Documentos de Académico

Documentos de Profesional

Documentos de Cultura

Informe Moodys Canje

Cargado por

Cronista.com0 calificaciones0% encontró este documento útil (0 votos)

4K vistas5 páginasArgentina's government announced a new draft law aimed at sidestepping court rulings. But on Thursday, US District Judge Thomas Griesa called Argentina's proposed actions illegal. Financial isolation would bring significant disruptions to the country's economy, he says.

Descripción original:

Título original

informe moodys canje

Derechos de autor

© © All Rights Reserved

Formatos disponibles

PDF, TXT o lea en línea desde Scribd

Compartir este documento

Compartir o incrustar documentos

¿Le pareció útil este documento?

¿Este contenido es inapropiado?

Denunciar este documentoArgentina's government announced a new draft law aimed at sidestepping court rulings. But on Thursday, US District Judge Thomas Griesa called Argentina's proposed actions illegal. Financial isolation would bring significant disruptions to the country's economy, he says.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

0 calificaciones0% encontró este documento útil (0 votos)

4K vistas5 páginasInforme Moodys Canje

Cargado por

Cronista.comArgentina's government announced a new draft law aimed at sidestepping court rulings. But on Thursday, US District Judge Thomas Griesa called Argentina's proposed actions illegal. Financial isolation would bring significant disruptions to the country's economy, he says.

Copyright:

© All Rights Reserved

Formatos disponibles

Descargue como PDF, TXT o lea en línea desde Scribd

Está en la página 1de 5

SECTOR COMMENT

SOVEREIGN & SUPRANATIONAL

AUGUST 25, 2014

Argentinas Proposal to Bypass US Court

Rulings Is Credit Negative for the Sovereign,

Banks and Corporates

From Credit Outlook

Last Tuesday, the Government of Argentina (Caa1 negative) announced a new draft law

aimed at sidestepping US court rulings that have blocked it from making payments to

bondholders without simultaneously paying certain holdout bondholders. But on

Thursday, US District Judge Thomas Griesa called Argentinas proposed actions illegal,

forbidding third parties from assisting Argentina in circumventing court orders and raising

serious questions about whether the proposal will be achievable.

This article discusses the credit negative effect of the proposal on the sovereign and on

Argentine banks and corporates. Argentinas move to sidestep US court rulings highlights the

countrys weak institutional framework. Argentine banks involvement in a debt exchange is

likely to further isolate them from the international financial community. Financial isolation

would bring significant disruptions to the countrys economy and would be detrimental to

corporates.

The Sovereign

Argentinas decision to ignore US legal rulings after voluntarily accepting the US courts

jurisdiction in the past and the unpredictable approach taken to resolve the debt impasse are

credit negative. These decisions also highlight Argentinas weak institutional framework, an

important driver behind Argentinas low rating.

Disbursements to holders of certain Argentine foreign-legislation bonds restructured in 2005

and 2010 have been frozen by US court orders since 26 June, when Argentina deposited the

required amounts into a trustee account in Buenos Aires. US court rulings require Argentina

to pay holdout bondholders concurrently with any payments it makes to holders of its

restructured debt, which Argentina refuses to do. The original payment was due 30 June and

the payment prohibition resulted in an event of default by Moodys definition on 30 July, at

the end of a 30-day grace period.

Argentina now seeks to bypass the payment prohibition via two separate approaches. First,

the country proposes changing the trustee of the restructured bonds to Nacion Fideicomisos,

a subsidiary of the government-owned commercial bank Banco de la Nacion (unrated),

which would presumably follow government instructions. Second, it will offer restructured

bondholders a voluntary exchange of foreign-legislation debt for local-legislation obligations,

over which Argentina believes US courts would have no jurisdiction.

What is Moodys Credit Outlook?

Published every Monday and Thursday

morning, Moody's Credit Outlook informs

our research clients of the credit

implications of current events.

Gabriel Torres

Vice President - Senior Credit Officer

+1.212.553.3769

gabriel.torres@moodys.com

SOVEREIGN & SUPRANATIONAL

2 AUGUST 25, 2014

SECTOR COMMENT: ARGENTINAS PROPOSAL TO BYPASS US COURT RULINGS IS

CREDIT NEGATIVE FOR THE SOVEREIGN, BANKS AND CORPORATES

Assuming the terms envisage a precisely like-for-like exchange, Argentinas proposal would, if

successful, be an opportunity for restructured bondholders to receive all scheduled payments.

However, it remains unclear whether the proposal will come into effect. Judge Griesas reaction will

likely impede the current trustee and other involved parties from providing Argentina the data and

assistance needed to carry out the swap or transfer funds to a new trustee. Even if a swap or transfer

were possible, it is not clear whether the new trustee would be able to disburse funds within the US

dollar clearing system given the US courts objections. The (P)Caa2 rating of these exchange securities

encompasses the range of possible outcomes, including the likely loss to investors from the continuing

default.

Argentinas more belligerent approach will prevent the country from accessing international capital

markets, and official reserves are already under pressure (see exhibit below). Official reserves, which are

the governments sole source for meeting its foreign-currency obligations, have fallen 47% in the past

three years. Continued pressure on reserves will likely exacerbate inflation that is already higher than

30% on an annual basis through faster devaluation, thereby deepening Argentinas ongoing recession.

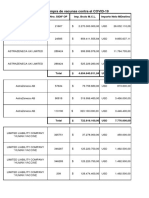

Argentinas Official Reserves Have Fallen 47% Since 2011

Source: Haver Analytics, Central Bank of Argentina

Banks

Argentinas debt proposal are credit negative for Argentine banks because their potential involvement

in the sovereign bond exchange is likely to further isolate them from the international financial

community, limiting their ability to deal with US banks or other foreign institutions.

Implementation of the swap will require the involvement of Argentine financial intermediaries and, in

the context of the US Supreme Courts ruling, will place them in uncertain legal territory. The legal

and financial uncertainties surrounding this move will deepen the countrys economic slump, leading

to a longer-than-expected recession.

The governments proposal would allow bondholders to ignore their current contracts and get paid in

Buenos Aires, or swap their debt for new securities governed by Argentine law. The bill includes the

removal of The Bank of New York Mellon (Aa2 stable, B-/a1 stable

1

) as trustee for exchange bonds

and the appointment of the government-owned Nacion Fideicomisos (unrated) as replacement trustee.

1

The bank ratings shown in this report are The Bank of New York Mellons deposit rating, its standalone bank financial strength rating/baseline credit assessment and the

corresponding rating outlooks.

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

$55

J

a

n

-

1

0

M

a

r

-

1

0

M

a

y

-

1

0

J

u

l

-

1

0

S

e

p

-

1

0

N

o

v

-

1

0

J

a

n

-

1

1

M

a

r

-

1

1

M

a

y

-

1

1

J

u

l

-

1

1

S

e

p

-

1

1

N

o

v

-

1

1

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

M

a

y

-

1

4

J

u

l

-

1

4

$

B

i

l

l

i

o

n

Valeria Azconegui

Assistant Vice President - Analyst

+54.11.5129.2611

valeria.azconegui@moodys.com

This publication does not announce

a credit rating action. For any

credit ratings referenced in this

publication, please see the ratings

tab on the issuer/entity page on

www.moodys.com for the most

updated credit rating action

information and rating history.

SOVEREIGN & SUPRANATIONAL

3 AUGUST 25, 2014

SECTOR COMMENT: ARGENTINAS PROPOSAL TO BYPASS US COURT RULINGS IS

CREDIT NEGATIVE FOR THE SOVEREIGN, BANKS AND CORPORATES

A swap for bonds under local jurisdiction would go against orders issued by US District Court Judge

Griesa last year, which complicates the participation of US-based intermediaries and could result in

those intermediaries being held in contempt of the US courts orders. The approval of this bill will

likely reduce the chances that the sovereign, as well as banks and other market participants, will soon

regain access to international markets.

Argentine banks deposit mix has shifted dramatically since the introduction of foreign exchange and

capital controls in November 2011. Foreign-currency funding only accounts for 8% of total liabilities

following the sharp decline in dollar-denominated deposits triggered by the implementation of the

restrictions (see exhibit below). Consequently, foreign trade facilities and interbank credit lines (which

account for roughly 4% of total liabilities) are more important sources of funding to finance loans to

exporters, particularly those related to agribusiness. A potential decrease in banks foreign-currency

funding, coupled with less access to international markets, will discourage these types of loans (which

were 10% of banks total lending two years ago, and have decreased to about 4% this year). This will

further lower banks business prospects and margins amid decelerating lending growth and high

inflation.

Argentine Banks US Dollar Private-Sector Deposits and Loans Fall Sharply

Source: Central Bank of Argentina

Argentina has been in an economic recession since first-quarter 2014, with banks business volumes

and earnings already declining, and the uncertainly about a sovereign debt swap and a prolonged

default will likely make matters worse. Should the government proposal be approved by the Argentine

National Congress, we expect a prolonged stagnation given that GDP growth will be hampered and

inflation will rise, hurting both the employment rate and households real wages. Moreover, the lack of

capital inflows and potentially rising capital outflows will likely pressure the foreign exchange rate and

the Argentine Central Banks international reserves.

Although the deteriorating operating environment will cause a decline in banks financial performance,

there is little risk that lenders face an imminent solvency crisis. Banks reduced lending appetite has

resulted in a buildup of liquidity, which has helped them prepare for the default and a weaker

economy. Capitalization is strong, and deposits have remained relatively stable this year, despite rising

anxiety among savers amid a currency devaluation.

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

J

a

n

-

1

1

M

a

r

-

1

1

M

a

y

-

1

1

J

u

l

-

1

1

S

e

p

-

1

1

N

o

v

-

1

1

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

M

a

y

-

1

4

J

u

l

-

1

4

$

B

i

l

l

i

o

n

US Dollar Loans US Dollar Deposits

SOVEREIGN & SUPRANATIONAL

4 AUGUST 25, 2014

SECTOR COMMENT: ARGENTINAS PROPOSAL TO BYPASS US COURT RULINGS IS

CREDIT NEGATIVE FOR THE SOVEREIGN, BANKS AND CORPORATES

Corporates

The financial isolation resulting from an Argentine debt swap would bring significant disruptions to

the countrys economy through GDP stagnation, inflation and currency devaluation. Local-currency

depreciation will increase the cost of foreign-currency debt. We also expect a halt in government

spending on public works and infrastructure. Rare beneficiaries of the turmoil will be those companies

that earn foreign-currency revenue, yet have peso-denominated debt.

Companies with Argentine peso revenue and foreign-currency debt include CableVision S.A. (Caa1

negative), which generates all of its revenues in pesos, yet approximately 90% of its debt is

denominated in US dollars.

A halt in federal and local government spending on public works and infrastructure would affect

construction companies, such as Jose Cartellone Construcciones Civiles S.A. (Caa1 negative) and

Electroingenieria S.A. (Caa1 negative), which generate more than 90% of their revenues from

government contracts.

Manufacturer dependency on foreign product inputs has declined over the past years, given the

imported-goods controls in place. However, companies such as Newsan S.A. (B3 stable), Mirgor S.A.

(Caa1 negative), Sullair Argentina S.A. (Caa1 stable) and Car Security S.A. (Caa1 negative) still import

a reduced amount of products and raw materials. Even though the imports account for a small portion

of their costs, if import permissions come to a halt for an extended period, the companies will be

affected because some of the imported goods cannot be found in the domestic market.

Exporters will benefit as the value of foreign-currency revenue increases in relation to Argentine peso

depreciation. Asociacion de Cooperativas Argentinas Coop (B3 stable) generates 62% of its revenues in

foreign currency and 58% of its debt is peso-denominated.

Many rated non-financial companies in Argentina have elevated liquidity risk. These companies have

significant debt coming due within one year, limited cash in relation to upcoming maturities, sizable

negative free cash flow and they lack access to committed bank credit facilities. Companies with some

combination of these factors include Carsa S.A., Longvie S.A., Papel Misionero S.A.I.F.C., and Zucamor

S.A., which are all rated Caa1 negative.

Martina Gallardo Barreyro

Analyst

+54.11.5129.2643

martina.gallardobarreyro@moodys.com

Veronica Amendola

Vice President - Senior Analyst

+54.11.5129.2610

veronica.amendola@moodys.com

SOVEREIGN & SUPRANATIONAL

5 AUGUST 25, 2014

SECTOR COMMENT: ARGENTINAS PROPOSAL TO BYPASS US COURT RULINGS IS

CREDIT NEGATIVE FOR THE SOVEREIGN, BANKS AND CORPORATES

2014 Moodys Corporation, Moodys Investors Service, Inc., Moodys Analytics, Inc. and/or their licensors and affiliates (collectively, MOODYS). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. (MIS) AND ITS AFFILIATES ARE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF

ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODYS (MOODYS

PUBLICATIONS) MAY INCLUDE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE

SECURITIES. MOODYS DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET

VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODYS OPINIONS INCLUDED IN MOODYS PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL

FACT. MOODYS PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY

MOODYS ANALYTICS, INC. CREDIT RATINGS AND MOODYS PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS

AND MOODYS PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS

NOR MOODYS PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODYS ISSUES ITS CREDIT RATINGS AND

PUBLISHES MOODYS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND

EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODYS CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS FOR RETAIL INVESTORS TO CONSIDER

MOODYS CREDIT RATINGS OR MOODYS PUBLICATIONS IN MAKING ANY INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL

ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR

OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH

PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODYS PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODYS from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other

factors, however, all information contained herein is provided AS IS without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit

rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODYS is not an auditor and cannot

in every instance independently verify or validate information received in the rating process or in preparing the Moodys Publications.

To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special,

consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if

MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited

to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODYS.

To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or

damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by

law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers,

arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR

OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODYS IN ANY FORM OR MANNER WHATSOEVER.

MIS, a wholly-owned credit rating agency subsidiary of Moodys Corporation (MCO), hereby discloses that most issuers of debt securities (including corporate and municipal bonds,

debentures, notes and commercial paper) and preferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and rating services rendered by it fees

ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address the independence of MISs ratings and rating processes. Information

regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an

ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading Shareholder Relations Corporate Governance Director and Shareholder Affiliation

Policy.

For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODYS affiliate, Moodys Investors Service Pty Limited ABN 61

003 399 657AFSL 336969 and/or Moodys Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to wholesale clients

within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODYS that you are, or are accessing the

document as a representative of, a wholesale client and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to retail clients

within the meaning of section 761G of the Corporations Act 2001. MOODYS credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities

of the issuer or any form of security that is available to retail clients. It would be dangerous for retail clients to make any investment decision based on MOODYS credit rating. If in doubt you

should contact your financial or other professional adviser.

Report Number: 174711

Authors

Gabriel Torres

Valeria Azconegui

Martina Gallardo Barreyro

Veronica Amendola

Production Specialist

Wing Chan

También podría gustarte

- Argentina Junio - Credit Suisse - 09 06 14Documento8 páginasArgentina Junio - Credit Suisse - 09 06 14csp69Aún no hay calificaciones

- The Republic of Argentina Unsolicited Ratings Lowered To 'CCC+/C' On Increasing Legal Risks Outlook NegativeDocumento7 páginasThe Republic of Argentina Unsolicited Ratings Lowered To 'CCC+/C' On Increasing Legal Risks Outlook Negativeapi-227433089Aún no hay calificaciones

- U.S.-Style Fiscal Federalism Buffers State and Local Governments From Another Federal Shutdown - SomewhatDocumento6 páginasU.S.-Style Fiscal Federalism Buffers State and Local Governments From Another Federal Shutdown - Somewhatapi-227433089Aún no hay calificaciones

- Discredited - The Impact of Argentina's Sovereign Debt Default and Debt Restructuring On U.S. Taxpayers and InvestorsDocumento35 páginasDiscredited - The Impact of Argentina's Sovereign Debt Default and Debt Restructuring On U.S. Taxpayers and InvestorsSubeer MongaAún no hay calificaciones

- Credit Suisse-Escenarios para La ArgentinaDocumento8 páginasCredit Suisse-Escenarios para La ArgentinaCronista.comAún no hay calificaciones

- Debt CeilingDocumento4 páginasDebt Ceilingsam_cancerianAún no hay calificaciones

- Bank of America Fights Pressure On MortgagesDocumento5 páginasBank of America Fights Pressure On MortgagesleefeldmanAún no hay calificaciones

- Global and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsDocumento4 páginasGlobal and Systemic Implications of United States Supreme Court Rulings in Favour of Hedge Funds Over Argentina On 2001 Defaulted BondsMinutoUno.comAún no hay calificaciones

- US Sovereign Rating Downgrade ImplicationsDocumento13 páginasUS Sovereign Rating Downgrade ImplicationsBirgit UrsulaAún no hay calificaciones

- Court Files $25B Mortgage SettlementDocumento3 páginasCourt Files $25B Mortgage SettlementRazmik BoghossianAún no hay calificaciones

- b23194 Assignment 4 Divyansh KhareDocumento4 páginasb23194 Assignment 4 Divyansh KhareDivyansh Khare B23194Aún no hay calificaciones

- WallstreetJournalDocumento28 páginasWallstreetJournalDeepti AgarwalAún no hay calificaciones

- Walter Brandimarte Daniel Bases: by andDocumento4 páginasWalter Brandimarte Daniel Bases: by andtarun_0219Aún no hay calificaciones

- U.S. Financial Turmoil and Impact On Korea's Economy by Florence Lowe-LeeDocumento2 páginasU.S. Financial Turmoil and Impact On Korea's Economy by Florence Lowe-LeeKorea Economic Institute of America (KEI)Aún no hay calificaciones

- After Subjecting The NationDocumento3 páginasAfter Subjecting The Nationyogesh saxenaAún no hay calificaciones

- The USA Financial Crisis and Its RepercussionsDocumento24 páginasThe USA Financial Crisis and Its RepercussionsRox BenaducciAún no hay calificaciones

- Global Financial Crisis Causes and Responses in 40 CharactersDocumento9 páginasGlobal Financial Crisis Causes and Responses in 40 CharactersMohit Ram KukrejaAún no hay calificaciones

- Weekly Market Commentary 07-05-2011Documento4 páginasWeekly Market Commentary 07-05-2011Jeremy A. MillerAún no hay calificaciones

- Consumer Default, Credit Reporting, and Borrowing ConstraintsDocumento38 páginasConsumer Default, Credit Reporting, and Borrowing ConstraintsNazmul H. PalashAún no hay calificaciones

- LAC Semiannual Report April 2014: International Flows to Latin America †“ Rocking the Boat?De EverandLAC Semiannual Report April 2014: International Flows to Latin America †“ Rocking the Boat?Aún no hay calificaciones

- AccountingDocumento4 páginasAccountinggodfreykaruku21Aún no hay calificaciones

- Conway Release Aug 21Documento4 páginasConway Release Aug 21mgreenAún no hay calificaciones

- Pham Letter Final GrassleyDocumento5 páginasPham Letter Final GrassleyMartin AndelmanAún no hay calificaciones

- Do Credit Rating Agencies Have CredibilityDocumento11 páginasDo Credit Rating Agencies Have CredibilityNitish BhaskarAún no hay calificaciones

- Argentine Corporates: Uncertainty of DefaultDocumento2 páginasArgentine Corporates: Uncertainty of DefaultRonar BermudezAún no hay calificaciones

- 12 Steps NRDocumento7 páginas12 Steps NRzeimonAún no hay calificaciones

- Talkot Capital - The End of White Picket FinanceDocumento24 páginasTalkot Capital - The End of White Picket FinanceKyle AkinAún no hay calificaciones

- The People United Will Leave The Banks DividedDocumento4 páginasThe People United Will Leave The Banks DividedRicharnellia-RichieRichBattiest-CollinsAún no hay calificaciones

- Sovereign Debt Litigation in Argentina Implications of The Pari Passu DefaultDocumento6 páginasSovereign Debt Litigation in Argentina Implications of The Pari Passu DefaultAlexandros KatsourinisAún no hay calificaciones

- Dissent from the Majority Report of the Financial Crisis Inquiry CommissionDe EverandDissent from the Majority Report of the Financial Crisis Inquiry CommissionAún no hay calificaciones

- Brief History of Federal ReserveDocumento11 páginasBrief History of Federal ReserveDuyen TranAún no hay calificaciones

- Grants Interest Rate Observer Summer E IssueDocumento24 páginasGrants Interest Rate Observer Summer E IssueCanadianValueAún no hay calificaciones

- JPM Market ReportDocumento3 páginasJPM Market ReportDennis OhlssonAún no hay calificaciones

- The Evolution of Government Support in U.S. Bank Ratings: Financial InstitutionsDocumento10 páginasThe Evolution of Government Support in U.S. Bank Ratings: Financial Institutionsapi-227433089Aún no hay calificaciones

- Crisis Financiera UsaDocumento10 páginasCrisis Financiera UsaRox BenaducciAún no hay calificaciones

- Moodys - Argentina - Affirmed at Ca, Outlook Maintained at Stable - 27sep2022Documento6 páginasMoodys - Argentina - Affirmed at Ca, Outlook Maintained at Stable - 27sep2022jatulanellamaeAún no hay calificaciones

- Part1 Brazil FightsDocumento9 páginasPart1 Brazil Fightsbajax_lawut9921Aún no hay calificaciones

- Why Constitutions MatterDocumento6 páginasWhy Constitutions MatterZerohedge100% (1)

- Bernanke A Year of CrisisDocumento10 páginasBernanke A Year of CrisisWallStreetPitAún no hay calificaciones

- BANK OF AMERICA TO ACQUIRE DISCOVERDocumento63 páginasBANK OF AMERICA TO ACQUIRE DISCOVERreegent_9Aún no hay calificaciones

- Global Economic Crisis 2008Documento9 páginasGlobal Economic Crisis 2008madhav KaushalAún no hay calificaciones

- Causes of the 2008 Global Financial CrisisDocumento9 páginasCauses of the 2008 Global Financial Crisismadhav KaushalAún no hay calificaciones

- Scooping and Tossing Puerto Rico's FutureDocumento8 páginasScooping and Tossing Puerto Rico's FutureRoosevelt Institute100% (2)

- IMF Says Mortgage Relief Program Would Not Hurt The Big BanksDocumento2 páginasIMF Says Mortgage Relief Program Would Not Hurt The Big Banks83jjmackAún no hay calificaciones

- Report Looks Harshly at I.M.F.'s Role in Argentine Debt Crisis 2004Documento2 páginasReport Looks Harshly at I.M.F.'s Role in Argentine Debt Crisis 2004fabian dionAún no hay calificaciones

- UBSeconomist-insights7 January2Documento2 páginasUBSeconomist-insights7 January2buyanalystlondonAún no hay calificaciones

- Sub Prime Overview For Samir 1 Final 97-2003 FormatDocumento10 páginasSub Prime Overview For Samir 1 Final 97-2003 FormatAliasgar SuratwalaAún no hay calificaciones

- Modeling Mortgage Defaults and LossesDocumento25 páginasModeling Mortgage Defaults and LossesSemaus LuiAún no hay calificaciones

- 2023.09.06 Joseph A. Smith, Jr. Perspective Dodd Frank Protection ActDocumento11 páginas2023.09.06 Joseph A. Smith, Jr. Perspective Dodd Frank Protection Actlarry-612445Aún no hay calificaciones

- 7-12-11 Too Big To FailDocumento3 páginas7-12-11 Too Big To FailThe Gold SpeculatorAún no hay calificaciones

- Senate Hearing, 113TH Congress - Housing Finance Reform: Essentials of A Functioning Housing Finance System For ConsumersDocumento135 páginasSenate Hearing, 113TH Congress - Housing Finance Reform: Essentials of A Functioning Housing Finance System For ConsumersScribd Government DocsAún no hay calificaciones

- Gelpern 2013 Sovereign Damage ControlDocumento14 páginasGelpern 2013 Sovereign Damage Control_Emilia_Aún no hay calificaciones

- Policymakers grapple stubborn inflation and market chaosDocumento5 páginasPolicymakers grapple stubborn inflation and market chaosSasha SitbonAún no hay calificaciones

- US Debt Crisis Explained: Causes, Implications and Congressional DebateDocumento2 páginasUS Debt Crisis Explained: Causes, Implications and Congressional DebateSatish SonawaleAún no hay calificaciones

- U.S. Bailout Plan Calms Markets, But Struggle Looms Over DetailsDocumento5 páginasU.S. Bailout Plan Calms Markets, But Struggle Looms Over Detailsdavid rockAún no hay calificaciones

- The New Depression: The Breakdown of the Paper Money EconomyDe EverandThe New Depression: The Breakdown of the Paper Money EconomyCalificación: 4 de 5 estrellas4/5 (5)

- Bob Chapman The Fed S Policy of Near Zero Interest Rates 16 11 09Documento8 páginasBob Chapman The Fed S Policy of Near Zero Interest Rates 16 11 09sankaratAún no hay calificaciones

- OCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - ForeclolsuresDocumento6 páginasOCC - THE REGULATOR Stands in The Way of Potential Multi Billion Dollar Settlement - Foreclolsures83jjmackAún no hay calificaciones

- El FMI Sobre La Inteligencia ArtificialDocumento42 páginasEl FMI Sobre La Inteligencia ArtificialCronista.comAún no hay calificaciones

- YPF 3Q23 Earnings Webcast PresentationDocumento9 páginasYPF 3Q23 Earnings Webcast PresentationCronista.comAún no hay calificaciones

- Berkshire Hathaway IncDocumento2 páginasBerkshire Hathaway IncZerohedgeAún no hay calificaciones

- FMI ArgentinaDocumento135 páginasFMI ArgentinaCronista.com100% (2)

- 2206 1Q Staff ReportDocumento105 páginas2206 1Q Staff ReportCronista.comAún no hay calificaciones

- Igj KMBDocumento21 páginasIgj KMBCronista.comAún no hay calificaciones

- World Happiness ReportDocumento158 páginasWorld Happiness ReportCronista.com100% (1)

- Documento Completo Del FMIDocumento111 páginasDocumento Completo Del FMILPOAún no hay calificaciones

- Fallo Expropiación YPFDocumento64 páginasFallo Expropiación YPFLPO100% (1)

- Carta MartinezDocumento4 páginasCarta MartinezbracamontiAún no hay calificaciones

- Vision Argentina FMIDocumento17 páginasVision Argentina FMICronista.comAún no hay calificaciones

- PR Russia ClassificationDocumento3 páginasPR Russia ClassificationBAE NegociosAún no hay calificaciones

- Paises Mas CarosjpgDocumento1 páginaPaises Mas CarosjpgCronista.comAún no hay calificaciones

- CamScanner 12-16-2021 11.38Documento2 páginasCamScanner 12-16-2021 11.38Cronista.comAún no hay calificaciones

- JuntosDocumento6 páginasJuntosCronista.comAún no hay calificaciones

- Frente de TodosDocumento10 páginasFrente de TodosCronista.comAún no hay calificaciones

- Frente Vamos Con VosDocumento4 páginasFrente Vamos Con VosCronista.comAún no hay calificaciones

- YPF 3Q21 Earnings Webcast Presentation FINAL.Documento11 páginasYPF 3Q21 Earnings Webcast Presentation FINAL.Cronista.com100% (1)

- Fdius Ubo Detailed Country Position 2008 2019Documento7 páginasFdius Ubo Detailed Country Position 2008 2019Cronista.comAún no hay calificaciones

- Fdius Ubo Detailed Country Position 2020, BEADocumento5 páginasFdius Ubo Detailed Country Position 2020, BEACronista.comAún no hay calificaciones

- Pagos Efectuados A LaboratoriosDocumento14 páginasPagos Efectuados A LaboratoriosCronista.comAún no hay calificaciones

- Inversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosDocumento19 páginasInversión Extranjera Directa en Los EE - UU. Por País de Origen de Los FondosCronista.comAún no hay calificaciones

- Ley Alivio Fiscal MonotributoDocumento18 páginasLey Alivio Fiscal MonotributoCronista.com100% (1)

- Direct Investment by Country and Industry, 2020Documento12 páginasDirect Investment by Country and Industry, 2020Cronista.com100% (1)

- Gas DeudaDocumento5 páginasGas DeudaCronista.comAún no hay calificaciones

- Soñando Un Mejor ReinicioDocumento4 páginasSoñando Un Mejor ReinicioCronista.comAún no hay calificaciones

- Apéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaDocumento122 páginasApéndice Del Acuerdo Mercosur-UE Con El Cronograma de Desgravación TarifariaCronista.com100% (1)

- Ley Alivio Fiscal MonotributoDocumento18 páginasLey Alivio Fiscal MonotributoCronista.com100% (1)

- Deuda Provincia Buenos Aires Propuesta BonistasDocumento6 páginasDeuda Provincia Buenos Aires Propuesta BonistasCronista.comAún no hay calificaciones

- El Informe de The LancetDocumento2 páginasEl Informe de The LancetCronista.comAún no hay calificaciones

- NTA Doorman Diversion Warning Letter June 2008Documento2 páginasNTA Doorman Diversion Warning Letter June 2008TaxiDriverLVAún no hay calificaciones

- Business Cards Policy 01.04.18 Ver 2.0Documento4 páginasBusiness Cards Policy 01.04.18 Ver 2.0Narayana ATLLCAún no hay calificaciones

- Akmal - Assignment On Thinking SkillsDocumento9 páginasAkmal - Assignment On Thinking SkillsChew Cheng HaiAún no hay calificaciones

- PPRA Procurement Code 4th EditionDocumento116 páginasPPRA Procurement Code 4th Editionaon waqasAún no hay calificaciones

- UNM Findings Letter - FinalDocumento37 páginasUNM Findings Letter - FinalAlbuquerque JournalAún no hay calificaciones

- B.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii SemesterDocumento1 páginaB.Tech in Civil Engineering FIRST YEAR 2014-2015: I Semester Ii Semesterabhi bhelAún no hay calificaciones

- Deepa Karuppiah SAP FICODocumento4 páginasDeepa Karuppiah SAP FICO437ko7Aún no hay calificaciones

- Skill Assessment Evidence GuideDocumento13 páginasSkill Assessment Evidence Guiderahul.ril1660Aún no hay calificaciones

- The Page Cannot Be Found: Custom Error MessagesDocumento14 páginasThe Page Cannot Be Found: Custom Error MessagesMuhammad Umar AshrafAún no hay calificaciones

- Abhivyakti Yearbook 2019 20Documento316 páginasAbhivyakti Yearbook 2019 20desaisarkarrajvardhanAún no hay calificaciones

- Legal Aid in Philipines 1Documento33 páginasLegal Aid in Philipines 1MEL JUN DIASANTAAún no hay calificaciones

- How To File Motionin in New JerseyDocumento11 páginasHow To File Motionin in New Jerseyrajinusa100% (1)

- Fourth Grade-Social Studies (Ss4 - 4)Documento7 páginasFourth Grade-Social Studies (Ss4 - 4)MauMau4Aún no hay calificaciones

- RFUMSV00 (TH) Wrong Non-Deductible Amount With Deferred TaxDocumento2 páginasRFUMSV00 (TH) Wrong Non-Deductible Amount With Deferred TaxNathaka SethiAún no hay calificaciones

- Unit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Documento2 páginasUnit 1. The Political Self: Developing Active Citizenship Exercise 1.0. Politics, Society, and You (Pg. 1 of 3)Rafael VillegasAún no hay calificaciones

- RBM ListDocumento4 páginasRBM ListEduardo CanelaAún no hay calificaciones

- Niva Bupa Health Insurance Company LimitedDocumento1 páginaNiva Bupa Health Insurance Company LimitedSujanAún no hay calificaciones

- People Vs PalmaDocumento3 páginasPeople Vs PalmaNunugom SonAún no hay calificaciones

- Applications Forms 2 EL BDocumento2 páginasApplications Forms 2 EL Bilerioluwa akin-adeleyeAún no hay calificaciones

- A Study On Maintenance Under Muslim Law: Haridharan SDocumento10 páginasA Study On Maintenance Under Muslim Law: Haridharan SSaurabh YadavAún no hay calificaciones

- Me Review: Von Eric A. Damirez, M.SCDocumento25 páginasMe Review: Von Eric A. Damirez, M.SCKhate ÜüAún no hay calificaciones

- Honeywell Acumist Micronized Additives Wood Coatings Overview PDFDocumento2 páginasHoneywell Acumist Micronized Additives Wood Coatings Overview PDFBbaPbaAún no hay calificaciones

- Echegaray Vs Secretary of JusticeDocumento12 páginasEchegaray Vs Secretary of JusticeCherry BepitelAún no hay calificaciones

- Lucky Chops - CocoDocumento6 páginasLucky Chops - CocoLe Poulet De KFCAún no hay calificaciones

- NOTIFICATION FOR GRAMIN DAK SEVAK POSTSDocumento68 páginasNOTIFICATION FOR GRAMIN DAK SEVAK POSTSShubham VermaAún no hay calificaciones

- Social Studies - Part 1Documento96 páginasSocial Studies - Part 1Jedel GonzagaAún no hay calificaciones

- LG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Documento66 páginasLG - Chem - On - User - Guide - EN - Manual For Using The Website - 20211129Our HomeAún no hay calificaciones

- Motion to Mark Exhibits PermanentlyDocumento3 páginasMotion to Mark Exhibits PermanentlyEm Mangulabnan100% (1)

- Donation: Concept, Nature, and Effect of DonationDocumento3 páginasDonation: Concept, Nature, and Effect of DonationJim M. MagadanAún no hay calificaciones