entity (a BRE), and the

BRE grants a license back to the patents to the

original patent owner. The BRE in turn issues

notes (i.e., IP-backed securities) to investors to

raise cash to pay the original patent owner the

agreed-upon purchase price. The notes are then

backed by the expected future royalties to be

earned from licensing the underlying patents (to

the original patent owner and/or third parties). At

the end of the transaction, the original patent

owner has essentially raised funds much more

cheaply than a loan backed by its traditional

assets. Thus, the IP-backed notes will generally

be higher rated commercial paper reflecting the

quality of the patents and not necessarily the

overall creditworthiness of the original patent

owner.

11

alseT IP

UCC Capital

9

Model Description Exemplary

Players

9

Patent Rating Software

and Services

These are entities that provide advanced patent

search and analytics software tools that allow

patent owners, attorneys, investors and other

players in the IP marketplace to obtain various

intelligence and data points about a single patent

or patent portfolio. These software tools and

platforms provide varied outputs related to patent

quality such as validity probabilities,

maintenance fee-related life expectancies, various

infringement-related metrics, prior art analysis,

related patent analysis, citation-related metrics,

etc. These entities earn revenue from pure

software sales, as well as consulting fees.

1790 Analytics

The Patent Board

PatentRatings

Patent Caf

University Technology

Transfer Intermediaries

These are entities that function as IP

Development Companies, IP Acquisition Funds,

Licensing Agents and/or Patent Brokers, but

focusing on the niche university technology

transfer (i.e., licensing) market. The choice to

focus on the university market by such entities is

not surprising given that in the 2005 fiscal year,

U.S. universities and research institutes spent

over $42 billion in R&D, received over 3,278

U.S. patents and executed over 4000 licenses.

12

Texelerate

UTEK

We now take a closer examination of one of these IP business models the live patent auction

house -- due to the press and industry attention they have received over the past year.

The Live Patent Auction House Business Model

No one will argue that intangibles, such as patents (and intellectual property in general), are

highly illiquid assets. This presents a problem in that companies cannot quickly and easily

convert a large portion of their assets to cash, and thus realize a return on their R&D

expenditures. This illiquidity is a result of the absence of an efficient IP marketplace to

exchange unused or underutilized IP rights. Traditionally, IP rights transactions have been

private, irregular and expensive to consummate. Further, potential sellers of IP rights have

historically been unable to access a large quantity of buyers who are willing to pay a predictable

price under an agreed-upon set of conditions (i.e., the conditions which exist for liquid assets

such as stocks and bonds). In order to create a liquid IP marketplace, a strong process,

transparency, and comparability of assets (i.e., the ability to use a standard valuation process) is

needed.

Given the foregoing, and recognizing that: (1) in order to extract maximum value from IP assets,

there must be a marketplace which renders such assets more liquid; and (2) economic theory

holds that an auction is a method for determining the value of a commodity that has an

10

undetermined price; it is not surprising that companies such as Ocean Tomo, LLC and IP

Auctions GmbH decided to attempt live patent auctions.

Ocean Tomo struck first by holding a live patent auction on April 6, 2006 in San Francisco.

Their goal was to establish evidence that an auction can create a viable market for the sale of

historically illiquid patent assets. With this goal in mind, seventy-eight lots were offered, of

which twenty-six were sold on the floor for approximately US$3M. According to Ocean Tomo,

the remaining lots were offered in post-auction, private trading. While this sales rate may seem

low, of note is the fact that over 51% of the sellers who participated in the auction successfully

transacted their patents.

Ocean Tomo then held a live IP auction in New York City on October 26, 2006. This auction

included patents, trademarks, copyrights and domain names (although 73 of the 96 lots were

pure patent lots). This time, on the floor sales totaled $23,903,000. Sellers include AT&T

Knowledge Ventures, Honeywell Intellectual Properties, Inc., The Boeing Company, Agere

Systems, Inc., Motorola, Inc., BellSouth Intellectual Property Marketing Corporation, Eastman

Chemical Company, Dow AgroSciences LLC, CREE, Inc., AIG, and IBM.

A third Ocean Tomo auction was held on April 19, 2007 in Chicago where cumulative lot prices,

including buyers premium, was $11,429,000. According to Ocean Tomo, a single patent sale of

$3.025M set a worlds record. Thirty-four of the 67 lots were sold on the floor for a 51%

transaction success rate and 55% of the sellers who participated in the auction successfully

transacted their patents. The average selling price per lot was $336,148. Successful sellers

included companies such as Eastman Kodak, Sun Microsystems, Inc., and Iomega Corporation

as well as small to mid-size companies, professional inventors, and others.

Next, IP Auctions GmbH struck with the first European auction on May 15, 2007. Held in

Munich, the auction included 80 lots of patents, licenses and brand rights from diverse

technology sectors. The Munich event led to only $675,000 in sales and a 30% transaction

success rate. The highest bid of 50,000 (approx. $67,046) was for a special surface coating

relating to nano-technology. There were approximately 40 sellers, including major companies

such as Bayer and Rolls-Royce.

On June 1, 2007, Ocean Tomo followed with its fourth auction overall and its first in Europe.

Held in London, England, cumulative sales on the auction floor, including buyers premium,

totaled 6,040,977 (approx. $8,100,503) and average sale price per lot was 431,498 (approx.

$578,607). Again, according to Ocean Tomo, another world record was set when an Internet

shopping patent sold for 3,650,873 (approx. $4,895,550).

Not surprisingly, there were many vocal critics of these auctions. Targets of criticism included

not only the auction process itself, but also the perceived low prices paid by the winning bidders.

Traditionally, IP transactions are characterized by difficult acquirer identification, long periods

of negotiations and endless due diligence activities all contributing to high transaction costs

(and thus, illiquidity). The auction process, however, has the potential to nullify these negative

characteristics. This is because sellers of IP rights can know their IP will be publicized, and that

on a certain date, and for a certain fixed listing fee, the transaction will presumably close.

11

Further, price discounts to buyers are always associated with illiquid markets (e.g., the private

equity market). This may account for the perceived low average winning bid at the auction.

One universally accepted positive result of the live patent auction model is that the public nature

of the process allows for a comparable valuation methodology to be employed for later IP asset

transactions. This will lead to a publicly-available data set of patent transaction values for

market-approach valuation, much in the way publicly-available sale prices are now employed for

other more-liquid assets such as real estate. That is, the emergence of a significant data set of

comparable patent transactions will aid inventors, IP practitioners, companies and governmental

agencies in pricing and valuing patents.

Whether the live patent auction model will thrive, succumb to an online format or eventually

cease to be relevant as new IP business models come into existence remains to be seen.

C. Emerging Business Models

Having described the business models now existing in this new era of IP for the masses, we

now turn to the newest players. More specifically, these IP business models include:

Model Description Examples

13

IP Transaction

Exchanges/Trading

Platforms

In further attempts to make IP a more liquid asset

class, plans have been announced to create traded

exchanges (whether physical or online locations)

similar to the NYSE and NASDAQ where yet-to-be-

created IP-based financial instruments would be

listed and traded much like stocks are today.

Another variant involves an on-line trading platform

where IP buyers and sellers can come together to

execute transactions based on a set of agreed rules

developed by a best practices steering committee

composed of major corporate buyers and buyer-

sellers.

IP Exchange Chicago

Gathering 2.0

Defensive Patent Pools

These are emerging entities employing a model born

in reaction to the established PLECs and Institutional

Patent Aggregators/IP Acquisition Funds business

models. That is, these entities seek to selectively

acquire portfolios of patents for defensive reasons.

Such pools are typically in one technology area or in

one industry segment, and are inspired by a lets

buy them before the trolls do attitude. Thus, this

model results in multiple operating companies --

who may have not previously cooperated, done

business or even respected each other joining

financial and other resources to create a corporate

entity to acquire problematic patents, and license

them to anyone willing to share the financial burden

Open Invention

Network

12

Model Description Examples

13

of acquisition of the patents and the overhead of

administering the pool.

Technology/IP Spinout

Financing

This emerging business model is best described as

being organized as a traditional venture capital (VC)

or private equity firm, but specializing in spinning

out promising non-core IP which has become

stranded within larger technology companies, or

creating joint ventures between large technology

companies to commercialize the technology and

monetize the associated IP. Thus, the revenue for

this emerging business model is the same as a

traditional VC or private equity firm achieving a

high ROI once a portfolio company is sold, goes

through an IPO (or sometimes evolves into an IP

licensing company).

Analytic Capital

Blueprint Ventures

New Venture Partners

Inflexion Point

Patent-Based Public

Stock Indexes

This emerging business model is the evolution of the

established Patent Rating Software and Services IP

business model described above. That is, once the

entities offering these software tools and platforms

realized that nearly 80% of the value of a U.S.

publicly-traded company now comes from intangible

assets, and that they possessed tools to measure the

quality of arguably the largest part of those

intangible assets, then it became clear that another

potential source of revenue would be the creation of

formalized stock indexes based on their existing

software tools and platforms. Put in different terms,

the Patent Rating Software and Services industry

theorized that investing in stocks with valuable

patents may allow investors to commit a meaningful

and sustainable portion of their assets to IP and allow

them to outperform other investment strategies.

Thus, they sought out different algorithms to create

baskets of stocks using the quality of a publicly-

traded companys patents as the primary selection

factor. Revenue from such an emerging business

model includes the sale of equity research and the

licensing of such indexes to ETF, mutual fund and

other investable financial instrument issuers.

Ocean Tomo Indexes,

Patent Board WSJ

Scorecard

13

V. Conclusion

It is clear that the players, and their attitudes, that dominated the feudal period will no longer

carry the day. The newly-established and emerging IP business models (and the players

exercising such models) are not going away. That is, neither U.S. Supreme Court decisions such

as eBay, nor any of the so-called anti-patent troll legislative proposals floating through

Congress, will make such intermediary entities such as PLECs, IP outsourcing companies,

licensing agents, merchant banks, exchange operators and the like go away. With as much as

three-quarters of the value of publicly traded companies in America coming from intangible

assets, and global IP licensing revenue now being measured in the hundreds of billions of dollars,

there is simply too much economic justification for such entities to exist. In fact, new players

implementing the IP business models described herein will come into existence. And, new IP

business models will also come into existence. Why? Quite simply, the business of IP (i.e., IP

marketplace) itself is not immune to innovation!

In sum, the concepts and theories presented in this paper and the accompanying presentation are

for introductory purposes only and meant to be thought provoking. They are not, however,

intended to be an all-inclusive encyclopedia of existing and emerging IP business models or the

IP marketplace as a whole.

14

IV. About The Authors

Raymond Millien is the CEO of PCT Capital, LLC, an intellectual property focused advisory

and asset management firm. Previously, he was General Counsel of Ocean Tomo, LLC, where

he is responsible for overseeing all legal and regulatory affairs, as well as assisting the firm's

management with acquisitions and the structuring of joint ventures. Prior to that, he was VP and

Group IP Counsel at American Express Company where his responsibilities included managing

the company's global patent portfolio and leading brand and technology outward-licensing deals.

His previous experience included practicing law in the Washington, DC offices of DLA Piper

US LLP and Sterne, Kessler, Goldstein & Fox PLLC. He has coauthored two books, Little Blues:

How to Build a Culture of Intellectual Property within a Small Technology Company

(Euromoney/MIP, 2006), and From Finals to the Firm: Top Ten Things New Law Firm

Associates Should Know (Matthew Bender, 2003). Prior to attending law school, he was a

software design engineer with General Electric. Since 2000, Mr. Millien has been a national

lecturer for the BAR/BRI

Patent Bar Review course, and he has served as an adjunct professor

of legal writing and oral advocacy at the George Washington University Law School, and a

professorial lecturer of IP Law at the George Washington University School of Engineering. He

received a B.S. from Columbia Universitys School of Engineering and Applied Science, and a

J.D. from The George Washington University Law School. He is admitted to the Illinois, New

York, Virginia, District of Columbia, U.S. Court of Appeals for the Federal Circuit and U.S.

Supreme Court bars, and is registered to practice before the U.S. Patent and Trademark Office.

Ron Laurie is Co-founder and Managing Director of Inflexion Point Strategy, LLC, an

intellectual property investment bank based in Silicon Valley. Inflexion Point represents

technology companies and institutional investors in the acquisition and sale of patent portfolios

having strategic value and in the sourcing and execution of IP-intensive M&A transactions. Ron

has worked in Silicon Valley for over 40 years, first as a software engineer and then as a patent

lawyer, advising computer, communications, semiconductor, media and financial services

companies on IP strategy, a subject he has taught at Stanford and Boalt (UC-Berkeley) law

schools. Ron was a founding partner of the Silicon Valley offices of Skadden Arps (in 1998),

Weil Gotshal (in 1991) and Irell & Manella (in 1988). The focus of Ron's prior legal practice

was on the strategic use of IP assets in complex business transactions such as mergers and

acquisitions, technology spin-outs, joint ventures, and strategic alliances, and Ron led IP teams

in some of the largest technology deals ever done, worth over $50 billion.

This paper reflects the authors current views and should not be necessarily attributed to their

former, current or future employers or their respective clients.

15

ENDNOTES

1

Industrial Metamorphosis: Factory Jobs Are Becoming Scarce. It's Nothing To Worry About,

The Economist 69 (Sept. 29, 2005).

2

Ned Davis Research for Ocean Tomo, LLC, http://www.oceantomo.com/index_ot300.html (Last

visited September 13, 2007).

3

CHI Research, Inc., Small Serial Innovators: The Small Firm Contribution to Technical Change

(Feb. 27, 2003) at 3.

4

Alan Greenspan, Remarks at the 2003 Financial Markets Conference of the Federal Reserve

Bank of Atlanta, Sea Island, Georgia (April 4, 2003).

5

J ames W. Ely, J r., The Guardian of Every Other Right: A Constitutional History of Property

Rights 6 (1

st

ed., Oxford University Press, 1992).

6

Marius Meland, IP Litigation Yielded $3.4B In 2006: Survey, IPLaw360 (Dec. 29, 2006).

7

S. Athreye and J . Cantwell, Creating Competition? Globalisation And The Emergence Of New

Technology Producer, Open University Discussion Papers, Economics, No. 52 (2005); see also S.

Athreye & J . Cantwell, Creating Competition? Globalisation And The Emergence Of New Technology

Producers 36(2) Research Policy 209 (2007).

8

We refer to those IP business models in existence as of this writing as established even though

such models may have had their birth within the last few years (if not months) of this writing.

9

The listing of players for each business model is exemplary and not meant to be exhaustive.

Further, entities may be listed as exemplary players under one or more business models due to their varied

service offerings and activities. Lastly, the authors do realize that attempting to describe the various

established IP business models is an exercise in categorization which unfortunately often leads to the

limitization of the named entities.

10

See Raymond P. Niro and Paul K. Vickery, The Patent Troll Myth, 7 The Sedona Patent J ournal

at 153 (Fall 2006) (explaining the origin of the term patent troll and defining it as somebody who tries

to make a lot of money off a patent that they are not practicing and have no intention of practicing and in

most cases never practiced.).

11

See generally, Anne Urda, IP Securitization Getting a Second Look, IPLaw360 (May 2, 2006);

William J . Kramer and Chirag B. Patel, Securitisation of Intellectual Property Assets in the US Market,

Marshall, Gerstein & Borun (J an. 2003) (available from http://www.marshallip.com/news-

publications.html).

12

Association of University Technology Managers, U.S. Licensing Survey, FY 2005 Survey

Summary (Dana Bostrom and Robert Tieckelmann eds.) (available from

http://www.autm.net/pdfs/AUTM_LS_05_US.pdf).

13

The listing of examples for each emerging business model is not meant to be exhaustive.

También podría gustarte

- Dealing With IP As An AssetDocumento3 páginasDealing With IP As An Assettemplecloud1Aún no hay calificaciones

- Intellectual Property AnalysisDocumento3 páginasIntellectual Property AnalysisShradha DiwanAún no hay calificaciones

- Ip Due DiligenceDocumento13 páginasIp Due DiligenceyoshimgamtAún no hay calificaciones

- The Founder's Guide to Intellectual Property Strategy: How Successful Startups Protect Great Ideas to Secure a Competitive AdvantageDe EverandThe Founder's Guide to Intellectual Property Strategy: How Successful Startups Protect Great Ideas to Secure a Competitive AdvantageAún no hay calificaciones

- 11.1valuation of Intellectual Property Assets PDFDocumento31 páginas11.1valuation of Intellectual Property Assets PDFShivam Anand100% (1)

- Mergers and Acquisition and Treatments To IPR Project (8th Semester)Documento15 páginasMergers and Acquisition and Treatments To IPR Project (8th Semester)raj vardhan agarwalAún no hay calificaciones

- Global: IP-backed Securitisation: Realising The PotentialDocumento4 páginasGlobal: IP-backed Securitisation: Realising The PotentialHarpott GhantaAún no hay calificaciones

- Intellectual Property ProtectionDocumento15 páginasIntellectual Property ProtectionalibabaUKAún no hay calificaciones

- Intellectual Property, Inventions and InnovationsDocumento8 páginasIntellectual Property, Inventions and InnovationsKunal GuptaAún no hay calificaciones

- Intellectual Property and Business - Chapters 1 - 2Documento96 páginasIntellectual Property and Business - Chapters 1 - 2Lakshmi HarshithaAún no hay calificaciones

- Business Innovation: How companies achieve success through extended thinkingDe EverandBusiness Innovation: How companies achieve success through extended thinkingAún no hay calificaciones

- Ipr and MergersDocumento7 páginasIpr and Mergersananya mohantyAún no hay calificaciones

- Ipr Valuation Study Material 1. Introduction and SignificanceDocumento9 páginasIpr Valuation Study Material 1. Introduction and SignificanceNeha SumanAún no hay calificaciones

- IPM - Monetising The Rembrandts in The AtticDocumento2 páginasIPM - Monetising The Rembrandts in The AtticCamarada RojoAún no hay calificaciones

- Topic 5 Intellectual Property 10 HoursDocumento11 páginasTopic 5 Intellectual Property 10 HoursOcaka RonnieAún no hay calificaciones

- Chapter 7 Introduction To Intectual PropertyDocumento12 páginasChapter 7 Introduction To Intectual PropertyDaisy Jane Beltran Lulab100% (1)

- Final Legal Aspects of LogisticsDocumento13 páginasFinal Legal Aspects of LogisticsPrasad ChamaraAún no hay calificaciones

- Intellectual PropertyDocumento2 páginasIntellectual PropertySwati AggarwalAún no hay calificaciones

- Valuation of Intellectual Property: Ankur SinglaDocumento12 páginasValuation of Intellectual Property: Ankur SinglaFeridb60Aún no hay calificaciones

- Blog 1 - Intellectual PropertyDocumento4 páginasBlog 1 - Intellectual PropertyKarthik GutthaAún no hay calificaciones

- Ipr Q&aDocumento31 páginasIpr Q&aSumit BhardwajAún no hay calificaciones

- Using KM to Protect IPDocumento3 páginasUsing KM to Protect IPJulius AlanoAún no hay calificaciones

- Using KM to Protect IPDocumento3 páginasUsing KM to Protect IPJulius AlanoAún no hay calificaciones

- Summarization 1: Introduction - Why License?Documento3 páginasSummarization 1: Introduction - Why License?Julius AlanoAún no hay calificaciones

- PHD Thesis Intellectual PropertyDocumento5 páginasPHD Thesis Intellectual Propertyamberrodrigueznewhaven100% (2)

- Importance of Ipr in Company ValuationDocumento5 páginasImportance of Ipr in Company ValuationGaurav SokhiAún no hay calificaciones

- Business Law 8th Edition Cheeseman Solutions Manual 1Documento36 páginasBusiness Law 8th Edition Cheeseman Solutions Manual 1josephdavidsonmgfbciotkj100% (22)

- Growing Business Innovation: Developing, Promoting and Protecting IPDe EverandGrowing Business Innovation: Developing, Promoting and Protecting IPAún no hay calificaciones

- Module - Intellectual Property Full VersionDocumento156 páginasModule - Intellectual Property Full VersionSiddharth BurmanAún no hay calificaciones

- Assignment No. 2 GEE 303 Living in An IT Era Midterm PeriodDocumento6 páginasAssignment No. 2 GEE 303 Living in An IT Era Midterm PeriodGeraldpe PeraltaAún no hay calificaciones

- The IP Driven Start Up Marks Clerk LLPDocumento56 páginasThe IP Driven Start Up Marks Clerk LLPAnh Trần HồngAún no hay calificaciones

- Protecting the Brand: Counterfeiting and Grey MarketsDe EverandProtecting the Brand: Counterfeiting and Grey MarketsAún no hay calificaciones

- United International University School of Business and Economics BBA ProgramDocumento5 páginasUnited International University School of Business and Economics BBA Programafnan huqAún no hay calificaciones

- Defending and Enforcing IP 0Documento15 páginasDefending and Enforcing IP 0Pradeep KumarAún no hay calificaciones

- Analyzing Costs and Benefits of Protecting Intellectual Property RightsDocumento9 páginasAnalyzing Costs and Benefits of Protecting Intellectual Property Rightsjason LeeAún no hay calificaciones

- Sme Risk Management: How Intellectual Property Can Help Build Risk Resilient Smes March 2022Documento8 páginasSme Risk Management: How Intellectual Property Can Help Build Risk Resilient Smes March 2022Abdelmadjid djibrineAún no hay calificaciones

- Introducing IP Laws For Start-UpsDocumento55 páginasIntroducing IP Laws For Start-UpsAsia jasmineAún no hay calificaciones

- Intellectual Property CourseworkDocumento8 páginasIntellectual Property Courseworkbcr9srp4100% (2)

- 2nd Draft INTRODUCTION TO INTELLECTUAL PROPERTYDocumento8 páginas2nd Draft INTRODUCTION TO INTELLECTUAL PROPERTYzainabAún no hay calificaciones

- Use of Intellectual Property in Launching An Internet Business in A Hostile SpaceDocumento26 páginasUse of Intellectual Property in Launching An Internet Business in A Hostile SpaceFerminSFAún no hay calificaciones

- Benefits of Ip Rights in Modern EraDocumento4 páginasBenefits of Ip Rights in Modern EraSamriti NarangAún no hay calificaciones

- Role of Intellectual Property Law in Mergers and AcquisitionsDocumento8 páginasRole of Intellectual Property Law in Mergers and AcquisitionsDaveAún no hay calificaciones

- Patent PoolsDocumento7 páginasPatent PoolsSebin JamesAún no hay calificaciones

- A Guide To Intellectual Property Litigation - Legal BlogDocumento3 páginasA Guide To Intellectual Property Litigation - Legal BlogVISHALAún no hay calificaciones

- IP Due Diligence M&A DealsDocumento11 páginasIP Due Diligence M&A DealsNarendra SharmaAún no hay calificaciones

- White House Patent Troll ReportDocumento17 páginasWhite House Patent Troll ReportGina SmithAún no hay calificaciones

- Launching A New Product: Freedom To Operate: Spotting Opportunities in Patent LimitationsDocumento3 páginasLaunching A New Product: Freedom To Operate: Spotting Opportunities in Patent LimitationsnanismartAún no hay calificaciones

- Intellectual Property Issues in Pharmaceutical Industries in Merger and Acqisitin - A Critical AnalysisDocumento17 páginasIntellectual Property Issues in Pharmaceutical Industries in Merger and Acqisitin - A Critical AnalysisDevvrat garhwalAún no hay calificaciones

- Managing Intellectual Property Today: Fuelling innovation and high growthDe EverandManaging Intellectual Property Today: Fuelling innovation and high growthAún no hay calificaciones

- Research Paper Topics On Intellectual Property RightsDocumento4 páginasResearch Paper Topics On Intellectual Property Rightsfv9x85bkAún no hay calificaciones

- ArticleDocumento13 páginasArticlesamruddhig28Aún no hay calificaciones

- Lee Davis CMR VersionDocumento28 páginasLee Davis CMR VersionTingting JiangAún no hay calificaciones

- What Is Intellectual Property: A Beginner's Primer Intellectual PropertyDocumento5 páginasWhat Is Intellectual Property: A Beginner's Primer Intellectual PropertymizzueAún no hay calificaciones

- Group 5 TechnopreneurshipDocumento54 páginasGroup 5 TechnopreneurshipBrandy Juet EcleviaAún no hay calificaciones

- Essential Patents, FRAND Royalties and Technological StandardsDocumento30 páginasEssential Patents, FRAND Royalties and Technological StandardsSniffer 1Aún no hay calificaciones

- Ipr GCDocumento12 páginasIpr GCashwarya singhAún no hay calificaciones

- Conclusion & SuggestionsDocumento20 páginasConclusion & SuggestionsSaideep SmileAún no hay calificaciones

- Dissertation Topics Intellectual PropertyDocumento8 páginasDissertation Topics Intellectual PropertyCustomizedWritingPaperUK100% (1)

- IPM - Monetising The Rembrandts in The Attic PDFDocumento2 páginasIPM - Monetising The Rembrandts in The Attic PDFyode51Aún no hay calificaciones

- IPRDocumento7 páginasIPRPriya SirnamAún no hay calificaciones

- Forward Ancillary Services Auction - Simultaneous ApproachDocumento45 páginasForward Ancillary Services Auction - Simultaneous ApproachCrispino SevillaAún no hay calificaciones

- Bid Documents Tender For ISODocumento40 páginasBid Documents Tender For ISOSanjay KulkarniAún no hay calificaciones

- Pre-Owned Vehicles Auction ListingDocumento25 páginasPre-Owned Vehicles Auction ListingBigasan ni JuanAún no hay calificaciones

- Book Review - Armchair Economist Group 7 Section BDocumento15 páginasBook Review - Armchair Economist Group 7 Section BGaurav Dani100% (2)

- Antique Dolls & Toys, Collectibles & Ephemera, Early Photography - Skinner Auction 2654MDocumento108 páginasAntique Dolls & Toys, Collectibles & Ephemera, Early Photography - Skinner Auction 2654MSkinnerAuctionsAún no hay calificaciones

- 2018-11-01 Stamp & Coin Mart PDFDocumento94 páginas2018-11-01 Stamp & Coin Mart PDFClaudiusAún no hay calificaciones

- IB 4a Chandrika Flora - DistributionDocumento3 páginasIB 4a Chandrika Flora - DistributionGinu George VargheseAún no hay calificaciones

- C&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernDocumento48 páginasC&C - Asset Sale Process Memorandum - 4th Auction - Going ConcernPalikatowns LLPAún no hay calificaciones

- Week 3 Offer 1. A: R V CAE Industries LTD (Canada Federal Court of Appeal, 1985) - FDocumento12 páginasWeek 3 Offer 1. A: R V CAE Industries LTD (Canada Federal Court of Appeal, 1985) - FSyeda Numaira Shehrin 2022400630Aún no hay calificaciones

- University of Veterinary & Animal Sciences: Auction Notice ADocumento1 páginaUniversity of Veterinary & Animal Sciences: Auction Notice Ahoware youAún no hay calificaciones

- Paintings & Sculpture - Skinner Auction 2598BDocumento252 páginasPaintings & Sculpture - Skinner Auction 2598BSkinnerAuctions100% (3)

- Law On Sales (Title Vi of CCP)Documento22 páginasLaw On Sales (Title Vi of CCP)LORI-LYN GUICOAún no hay calificaciones

- Gemc 511687765242692 29122022Documento3 páginasGemc 511687765242692 29122022Priyanka DevghareAún no hay calificaciones

- The Psychology of Pricing: A Gigantic List of StrategiesDocumento30 páginasThe Psychology of Pricing: A Gigantic List of StrategiesLuca FontaniAún no hay calificaciones

- Land Your Destiny in the City of DestinyDocumento35 páginasLand Your Destiny in the City of DestinyDanish JavedAún no hay calificaciones

- Sbi Racpc III 10 PropertiesDocumento1 páginaSbi Racpc III 10 Propertiesranjit666Aún no hay calificaciones

- List of Commercial Properties in Respect of ROHTAK ZONE For E-Auction - 29.12.2021Documento4 páginasList of Commercial Properties in Respect of ROHTAK ZONE For E-Auction - 29.12.2021ShinuSinglaAún no hay calificaciones

- FLIPDOC April 12 WesternDocumento142 páginasFLIPDOC April 12 WesternRobert FlorezAún no hay calificaciones

- Law On SalesDocumento3 páginasLaw On SalesAnonymous OXOfPRGAún no hay calificaciones

- RFP For Procurement of 2700 PBKsDocumento194 páginasRFP For Procurement of 2700 PBKsAbhik ChattopadhyayAún no hay calificaciones

- BHEL Tiruchirappalli OSB NIT 2021OSB051 for Galvanised HandrailsDocumento66 páginasBHEL Tiruchirappalli OSB NIT 2021OSB051 for Galvanised HandrailsAkepati Sunil Kumar ReddyAún no hay calificaciones

- WCLDocumento23 páginasWCLdfhjhdhdgfjhgdfjhAún no hay calificaciones

- Collecting: United States StampsDocumento12 páginasCollecting: United States Stampsboiboiboi100% (1)

- Dune Planet of Intrigue and SpiceDocumento46 páginasDune Planet of Intrigue and SpiceJacomoAún no hay calificaciones

- Silent Auction Program 2009 Rev 11-12-09-WebDocumento60 páginasSilent Auction Program 2009 Rev 11-12-09-WebtparaventiAún no hay calificaciones

- LFC Chapter 1 Finance OverviewDocumento16 páginasLFC Chapter 1 Finance OverviewChealseah MerceneAún no hay calificaciones

- M11 MishkinEakins3427056 08 FMI C11Documento53 páginasM11 MishkinEakins3427056 08 FMI C11habiba ahmedAún no hay calificaciones

- K.g.sasi - The Book On The Portrait of The Christ With A BindhiDocumento322 páginasK.g.sasi - The Book On The Portrait of The Christ With A BindhiSasi KadukkappillyAún no hay calificaciones

- United States v. Franklin M. Yoffe, 724 F.2d 3, 1st Cir. (1983)Documento2 páginasUnited States v. Franklin M. Yoffe, 724 F.2d 3, 1st Cir. (1983)Scribd Government DocsAún no hay calificaciones

- Air 2022 Supreme Court 545Documento15 páginasAir 2022 Supreme Court 545Prashant SarwankarAún no hay calificaciones