Documentos de Académico

Documentos de Profesional

Documentos de Cultura

2001

Cargado por

Ian GiaroliDescripción original:

Derechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

2001

Cargado por

Ian GiaroliCopyright:

Formatos disponibles

Box Office

2001 US Economic Review

US gross box office reached an all-time high of $8.4 billion -- a

9.8% increase over last year.

US Theatrical Box Office

9.0

8.41

8.0

$ Billions

7.45

7.66

6.95

7.0

6.37

5.91

6.0

5.0

4.80

4.87

5.15

5.40

5.49

4.0

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

Year

Source: MPAA

MPAA Worldwide Market Research

-1-

Box Office

2001 US Economic Review

US box office posted a new high for the tenth consecutive year -growing by 75% since 1991.

US Theatrical Box Office

Year

Box Office

Gross (mil)

Yearly

Change

2001

Versus

2001

$8,412.5

9.8%

--

2000

$7,661.0

2.9%

9.8%

1999

$7,448.0

7.2%

12.9%

1998

$6,949.0

9.2%

21.1%

1997

$6,365.9

7.7%

32.1%

1996

$5,911.5

7.6%

42.3%

1995

$5,493.5

1.8%

53.1%

1994

$5,396.2

4.7%

55.9%

1993

$5,154.2

5.8%

63.2%

1992

$4,871.0

1.4%

72.7%

1991

$4,803.2

-4.4%

75.1%

Source: MPAA

MPAA Worldwide Market Research

-2-

Box Office

2001 US Economic Review

Strong growth in the fourth quarter of 2001 offset the 2nd

quarter decline (-11%) in US box office -- contributing to a 10%

increase in overall box office.

Quarterly Box Office

($ Millions)

Quarter

2000

2001

% Change

First

1,620.6

1,811.7

11.8%

Second

2,126.9

1,891.5

-11.1%

Third

2,017.3

2267.4

12.4%

Fourth

1,895.9

2,441.8

28.8%

Year

7,660.7

8,412.5

9.8%

Source: MPAA

MPAA Worldwide Market Research

-3-

Box Office

2001 US Economic Review

US admissions in 2001 hit a record high of 1.49 billion, an increase

of almost 78 million compared to last year.

US Theatrical Admissions

2.0

1.8

1.49

Billions

1.6

1.29

1.4

1.14

1.17

1.24

'91

'92

'93

1.34

1.48

1.47

'98

'99

1.39

1.42

1.26

1.2

1.0

0.8

0.6

0.4

'94

'95

'96 '97

Year

'00

'01

Source: 1989 to Present, based on NATO average ticket price

MPAA Worldwide Market Research

-4-

Box Office

2001 US Economic Review

Total admissions have increased by 5% since last year and

reflect a 30% increase (+346 million) since the beginning of the

decade.

US Theatrical Admissions

2001

Admissions

(mil)

1,487.3

Yearly

Change

4.7%

2001

Versus

--

2000

1,420.8

-3.0%

4.7%

1999

1,465.2

-1.0%

1.5%

1998

1,480.7

6.7%

0.4%

1997

1,387.7

3.7%

7.2%

1996

1,338.6

6.0%

11.1%

1995

1,262.6

-2.3%

17.8%

1994

1,291.7

3.8%

15.1%

1993

1,244.0

6.0%

19.6%

1992

1,173.2

2.9%

26.8%

1991

1,140.6

-4.0%

30.4%

Year

Source: 1989 to Present, based on NATO average ticket price

MPAA Worldwide Market Research

-5-

Box Office

2001 US Economic Review

Average admissions per person slightly increased in 2001 -- US

residents have attended at least 5 movies per year for the past six

years.

Average Admissions Per Capita

6.0

5.8

5.5

5.6

5.4

5.3

5.4

5.2

5.2

5.2

5.0

5.0

5.0

4.8

4.8

4.5

4.8

4.6

4.6

4.4

4.2

4.0

1991

1992

1993

1994

1995

1996

Year

1997

1998

1999

2000

2001

Source: MPAA

MPAA Worldwide Market Research

-6-

Box Office

2001 US Economic Review

Average Annual Admission Price*

Year

2001

Ave. Annual

Yearly

Admission Price % Change

$5.66

4.9%

2001

Versus

--

CPI %

Change

1.6%

2000

$5.39

6.1%

4.9%

3.4%

1999

$5.08

8.3%

11.3%

2.7%

1998

$4.69

2.3%

20.5%

1.6%

1997

$4.59

3.9%

23.3%

1.7%

1996

$4.42

1.5%

28.1%

3.3%

1995

$4.35

4.1%

30.0%

2.5%

1994

$4.18

0.8%

35.3%

2.7%

1993

$4.14

-0.2%

36.6%

2.7%

1992

$4.15

-1.4%

36.3%

2.9%

1991

$4.21

-0.3%

34.3%

3.1%

Source: NATO average ticket price, based on

NSBN Survey

MPAA Worldwide Market Research

*Average price paid for all admissions to movie theaters,

inclusive of first run, subsequent runs, senior citizens,

children, and all special pricing.

-7-

Box Office

2001 US Economic Review

Number of High Grossing Features -- Film Rentals

$10 mil +

$20 mil +

100

90 90

75

80

# Films

59

68

64

57

69 66 69 71

57

60

49 50

42

40

36

36

30 30

33 36 31

28

39 37 42

17 13

20

0

'80 '85 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01

Source: MPAA

MPAA Worldwide Market Research

-8-

Films Released

2001 US Economic Review

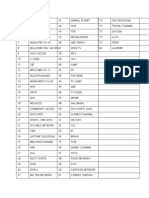

Number of Theatrical Films Rated & Released in the US

Year

Rated

Released

2001

2000

1999

739

762

677

482

478

461

1998

1997

1996

661

673

713

509

510

471

1995

1990

1980

697

N/A

N/A

411

410

233

1970

1960

1950

N/A

N/A

N/A

306

248

483

Source: MPAA

MPAA Worldwide Market Research

-9-

Films Released

2001 US Economic Review

Films Released in the US

Total

MPAA Members

600

Releases

500

All Other Distributors

510

509

471

410

461

478

482

281

286

197

196

2000

2001

411

400

300

241

234

240

200

231

100

169

177

1990

1995

257

274

253

235

218

1998

1999

243

0

1996

1997

Year

Source: MPAA

MPAA Worldwide Market Research

-10-

Films Released

2001 US Economic Review

Feature Films Released in the US

New Films

Source: MPAA

Reissued Films

Year

MPAA

All Other

Distributors

Total New

Releases

MPAA

All Other

Distributors

Total Reissues

2001

189

273

462

13

20

2000

191

270

461

11

17

1999

213

229

442

14

19

1998

221

269

490

14

19

1997

219

242

461

34

15

49

1996

215

205

420

25

26

51

1995

212

158

370

22

19

41

1994

166

244

410

17

26

43

1993

156

284

440

17

22

1992

141

284

425

46

55

1991

150

273

423

14

21

35

1990

158

227

385

11

14

25

1985

138

251

389

15

66

81

1980

134

57

191

27

15

42

MPAA Worldwide Market Research

-11-

Ratings

2001 US Economic Review

PG-13 represents over 20% of all films rated in 2001, reflecting a

3 % increase over last year -- while the number of films with an

R rating slightly decreased.

Film Rating Trends

G

2001 Films Rated

PG

PG-13

600

528

G

4%

PG

7%

500

458

469

PG-13

22%

490

468

432

432

400

# Films

R

67%

NC-17/X

0%

300

200

146

111

100

99

0

25

1995

116

105

117

97

21

23

1996

1997

115

107

64

70

40

1998

163

36

1999

51

36

2000

55

30

2001

Source: MPAA

MPAA Worldwide Market Research

-12-

Ratings

2001 US Economic Review

Over 17,000 films have been rated since 1968, with over half

(57%) being R rated -- while PG and PG-13 films make up

another third.

Percent of Films by Rating - 1968 to 2001

NC-17

2%

R

57%

G

7%

PG

23%

PG-13

11%

Source: MPAA

MPAA Worldwide Market Research

-13-

Theatrical Costs

2001 US Economic Review

MPAA Average

Negative Costs

($ millions)

(includes production costs,

studio overhead and capitalized

interest)

*Due to changes in financial reporting regulations, abandoned

project costs are no longer included in studio overhead, and as such,

are no longer a part total Negative Costs.

Source: MPAA

MPAA Worldwide Market Research

Year

2001*

2000*

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

1989

1988

1987

1986

1985

1984

1983

1982

1981

1980

Cost Per

Feature

47.7

54.8

51.5

52.7

53.4

39.8

36.4

34.3

29.9

28.9

26.1

26.8

23.5

18.1

20.1

17.5

16.8

14.4

11.9

11.8

11.3

9.4

Yearly

Change

-13.0%

6.5%

-2.3%

-1.4%

34.1%

9.5%

6.1%

14.6%

3.6%

10.4%

-2.4%

14.2%

29.9%

-9.9%

14.9%

4.0%

16.4%

21.3%

0.3%

4.5%

20.8%

--

2001

Versus

--13.0%

-7.3%

-9.5%

-10.7%

19.7%

31.1%

39.0%

59.4%

65.2%

82.4%

78.0%

103.3%

164.0%

137.8%

173.1%

184.1%

230.8%

301.1%

302.3%

320.6%

408.1%

-14-

Theatrical Costs

2001 US Economic Review

MPAA Member Company

Average Negative Cost Trends

70

MPAA Member Company

60

50

$ Millions

53.4

MPAA Member

Subsidiary/Affiliate*

36.4

40

52.7

54.8

51.5

47.7

39.8

31.5

26.8

30

21.8

16.8

20

21.8

18.4

9.4

10

3.1

0

75

Source: MPAA

80

85

90

95

96

Year

97

98

99

'00

'01

*Subsidiaries include studio classics divisions such as Sony Pictures Classics, Fox Searchlight, New

Line, Miramax, etc.

MPAA Worldwide Market Research

-15-

Theatrical Costs

2001 US Economic Review

MPAA Member Company

Average Marketing Costs of New Feature Films

($ Millions)

Source: MPAA

Year

Total P&A

Advertising

2001

31.01

3.73

27.28

2000

27.31

3.30

24.00

1999

24.53

3.13

21.40

1998

25.31

3.25

22.07

1997

22.26

3.02

19.24

1996

19.84

2.63

17.21

1995

17.74

2.35

15.38

1994

16.06

2.19

13.87

1993

14.07

1.94

12.13

1992

13.46

1.97

11.48

1991

12.06

1.65

10.41

1990

11.97

1.73

10.24

1985

6.45

1.21

5.24

1980

4.33

0.79

3.54

MPAA Worldwide Market Research

-16-

Theatrical Costs

2001 US Economic Review

MPAA Member Subsidiary/Affiliate

Average Marketing Costs of New Feature Films

($ Millions)

Year

Total P&A

Advertising

2001

9.50

1.21

8.29

2000

10.14

1.18

8.96

1999

6.52

0.78

5.74

1998

5.47

0.62

4.86

*Subsidiaries include studio classics divisions such as Sony Pictures Classics, Fox Searchlight, New

Line, Miramax, etc.

Source: MPAA

MPAA Worldwide Market Research

-17-

Theatrical Costs

2001 US Economic Review

MPAA Member Company

Average Marketing Cost Trends

35

$ Millions

31.0

30

MPAA Member

Company

25

MPAA Member

Subsidiary/Affiliate*

27.3

25.3

24.5

22.3

19.8

20

17.7

16.1

13.5

15

12.0

14.1

12.1

10.1

9.5

'00

'01

10

6.5

5.5

4.3

6.5

0

80

Source: MPAA

85

90

91

92

93

94

95

Year

96

97

98

99

*Subsidiaries include studio classics divisions such as Sony Pictures Classics, Fox Searchlight, New

Line, Miramax, etc.

MPAA Worldwide Market Research

-18-

Theatrical Costs

2001 US Economic Review

MPAA Member Company

Distribution of Advertising Costs by Media

2001

2000

1999

1998

13.1%

15.6%

17.6%

15.9%

25.4%

23.8%

23.5%

24.1%

16.9%

18.3%

19.8%

18.2%

Internet/

Online

1.3%

0.7%

0.5%

N/A

1997

1996

1995

1994

15.8%

18.2%

19.5%

21.8%

23.8%

23.9%

23.0%

21.3%

21.0%

22.4%

24.4%

22.8%

N/A

N/A

N/A

N/A

4.5%

5.2%

4.6%

4.6%

34.9%

30.2%

28.4%

29.5%

1993

1992

1991

1990

22.0%

22.3%

22.4%

23.8%

21.5%

21.2%

21.9%

21.2%

22.7%

22.3%

21.2%

23.0%

N/A

N/A

N/A

N/A

4.4%

4.0%

5.3%

N/A

29.4%

30.2%

29.2%

32.0%

Year Newspaper Network Spot TV

Source: MPAA

MPAA Worldwide Market Research

Other Media includes:

Cable TV/Network TV

Network Radio

Spot Radio

Magazines

Billboards

Trailers

5.1%

6.4%

7.8%

4.7%

Other

Media

20.2%

18.8%

15.4%

18.2%

Other

Non-Media

17.9%

16.3%

15.5%

18.9%

Other Non-Media includes:

Production/Creative Services

Exhibitor Services

Promotion & Publicity

Market Research

-19-

Theatrical Costs

2001 US Economic Review

MPAA Member Company Subsidiary/Affiliate

Distribution of Advertising Costs by Media

Year Newspaper Network Spot TV

Internet/

Online

Trailers

Other

Media

Other

Non-Media

2001

18.6%

42.8%

3.2%

0.4%

5.2%

9.9%

19.9%

2000

20.5%

36.4%

6.1%

0.5%

5.5%

13.8%

17.3%

1999

23.8%

35.4%

6.8%

0.3%

4.1%

10.5%

19.1%

1998

23.5%

42.2%

3.6%

N/A

4.1%

3.6%

19.0%

Other Media includes:

Cable TV/Network TV

Network Radio

Spot Radio

Magazines

Billboards

Other Non-Media includes:

Production/Creative Services

Exhibitor Services

Promotion & Publicity

Market Research

*Subsidiaries include studio classics divisions such as Sony Pictures Classics, Fox Searchlight, New

Line, Miramax, etc.

Source: MPAA

MPAA Worldwide Market Research

-20-

US Screens

2001 US Economic Review

Total Number of US Screens

Total

Screens

2001

Versus

Indoor

Screens

2001

Versus

Drive-In

Screens

2001

Versus

36,764

--

36,110

--

654

--

2000

37,396

-1.7%

36,679

-1.6%

717

-8.8%

1999

37,185

-1.1%

36,448

-0.9%

737

-11.3%

1998

34,186

7.5%

33,440

8.0%

746

-12.3%

1997

31,640

16.2%

30,825

17.1%

815

-19.8%

1996

29,690

23.8%

28,864

25.1%

826

-20.8%

1995

27,805

32.2%

26,958

33.9%

847

-22.8%

1990

23,689

55.2%

22,774

58.6%

915

-28.5%

1985

21,147

73.8%

18,327

97.0%

2,820

-76.8%

1980

17,590

109.0%

14,029

157.4%

3,561

-81.6%

Year

2001

Source: MPAA

MPAA Worldwide Market Research

-21-

US Theaters

2001 US Economic Review

Total Number of US Theaters

Year

Total

Theaters

2001

Versus

Indoor

Theaters

2001

Versus

Drive-In

Theaters

2001

Versus

2001

7,070

--

6,596

--

474

--

2000

7,421

-4.7%

6,909

-4.5%

512

-7.4%

1999

7,551

-6.4%

7,031

-6.2%

520

-8.8%

1998

7,418

-4.7%

6,894

-4.3%

524

-9.5%

1997

7,480

-5.5%

6,903

-4.4%

577

-17.9%

1996

7,798

-9.3%

7,215

-8.6%

583

-18.7%

1995

7,744

-8.7%

7,151

-7.8%

593

-20.1%

Source: MPAA

MPAA Worldwide Market Research

-22-

US Theaters

2001 US Economic Review

2001 US Theaters by Number of Screens

Number of Theaters

2001

2,280

2000

2,368

Yearly

Change

-3.7%

2,901

Miniplex

(2 to 7 screens)

1,458

Multiplex

(8 to 15 screens)

431

Megaplex

(16 or more screens)

3,170

-8.5%

1,478

-1.4%

405

6.4%

Single Screen

Multiplex

21%

Megaplex

6%

Single Screen

32%

Miniplex

41%

Total Number of Theaters: 7,070

Source: MPAA

MPAA Worldwide Market Research

-23-

Employment

2001 US Economic Review

Total US Motion Picture Industry Employment

(000s)

Year

No. of

Employees

Yearly

Change

2001

Versus

2001 (p)

2000 *

1999 *

1998

1997

1996

1995

1994

1993

1992

1991

1990

1989

1988

591.8

593.8

598.8

576.0

550.4

524.7

487.6

441.2

412.0

400.9

410.9

407.7

374.7

340.9

-0.3%

-0.8%

4.0%

4.7%

4.9%

7.6%

10.5%

7.1%

2.8%

-2.4%

0.8%

8.8%

9.9%

--

--0.3%

-1.2%

2.7%

7.5%

12.8%

21.4%

34.1%

43.6%

47.6%

44.0%

45.2%

57.9%

73.6%

(p) Preliminary estimate

*numbers adjusted by BLS

Source: Bureau of Labor Statistics

MPAA Worldwide Market Research

-24-

Employment

2001 US Economic Review

US Motion Picture Industry Employment Areas

(000s)

Year

Total

2001(p)

2000 *

1999 *

1998

1997

1996

1995

1994

1993

1992

1991

1990

1989

1988

591.8

593.8

598.8

576.0

550.4

524.7

487.6

441.2

412.0

400.9

410.9

407.7

374.7

340.9

Source: Bureau of Labor Statistics

MPAA Worldwide Market Research

Production

Video Tape

& Services Theaters

Rental

259.0

269.9

270.9

255.4

237.4

222.5

200.7

169.6

152.7

148.8

153.1

147.8

133.9

113.7

140.4

139.1

140.4

136.8

133.0

123.9

118.7

113.4

110.6

110.2

112.0

112.1

109.9

108.0

175.9

167.8

170.3

166.7

160.9

155.1

146.1

138.8

132.4

127.1

131.2

133.7

118.2

103.3

Other

16.5

17.0

17.2

17.1

19.1

23.2

22.1

19.4

16.3

14.8

14.6

14.1

12.7

15.9

(p) Preliminary estimate

*numbers adjusted by BLS

-25-

Employment

2001 US Economic Review

US Motion Picture Industry Employment Areas

Production & Services

Theaters

Video Rental

300

255

Thousands

250

223

270

269 259

237

201

200

148

146

134

150

155

108

100 105

88

112

119

124

161

133

167

137

170

140

167

139

175

140

50

'85

'90

'95

'96

'97

'98

'99

'00

'01

Source: Bureau of Labor Statistics

MPAA Worldwide Market Research

-26-

Home Video

2001 US Economic Review

VCR Penetration in US TV Households

(millions)

VCR

TV

Penetration

Households Households

Rate

Year

VCR

Households

Yearly

Change

2001

Versus

2001

96.2

105.5

91.2%

2001

96.2

9.2%

--

2000

88.1

102.2

86.2%

2000

88.1

2.7%

9.2%

1999

85.8

100.8

85.1%

1999

85.8

2.0%

12.1%

1998

84.1

99.4

84.6%

1998

84.1

4.7%

14.3%

1997

80.4

98.0

82.0%

1997

80.4

2.0%

19.7%

1996

78.8

95.9

82.2%

1996

78.8

4.0%

22.1%

1995

75.8

95.4

79.5%

1995

75.8

4.1%

726.9%

1990

65.4

93.1

70.2%

1990

65.4

5.0%

47.2%

1985

23.5

86.1

27.3%

1985

23.5

56.7%

309.4%

1980

1.9

78.0

2.4%

1980

1.9

--

5100.0%

Source: Nielsen Media Research

MPAA Worldwide Market Research

-27-

Home Video

2001 US Economic Review

Sales of Pre-Recorded Videocassettes to US Dealers

(millions)

Year

Total

Cassettes

Yearly

Change

2001

Versus

Rental

Cassettes

Sell-Through

Cassettes

2001

639.1

-8.9%

--

73.1

566.0

2000

701.7

1.2%

-8.9%

78.4

623.3

1999

693.2

-1.2%

-7.8%

73.1

620.1

1998

701.6

4.2%

-8.9%

44.5

657.1

1997

673.5

5.2%

-5.1%

38.6

634.9

1996

640.5

22.6%

-0.2%

40.4

600.1

1995

522.4

20.1%

22.3%

38.7

483.7

1994

434.9

19.9%

47.0%

36.5

398.4

1993

362.7

22.0%

76.2%

35.8

326.9

1992

297.4

12.8%

114.9%

33.3

264.1

1991

263.6

9.0%

142.5%

31.6

232.0

1990

241.8

18.6%

164.3%

32.3

209.5

1985

40.9

--

15.2

25.7

1980

3.0

--

2.0

1.0

Source: Adams Media Research

MPAA Worldwide Market Research

-28-

Home Video

2001 US Economic Review

Sales of Blank Videocassettes to US Consumer Market

(millions)

Year

End

2001

2000

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

1985

1980

Source: Electronic Industries Alliance

MPAA Worldwide Market Research

Blank

Cassettes

372.0*

404.0

410.0

420.0

398.0

408.0

384.0

383.0

377.0

358.0

362.0

338.0

233.0

15.0

Yearly

Change

-7.9%

-1.5%

-2.4%

5.5%

-2.5%

6.3%

0.3%

1.6%

5.3%

-1.1%

7.1%

18.2%

75.2%

--

2001

Versus

--7.9%

-9.3%

-11.4%

-6.5%

-8.8%

-3.1%

-2.9%

-1.3%

3.9%

2.8%

10.1%

59.7%

2,380.0%

*estimate

-29-

Home Video

2001 US Economic Review

US DVD Statistics

1997

1998

1999

2000

2001

DVD Players Shipped to Dealers* (000s)

350

1,100

4,100

8,499

12,706

Installed Consumer Base* (000s)

175

1,000

5,400

13,100

25,100

Avg. DVD Player Price

$491

$390

$275

$204

$153

DVD Software Units Shipped to Dealers* (mil)

10.8

34.9

77.9

182.0

364.4

Titles Available on DVD**

600

1,500

5,000

8,500

13,000

*DVD/LD Combo players are included exclusively with DVD Players.

**Titles available on DVD include movies and music videos.

Source: Consumer Electronics Association, Adams Media Research, DVD Entertainment Group

MPAA Worldwide Market Research

-30-

Home Video

2001 US Economic Review

DVD Player

Shipments to

Retailers

Monthly Sales

2000

2001

% Change

January

370,031

572,031

54.6%

February

401,035

555,856

38.6%

March

412,559

1,207,489

192.7%

April

409,192

631,353

54.3%

May

453,435

523,225

15.4%

June

654,687

920,839

40.7%

July

537,453

693,013

28.9%

August

557,671

673,926

20.8%

September

1,296,280

1,768,821

36.5%

October

1,236,658

1,516,211

22.6%

November

866,507

1,781,048

105.5%

December

1,303,091

1,862,772

43.0%

Total

8,498,599

12,706,584

49.5%

Source: Consumer Electronics Association

MPAA Worldwide Market Research

-31-

Television

2001 US Economic Review

US Television Households

(millions)

Year

TV

Households

2001

105.5

108.2*

97.5%

2000

102.2

104.7

97.6%

1999

1998

1997

100.8

99.4

98.0

103.9

102.5

101.0

97.0%

96.9%

97.0%

1996

1995

95.9

95.4

99.6

98.9

96.3%

96.4%

1994

94.2

97.1

97.0%

1993

1992

93.1

93.1

96.4

95.7

96.6%

97.2%

1991

92.0

94.3

97.6%

1990

1985

93.1

86.1

93.3

92.8

99.7%

99.2%

Source: Nielsen Media Research, U.S. Census Bureau

MPAA Worldwide Market Research

Total

Penetration

Households

Rate

* estimate

-32-

Television

2001 US Economic Review

(Sept-Aug)

US Average Hours of TV

Usage Per Household

(Hours:Minutes)

Source: Nielsen Media Research

MPAA Worldwide Market Research

Season

00-01

99-00

98-99

97-98

96-97

95-96

94-95

93-94

92-93

91-92

90-91

89-90

88-89

87-88

86-87

85-86

84-85

83-84

82-83

81-82

80-81

Per Week Per Day

53:35

51:44

51:45

50:44

50:24

50:44

50:42

50:50

50:24

49:25

48:40

48:29

49:19

49:04

48:22

50:16

50:00

49:58

48:31

47:44

47:07

7:35

7:24

7:24

7:15

7:12

7:15

7:15

7:16

7:12

7:04

6:57

6:56

7:02

7:00

6:54

7:10

7:07

7:08

6:55

6:48

6:43

-33-

Television

2001 US Economic Review

NTI Average Household Ratings Prime Time

(Average of Networks Combined)

(Sept-Aug)

Season

Three Networks

Rating

Share

Four Networks

Rating

Share

Six Networks

Rating

Share

00-01

22.5

3.8

27.9

47

32.5

55

99-00

24.3

41

29.6

50

34.4

58

98-99

97-98

96-97

95-96

94-95

93-94

92-93

91-92

90-91

85-86

80-81

23.8

25.6

26.9

29.7

31.4

33.9

33.6

34.6

33.9

44.4

50.1

41

44

47

51

54

57

58

60

60

73

84

30.0

32.0

33.7

36.2

38.2

40.8

40.6

-----

52

55

59

62

66

68

70

-----

34.8

-----------

60

-----------

Source: Nielsen Media Research

MPAA Worldwide Market Research

*Three Networks Include: ABC, NBC, CBS

Four Networks Include: ABC, NBC, CBS, FOX

Six Networks include: ABC, NBC, CBS, FOX, WB, UPN

-34-

Television

2001 US Economic Review

US Commercial Television Station Counts

by Primary Network Affiliation

(Sept-Aug)

Season

ABC CBS NBC FOX

WB

UPN

00 01

219

215

219

183

182

79

99 - 00

217

213

217

187

171

83

98 - 99

219

212

218

182

173

74

97 - 98

219

212

214

178

64

78

96 - 97

218

213

213

173

58

71

95 - 96

217

215

213

169

--

--

94 - 95

222

215

213

162

--

--

93 - 94

226

214

212

--

--

--

90 - 91

222

217

208

--

--

--

87 - 88

219

216

210

--

--

--

Source: Nielsen Media Research

MPAA Worldwide Market Research

-35-

Television

2001 US Economic Review

Total US Television Station Counts

(Including Network Affiliates and Independents)*

(Sept-Aug)

Season

Stations

% Share

Affiliates

00 - 01

1,580

100.0%

1,376

87.1%

204

12.9%

99 - 00

1,393

100.00%

1,201

86.2%

192

13.8%

98 - 99

1,363

100.00%

1,176

86.3%

187

13.7%

97 - 98

1,222

100.00%

999

81.8%

223

18.2%

96 - 97

1,201

100.00%

946

71.1%

255

28.9%

95 - 96

1,011

100.00%

814

80.5%

197

19.5%

94 - 95

1,156

100.00%

812

70.2%

344

29.8%

93 - 94

1,125

100.00%

652

58.0%

473

42.0%

90 - 91

1,100

100.00%

647

58.8%

453

41.2%

87 - 88

1,018

100.00%

645

63.4%

373

36.6%

Source: Nielsen Media Research

% Share Independents % Share

* Beginning with 98-99 season, affiliates includes Univision, Telemundo & PAX

MPAA Worldwide Market Research

-36-

Television

2001 US Economic Review

US Basic Cable Households **

(millions)

Year

Basic Cable

Households

Yearly

Change

2001

Versus

2001

73.2

5.3%

--

2000

69.5*

1.4%

5.3%

1999

68.6

2.1%

1998

67.1

1997

Basic Cable

TV

Penetration

Year Households Households

Rate

2001

73.2

105.5

69.4%

2000

69.5*

102.2

68.0%

6.8%

1999

68.6

100.8

68.0%

1.8%

9.1%

1998

67.1

99.4

67.5%

66.0

3.1%

11.0%

1997

66.0

98.0

67.3%

1996

64.0

2.1%

14.4%

1996

64.0

95.9

66.7%

1995

62.7

4.9%

16.8%

1995

62.7

95.4

65.7%

1990

54.9

4.4%

33.3%

1990

54.9

93.1

59.0%

1985

39.8

6.7%

84.0%

1985

39.8

86.1

46.2%

1980

17.6

--

315.2%

1980

17.6

78.0

22.6%

Source: Nielsen Media Research

* revised

MPAA Worldwide Market Research

** Refers to wired cable households with basic cable

-37-

Television

2001 US Economic Review

US Addressable Cable Households*

(millions)

Year

Addressable

Households

Yearly

Change

2001

Versus

2001

32.0

-14.7

--

2000

37.5

6.5%

-14.7%

1999

1998

1997

1996

1995

1994

1993

1992

1991

1990

1985

1982

35.2

33.2

31.2

30.9

28.7

26.5

25.9

25.2

24.0

22.0

9.0

1.5

6.0%

6.4%

1.0%

7.6%

8.3%

2.3%

2.8%

5.0%

9.1%

----

-9.1%

-3.6%

2.6%

3.6%

11.5%

20.8%

23.5%

27.0%

33.3%

45.5%

254.8%

2033.3%

Source: Kagan Media Money

MPAA Worldwide Market Research

*Cable homes which have set-top boxes that can

be linked to the address of the subscriber.

-38-

Television

2001 US Economic Review

US Pay Cable Households*

(millions)

Pay Cable

Households

Yearly

Change

2001

Versus

2001

34.1

1.1%

--

2001

34.1

105.5

32.3%

2000

33.7

6.2%

1.1%

2000

33.7

102.2

33.0%

1999

31.7

-18.8%

7.4%

1999

31.8

100.8

31.5%

1998

39.1

14.7%

-12.8%

1998

39.1

99.4

39.3%

1997

34.1

7.8%

0.0%

1997

34.1

98.0

34.8%

1996

31.6

4.2%

7.8%

1996

31.6

95.9

33.0%

1995

30.4

12.0%

12.3%

1995

30.4

95.4

31.8%

1990

27.0

--

26.1%

1990

27.0

93.1

29.0%

1985

22.8

--

49.3%

1985

22.8

86.1

26.5%

Year

Source: Nielsen Media Research,

Year

Pay Cable

TV

Households Households

Penetration

Rate

*Refers to wired cable households with pay.

1999 decline due in part to redefinition of some pay channels to basic cable

MPAA Worldwide Market Research

-39-

Television

2001 US Economic Review

Satellite Households*

(millions)

Year

Satellite

Households

Yearly

Change

2001

Versus

2001

12.9

34.4%

--

2000

9.6

11.6%

34.4%

1999

8.6

3.6%

50.0%

1998

8.3

29.7%

55.4%

1997

6.4

45.5%

101.6%

1996

4.4

33.3%

193.2%

1995

3.3

--

290.9%

Source: Nielsen Media Research

MPAA Worldwide Market Research

*Satellite homes include EchoStar and DirecTV

-40-

Internet

2001 US Economic Review

US Computer Households

(millions)

Year

Computer

HHs

2001

Versus

% of Total

US HHs

2001

69.1

--

66.0%

2000

66.0

4.7%

63.0%

1999

61.1

13.1%

59.0%

1998

51.2

35.0%

49.9%

1997

44.0

57.0%

43.6%

1996

38.8

78.1%

39.0%

1995

33.6

105.7%

34.0%

1994

32.0

115.9%

33.0%

1993

28.9

139.1%

30.0%

1990

21.9

215.5%

23.5%

Source: MPAA/US Census Bureau

MPAA Worldwide Market Research

-41-

Internet

2001 US Economic Review

Number of US Homes With Internet Access

(millions)

Year

Internet

Households

2001 % of Computer % of Total

Versus

HH

US HH

2001

60.1

--

87.0%

57.4%

2000

54.4

10.5%

82.5%

52.0%

1999

45.2

33.0%

74.0%

43.6%

1998

31.7

89.6%

62.0%

30.9%

1997

21.8

175.7%

49.5%

21.6%

1996

15.2

295.4%

39.3%

15.3%

1995

9.4

539.4%

28.3%

9.5%

1990

1.6

3,656.3%

7.3%

1.7%

Source: MPAA/US Census Bureau

MPAA Worldwide Market Research

-42-

Internet

2001 US Economic Review

Number of US Homes with Broadband Internet Access*

(millions)

10

8.6

Households (mil)

8

6

4.8

4

1.8

2

0.6

0

'98

Source: Jupiter Research

'99

'00

'01

*Households with Internet access at speeds of at least 200 Kbps

(includes ADSL, other wireless, coaxial cable, fiber, satellite &

fixed wireless) and excludes ISDN services

MPAA Worldwide Market Research

-43-

Internet

2001 US Economic Review

Number of US Internet Hosts*

80

68.4

53.2

60

Millions

49.3

40

30.5

18.6

20

0

97

Source: NetSizer

98

99

'00

'01

* A host is defined as any computer that has full two-way access

to other computers on the Internet, such as network servers.

MPAA Worldwide Market Research

-44-

También podría gustarte

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2104)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Lionel Delasse - La Verite Sur Les Idoles Des JeunesDocumento2 páginasLionel Delasse - La Verite Sur Les Idoles Des JeunesShula RajaonahAún no hay calificaciones

- CatalogueDocumento40 páginasCatalogueAlexander KingsAún no hay calificaciones

- Rephrase Exercises - Intermediate LevelDocumento3 páginasRephrase Exercises - Intermediate LevelOlivia-A. Tudoran (Cretu)100% (1)

- User Manual SR X1200D SuperDocumento35 páginasUser Manual SR X1200D SuperjuntujuntuAún no hay calificaciones

- Present Perfect or Past Simple TenseDocumento1 páginaPresent Perfect or Past Simple TenseMiloš AsAún no hay calificaciones

- Esquiresept 13Documento218 páginasEsquiresept 13Stelios John Ferluci100% (1)

- L13-MUSE SystemDocumento15 páginasL13-MUSE SystemNitin PanchalAún no hay calificaciones

- Sample Midterm Examination: Ae2 WritingDocumento3 páginasSample Midterm Examination: Ae2 WritingYen Tho NguyenAún no hay calificaciones

- Gold Exp B1 Photocopiable 1B PDFDocumento1 páginaGold Exp B1 Photocopiable 1B PDFSol Garcia GimaAún no hay calificaciones

- B Ru X03 NYDocumento4 páginasB Ru X03 NYJonas SouzaAún no hay calificaciones

- Asking For A Promise, Materi I Kelas IIIDocumento1 páginaAsking For A Promise, Materi I Kelas IIIJuwaidin Bin Anggur100% (1)

- Agencias ActuacionDocumento11 páginasAgencias ActuacionRocio GrimaldiAún no hay calificaciones

- Penn State Behrend TV Channel ListingDocumento1 páginaPenn State Behrend TV Channel ListingrichmccarrickAún no hay calificaciones

- Elementary Test - 1: Choose The Correct Answer. Only One Answer Is CorrectDocumento18 páginasElementary Test - 1: Choose The Correct Answer. Only One Answer Is CorrectÁgnes Andrea BalázsAún no hay calificaciones

- Grila Programe (Digitala) Next GenDocumento1 páginaGrila Programe (Digitala) Next GenMarius MihailaAún no hay calificaciones

- Theory Notes DEMG (U1Ch1)Documento5 páginasTheory Notes DEMG (U1Ch1)Pravin KarleAún no hay calificaciones

- Comcast Channel LineUp Aug-2016Documento2 páginasComcast Channel LineUp Aug-2016MD PrasetyoAún no hay calificaciones

- A. Fill in The Blanks With The Correct Modal Verbs (Can or Can't) .Documento4 páginasA. Fill in The Blanks With The Correct Modal Verbs (Can or Can't) .Sofiabv:3Aún no hay calificaciones

- Witchblade TimelineDocumento3 páginasWitchblade TimelineJoshua Muro100% (1)

- Investor Pitch Deck of Trio EntertainmentDocumento12 páginasInvestor Pitch Deck of Trio EntertainmentAnand LalAún no hay calificaciones

- List of Agents of S.H.I.E.L.D. Episodes: Series OverviewDocumento13 páginasList of Agents of S.H.I.E.L.D. Episodes: Series OverviewRENATO NATORAún no hay calificaciones

- O, The Oprah MagazineDocumento21 páginasO, The Oprah MagazineDivya ShuklaAún no hay calificaciones

- Phillips srp5107Documento17 páginasPhillips srp5107JoelAún no hay calificaciones

- The Flash Beat SheetDocumento5 páginasThe Flash Beat SheetVenice GrayAún no hay calificaciones

- Godišnji Plan Za 5. Razred.Documento4 páginasGodišnji Plan Za 5. Razred.Ervin MakićAún no hay calificaciones

- Truman ShowDocumento8 páginasTruman ShowRahul GabdaAún no hay calificaciones

- Identifying The Time 2 (Page 38)Documento58 páginasIdentifying The Time 2 (Page 38)Trần Công LâmAún no hay calificaciones

- IplDocumento20 páginasIplAshwin EsanAún no hay calificaciones

- 25 Things You Should Know About NirvanaDocumento9 páginas25 Things You Should Know About NirvanaJulan UyAún no hay calificaciones

- Practice 2 - Listening Identifying PeopleDocumento12 páginasPractice 2 - Listening Identifying PeopleMaininh2012Aún no hay calificaciones