Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Concept Note - Micro Credit Corpus Expansion AVAG

Cargado por

Auroville Village Action GroupDerechos de autor

Formatos disponibles

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoCopyright:

Formatos disponibles

Concept Note - Micro Credit Corpus Expansion AVAG

Cargado por

Auroville Village Action GroupCopyright:

Formatos disponibles

AUROVILLE VILLAGE ACTION GROUP Concept note: Micro credit corpus expansion

Irumbai, June 2011

www.villageaction.in avagoffice@auroville.org.in Ph (0413)267-8871

The implementing organization:

Founded in 1983, Auroville Village Action Group (AVAG) is an NGO committed to grass roots community development in the villages neighboring Auroville a pioneering social experiment in Villipuram district, rural Tamil Nadu, South India, which aims to realize human unity. Since its inception, AVAG has developed into a solid and reputable organisation for positive social change that fosters the integral development of civil society, democracy building and social advocacy, including gender equity and caste equality the foundation stones for building a sustainable and healthy co-operative Indian society. AVAGs activities are all designed to empower the rural communities to organize themselves for their own personal and communal empowerment. Some examples of AVAG activities: Micro projects to improve village infrastructure. Inter-caste and inter-gender exchange meetings for caste and gender integration and sensitization. Capacity building through trainings and seminars for villagers on various topics such as: livelihood trainings and social enterprise development; expansion of legal access for women and children confronted with human rights abuses; global warming and environmental degradation awareness. Psychological and physical health initiatives through counseling services, health camps and referrals and trainings. Environmental initiatives through home and community gardens, tree plantation and making the eco friendly products accessible to the communities. Mirofinance see below.

In 1995 the first women's SHG was formed and since then, this network of SHGs has expanded steadily. In 2000 a federation for women SHGs and in 2007a federation for men were formed to share responsibility and for collective decision-making. They give AVAG feedback and suggestions pertaining to the planning and implementation of the programs of AVAG. The federations and AVAG have developed a symbiotic relationship with guidance and advice freely exchanged. AVAG is maintaining a formal oversight over the federations.

The Micro-finance programme: The central aim of the micro finance programme is: To free the poor from the clutches of the money lenders who charge prohibitively high interest (sometimes as high as 90% per year!) To increase livelihood possibilities for SHG members To inculcate the habit of savings among the villagers To teach villagers the concept of self help To give a sense of cooperation and mutual help among the women and men To help SHG members to get recognition from their families and from society at large.

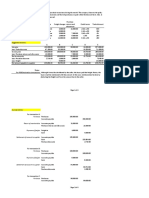

Year Members 1995-1996 68 1996-1997 188 1997-1998 327 1998-1999 435 1999-2000 614 2000-2001 1101 2001-2002 1600 2002-2003 1741 2003-2004 1800 2004-2005 1950 2005-2006 2000 2006-2007 2334 2007-2008 3245 2008-2009 3466 2009-2010 3478 2010-2011 3726

4000 3500 3000 2500 2000 1500 1000 500 0 1997-1998 2001-2002 2005-2006 2009-2010 1995-1996 1999-2000 2003-2004 2007-2008

Udhayam Women Federation Members Progress Micro Finance Activity (As of 1st April 2011): AVAG works with 3,726 women organised in 197 SHGs, and 701 men organised in 42 SHGs. Rs. 20,830,771 is the total amount saved collected by SHGs. Rs. 55,552,350 is circulating among the groups as loans. Repayment is through fixed installments. Loans are offered for business development, agriculture, education, housing, consumption, family functions, and health, at an annual interest rate of 18%-- which is far lower than the rates from the usual village sources. So far finance has been facilitated from the following sources: savings generated by SHGs, corpus fund of AVAG, Government Funds and Indian and Pallavan Grameen Banks through SHG linkage.

The ratio between SHGs to AVAG field staff is 35/1, which allows effective monitoring. AVAG collects copies of all receipts and invoices and monitors each transaction. Loan repayment rate is virtually 100%: only two people have defaulted over the past 15 years of AVAG microfinance activity.

What is special about the AVAG micro-funding programme? The Micro-funding programme is the backbone of AVAGs integral rural development activities. Capacity building is of prime importance, so SHG members receive constant training and education. The SHG Federations have a core position in AVAGs decision making process, in the microfinance programme as well as in other AVAG activities, which is a key factor in the successful performance of the ongoing SHG programme. To avoid that any one individual would monopolize SHG dynamics, and to make sure that each member takes up responsibility, AVAG encourages regular change in SHG leadership. Empowering lending policies as mentioned below: Loan amounts are awarded gradually, increasing as each member proves his/her capacity for repayment. Loans are offered for a wide variety of needs. AVAG experience has shown that purpose dependent loans drives people to cheat and would weaken the trust and relationship between AVAG and its SHGs. Members can easily access loans as long as they are supported by the SHG, funds are available, and the SHG is confident of the members repayment capacity. Group members are encouraged to give priority to each members financing needs, rather than dividing the borrowed amount into equal shares. Re-lending does not depend on the completion of a previous loan, but rather is encouraged only when there is a genuine need. This system ensures group members will not compulsively reapply for a loan immediately after the previous loan has ended.

To be member of a SHG, a person should: be aged from 18 to 55 years be a resident of the village where the group is based not be a member of any other SHG of any organisation.

To make sure that there is no misuse of funds, AVAG keeps track of all the financial transactions of the SHGs, a monitoring activity that is unique to AVAG. AVAG liaises between banks and SHG members which helps the banks to understand the SHG member needs. As AVAG has established close relationships with the banks, it helps the SHGs in getting their needs met. The SHGs have a double aim, micro-funding activities and debate and action about community development, human rights and other issues.

Types of loans by source and purpose: Internal Lending: Individual SHG members can take loans from savings accumulated within his/her SHG group. AVAG Loan: SHG members can also apply for an AVAG loan by submitting an application through his/her SHG to AVAG. These requests must be processed and approved by Federation members before they can be sanctioned by AVAG. Government Lending: AVAG evaluates SHG requests and recommend them for access to Government schemes such as Revolving Fund1, Economic Assistance (E.A)2, Toilet Scheme, Housing Scheme, etc.) Direct Lending: SHGs can apply directly to banks for loans. Groups can get up to Rs. 5,00,000.

Loan Repayment Housing Function Agriculture Education Business Medical Others

Purpose of loans M&W SHGs

Federation and Self Help Group Decision-making At present there are 25 Womens Federation members and 15 Mens Federation members, each elected to represent an average of 8 womens SHGs and 3 mens SHGs for a period of two years. In addition to regular Federation meetings, Federation members also attend AVAGs regular seminars and trainings in order to build capacity and skills. The formation of the Womens and Mens Federations marks a crucial step in handing over responsibility and decision making to the local beneficiaries of AVAGs programs. Since decisions are taken collectively, they take every single step to make it a success.

Under this scheme, each group can sign up for an amount of Rs. 60,000 out of which Rs. 10,000 is subsidy and Rs. 50,000 is loan to be repaid in monthly installments. This scheme has a subsidy component of Rs. 1,25,000 sanctioned by the government to commence agricultural or business activities.

Micro finance and the UWC (Udhayam Womens Center): A major function of the Federations is to transfer micro finance loan administration from AVAG to local people. By investing authority and decision making responsibility in their hands, AVAG engages beneficiaries as active participants in the successful outcome of the micro finance program, a mechanism which has significant implications both for technical loan management and personal empowerment. At the moment the Mens Federation work mainly with the internal lendings of every group plus the links provided by AVAG with the commercial banks and the Governmental credit schemes. SHG Group formation and day to day work. Each group can have 12-20 members. The group has to choose its own leaders i.e. an animator and two representatives. The position must be renewed every 2 years, in order to give the opportunity to everybody to grow in capacities. The group meets at least twice a month. The first meeting of the month is to deposit the savings, to pay back the loans and to decide upon the new loans. The second meeting is allotted to discuss about the issues, projects, participation in the seminars and meetings, report about the trainings and meetings etc. When a group is accepted by AVAG, it is asked to join the federation and pay the annual subscription which is Rs.50 per member. The group receives from the federation a set of registers to maintain the groups accounts.

Each SHG decides on a monthly savings amount Federation members are (usually between Rs. 50-100 per month and per responsible for loan member) which is deposited in the name of the club application review. While most in the bank of AVAGs staff live in the With the introduction of AVAG, each SHG opens organizations target area and a bank account to deposit the monthly savings. have extensive knowledge of conditions on the ground, the Once a year every group participates in the Federations have an even cluster meeting, with other SHG groups of the better check on the pulse of same panchayat (local government). In these village life. By employing meetings participants discuss the community beneficiaries in the micro development activities undertaken during the last finance process, AVAG can be year (fixing the road, distribution of food in health confident that financing is centers...), and share community problems facing being used for pertinent village SHG's in an attempt to arrive to a collective action needs. AVAGs role is more to solve them. advisory than controlling, although the organization does hold veto power over any decisions to avoid incidents of abuse and prevent corruption.

The impact that an AVAG micro funding corpus increase would have: Based on field assessment of need, there is a pressure to significantly increase the number of new SHGs. Furthermore, with existing groups, there is an ever increasing demand to access more credit which AVAG is no longer able to extend as its reserves are saturated. Our estimations show that if we want to be able to substitute the most expensive source of lending of the SHG members, which are the money lenders (who usually charge 60-120% interest per year), we would need to immediately increase the AVAG corpus by at least one crore rupees. (One crore = 100 lakh = 10 million rupees). With this amount we would also be able to enlarge to some extent the number of women and men SHGs. Capacity building and livelihood impact: The increase efficiency in the use of our staff will allow AVAG to implement more capacity building activities. More credit will provide the possibility for the creation of new social enterprises and conventional businesses. Farmers will have increased loan possibility for agriculture. The access to credit and the participation in AVAG programmes also allow men and women to get skills in leadership, accounting, team building, social analysis. Community impact: Currently the 239 SHGs undertake several activities every year for the benefit of the community like maintenance of school building and distribution of food in the health centres. Extra funds would allow us to increase the number of SHGs so the integration of the community will receive another impulse. The participation in SHG makes villagers feel supported and they start to help each other. Educational impact: Children from families who have an SHG member among them are more likely to attend school and higher education (girls in particular), partially because of access to loans and also due to awareness. An increase in the number of SHGs would mean a significant increase of students including many girls who have access to higher education due to the availability of loan for education. Other impacts: More villagers would have access to loans in times of needs and crisis. Women SHG members are more likely to take finance-related decisions in the household even though tradition denies them this right. More SHGs will mean more women empowered to participate in family finance decision-making. More villagers will get the access to banks and government funds that SHG membership affords them. Housing conditions will improve through increased loans. More women will own assets. An increase in SHGs will mean overall improved cooperation among members and by extension among villagers. An increase in leadership capabilities among women and men.

También podría gustarte

- Newsletter Q1-2013Documento3 páginasNewsletter Q1-2013Auroville Village Action GroupAún no hay calificaciones

- AVAG Micro Finance Profile 2011Documento9 páginasAVAG Micro Finance Profile 2011Auroville Village Action GroupAún no hay calificaciones

- AVAG Micro Finance Profile 2012Documento12 páginasAVAG Micro Finance Profile 2012Auroville Village Action GroupAún no hay calificaciones

- AVAG 2011-2012 Annual ReportDocumento25 páginasAVAG 2011-2012 Annual ReportAuroville Village Action GroupAún no hay calificaciones

- Auroville Village Action Group - 2011 Newsletter #2Documento4 páginasAuroville Village Action Group - 2011 Newsletter #2Auroville Village Action GroupAún no hay calificaciones

- 2010-2011 Annual Report AVAGDocumento25 páginas2010-2011 Annual Report AVAGAuroville Village Action GroupAún no hay calificaciones

- Ecolife Price ListDocumento3 páginasEcolife Price ListAuroville Village Action GroupAún no hay calificaciones

- Auroville Village Action Group - 2011 Newsletter #1Documento4 páginasAuroville Village Action Group - 2011 Newsletter #1Auroville Village Action GroupAún no hay calificaciones

- EcoLife CatalogDocumento18 páginasEcoLife CatalogAuroville Village Action GroupAún no hay calificaciones

- AVAG Menstrual Survey ReportDocumento23 páginasAVAG Menstrual Survey ReportAuroville Village Action Group100% (1)

- Ecolife Price ListDocumento3 páginasEcolife Price ListAuroville Village Action GroupAún no hay calificaciones

- Villageaction BriefDocumento2 páginasVillageaction BriefAuroville Village Action GroupAún no hay calificaciones

- VillageAction Micro Finance ProfileDocumento11 páginasVillageAction Micro Finance ProfileAuroville Village Action GroupAún no hay calificaciones

- VillageAction Womens Empowerment ReportDocumento32 páginasVillageAction Womens Empowerment ReportAuroville Village Action GroupAún no hay calificaciones

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDe EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeCalificación: 4 de 5 estrellas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDe EverandThe Little Book of Hygge: Danish Secrets to Happy LivingCalificación: 3.5 de 5 estrellas3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDe EverandShoe Dog: A Memoir by the Creator of NikeCalificación: 4.5 de 5 estrellas4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDe EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceCalificación: 4 de 5 estrellas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)De EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Calificación: 4 de 5 estrellas4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDe EverandThe Emperor of All Maladies: A Biography of CancerCalificación: 4.5 de 5 estrellas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDe EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryCalificación: 3.5 de 5 estrellas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDe EverandNever Split the Difference: Negotiating As If Your Life Depended On ItCalificación: 4.5 de 5 estrellas4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDe EverandGrit: The Power of Passion and PerseveranceCalificación: 4 de 5 estrellas4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDe EverandOn Fire: The (Burning) Case for a Green New DealCalificación: 4 de 5 estrellas4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDe EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureCalificación: 4.5 de 5 estrellas4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDe EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaCalificación: 4.5 de 5 estrellas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDe EverandThe Unwinding: An Inner History of the New AmericaCalificación: 4 de 5 estrellas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDe EverandTeam of Rivals: The Political Genius of Abraham LincolnCalificación: 4.5 de 5 estrellas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDe EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyCalificación: 3.5 de 5 estrellas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDe EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreCalificación: 4 de 5 estrellas4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDe EverandRise of ISIS: A Threat We Can't IgnoreCalificación: 3.5 de 5 estrellas3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDe EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersCalificación: 4.5 de 5 estrellas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)De EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Calificación: 4.5 de 5 estrellas4.5/5 (121)

- The Perks of Being a WallflowerDe EverandThe Perks of Being a WallflowerCalificación: 4.5 de 5 estrellas4.5/5 (2102)

- Her Body and Other Parties: StoriesDe EverandHer Body and Other Parties: StoriesCalificación: 4 de 5 estrellas4/5 (821)

- Lone Pine CaféDocumento3 páginasLone Pine Caféchan_han123Aún no hay calificaciones

- Motives For Internationalisation of Financial Markets: ProfitabilityDocumento9 páginasMotives For Internationalisation of Financial Markets: ProfitabilityPearl KhuranaAún no hay calificaciones

- Module 12 - Financial StatementsDocumento3 páginasModule 12 - Financial StatementsGeneen LouiseAún no hay calificaciones

- Ch.09 Solution Manual - Funadmentals of Financial ManagementDocumento18 páginasCh.09 Solution Manual - Funadmentals of Financial Managementsarahvillalon100% (2)

- Assignement - Case Study - Fortis & ABN AMRODocumento3 páginasAssignement - Case Study - Fortis & ABN AMROMuhammad Imran Bhatti86% (7)

- Research Paper On Construction Management PDFDocumento7 páginasResearch Paper On Construction Management PDFj0lemetalim2Aún no hay calificaciones

- Chapter 1-Ten Principles of Economics: Instructor: A Tabassum Class Notes ECON 1000Documento2 páginasChapter 1-Ten Principles of Economics: Instructor: A Tabassum Class Notes ECON 1000AmanAún no hay calificaciones

- Journalizing TransactionsDocumento38 páginasJournalizing TransactionsPratyush mishraAún no hay calificaciones

- International Business: by Charles W.L. HillDocumento31 páginasInternational Business: by Charles W.L. HillFahad KhanAún no hay calificaciones

- Principles of ManagementDocumento225 páginasPrinciples of Managementsrisuji14Aún no hay calificaciones

- No36 (8) /09-Estt./110 Dated: 24.11.2009: National Buildings Construction Corporation LTDDocumento9 páginasNo36 (8) /09-Estt./110 Dated: 24.11.2009: National Buildings Construction Corporation LTDSoundar RajAún no hay calificaciones

- Manpower Supply Service Agreement-Security ServicesDocumento3 páginasManpower Supply Service Agreement-Security Servicesusaha sama workAún no hay calificaciones

- A Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Documento19 páginasA Glass Half Full - Rhb-Report-My - Budget-2022-Equity-Impact - 20211030Shaun WooAún no hay calificaciones

- Pens I o CircularsDocumento7 páginasPens I o Circularspj_bsnlAún no hay calificaciones

- Handout No. 03 - Purchase TransactionsDocumento4 páginasHandout No. 03 - Purchase TransactionsApril SasamAún no hay calificaciones

- Universiti Teknologi Mara Final Examination: CourseDocumento7 páginasUniversiti Teknologi Mara Final Examination: Coursemuhammad ali imranAún no hay calificaciones

- Preboard 1 Plumbing ArithmeticDocumento8 páginasPreboard 1 Plumbing ArithmeticMarvin Kalngan100% (1)

- FAR1 ASN02 Financial Transaction WorksheetDocumento2 páginasFAR1 ASN02 Financial Transaction WorksheetPatricia Camille AustriaAún no hay calificaciones

- Labor Law MCQDocumento12 páginasLabor Law MCQalexes negroAún no hay calificaciones

- HFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALDocumento211 páginasHFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALVidhya Charan PAún no hay calificaciones

- 1 Handbook of Business PlanningDocumento326 páginas1 Handbook of Business PlanningjddarreAún no hay calificaciones

- 1 - Understanding BrandsDocumento29 páginas1 - Understanding BrandsMehal Ur RahmanAún no hay calificaciones

- Maybank Market Strategy For InvestmentsDocumento9 páginasMaybank Market Strategy For InvestmentsjasbonAún no hay calificaciones

- LT B SWOT Analysis NUR 587Documento18 páginasLT B SWOT Analysis NUR 587Susan MateoAún no hay calificaciones

- International MarketingDocumento77 páginasInternational MarketingSaki HussainAún no hay calificaciones

- Ch. 1 Globalization IBDocumento18 páginasCh. 1 Globalization IBnikowawaAún no hay calificaciones

- Draft Bangladesh Railwasy (Managing High Performance)Documento24 páginasDraft Bangladesh Railwasy (Managing High Performance)Asif W HaqAún no hay calificaciones

- The Town of Brookside Annual Financial Report 2021Documento62 páginasThe Town of Brookside Annual Financial Report 2021ABC 33/40Aún no hay calificaciones

- Piece Work - WikipediaDocumento5 páginasPiece Work - WikipediaBrayan Anderson Chumpen CarranzaAún no hay calificaciones